Garbage News: When Information Overwhelms Quality

Oct 8, 2023

Introduction:

In today’s digital age, news shapes our understanding of the world. However, amidst the vast amount of information available, a concerning issue arises—garbage news. This narrative delves into garbage news, which refers to trending news driven by sensationalism and fear-mongering that may lack reliability and value.

The introduction sets the stage for our exploration, highlighting the integral role of news in our daily lives and the growing concern of garbage news in the media landscape. It emphasizes the notion that trending news, often fueled by sensationalism and fear, may not provide trustworthy or valuable information.

The subsequent topics will delve deeper into the various aspects of garbage news, exploring its manipulative nature, the fallacy of news as gossip, the weaponization of news, and the need to recognize and critically evaluate the information we consume. Each topic will examine these aspects in more detail, providing insights into the tactics used by media outlets and emphasizing the importance of discernment and long-term trend analysis.

Ultimately, the conclusion will tie together the key points discussed and emphasize the need to regain control over our information consumption. It highlights the significance of critically evaluating news quality and reliability, recognising garbage news’s manipulative nature, and focusing on long-term trends to make informed decisions.

By addressing each topic individually, we can delve deeper into the nuances and intricacies of garbage news, unravelling its impact on our understanding of the world and exploring strategies to navigate through the sea of misinformation.

The Manipulative Nature of Trending News:

In the realm of trending news, manipulation thrives. News outlets, driven by the insatiable thirst for profit and increased audience engagement, have mastered exploiting our primal instincts. Fear, an emotion that seizes our attention and triggers a response, becomes their weapon of choice.

Headlines are crafted with meticulous precision, designed to shock, entice, and captivate. Sensationalism reigns supreme as stories are amplified beyond their true significance. The truth becomes secondary to the desire for clicks and shares, leading to a distortion of reality and a disservice to the public.

Exaggeration becomes a common tactic to inflate the importance of events and issues. Minor incidents are blown out of proportion, and the gravity of situations is magnified to create a sense of urgency. In this relentless pursuit of attention, context is often sacrificed, and nuance is lost in sensational headlines.

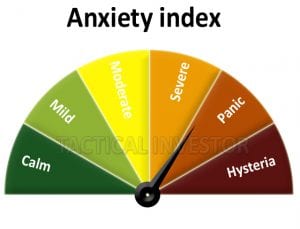

News outlets manipulate our emotions and shape our perception of the world by preying on our fears. They instil anxiety, stoke outrage, and fuel divisiveness. The consequences are far-reaching, as the public is left misinformed, polarized, and vulnerable to manipulation.

The manipulative nature of trending news not only compromises the integrity of news reporting but also erodes the trust between media outlets and their audiences. It perpetuates a cycle of garbage news, where sensationalism and fear-mongering become the norm, drowning out valuable information and objective reporting.

To combat this manipulation, we must cultivate a critical mindset. We must question the motives behind sensational headlines and seek reliable sources, prioritising accuracy and context. By recognizing the manipulative tactics employed by news outlets, we can break free from the cycle of fear-driven information and demand a higher standard of journalism.

In pursuing truth, let us not be swayed by the allure of trending news. Instead, let us champion integrity, discernment, and a commitment to uncovering the facts behind the headlines. Only then can we reclaim the power over our information consumption and navigate the complex landscape of news with clarity and confidence.

Recognizing the Ruse:

In the era of garbage news, recognizing the ruse is paramount to reclaiming our information landscape. Breaking free from the constant bombardment of sensationalized information requires a conscious effort to distance ourselves from traditional news sources and reduce our reliance on them.

The first step is acknowledging the overwhelming influence that traditional news outlets have on our lives. They shape our beliefs, attitudes, and understanding of the world. However, these outlets are not immune to the allure of sensationalism and the pursuit of profit. By recognizing this inherent bias, we can begin to question their narratives and seek alternative sources of information.

Cutting the cord, metaphorically speaking, involves reducing our dependence on traditional news channels. It means breaking away from the incessant news cycle that bombards us with sensational headlines, breaking news alerts, and fear-inducing stories. By reducing our exposure to these sources, we create space for critical thinking and a more discerning approach to news consumption.

With fewer distractions and less noise, we gain a clearer perspective on the true value—or lack thereof—of the information presented to us. We can assess the reliability and credibility of news stories, scrutinize their sources, and evaluate their relevance to our lives.

In this process of distancing ourselves from the noise, we open ourselves up to a broader range of information sources. Independent journalism, fact-checking organizations, and alternative media platforms offer diverse perspectives and insights that may be absent from mainstream news. By seeking out these sources, we can gain a more balanced and nuanced understanding of the issues that matter most to us.

Recognizing the ruse also requires a commitment to critical thinking. We must question the motives behind the information presented to us, consider the potential biases at play, and engage in fact-checking and verification. This empowers us to separate reliable, well-substantiated information from the noise of garbage news.

In the pursuit of an informed and discerning mindset, let us embrace the challenge of recognizing the ruse. By cutting the cord, reducing reliance on traditional news sources, and engaging in critical thinking, we can navigate the complex media landscape with greater clarity and make informed decisions based on reliable information.

