Inflation 2021: Is It Something To Worry About

Let’s start off with some headlines that have been posted over the years before we respond to the Inflation 2021 question. These headlines will illustrate how many times experts have cried wolf.

2009: “Inflation Scare: Crazy but Real” – American Enterprise Institute

2010: “My Inflation Nightmare: Am I crazy, or is the commentariat ignoring our biggest economic threat?” – Michael Kinsley, The Atlantic Monthly

2011: “Inflation: A high price to pay: Surge in cost of food and other products fuels fears of a re-run of 2008” – The Financial Times

2016: “Inflation will be the biggest economic story in 2016… Inflation is coming down the pike whether the markets believe it or not.” – Business Insider

2017: “Gold Won’t Protect You From Hyperinflation” – Barron’s

2018: “Investors are bracing for a period of consistently higher inflation” – The Wall Street Journal

2020: “The Coronavirus Economy Will Bring Inflation” – National Review

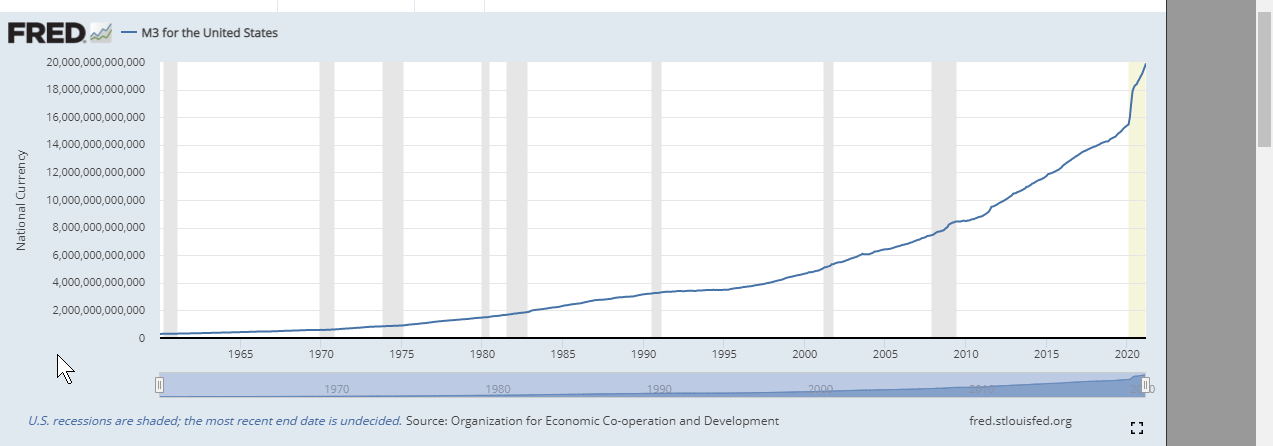

Now, look at the M3 Money supply chart

The actual definition of inflation is an increase in the money supply. Still, today, the term has been bastardised, so everyone associates it with increased prices. An increase in the cost of goods is the symptom of the disease and does not cover the illness itself. So, we will focus on the bastardised term, as the masses have embraced that definition. The real meaning is almost worthless for all intents and purposes.

Time to Test The Inflation 2021 Argument

Hint: in part, the markets have been discounting the power of technology decades in advance. Now, they are overlooking the gut-wrenching deflationary forces AI will unleash upon this world.

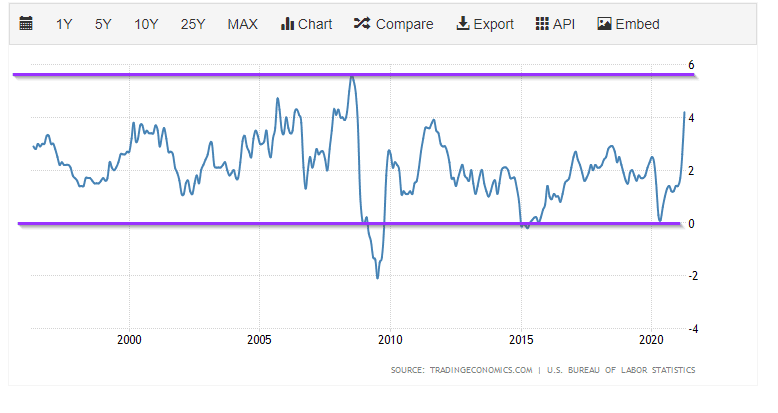

25-year chart of CPI

Looks like a non-event, right? For 25 years, the CPI has essentially done nothing after having peaked roughly in 2009.

