Global Trading Volume is Declining: Time To Worry

Updated Feb 2022

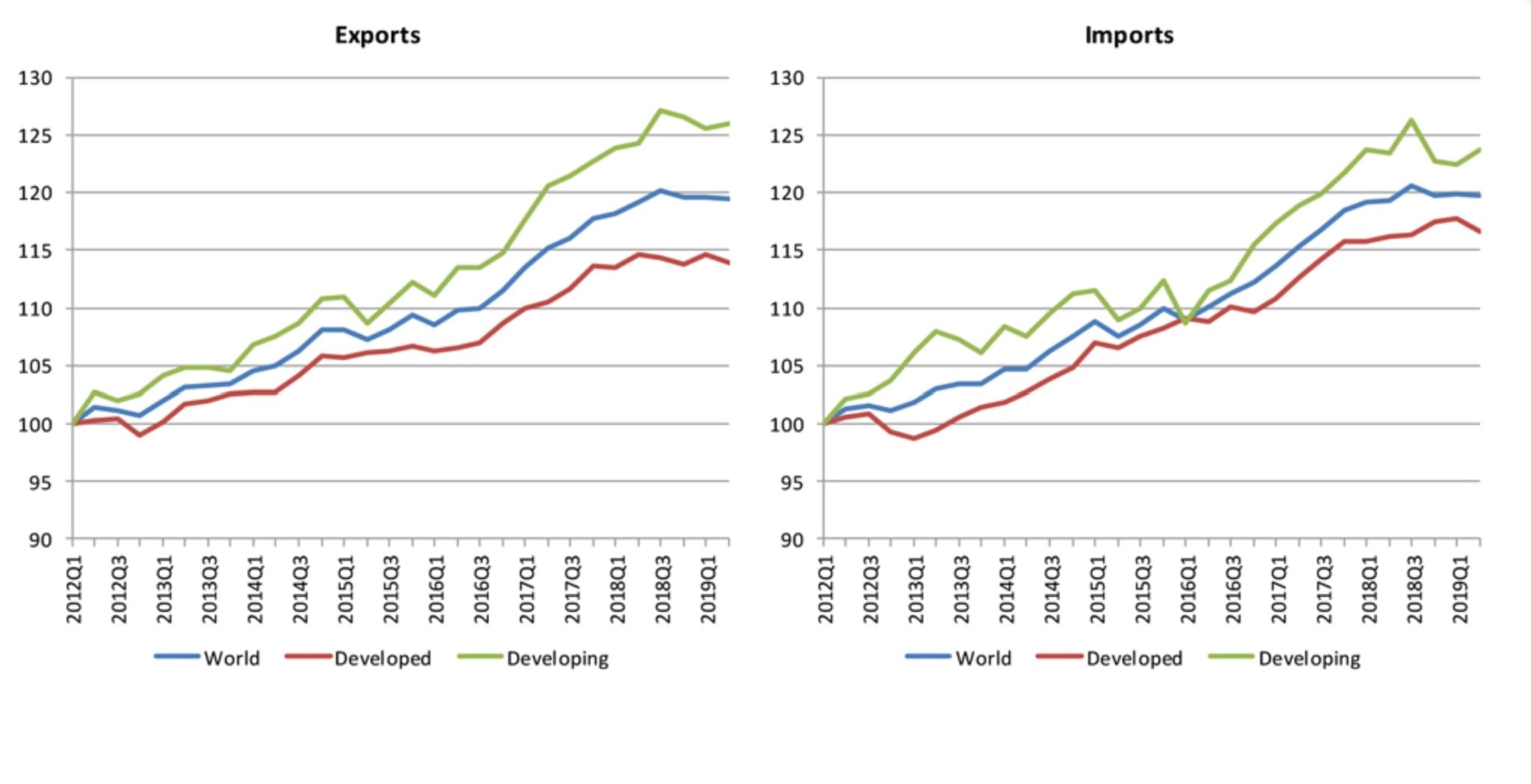

There are indications that trading volumes may be decreasing in specific markets. The charts below provide some insights into this phenomenon.

image courtesy of https://www.wto.org/

Impact of Covid On Global Trading Volume

In 2020, the volume of global stock trading declined due to the COVID-19 pandemic and related economic uncertainty. The World Federation of Exchanges reported an 11.8% drop in global trading volume in equities in 2020 compared to the previous year. This decline is likely due to the pandemic’s impact on economic conditions, investor behaviour, and market volatility.

