Stock Market Bubble Chart: Opportunity and the Misconception of Crashes

Updated April 30, 2024

Introduction:

Stock market bubbles have been a recurring phenomenon throughout history, capturing the attention of investors and economists alike. While these bubbles are often associated with economic downturns and market crashes, it is crucial to recognize that they also present opportunities for astute investors. This essay will explore the notion that stock market bubbles can be seen as periods of opportunity and examine how many bubbles are mistakenly interpreted as crashes due to the euphoria and overconfidence of the masses. To illustrate this, we will analyze the 1987, 2008, and 2020 COVID-induced market decline crashes.

Opportunity in Stock Market Bubbles:

Stock market bubbles create an environment of heightened optimism and speculative behaviour. During the bubble phase, market participants strongly believe in perpetual market growth, leading to inflated asset prices. This exuberance attracts more investors, driving prices even higher. While it is crucial to acknowledge that bubbles eventually burst, leading to market corrections, it is equally important to recognize that the bubble phase offers unique profit opportunities.

1. The 1987 Crash:

The 1987 stock market crash, known as “Black Monday,” is a prime example of a bubble-like scenario. Before the crash, the stock market experienced an unprecedented rise, fueled by the proliferation of computerized trading strategies. However, the market became overbought, with prices detached from underlying fundamentals. The crash was inevitable, but for those who recognized the bubble and positioned themselves accordingly, it presented an opportunity to profit from the subsequent decline and subsequent recovery.

2. The 2008 Crash:

The 2008 financial crisis is often associated with the bursting of the housing bubble and the subsequent market crash. The period leading up to the crash saw a surge in housing prices and the proliferation of risky mortgage-backed securities. As more investors jumped on the bandwagon, the bubble grew larger. However, the crash phase could be seen miles away for those who noticed the signs of an overheated market. Savvy investors who recognized the bubble had the opportunity to protect their investments or even profit from short-selling strategies.

3. The 2020 COVID Crash:

The COVID-19 pandemic led to a significant market decline in early 2020. While the initial trigger was a global health crisis, it is essential to recognize that the market had already reached bubble-like levels before the outbreak; the prolonged period of optimism and overconfidence created an environment ripe for correction. Investors who were cautious and recognized the unsustainable market conditions had an opportunity to protect their portfolios or strategically enter the market at lower prices during the crash phase.

The Masses and Misconceptions:

One common characteristic of stock market bubbles is the euphoria and overconfidence exhibited by the masses. This enthusiasm often leads to misconceptions, with many mistaking the bubble phase for a permanent surge. This results in the misconception of crashes when they are, in fact, market corrections. The masses’ belief that the market will continue to rise indefinitely blinds them to the signs of an impending crash. This sentiment creates an opportunity for savvy investors who can identify the overbought conditions and strategically position themselves to profit during the subsequent correction.

Let’s examine historical stock market bubbles to demonstrate how they lead to monumental opportunities. Those who fail to learn from history are doomed to repeat it.

Stock Market Bubble Not In Sight As Trend Is UP

Buffett’s latest views on corrections and the coronavirus

‘It wasn’t October 1987, but it was an imitation… [and the financial crisis] was much more scary, by far, than anything that happened [on Monday].’

“If you stick around long enough, you’ll see everything in markets,” he said from his Omaha headquarters. “And it may have taken me to 89 years of age to throw this one into the experience, but the markets, if you have to be open second by second, react to news in a big-time way.

The astute investor now has a front-row seat to witness in real-time that the best time to buy stocks is when the masses are in disarray. They are now throwing the bathwater out with the baby, grandpa, grandma, and the family pet. It is in such moments that astute investors find real bargains. One needs to be patient for these opportunities and, more importantly, act when they present themselves. As usual, the crowd panicked and fanned for the hills when, less than two weeks ago, they were begging for a chance to get into the very stocks they were now running from.

Nothing changes, and that is why the masses are destined to lose. The storyline is the same if you examine every single bubble in history.

