Forget Higher Interest Rates: Zero Here We Come

This entire economic recovery is an illusion and higher rates will kill the illusion. So any surge in rates is just a temporary distraction to give others the illusion that the USD is still the best currency in the world. We are in a currency war and the idea is to finish last. The US will join the rate lowering bandwagon sooner than later, for if they don’t this economic recovery will end up like roadkill, something that used to be good but now has no value whatsoever.

Look at the Bond Market does it look like it is factoring in higher rates.

In 2018 Stated The Following

We are entering a new paradigm; get used to forever QE, though it will be given other names along the journey to make it appear more palatable. The US and by default worldwide debt is set to soar to preposterous levels; get used to it and embrace this fact for nothing has changed since we got off the Gold standard and nothing will change until the system collapses, though waiting for that day might prove to be fatal as the masses are completely asleep.

If a national debt of almost $22 trillion is shocking to some; imagine how they will feel when the debt soars to $100 trillion. Many might say no way in hell that is going to come to pass. Take a look at the national debt numbers in the early 1900s. Go back to 1900 and then fast forward to the present.

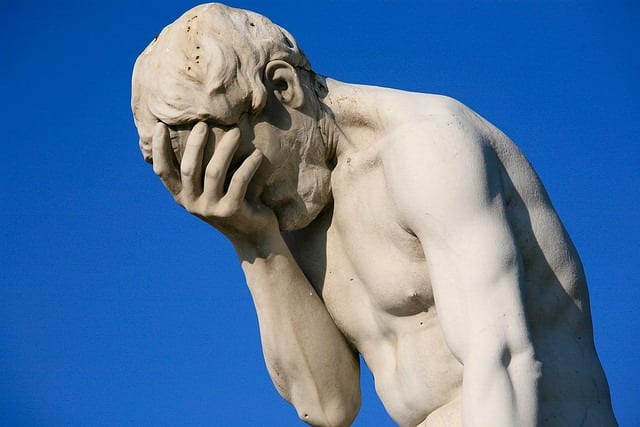

Once upon a time, our national debt was less than 1 million USD. Now if you told people back then it would be at $22 trillion one day; would the reaction not be the same? We will go on record to state that there is a good chance that worldwide debt will surge to $1000 trillion before the masses discover the emperor is naked, fat, bald and ugly; until then they will continue to believe he is a handsome prince. It currently stands at $247 trillion

And In Dec 2019 we made the following comments

The lack of liquidity in the repo market is only a symptom.

“There isn’t any real economic catastrophe occurring,” says Tim Speiss, co-leader of the personal wealth advisors group at accounting and advisory firm EisnerAmper. “That this could be a regulatory matter makes the most sense.”

Banks also make 1.8% interest on money they keep on reserve with the Fed. Not just mandated on levels, but excess reserves that could use to cover liquidity shortfalls. The latter practice started with post-economic crash QE. “They had to compensate banks, which were giving up interest-bearing assets,” Zhao says. “But once you pay rates, some banks don’t have the incentive to lend it out.”

The total is currently more than $1.3 trillion in excess reserves, meaning at least $19.5 billion in interest with no risk is paid to the banks every month. When repo pays 1.75% to 2.0%, banks may prefer to park all the extra and collect guaranteed interest. Full Story

Whatever reason is laid out here, the main goal of central bankers worldwide is to destroy their currencies. The world is now locked in a currency war and the goal is to attempt to finish last. When the Feds bailed out the banks in 2008 and refused to allow market forces to take over after the bailout, they set the path in motion for forever QE. Now the moment the market gets any signal that the Fed might be inclined to tighten the spigots the markets tank. This entire economic recovery is founded on a lie and the only driving force behind this recovery is hot money.

What’s our Stance in 2020 On Interest Rates

Interest rates will remain low for a long time; in between interest rates will rise (covered in more detail under the Bond Market section), but for the foreseeable future, an environment of sustained high-interest rates is not a likely scenario. For one, it would tank the World’s Economy as governments and corporations have leveraged themselves to the hilt. Secondly, and more importantly, technology and AI will continue to provide massive amounts of deflationary pressure.

