Stock Market Forecast for Next 3 Months: Trends Over Predictions

April 30, 2025

April Firestorm: The Plunge, the Pop, and the Yo-Yo Nightmare

From April 2–7, the S&P 500 free-fell over 10%—a spiral this brutal has only shown up five times in history. Every headline screamed “Sell-off,” fueling the panic. Then, on April 9, markets exploded higher in a single-day rally so violent it felt like charging back into battle after retreat. That rapid-fire rebound was the sugar rush that makes bulls believe they’ve cracked the code—until the next plunge reminds them it’s all smoke and mirrors.

The Trap of Extremes: Why Predictions Are Poison

Right now, investors are drowning in bullish euphoria. TSLA, AMD, TSM, QCOM, AMAT, ASML—stocks at cosmic highs—are being chased like the holy grail of AI hype. The assumption? “They can only go up.” When everyone believes the bull will never die, cognitive biases flip overnight. The same herd that chased stocks to the stratosphere will retreat into the abyss once doubt takes hold. By the time they wake up, the bottom is long behind them.

Sentiment Shockwaves: Playing the Crowd’s Psychology

Bearish sentiment readings below 20 are almost unprecedented, yet we’re here, with markets still near all-time highs. Three straight weeks of sentiment at 20+ points under its historical average tell you one thing: the crowd is trapped between FOMO and fear. When sentiment surges above 55–60+, that’s your cue to start trimming. Big players unload into euphoria, leaving everyone else holding the bag.

Trends Over Forecasts: The Only Signal That Matters

Forget calling exact tops and bottoms. The April yo-yo proves the market doesn’t move on your timetable. What matters is quality and trend, not crystal-ball predictions. When the market grinds sideways into oversold territory or dips toward 4800, that’s your bedrock for the next rally. Your playbook? Buy the dip in quality stocks, sell high-premium options, or write covered calls. Tech may offer flash setups, but real value often lives in the non-tech corners where fear hasn’t yet left.

The Harsh Reality: Why Most Traders Deserve to Get Wrecked

Let’s cut through the noise—the stock market isn’t the complex beast it’s made out to be. The real danger isn’t the charts or the volatility—the herd mentality dominates. Most traders aren’t making decisions based on data or sound strategy; they’re chasing hype, reacting to noise, and folding when the pressure hits. This isn’t a game of intelligence—it’s a game of psychological endurance, and most traders don’t have it.

Harsh? Absolutely.

Deserved? Without a doubt.

Winning the market isn’t about luck or timing—it’s about Patience, Discipline, and Psychological Awareness. These are the pillars that most traders can’t hold up. They jump from strategy to strategy, looking for shortcuts, chasing trends, and ultimately crumbling when it matters most. They don’t last because they’re too busy reacting to the latest “hot tip” or “breaking news” ever to form a real strategy.

Here’s the truth: Markets are cyclical—fear, greed, euphoria, despair. The crowd gets it wrong at every turn—buying the tops and selling at the bottoms. The real winners don’t just ride the waves—they create them. They don’t follow trends—they shape them.

This isn’t about gambling or wild predictions but strategy and execution. A clear vision, a strong psychological edge, and consistent discipline separate the winners from the losers. When the crowd is panicking, real winners are accumulating. When the crowd is euphoric, they’re selling. They understand that it’s not about trying to predict the short-term future; it’s about reading the psychology of the masses and knowing when to exploit it.

The Ruthless Edge: Core Principles for Market Domination

- Psychology Moves Markets

Let’s face it—markets aren’t logical. They’re emotional. Fear and greed rule the day, and emotions are contagious. The key to dominating the market is learning to read the crowd, anticipate their moves, and exploit their weaknesses. When the masses panic, you buy. When they’re chasing the latest shiny object, you sell. It’s that simple. - Contrarian Investing

Big wins are found where others won’t go. While the masses flee, the contrarian steps in. Fear is where opportunity lies—when everyone’s running for the hills, that’s when you’re picking up the scraps that others are too scared to touch. The best plays don’t happen in euphoric markets; they happen when everyone else is panicking, and that’s your cue to step in. - Spot Trends Early

The best trades don’t happen after the headlines hit—they happen before the herd even knows what’s coming. Great investors identify breakout sectors before they catch mainstream attention. The secret? Start early, capitalise on the momentum, and exit before the crowd piles in. Once the headlines explode, it’s too late—the best trades were made while everyone else was still oblivious. - Pick the Leaders

A sector might be strong, but strength alone isn’t enough. You need to identify the stocks with true momentum—those that aren’t just following the trend, but leading it. Tools like Finviz and BarChart help you cut through the noise and find the real winners—skip the hype, and focus on strength. The market doesn’t reward the loudest stock. It rewards the one with real, sustained momentum.

Technical Analysis: Your Edge

Don’t mistake charts for magic. Technical analysis isn’t about predicting the future but identifying probabilities. Learn to read charts, recognise patterns, and make calculated entries and exits. The market rewards skill, not feelings. Charts don’t care about emotions; they show you where the market’s likely to go, based on past behaviour.

Next Up: Sector Rotations, Pullbacks, and Hidden Patterns

Want to ride the next massive rally? It’s not about chasing the hype. It’s about understanding the sector rotations, mastering risk-adjusted pullback entries, and uncovering those hidden technical patterns that signal when the real rally begins.