The Fallacy of News as Gossip:

Indeed, the fallacy of news as gossip has become increasingly prevalent in today’s media landscape. The prioritization of scandal, controversy, and sensationalism over substantive reporting has transformed news into entertainment rather than a source of reliable information.

In this context, garbage news can be likened to “toilet paper” – it may grab attention momentarily, but it lacks substance and fails to provide genuine insight into the world around us. Instead of delving into meaningful issues, news outlets often prioritize click-worthy headlines and salacious stories that appeal to our voyeuristic tendencies.

The focus on gossip-like news undermines the role of journalism as a source of objective reporting and analysis. Instead of informing and enlightening the public, news as gossip perpetuates a culture of shallow engagement and trivialization of important issues. It fuels a never-ending thirst for scandal and controversy, diverting attention away from topics that truly matter.

As news consumers, it is crucial to recognize the fallacy of news as gossip and demand better from our media outlets. We should seek out sources that prioritize substantive reporting, provide context, and foster critical thinking. By shifting our attention away from tabloid-like sensationalism and towards more meaningful journalism, we can better understand the world and make informed decisions.

Moreover, we must also take responsibility for our engagement with news. By actively seeking out reliable sources, fact-checking information, and engaging in critical analysis, we can avoid being swept away by the allure of garbage news. It is essential to be discerning readers and viewers, distinguishing between valuable insights and mere gossip.

Ultimately, we can strive for a media landscape that prioritizes substantive reporting, promotes informed citizenry, and fosters meaningful dialogue by rejecting the fallacy of news as gossip. Only then can we break free from the cycle of garbage news and engage with the world in a more thoughtful and informed manner.

The Weaponization of News

The weaponization of news is a concerning phenomenon that occurs when media outlets exploit garbage news to serve their own agendas. By sensationalizing and manipulating information, they can shape public opinion, generate fear and uncertainty, and advance specific narratives.

Complex issues such as Brexit and trade wars are often fertile ground for the weaponization of news. Media outlets may amplify the potential negative consequences, emphasize worst-case scenarios, and present a skewed perspective that aligns with their own interests or biases. This fear-driven approach can create a climate of anxiety and polarization, hindering rational discourse and informed decision-making.

By weaponizing garbage news, media outlets seek to influence public perception, sway political outcomes, or serve the interests of specific stakeholders. They may exploit people’s fears, exploit confirmation biases, and promote divisiveness to maintain high levels of engagement, increase viewership or readership, or advance their own agendas.

Recognizing this manipulation is crucial to break free from the grip of fear-driven garbage news narratives. Individuals can take a step back, critically analyze the information presented, and seek out alternative perspectives. By focusing on broader trends, long-term analysis, and reliable sources, individuals can gain a more comprehensive understanding of complex issues and avoid being swayed by sensationalized narratives.

Furthermore, we must be aware of our biases and cognitive vulnerabilities when consuming news. By actively seeking diverse viewpoints, fact-checking information, and engaging in critical thinking, we can mitigate the impact of weaponized news and make more informed judgments.

Ultimately, by recognizing the weaponization of news, individuals can guard against the manipulation and fear-mongering tactics employed by media outlets. By focusing on broader trends, analyzing information critically, and seeking reliable sources, we can navigate through the landscape of garbage news and engage with a more informed and nuanced understanding of the world.

Embracing the Trend

Amidst the chaos of garbage news, there is indeed an opportunity for individuals to embrace market trends and adopt a logical approach to decision-making. While garbage news may provoke panic and irrational responses, focusing on long-term trends can provide a more informed perspective and guide more strategic decision-making.

The constant influx of sensationalized headlines and short-lived news stories can create a sense of urgency and distract from the bigger picture. Garbage news often amplifies short-term fluctuations and exaggerates their significance, leading to impulsive and ill-informed reactions. However, by ignoring the noise and concentrating on long-term trends, individuals can better understand the underlying forces at play.

Market trends encompass broader patterns and movements shaped by various economic, social, and technological factors. By analyzing these trends, individuals can identify the underlying drivers of change and make more informed decisions based on a deeper understanding of the forces shaping the landscape.

Embracing trends requires a shift in focus from reactive responses to proactive anticipation. Rather than being swayed by the latest sensational headlines, individuals can assess the broader trajectory of industries, sectors, or markets. This allows for a more strategic and forward-thinking approach that is less influenced by short-term noise.

By embracing trends, individuals can also filter out the noise of garbage news and avoid getting caught up in the cycle of panic and misinformation. By focusing on reliable sources of information that provide a broader perspective on long-term trends, individuals can navigate the turbulent waters of information overload with greater clarity.

Of course, it is essential to acknowledge that trends are not infallible and can be subject to unforeseen events or disruptions. However, by adopting a trend-oriented approach, individuals can develop a more grounded and rational decision-making process less susceptible to the whims of garbage news.