Back to the present, the trend is still bullish, and so Tactical Investors should hope the markets blow out a nice dose of steam so that they can get into great stocks at a much lower price. Market Update Jan 31, 2020

The story below sums up views quite well

The New York Fed added $83.1 billion in temporary liquidity to financial markets Thursday, and the U.S. central bank looks primed to keep pumping cash for at least the next few months. Why it matters: The stock market’s 30% gain in 2019 was in no small part backed by the Fed’s decision to cut U.S. interest rates three times and inject more than $1 trillion of temporary financing into the repo market. It also added more than $400 billion to its balance sheet in the fourth quarter.

What we’re hearing: Fed vice chair Richard Clarida told an audience assembled at the Council on Foreign Relations Thursday that the Fed was prepared to continue adding to its balance sheet and providing liquidity to the repo market “at least through April.”

Clarida told me after the event he was not concerned markets could be taking advantage of the so-called “Powell put” — the belief that the Fed and chair Jerome Powell are using the cash to stimulate the economy or that they will cut rates to juice the stock market if prices fall significantly.

“We realize that sometimes we’ll be criticized for it, but it’s not a factor driving our decisions,” he said. “We have a very clear mandate, and are focused on what we need to do.”

What they’re saying: Clarida’s speech was “music to the ears of traders and investors who have profitably ridden a liquidity-driven rally that has allowed them to quickly overcome a set of shocks, including the latest one, the sudden escalation of the U.S.-Iran conflict,” Mohamed A. El-Erian, chief economic adviser at Allianz SE, wrote in an opinion piece for Bloomberg. Full Story

You don’t say and here we thought the Fed was trying to do the right thing, like helping the average “American” to attain his or her dreams by maintaining fair market interest rates. A nice fairytale at best, but the reality is that the Fed has decided “Forever QE” is the best path to take, and this is something we have been saying for a long time. So even if you see rates rise; these upward moves will be short in duration. One should understand that these stories of hyperinflation are just works of fiction at least for the foreseeable future.

One day the markets might crash and burn, the world might end and blah blah; the question is when. And not one naysayer can provide an answer that makes any sense; many have tried and a good percentage of those that did are no longer here. The moral of the story is that the world will end one day, but it will end for you and not for everyone because one day you won’t be around as no one is immortal, so in that sense, the world will end one day. This world is going to scenario end must have started when some miserable soul had nothing better else to do and since then it has gained traction, proving the concept that misery loves company and stupidity simply demands it.

Other Stories of Interest

Dow Transports Validating Higher Stock Market Prices (Dec 30)

Global Trading Volume is Declining & It’s A Non Event (Dec 20)

Dogs Of The Dow Jones Industrial Average (Dec 10)

Trump Stock Market: Will Impeachment Hearings Derail This Bull (Nov 21)

Negative Thinking: How It Influences The Masses (Nov 15)

Leading Economic Indicators: Finally in Syn With The Stock Market? (Oct 28)

Dow Stock Market Outlook: Time To Dance or Collapse (Oct 25)

What Is Fiat Money: USD Is Prime Example Of Fiat (Oct 13)

Yield Curve Fears As Treasury Yield Curve Inverts (Oct 12)

Current Stock Market Trends: Embrace Strong Deviations (Oct 2)

Market Insights: October Stock Market Crash Update (Oct 1)

BTC Update: Will Bitcoin Continue Trending Higher (Sept 17)

Stock Market Forecast For Next 3 months: Up Or Down? (Sept 16)

Stock Market Crash Date: If Only The Experts Knew When (Aug 26)

Nickel Has Put In A long Term Bottom; What’s Next? (July 31)

AMD vs Intel: Who Will Dominate the Landscape going forward (June 28)

Fiat Currency: Instruments of Mass Destruction (June 18)

The Retirement Lie The Masses Have Been Conned Into Accepting (June 15)

Stock Market Bull 2019 & Forever QE (June 13)

Forever QE; the Program that never stops giving (May 31)

Trending Now News Equates To Garbage; It’s All Talk & No Action (April 24)

Americans Are Scared Of Investing And The Answer Might Surprise You (March 9)

Experts Finance Predictions for 2019

Stock Market Crash Stories Experts Push Equate to Nonsense (March 4)