Stop guessing. Start learning. The trend is your truth—everything else is noise. Keep an eye on the long game, let the herd get whipped around, and stay grounded. The market is full of explosive opportunities if you know where to look. Stay locked in, and let the psychological edge and technical mastery fuel your moves.

The Takeaway:

Ignore the noise. The crowd will always get it wrong. Exploit fear. Understand the psychology of mass panic and euphoria. Stay sharp. Use trends, technicals, and your own discipline to take what’s yours.

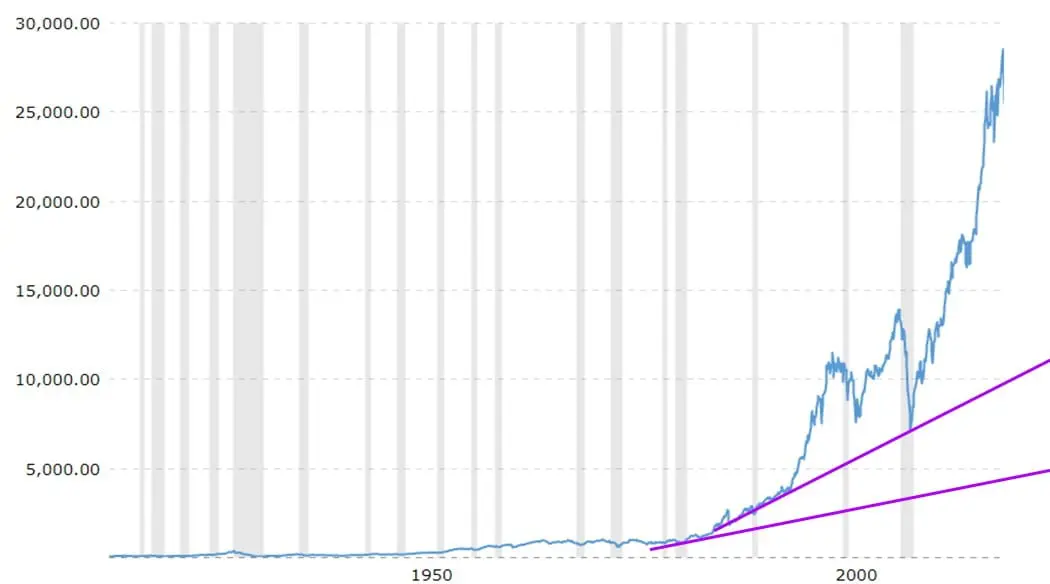

Crash Buying: When Blood in the Streets Pays

Market crashes and deep pullbacks aren’t threats—they’re opportunities. Use long-term charts and trend lines to spot major support zones. A dip slightly below the trend and bearish sentiment above 55 can signal a strong buy. These moments are rare. Be ready.

Charts spanning 15–20 years often test trend lines more frequently, offering more chances to buy when the market overshoots to the downside.

But no system guarantees success. Risk is real. Protect yourself with research, multiple indicators, and a diversified portfolio.

Institutional moves may shake the short term, but a long-term focus wins. Deep dips under major trend lines, confirmed by sentiment data, often lead to high-reward setups.

The Invisible Scalpel: When Sentiment Becomes the Weapon

Zoom out and strip away the chatter—what remains is a battlefield of relentless forces, each vector a carving tool, each pullback a recalibration. This market isn’t chaos; it’s controlled asymmetry, and survival hinges not on forecasting but on positioning where the psychological seams will split.

We’re deep in the late-stage accumulation of a crafted belief system. Forget earnings whispers or Fed speculation—this is sentiment engineering at its finest. Three weeks of muted bullish readings while indices flirt with record highs? That’s no tired market—it’s a coiled spring. A deliberate setup.

This isn’t your textbook correction. It’s a vector inversion, a psychological whip-crack in real time. On the surface, prices stall. Underneath, sentiment divergence fractures the narrative. Volatility squeezes, sector rotations flicker, optimism wanes—all pressure points awaiting rupture. When it snaps, it will be surgical, swift, and ruthlessly profitable for pre-positioners.

Most traders won’t see it coming. They’re wired to chase strength and panic on weakness—never early, always leveraged. They trade feeling, not vectors. We trade vectors.

Vectors converge into a rare phenomenon: a sentiment vacuum at historic highs. This is your warning shot—not necessarily a crash, but a phase shift. The next quarter isn’t about direction; it’s about extraction. Professionals will unload into overconfidence, siphoning gains from the crowd before the herd even realises it’s been baited.

Watch behaviour, not headlines. Retail traders are flooding into overpriced options. Tech names hyped to perfection. AI narratives are screaming for attention. These aren’t signals of strength—they’re flashing neon signs of a trap. Meanwhile, under-the-radar plays, like HIMX quietly building momentum, slip past as everyone else stares at the wrong ticker.

We’re not predicting doom. We’re anticipating a sentiment inversion: grind, trap, then lacerate. When bullish sentiment crosses 55, 60, or 65—that’s the trigger. Then comes the distribution, the exit, the moment the calm shatters into chaos.

Don’t be seduced by silence. The higher the calm, the sharper the snap. The vector never lies.

This market belongs to those who read the shift and strike before the echo. We’ve danced this dance before—and we’ll dance it again. The only question: Are you already in position? Because when the cycle flips, you won’t have time to think. You’ll already be done.

Click the link below for a historical view of our 2023 stock market forecast. Explore insights and past predictions.

Stock Market Forecast: Historical outlook