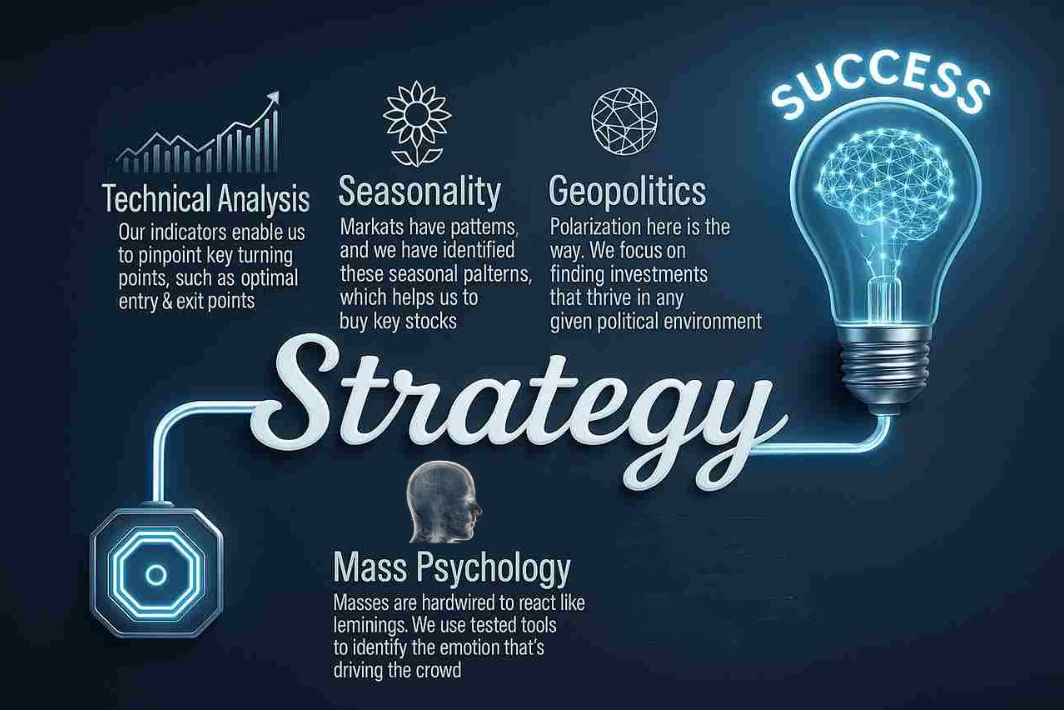

Tactical investing isn’t guesswork. It’s a deliberate collision of mass psychology and technical precision, forged to exploit market behaviour before the herd even sees the smoke. Most investors chase motion; we read its intent. The goal is not to predict—it’s to position ourselves at the inflexion point, where probability turns into inevitability.

The Market Moves on Emotion. We Move Ahead of It.

Markets aren’t driven by logic; they’re driven by emotional contagion. Fear, greed, denial, euphoria—each leaves fingerprints on price. The crowd acts after the feeling peaks. We act as it forms. That’s the edge. By mapping emotional velocity, we track where confidence breaks, where panic ignites, and where opportunity hides inside chaos.

Data Is Nothing Without Direction.

Technical analysis is our scalpel, not our crutch. Every signal is pressure-tested against mass psychology—momentum, exhaustion, reversal. We don’t chase trends; we identify when they’re preparing to mutate. That’s the difference between trading noise and commanding it.

Proof in Motion.

This is not theory—it’s outcome. 81% of our plays ride the dominant trend before it becomes consensus. We don’t deal in hope, hype, or hindsight. We deal in vector, probability, and timing. Tactical investing isn’t about being right; it’s about being first, and staying grounded while the crowd loses its mind.

Coal futures are sitting at an extreme, the most oversold level in more than 16 years. Coal stocks have already broken out, which tells you there is a lot more to come and that it’s in the early phases. Market Update Jan 11, 2026

Copper futures are likely heading toward 6.00. A monthly close at or above 5.50 would likely trigger a test of the 6.00 to 6.30 range. Longer term, copper could trade beyond 9.00, but we will cross that bridge when it arrives. Market update Dec 16, 2025

Right now, we don’t see an outright crash ahead. A pullback in the 9–11% range? That’s far more likely. It’s not the end of the bull, just the market catching its breath before the next and probably final parabolic run. Market Update Oct 29, 2025

Gold, the ancient constant, is reclaiming its role as the world’s strategic reserve. There is a deep psychological imprint at work here: something older than conditioning. Across civilisations and centuries, every culture has treated Gold as both currency and sanctuary. What we are witnessing now isn’t manipulation or mass hypnosis; it’s a return to common sense. Gold has preserved value through every cycle. Paper never does. Market Update Oct 29, 2025

A fresh MOAB (Mother of all Buys) detonated on May 7, a signal so rare it has never missed. The blast was immediate. Those who moved quickly rode a surge that swept through the market and reaped substantial gains. Now the air is thick, the ground still humming. This is the moment to tighten grip, not to flinch. Caution sharpens the edge, fear dulls it. Tactical Investor, Sept 2025

Bottom line: now isn’t the time to chase BTC, despite experts pushing wild targets of $250K and higher.

