Novell Stock Market Cycle: The Era of Forever QE and Soaring Debt

Updated March 31, 2024

The global landscape is transforming profoundly, marked by the persistent adoption of Quantitative Easing (QE) as the new norm. As debt levels soar to unprecedented heights, waiting for a potential system collapse may pose significant risks, especially with much of the public largely unaware. While the current $31 trillion national debt might startle some, the forecast suggests a staggering future, potentially reaching $100 trillion.

Looking back to the early 1900s when our national debt was under $1 million, the current trajectory raises the spectre of a future where global debt could skyrocket to $1000 trillion before the reality becomes apparent. It is imperative to acknowledge and adapt to this new reality, understanding that the current system will persist until an eventual collapse occurs.

We assert that there is a considerable likelihood that worldwide debt could surge to $1000 trillion before the masses realize the truth about the economic situation. Until that revelation, people may continue to believe in the monetary equivalent of an emperor who is perceived as handsome but, in reality, is naked, fat, bald, and ugly. As of now, the global debt stands at $307 trillion.

Navigating the Peaks: Understanding the Global Debt Landscape

Global debt has steadily increased in recent years, reaching an unprecedented $307 trillion in 2023. This staggering figure encompasses the cumulative debt of governments, households, financial corporations, and non-financial corporations worldwide, equivalent to 349% of the global gross domestic product (GDP). This marks a substantial increase from the pre-Global Financial Crisis (GFC) level of 278%.

The surge in global debt is multifaceted, attributed to factors such as the economic repercussions of the COVID-19 pandemic, prompting increased borrowing by governments and private entities. Notably, the monetary value derived from each additional dollar of debt has been diminishing, signalling a decline in productivity associated with increased debt.

While elevated levels of debt raise concerns, it is crucial to recognize that debt is not inherently detrimental. It can serve as a tool for stimulating economic growth and development. However, effectively managing this debt becomes paramount to forestall potential financial crises and ensure enduring economic stability.

Stock Market Cycle Tip 2: Embrace Corrections

“We consider all significant corrections in the stock market as potential buying opportunities as long as the overall trend remains positive. Drastic corrections should be viewed as ‘once-in-a-lifetime events.’ Our primary objective is to keep you informed about the trend’s direction. However, the Federal Reserve’s decision to deploy a mix of powerful stimuli, akin to a cocktail of potent drugs, including Coke, Heroin, Crack, and Meth, may have profound consequences.

While precious metals are expected to perform well, we believe that stocks in vital sectors, excluding Gold stocks, will outperform the precious metals sector in terms of returns. One notable area is robotics, with a particular emphasis on Sex-bots and AI.”

From this point on, exploring these facets from a historical perspective yields valuable insights and furnishes investors with actionable intelligence when seamlessly intertwined with current events. This nuanced approach empowers them to seize opportunities and strategically elevate their financial gains.

Stock Market Cycle: The Contrarian Playbook

Sticking to the old adage, the stronger the deviation, the better the opportunity; we reiterate that the trend is your friend unless you want it to be your nemesis. Over the long term, there has never been a permabear who has been correct about the market trend. Those who bet against the market have been blown out of the water, so there are no successful permabears. Take the backbreaking market crashes of 1987 and 2008, for instance. Looking at the chart below, it’s evident that being a long-term bear is hazardous to one’s financial well-being.

Stock Market Cycle Trend Forecast

According to our monthly chart indicators, the stock market is currently in a highly oversold range. Historically, this has resulted in the markets rallying higher instead of breaking down. Therefore, any correction is expected to be short-lived. However, we prefer a sharp pullback, allowing for more significant buying opportunities. Nonetheless, it’s crucial to identify opportunities instead of dictating the markets. Viewing every reversal through a bullish lens is vital as the trend is up.