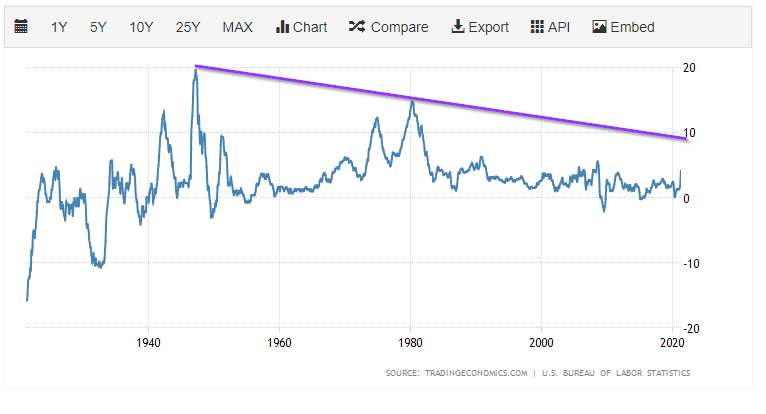

107-year chart of the CPI

This chart effectively puts an end to the Rubbish theory of inflation. The CPI index would have to hit 10 before we would start to pay close attention to it. Today, we have a generation of spoilt brats, including the old and the young. Everyone has been brainwashed into believing any crap published in a so-called respectable journal qualifies as the “word of God”. Less than 10% of the populace attempts to seek the truth. A large portion of what qualifies as science today should be classified as Pseudoscience. Secondly, most of today’s experts would have been classified as mental retards a few decades ago.

What about inflation in Europe?

Our response is, yeah, what about it?

Europe’s average annual inflation rate over the last five years equates to 0.9%. In 2020, it was 0.69%. Germany, the most significant player in the EU, experienced negative inflation for the second half of 2020. Spain has been floating in and out of the negative territory for years. Almost 70% of European sovereign bonds had negative nominal yields up to roughly Nov 2020.

It seems that there is a lot of commotion in Europe regarding inflation, which has been on a slight upward trend after reaching multi-year lows. In Germany, for instance, the inflation wave began in the first quarter of 2021 after five consecutive months of negative inflation, caused by energy prices dropping. However, energy prices are now increasing again as people resume their daily activities, using more energy and consuming more goods, which is expected to cause a rebound in inflation across various sectors that were previously impacted. Additionally, due to COVID-19, Germany had a VAT holiday, which has now ended, leading to a slight increase in prices.

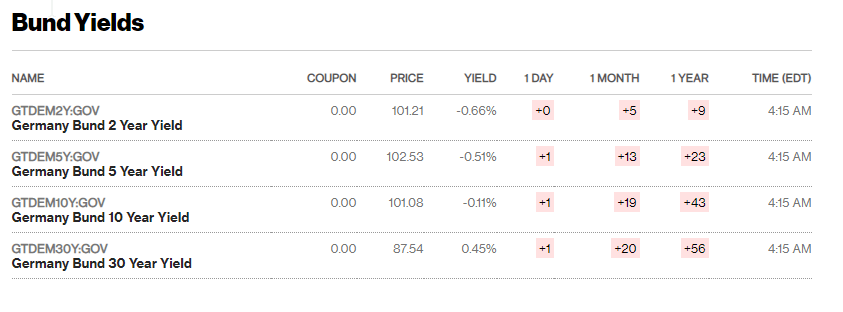

Current German Yields

Well, if inflation were an issue, why are the 2, 5- and 10-year yields still negative? The 30-year bond yield is a whopping 0.45%. At that rate, it would take you almost forever to double your money.