For those looking to play the downside, MSTR offers a cleaner proxy. It’s essentially a leveraged bet on Bitcoin, built on debt-fueled accumulation. But options aren’t cheap—super far OTM strikes like the Jan ’27 $150 put still cost over $1,600 each, with the stock at $334. A higher-risk alternative is the Jan ’26 $210 put, with the idea of rolling forward once momentum turns, though time decay works against you. If you short, through puts, deploy your funds in lots. Market Update August 31, 2025

Despite a storm of shocks, tariff wars, political noise, endless volatility, and a hundred other distractions you could throw into the mix, the one element that matters most is still missing: broad market euphoria. Yes, certain sectors are frothy, but the market as a whole isn’t there. That’s why every correction, no matter how sharp, should be welcomed rather than feared. Market Update, Aug 19, 2025

Stronger pullbacks equal stronger opportunities. This market isn’t ready to collapse into oblivion, well, not until we see the crowd FOMO’ing like rabid dogs, not just into AI or tech, but into everything. That’s when you worry. Right now? We’re still in the despair stage. And that’s exactly where bottoms are born. Market update May 7th, 2025

Fear has been recorded for centuries, and the outcome is always the same: those who panic always panic too late, and they end up losing their shirts, their pants, and everything in between. If the market does crash now, there’s only one logical move—back up the truck and buy. Market Update March 9, 2025

For now, market psychology suggests that buying the dip remains a valid strategy. The shift from fear-driven buying to euphoric excess has not yet occurred, meaning the market remains in a phase where corrections are more likely to be met with renewed optimism rather than widespread panic. Market update Feb 8, 2025

Although the broader markets have experienced a slight pullback, the risk-to-reward ratio for index investing, particularly with the Russell 2000 (RUT), remains unfavourable. It would be more appealing if the RUT dropped to the 1980-2040 range before considering investments in IWM or leveraged ETFs. On the other hand, individual stocks present a better upside potential, especially if they are trading in oversold territory. Market update Jan 30, 2025

The strange story continues to unfold, and bullish sentiment this week stands at 33, five points below its historical average. The Santa Claus rally was negative, but the January effect has been positive. What does this mean? Simple: humbug, rubbish, and who cares. What truly matters is the sentiment, which indicates nervousness, and that means any pullbacks should be embraced. Market Update Jan 13, 2025

In simple terms, this suggests that the bull market will only end when bullish readings surge to levels never before seen. Until that moment arrives, every pullback—whether moderate or intense—should be seen as an opportunity, not a setback. For the record, this week’s reading dropped from 50 to 42. Market update December 15, 2024

In an ideal world, the markets would shed 10% or more of their froth before bullish sentiment settles above 55 for weeks. But, let’s face it, ideal scenarios are rare. For now, the markets are likely to continue trending upward since we’re still in the traditionally bullish season.

The only potential spoiler would be if the crowd becomes excessively bullish. However, for the past 15 months and counting, there’s been no indication of this happening. Until that changes, corrections should be seen as opportunities, not obstacles. Market Update Dec 11, 2024

For now, the US dollar seems destined to retest the 108 mark, give or take 0.50. Aggressive investors may want to capitalise on strong pullbacks by going long via UUP or purchasing LEAPs. Market update October 31, 2024

For now, despite the contradictions and the seemingly irrational nature of the markets, we must accept that until the psychological factors align, these aberrations—no matter how gloomy or alarming they may appear—should be taken with a grain of salt. The market can defy logic for extended periods, and without the right psychological triggers, those negative signals are more noise than actionable insight. Market Update Sept 22, 2024

The targets of 108 to 109 (For USD) remain firmly in play, but reaching 110 will be more challenging. Market update September 15, 2024

The lowest the Russell 2000 dipped to was 1993, and it refused to budge from there, surging upwards from that level. This move is particularly interesting because it occurred while many key players in the tech-heavy Nasdaq were pulling back. This is the first signal of sector rotation, where smart money moves out of overvalued companies into those with strong upward potential that are selling cheaply.