In conclusion, embracing market trends allows individuals to rise above the chaos of garbage news. By focusing on long-term patterns and understanding the underlying forces driving change, individuals can make more informed decisions and navigate the complexities of the information landscape with greater clarity and confidence.

Random Reflections On Garbage News

Never fixate on what’s currently in the news; instead, direct your attention to market trends, where the true wealth lies. News is essentially trivial, whereas forecasting market trends ahead of the curve is the method by which savvy investors secure long-term gains.

Have you ever observed the press vigorously promoting positive news stories? This prompts the question: why? Fear is a potent seller, and it’s a tool wielded by everyone to manipulate the masses. It’s one of the oldest tricks in the book, unfortunately, one that continues to be highly effective. The so-called concept of “Trending Now News” is merely another tactic to make garbage appear somewhat palatable.

Once you recognize this manoeuvre, handling the issue becomes straightforward. How can you discern the deception? The most effective approach is to cease watching television. For instance, I cut the cord approximately a decade ago. When people ask if I own a smart TV, I respond, “Yes, it’s brilliant,” because it mostly remains silent. When you abstain from watching the news, which is essentially gossip on steroids, you discover that little has changed.

It’s then that the realization dawns that today’s news, and indeed news throughout history, has served as a platform for the most skilled gossipmongers to transform nonsense into sensational headlines. News is even more disposable than “toilet paper”; at least toilet paper serves a purpose with a single use, while the same can’t be said for today’s news.

The media will persist in weaponizing the news. Prepare for unbelievable claims regarding Brexit, the trade war with China, and other factors that can be spun. Outlandish assertions that lack coherence will be employed to elevate the fear factor. Once again, the wisest course of action is disregarding the media’s agenda and concentrating on the prevailing trend.

The “silver lining” here is that fear of the unknown amplifies the “uncertainty factor,” further invigorating this bullish market.

Until the masses embrace this bull market, this seemingly irrational bull is unlikely to wane. The logical course of action based on news is to succumb to panic, whereas the illogical course is to disregard it. Logic is effective when grounded in reality, but fear operates on a perception of what “might” occur. If you begin to dwell on hypotheticals – what could, should, or would happen – you lose sight of the prevailing trend. Ignore the cacophony and concentrate on the trend.

Let’s now delve into the “garbage news” concept from a historical perspective. Let’s rewind to the year 2019.

Current Trend in Development: The Crowd Remains Anxious

Despite the Dow edging dangerously close to retesting its previous highs, a significant number of traders are cautiously waiting on the sidelines for a market pullback. This year, the count of individuals adopting a neutral stance has consistently surpassed those in the bearish and bullish camps. Neutrality essentially translates to uncertainty; individuals plagued by uncertainty tend to be the first to succumb to panic.

These individuals are likely to react in the same manner they have historically when faced with market pullbacks – with panic, leading them to exit the market hastily. This, in turn, initiates the cycle of waiting for the next pullback. Ultimately, their concern revolves around everything except the primary objective: making profits in the markets. As the saying goes, the key to successful market participation is being actively involved, while the rest is merely background noise. Consequently, there exists a high probability that the next pullback could push neutral sentiment readings to the 50% mark. Every time such an occurrence has transpired (since the commencement of this bull market), the markets have not only recovered their losses but also surged to new record highs.

The weekly charts illustrate that the Dow is now trading in the overbought ranges; it still has a bit of room before it moves into the extremely overbought zone. On the monthly charts the MACD’s have still not experienced a bullish crossover; until they do there is always a chance that the markets could experience a stronger than expected pullback. If this occurs embrace the correction as we from Nov 2018 to Jan 2019. Market Update April 13, 2019

Conclusion:

Amid an information battlefield where sensationalism reigns supreme, hope emerges. It is a call to arms, a rallying cry to reclaim our discernment and rise above the sea of garbage news that engulfs us. The stakes are high, for the news we consume shapes our understanding of the world and influences our decisions.

Imagine a world where headlines no longer dictate our emotions, where fear is not the currency of information. It’s a world where we become the gatekeepers of truth, demanding quality and reliability in every piece of news that reaches our screens. The drama unfolds as we challenge the status quo, unveiling the manipulative tactics of media outlets seeking to control our thoughts and actions.

But fear not, for we possess the power to break free from this cycle of deception. We become warriors armed with discernment by critically evaluating the information presented to us. We refuse to be swayed by the allure of trending news, knowing that beneath the flashy headlines lies a web of distortion and half-truths.

Instead, we shift our focus to the panoramic view of long-term trends. Like skilled navigators, we steer our course through the turbulent waters of information overload, guided by the compass of reliable sources and substantiated facts. In this pursuit, we regain control over our information consumption, making choices that empower us rather than manipulate us.

With each step we take, we dismantle the foundations of garbage news, replacing them with a new era of informed decision-making. Our actions become a testament to our resilience, our commitment to truth, and our determination to shape a world where quality prevails over sensationalism.

So, let us heed this call, for the future of our collective understanding depends on it. Together, we can rise above the noise, rise above the garbage news, and forge a path towards a more enlightened and empowered society.