Other factors could be at play.

At the same time, there are concerns about declining trading volumes in some major financial markets, such as the bond market. Some analysts suggest that regulatory changes, technological advancements, and changing investor behaviour could be contributing to a longer-term decline in trading volumes.

The decline in global trade volume, which has been ongoing since 2018, is also a contributing factor. This decline is mainly due to geopolitical tensions and changing attitudes towards globalization. While the reasons for the decline in the trading volume are complex, it is clear that various factors such as market volatility, economic conditions, and geopolitical events are all playing a role. Therefore, it is crucial to consider the specific market and time period being examined to assess trends in global trading volume. Despite the challenges, most economists remain optimistic about the global economy’s long-term prospects.

The trend is up: market sentiment does not support a crash

Let’s look at what we said to our premium subscribers not too long ago regarding the turmoil in the markets

There is a strong layer of resistance in the 26,900 to 27000 ranges, and that goes back to the beginning of 2018. Only a monthly close above 27,200 could potentially overrule a quick fast downward move. A monthly close above 27,200 would lower the odds of a strong pullback, and a monthly close above 27,450 should pave the way for a blistering strike of the 29K ranges. Market Update Oct 30, 2019

While the Dow has not closed above 27,200 monthly, it has broken out to new highs, which significantly lowers the odds of it dropping to the 24,500 range. While we stated that this is an outlook we would have favoured, we did not put all our eggs in one basket by going into cash or shorting the markets. If the Dow pulled back strongly, it would have made for a lovely buying opportunity; the trend, as we alluded, was still firmly positive. Shorting a market when the trend is up is a recipe for disaster. Market Update Nov 10, 2019

The current market action validates what we have been stating for a while now if one will rely only on technical or fundamental analysis. The outcome is going to be far from optimal. What worked before 2008, in most cases, no longer works today. We threw 90% of our tools out and replaced them with new tools, and we placed more emphasis on mass psychology.

Our primary goal is to identify the main trend, and after that, we look for additional opportunities. Hence new subscribers should understand that while looking for a pullback that could range from mild to wild, our focus is always on the long-term trend. As it stands, the trend is still positive (up), and hence all pullbacks have to be viewed through a bullish lens.

Global trading is declining, But Sentiment Supports higher prices

Investors are bullish; until they embrace this market with gusto, every strong pullback should be viewed through a bullish lens.

One could have written a small novel 3-5 years ago on why this market should have crashed, but that novel, registered as a work of non-fiction, would fall under the fiction category today. 90% or more of the tools, indicators, or whatever one employed before 2008 will never work again. This is the main reason so many experts have gotten this market wrong. We don’t care what calls they made or how wonderful they were before 2008; those tools are dead. Despite all the lies pushed out there, the main force driving this market is “hot money”.

Once you understand that the masses still have faith in these so-called experts, better known as modern snake oil salesmen, one can understand why the crowd has refused to embrace this bull market. Frankly, we are delighted that they have refused to jump in, for its 3X easier to make money in a bull market than in a bear market.

We feel pretty disturbed when people start to agree with us, so the fact that many individuals disagree with our assessment is music to our ears. We hear the same rubbish mouthed in 2015 and 2016 being pushed as sage advice today; it did not work then and will not work today.

Conclusion:

Every disruptive event creates opportunities; one only has to know when to look for them. One can only spot new emerging opportunities if one is calm and does not follow the gloom and doom scenarios the mass media loves to come out with. In fact, if one looks at history, one can see how the mass media went out of their way to stampede the crowd and make the situation worse. Some recent examples that come to mind are the dot.com crash, the housing bubble, President Trump’s election victory in 2015, and the list goes on.

Other Articles of Interest

Dogs Of The Dow Jones Industrial Average (Dec 10)

Trump Stock Market: Will Impeachment Hearings Derail This Bull (Nov 21)

Negative Thinking: How It Influences The Masses (Nov 15)

Leading Economic Indicators: Finally in Syn With The Stock Market? (Oct 28)

What Is Fiat Money: USD Is Prime Example Of Fiat (Oct 13)

Yield Curve Fears As Treasury Yield Curve Inverts (Oct 12)

Current Stock Market Trends: Embrace Strong Deviations (Oct 2)

Market Insights: October Stock Market Crash Update (Oct 1)