Currently, there is strong support (former resistance turned support) in the 1965 to 1990 range. As long as this level is not breached on a weekly basis, aggressive investors can consider opening new positions when this range is tested. Market update July 21, 2024

If gold sustains its close above 1960 monthly, the path towards the 2400 to 2700 range remains intact. Tactical Investor March 2024

In summary, the odds of a crash are extremely low, and the only thing that could change that outlook is a black swan event. In such a situation, the only game plan is the one we have advocated: embrace all sharp pullbacks. The greater the pullback, the better the opportunity. Market Update April 26, 2024

No major shifts have happened since our previous remarks about long-term patterns. In simpler terms, we don’t foresee the SPX losing more than 450 to 550 points from its peak to trough, with a little wiggle room of plus or minus 50 points. Market update February 19, 2024

The chart above outlines our anticipated trajectory for the S&P 500 (SPX). We foresee a slight downturn, followed by a rise towards the 4900 to 5000 range. The journey to the 4900 to 5000 range for the SPX is a high-stakes endeavour if you’re considering going long. The SPX has already hit all our targets from last year. We’re now in the extended tail end of the move, which is typically volatile and can end abruptly. Market Update Jan 29, 2024

The Russell 2000 Index (RUT) has performed commendably, gaining approximately 10% from its lowest to highest point since our previous commentary. In line with our predictions, the markets refused to bow down to a correction, instead maintaining their relentless ascent. Market Update January 15, 2024

From a risk-to-reward perspective, the index offering the most promising ratio is the Russell 2000 (RUT). On a different note, certain technicians contend that the current rally might be a bear rally, despite its robust nature. We are not going to debate this issue until bullish sentiment reaches 55. For the argument to hold water, the respective index (NDX, SPX, etc) should not surge to new highs. (If they do, it will nullify their arguments.) Market update Dec 9, 2023

The overall outlook is unchanged, indicating that the SPX is still trending towards 4700. Market update Dec 9, 2023

Bonds are dangerously close to triggering a positive divergence signal, notably on the monthly charts. If this signal comes to fruition, brace yourself for a significant move akin to “bandits being chased by the hounds of hell.” The pattern has notably strengthened since the last update. Moreover, if this pattern unfolds, it will serve as a dangerously clear precursor to similar movements in markets like Palladium, Lithium, and others. Market Update November 12, 2023

Given that bullish sentiment still appears somewhat elevated, the potential for a selling climax looms larger. A selling climax involves swift and aggressive downward movements, typically occurring within a span of about five days. Such an event could push bearish sentiment readings beyond 51 while driving bullish readings below 21.00. Market update Oct 29, 2023

In September, it made more sense for risk-takers to take a short position. The current rally has an above-average likelihood of failing over the short term. Bearish sentiment has to spike, and markets usually bottom with a climactic sell-off. Hence, a test of the 4080 to 4140 range on the SPX is likely to coincide with a bottom, though don’t rule out the possibility of the SPX shooting down to the 4000 range. However, at this stage of the game, any spike down will be momentary.

Regarding the NDX, it briefly traded below 14550 but reversed course just as fast. A weekly close below that level would be needed to indicate a test of the 13500 to 13,700 range. If you are short, then use the downside targets of the SPX to close your short or, consequently, close them when the NDX trades below 13,950. Market Update October 12, 2023

If the Nasdaq closes at or below 14443 on a weekly basis, then the odds are quite high that it will test the 13950 to 14,050 range with an overshoot of 13,800. Again, if this happens, it’s a buying opportunity. Market Update Oct 5, 2023

From a purely technical standpoint, indices like the NDX and SPX could trend higher before pulling back. However, when we assess the risk-to-reward ratio, the risk doesn’t justify the potential reward.

If you believe you possess the agility, you might consider taking a long position with the hope that the NDX (Nasdaq 100) tests the 15,700 to 15,900 range. Once again, considering the risk-to-reward ratio, it’s wiser to capitalise on market rallies to expand your short position if you’re an aggressive trader.