Stock Market Bubble Not In The Offings Yet

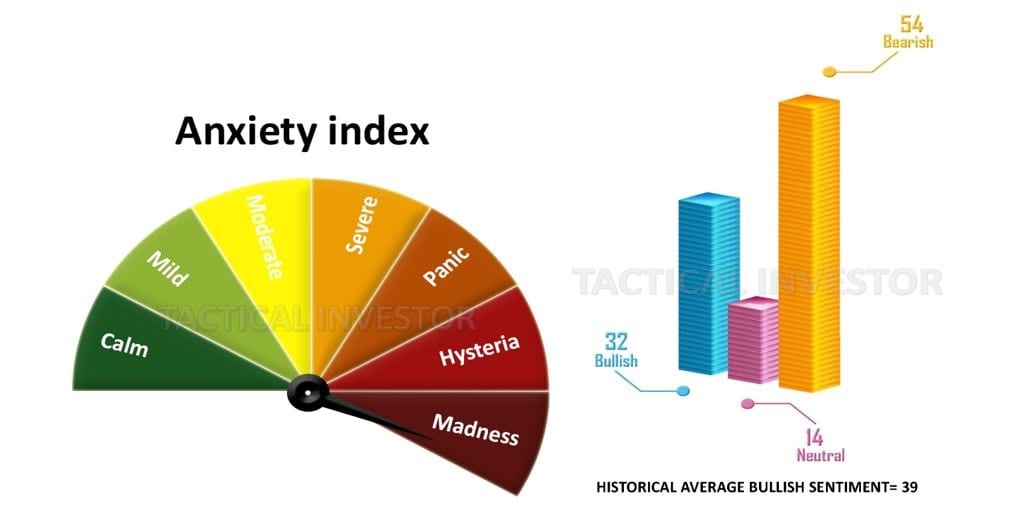

These readings were tabulated before yesterday’s pullback (July 31st), so a few more days of selling could propel bearish readings. At this very late stage of the game, it is astounding to see such a small number of individuals in the bullish camp. Once again, we have to reiterate no matter how strongly you might feel that this market should crash and burn, don’t act on those sentiments. No market in history has ever crashed until the masses have embraced it, and we don’t think this Bull market is going to change that equation. Market Update July 31, 2019

Just one week later, the outlook has shifted, demonstrating how easily the masses can change their stance. It will require considerable effort for them to embrace this bull market wholeheartedly. However, this fickleness among the masses brings excellent news, as it suggests that this bull market has the potential to surge even higher than we initially anticipated.

Conclusion

If the market experiences a pullback, it should be seen as a bonus. This is why we also adopt the belief that in an upward trend, stronger deviations from the trend present better opportunities. Considerable pullbacks should be regarded as early Christmas bonuses, indicating that the trend remains firmly upward. Sharp pullbacks can be utilized to initiate new positions or add to existing ones.. Market Update July 24, 2019

If the pullback from yesterday starts to gain momentum, it should be welcomed as it will likely present a buying opportunity. The optimal time to make purchases is when the trend is upward and uncertainty begins to arise, and vice versa. When one feels confident that everything is going well and the markets are bound to continue rising, it is more probable that the opposite outcome will occur.s. Market Update July 31, 2019

Hindsight is fantastic, for it gives you all sorts of beautiful ideas that most fail ever to implement when presented with the same situation again.

Random Notes: Buffett’s View on Stock Market Bubbles

“You, as shareholders of Berkshire, unless you own your shares on borrowed money or are going to sell them in a very short period of time, are better off if stocks get cheaper, because it means that we can be doing more intelligent things on your behalf than would be the case otherwise,”

“The real question is: ‘Has the 10-year or 20-year outlook for American businesses changed in the last 24 or 48 hours?’” the billionaire investor said on CNBC.

“You’ll notice many of the businesses we partially own, American Express AXP, +0.86% , Coca-Cola KO, those are businesses and you don’t buy or sell your business based on today’s headlines. If it gives you a chance to buy something you like and you can buy it even cheaper then it’s your good luck,” the chairman and CEO of Berkshire Hathaway BRK.B, added.

In his annual investor letter over the weekend, Buffett said equities would outperform bonds for years due to low tax rates.

“If something close to current rates should prevail over the coming decades and if corporate tax rates also remain near the low-level businesses now enjoy, it is almost certain that equities will over time perform far better than long-term, fixed-rate debt instruments,” he said. Full Story

Stock Market Bubble 2020 Conclusion

These individuals who felt clever by criticizing us during the market downturn will soon experience regret if they haven’t already. They made the same mistake in the past, vowing never to succumb to fake news or panic that led them to sell their shares at the market bottom. However, like mentally unstable individuals, they repeated the same error at the most inopportune moment, using the excuse of “it’s different this time.” The truth is, it will always be different, and that’s the excuse the masses will perpetually use to justify their emotionally driven selling instead of buying with logic.

This pattern will repeat itself over and over because the masses’ collective mindset lacks proper understanding. Hence, the saying, “misery loves company,” and stupidity demands it. Success is based on adopting an approach likely to attract criticism from the masses. The only saying that comes to mind is that the truth hurts, and indeed it does.

Achieving success in the market requires mastering control over one’s emotions. However, this cannot be accomplished through force, as it is not sustainable in the long run. Instead, it demands self-realization that emotions serve no purpose in investing. How can one attain this self-realization? Primarily through self-observation and, secondarily, by reading the right books. A curated list of recommended books is provided in the passcoded section of the website. A helpful approach to expedite the process of enlightenment is to perceive the stock market as a vast video game.

Considering the current discontent among the masses, every significant market correction should be embraced like a lost love, recognizing its potential.

Other Articles of Interest

What is the Gambler’s Fallacy? The Fast Track to Financial Ruin

The Statin Scam: Deadly Profits from a Pharmaceutical Deception

The Great Cholesterol Scam: Profiting at the Expense of Lives

Wealth is Health: It’s Essential for Everything

The Cholesterol Hoax: Unveiling the Hidden Truth

CLA vs Linoleic Acid: The Ultimate Omega Showdown

Coffee Lowers Diabetes Risk: Sip the Sizzling Brew

Oleic Acid Benefits for Skin: The Secret to Luminous, Ageless Glow

Beetroot Benefits for Female Health: Boost Natural Vitality

Example of Out of the Box Thinking: How to Beat the Crowd

6 brilliant ways to build wealth after 40: Start Now

Fear of Investing: Overcoming and Succeeding

Maximizing Wellness: Exploring Zinc Carnosine Benefits

Beetroot Benefits for Men: Extraordinary Potential, Humble Root

What is a Paradox: Understanding the Laws of Life and the Path to Peace