You would think that the experts with access to all this data and more would at least attempt to take a cursory look at it. But then again, why would they, when they know that 90% or more of their audience are brain dead and believe whatever crap they publish. So, keeping up with the style of shoddy journalism, these reporters/experts (AKA digital wenches) do what they are best known for, serving crap under the guise of caviar. Here are some of the recent headlines that don’t fit the narrative when you look at the long-term charts we posted above.

Should a rising 10-year yield scare you out of stocks? Yahoo- March 4, 2021

Inflation Fear Lurks, Even as Officials Say Not to Worry. New York Times, March 10

ECB plans to ramp up bond buying to tackle surging yields CNBC – March 11

Eurozone inflation continued to surge in March. Reuters – March 31

Eurozone Inflation at Highest Rate Since Start of Pandemic. Financial Times Headline – March 31

Should You Be Worried About Inflation? Forbes- April 19

US: Inflation – to the moon! think.ing.com- May 12

Other random factors to consider

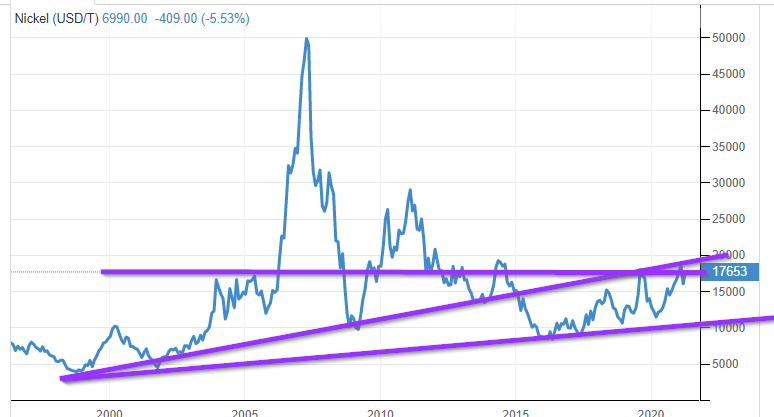

Let’s look at Nickel’s 25-year chart.

Looking at the 25-year chart of Nickel, if inflation were an issue, then prices should be trading above their highs of 50k set on April 5, 2007. The money supply was considerably smaller back then. The M3 money supply stood at 7.3 trillion; today, it’s almost 20 trillion. Using the bastardised definition of inflation, we can see that Nickel prices should be trading at least north of 100K to indicate that inflation is an issue today. Instead, they have been trending downwards, illustrating that deflation is the issue at hand. When the price of (almost ) every commodity is adjusted for inflation (adjusted to reflect the increase in the money supply), inflation appears to be a non-event. Prices appear to be trending downwards instead of upwards. So, what is really going on? In general, it seems to be a simple matter of supply and demand.