Additionally, a breach below 14,550 would signal the potential for lower prices and a test of the 13,500 and 13,700 range. Market update Sept 7, 2023

As a result, we anticipate the rally phase to continue for several weeks, extending into mid-April. However, most indices are expected to form lower highs, with the possibility of one index diverging. Given its current strength, the NDX is the leading contender for this divergence. It could potentially trade as high as 13,950 on the upper end, with a lower range of 12,900 to 13,200. Market Update March 21, 2023

As long as it doesn’t fall below 18,000 on a monthly basis, the outlook for BTC remains positive. It has now established a trajectory that could lead to a test of the range between 25,500 and 29,009. Market Update Feb 9, 2023

It rallied as projected, and it traded within the suggested targets. Currently, the Dow trades in the insanely overbought ranges on the daily charts, so the odds favour a sharp pullback. A test of 32,500 to 32,700 is likely, with a possible overshoot of 32,100. Market Update January 30, 2023

The daily charts are close to trading in the extremely oversold ranges. Hence an interim bottom is likely. The ideal scenario calls for them to rally to the 29 to 30 of this month and then drop lower into January 2023. Market Update Forum Dec 20, 2022

The Dow managed to end the week above a key short-term zone of resistance (32,250); by closing above this level on a weekly basis, it has set the path for a test of the 34,300 to 34,650 range. Market update October 31, 2022

If the markets follow the projected path from October, a test of the 9,900 to 10,500 range will probably mark a bottom. In other words, if they follow the 1973-74 pattern, a test of the above ranges will make for an enormous opportunity. Will the Nasdaq follow this path; nothing is written in stone. However, if it were to happen, it would provide a mouth-watering opportunity for Tactical Investors. Market Update, Sept 11, 2022

Short term, the markets are entering a corrective phase; the SPX has hit short-term targets. Former support points turned into resistance which should turn into zones of support again, albeit on a short-term basis. The likely pullback targets fall in the 3960 to 4020 with a decent chance of overshooting as low as 3870. Market Update August 2, 2022

It appears likely that the market will experience two corrections this year. The first one, which could already be underway, is expected to occur in the 1st quarter. The 2nd one is more likely to occur towards the end of the 3rd quarter to the 4th quarter. This year, two corrections and lots of volatility would be the best way to destroy the vast majority of investors and rob them of all their hard-earned gains. Market update Jan 11, 2022

Not one investor in the world can prove that giving in to panic paid off over the long run. If they dare attempt to take this challenge, this graph will end any rubbish argument they come up with. The recovery rate from crash to boom will accelerate as the money supply rises. Look at how fast the markets recovered from the COVID crash. Market Update August 29, 2021

If the trend is up, no matter how sharply the markets pull back, do not panic, even if every expert and his grandma are telling you it’s time to flee for the hills. Market Update March 11, 2021

Many investors are stating they are itching to jump into the markets; isn’t this bloody amazing? When the markets were crashing last year, and we were telling everyone to buy, they wanted to do the opposite. Now we are stating that it’s time to hold the gunpowder dry, and they want to move in the opposite direction again—a classic replay of the secret desire to lose syndrome in action. Misery loves company, and stupidity demands it. The average mindset is wired to lose, so when you feel sure about something, check ten times before you get into it. Certainty about the markets is probably the best signal that you will get hammered. Market Update Jan 11, 2021

Most investors react to disasters by panicking and throwing the baby out with the bathwater; in recent times, they have thrown the babysitter and the entire family out too. Disaster is the code word for opportunity, especially when it comes to the financial markets. Lastly, remember how far the Dow has rallied off its low in March; the naysayers only focus on the pullbacks but not on the big upward moves the market experienced before the pullback, for if they did, it would shatter their already pathetic record. Market Update Nov 13, 2020

It appears that markets are experiencing the “backbreaking correction” one, which every bull market experiences at least once and is often mistaken for the end of the bull market. While it feels like the end of the world, such corrections always end with a massive reversal. Given the current overreaction to the coronavirus, there is now a 70% probability that when the Dow bottoms and reverses course, it could tack on 2200 to 3600 points within ten days. Interim Update March 9th, 2020

A sharp pullback is still an outcome we view through a very bullish lens. The ideal setup calls for the Dow to trade in the 28,800 to 29,000 range, with a possible overshoot to 29,300. After that, a nice sharp pullback would set the bedrock for a surge to and possibly well past 30k. Market Update Dec 29, 2019

Tactical Investor Site Disclaimer

The Tactical Investor does not give individualised market advice. We publish information regarding companies we believe our readers may be interested in, and our reports reflect our sincere opinions. However, they are not intended as personalised recommendations to buy, hold, or sell securities. Investments in the securities markets, especially options, are speculative and involve substantial risk. Only you can determine what level of risk is appropriate for you. Continue to read the disclaimer in full.

Tactical Investing blends Crowd Behaviour analysis with technical analysis, foreseeing market trends and pinpointing crucial turning points.