Those who hold out for a meaningful correction

Investors expecting a significant correction might be disappointed as the Dow currently trades in the oversold ranges on the monthly charts, limiting the potential downside. Those unfamiliar with mass psychology tend to have floating targets when predicting market corrections. For instance, they might be satisfied with a correction of 1500-2000 points, but once panic sets in, they lower their targets and jump on the panic train. It’s essential to have a clear and rational target and not get carried away by emotions.

History illustrates that they will keep lowering the targets until the markets suddenly reverse course, catching them off guard again. The crowd never wins, and that’s one of the main lessons investors need to understand when investing. Market Update May 7, 2019.

The current state of news media can be likened to sewage, as exemplified by the CIA’s admission of having agents in the industry. Large corporations could also follow suit, making it difficult to trust the information disseminated through mass media.

For over a decade, no financially related news has been found to help investors in the long run. The media seems to lead the masses towards euphoria during the worst times and panic during the best times. A winning strategy in investing is to buy during a stampede of the masses when the trend is up and vice versa.

The lack of liquidity in the repo market is only a symptom.

According to Tim Speiss, co-leader of personal wealth advisors at EisnerAmper, there isn’t an actual economic crisis, and the situation may be a regulatory matter. Banks also make 1.8% interest on money they hold in reserve with the Federal Reserve, including excess funds that could cover liquidity shortfalls.

The incentive to lend out this money decreases if banks already receive guaranteed interest rates. Banks are currently being paid over $19.5 billion monthly in interest for their excess reserves, totalling more than $1.3 trillion. When repo rates reach 1.75% to 2.0%, some banks may park their extra funds and collect the guaranteed interest instead. Full Story

Central banks worldwide appear to be intentionally destroying their currencies as part of a global currency war. The US Federal Reserve’s actions since bailing out banks in 2008 have set the stage for “forever QE” and have led to a reliance on hot money to fuel the economic recovery.

Any sign that the Fed might tighten monetary policy causes market panic. This economic recovery may be built on a lie, and the world faces a dangerous currency devaluation cycle.