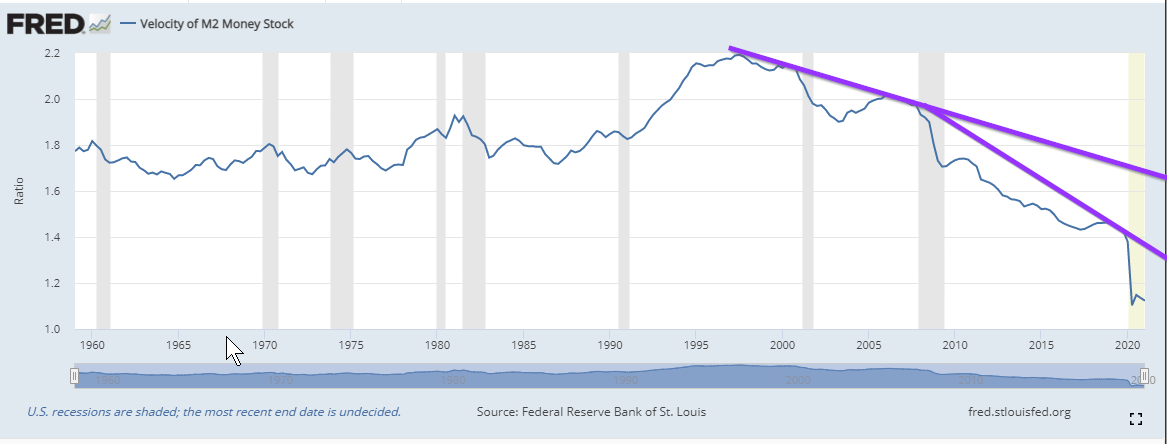

The velocity of money is a key factor when it comes to inflation

The velocity of money as defined by Investopedia

The velocity of money is a measurement of the rate at which money is exchanged in an economy. It is the number of times that money moves from one entity to another. It also refers to how much a unit of currency is used in a given period of time. Simply put, it’s the rate at which consumers and businesses in an economy collectively spend money.

Referring to the Federal Reserve and most experts’ interpretation of inflation, it’s worth noting that the velocity of money has been in a steep decline since its peak in 1999, and it has now hit a 60-year low. This decline in velocity could be an indication that despite all the money being pumped into the economy, inflation may not be a significant concern. From a supercycle perspective, this could also be a warning that AI advancements are going to disrupt all traditional models, which economists have relied on to predict inflation. Despite the rise in the prices of precious metals like gold and silver, for example, commodities as a whole are trading at much lower levels than they did in 2011, taking into account the new money that has been created.

Inflation will not be a concern until there is an increase in the velocity of money. The chart also shows that yields will remain low for the foreseeable future, with occasional minor spikes. This suggests that the amount of hot money being pumped into the economy will continue to rise, eventually leading to a situation where everyone will be forced to speculate. If this hypothesis is true, the market will reach insane levels before eventually crashing. However, during the climb, many sectors will suffer significant losses. For instance, Bitcoin could reach the $84,000 to $100,000 range, but the resulting crash would be spectacular. Nevertheless, it is unlikely to have a significant impact on the overall market. Therefore, even if Bitcoin crashes, the market will continue to trend higher.

Artificial Intelligence (AI) is expected to have a significant deflationary impact on the economy. In the future, many sectors and jobs may become obsolete as AI technology renders them useless. For instance, middlemen in various industries will no longer be required. This will result in a considerable drop in prices. Although it is a fact that a new world order is coming, it may not be the one that people were anticipating. From a long-term perspective, it seems that inflation is not a significant concern to focus on. The emergence of AI and other technological developments indicate that the current bull market is different from any other in history.

What will occur in the commodities sector is that the forces of supply and demand will be mistaken for inflationary pressures.

Other Articles of Interest

Is Israeli Secret service Intelligence ISIS

Ted Cruz master Con Man & Master of Lies

Saving for retirement: Invest in stocks & retire rich

Muslim Migrants unleashed make Sweden Rape Capital of West

China reform: powering ahead with supply-side reforms

Can China attract foreign talent via green card Program

China Corruption Still Running Rampant

Currency Wars & Negative Rates Equate To Next Global Crisis

China’s Rural Transformation creating Boom Towns

Control Group Psychology: Stock Crash of 2016 Equates To Opportunity

Erratic Behaviour Meaning:Dow likely to test 2015 lows

India vs China: Can India surpass China

Interest rate wars-Fed stuck between a hard place & Grenade

India overtaking China just a pipe dream

Wealth Tax & The War On Wealth

Herd behavior The Mass Mindset Is Destined For Failure

Stock market monthly trends Indicate that the Dow is heading Higher

Dow Trends 2021 & The Market of Disorder

The Fear Factor is what Propels Investors to Panic at the Wrong time

Perception Is The Key To Everything-If used correctly

Dow jones trends: Sharp Corrections Should Be Embraced

Stock market trends 2020 and Beyond

Tech Trends 2020: The Future of Farming

The death of the Investment guru

Sentiment investing: Mass Psychology Holds the Key