Forever QE & Insane Bull Market Update April 2020 Update

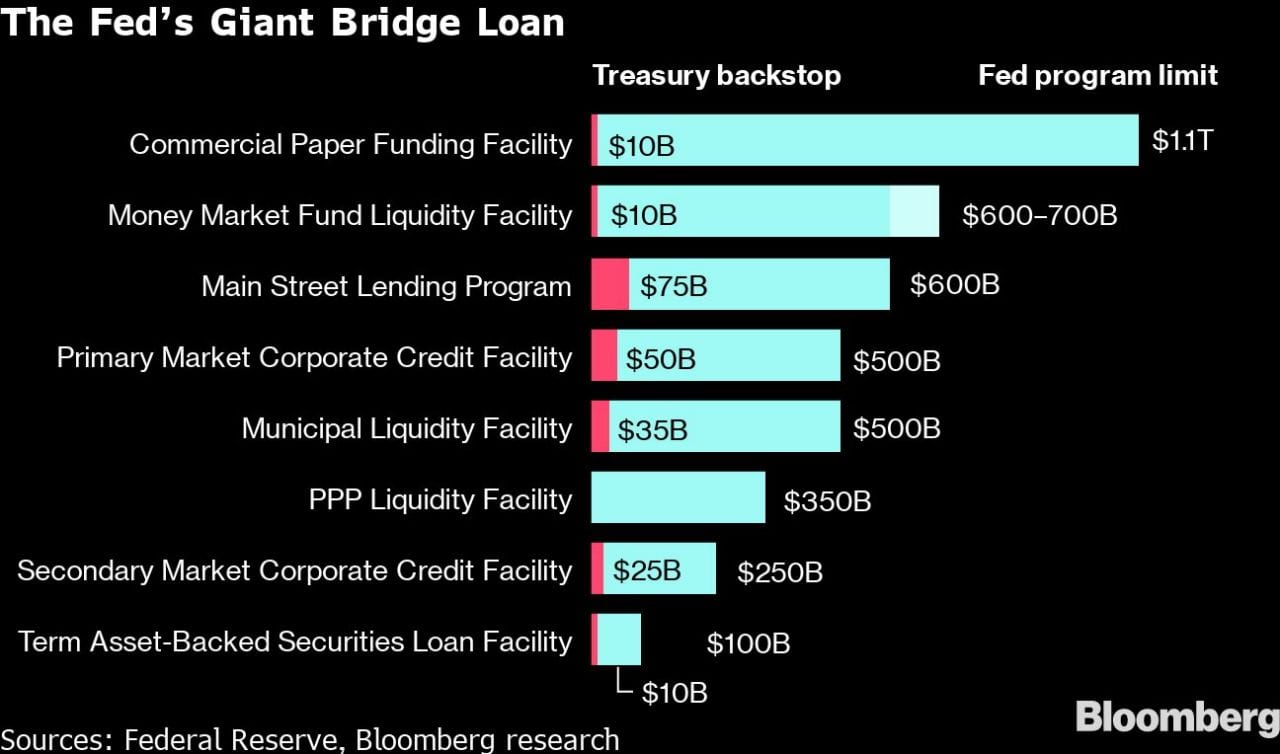

The Trump administration has dispersed around $881 billion from the pandemic relief package signed into law a month ago, and there will be an additional $500 billion to infuse into the economy. The Treasury Department distributes almost half of the $2.2 trillion Coronavirus Aid, Relief, and Economic Security Act through various channels.

Though small businesses run out of aid within two weeks, considerable funds are still available. Another $484 billion will be signed into law to replenish small companies and support hospitals and virus testing. Treasury Secretary Steven Mnuchin called it an “unprecedented fiscal and monetary response.” Yahoo

This influx of liquidity is akin to pouring gasoline on a raging fire; although the recent pullback has been severe, the forthcoming counter-rally will be even more robust. Early indications of the counter-rally suggest that the market has a bright future. It’s time to seize the opportunity and invest in high-quality stocks.

Closing Thoughts

In the current global landscape, mass media often seems to be a tool for spreading propaganda, distracting the public with inconsequential matters, and creating a sense of euphoria when caution might be more prudent It’s crucial to discern between what presents an opportunity and what does not. The more significant the deviation from the norm, the more excellent the potential opportunity; remember, the trend is your friend unless you challenge it, which could become your adversary.

We find ourselves amid a **global currency war**, with central banks striving to devalue their currencies worldwide. The so-called economic recovery is primarily fueled by hot money, and any hint of the Federal Reserve tightening its monetary policy sends the markets into a downward spiral. The only thing driving this recovery is a facade.

Investing wisely requires understanding market trends. The best time to buy is when the upward trend and uncertainty are low. Conversely, it’s risky to bet against the market in the long run. Being a long-term bear can be detrimental to your financial health. Until the masses fully embrace this bull stock market, the chances of a crash remain low.

The **Federal Reserve** seems to be concocting a potent cocktail of economic stimulants, akin to mixing Coke, Heroin, Crack, and Meth and consuming it all at once. Technology, particularly robotics and AI, is one sector poised to outperform others, including precious metals. Now is the time to invest in quality stocks, as any market correction will likely be short-lived due to oversold conditions.

In response to the pandemic, the **Trump administration** has already spent approximately $881 billion of the relief package, with an additional $484 billion in rescue funds set to be signed into law. This influx of liquidity is akin to pouring gasoline on a raging fire. While the short-term market pullback has been severe, the subsequent rally is expected to be stronger. It’s time to focus on identifying opportunities and adapting to the market’s ever-changing conditions, viewing every significant or minor reversal through a bullish lens.

Remember, the key to successful investing is understanding current market trends, adapting to changing circumstances and seizing opportunities. It’s time to focus on identifying opportunities and adapting to whatever hand the market deals, viewing every sharp or shallow reversal through a bullish lens.