Federal Reserve System: Fosters Boom & Bust Cycles

The weapon of choice is money, and central bankers utilize this weapon merciless to rain misery and death on the unknowing masses. Since Fiat was created, bankers have fed off the misery they have wreaked on humanity. How do they feed off this misery? They no longer take from Peter and give to Paul; they make sure that Peter and Paul try to rob each other and everyone else to survive. They control the game, and you are just a pawn in this game. The only day the outcome will change, is when the Fed is eliminated from the equation. Many Great presidents and leaders shared this opinion, and the following quotes prove this:

“If Congress has the right [it doesn’t] to issue paper money [currency], it was given to them to be used by…[the government] and not to be delegated to individuals or corporations.” President Andrew Jackson, Vetoed Bank Bill of 1836

George Washington, one of the wisest of all presidents, understood this very well and it’s revealed clearly in this quote.

“But if in the pursuit of the means we should, unfortunately, stumble again on unfunded paper money or any similar species of fraud, we shall assuredly give a fatal stab to our national credit in its infancy. Paper money will invariably operate in the body of politics as spirit liquors on the human body. They prey on the vitals and ultimately destroy them. Paper money has had the effect in your state that it will ever have, to ruin commerce, oppress the honest, and open the door to every species of fraud and injustice.” George Washington in a letter to Jabez Bowen, Rhode Island, Jan. 9, 1787

Thomas Jefferson on the Federal Reserve System:

Another wise president was Thomas Jefferson, who was so against bankers that he thought they were worse than a thousand standing armies and he was correct.

“I believe that banking institutions are more dangerous to our liberties than standing armies. Already they have raised up a monied aristocracy that has set the government at defiance. The issuing power (of money) should be taken away from the banks and restored to the people to whom it properly belongs.” Thomas Jefferson, U.S. President

“We have, in this country, one of the most corrupt institutions the world has ever known. I refer to the Federal Reserve Board. This evil institution has impoverished the people of the United States and has practically bankrupted our government. It has done this through the corrupt practices of the moneyed vultures who control it.” Congressman Louis T. McFadden in 1932 (Rep. Pa)

Does This Quote Indicate that the Rothschilds Control The Federal Reserve System:?

“Give me control of a nation’s money and I care not who makes its laws.”– Mayer Amschel Bauer Rothschild

Indirectly central bankers have killed more people than the worst Tyrant could ever hope to and they have done so without firing a single bullet. They have the ability to create money out of thin air; governments and nefarious individuals with access to easy money can use these funds to start wars or control the media. If you control the media you can influence the individual and once you can do that, you can do anything. Money trumps everything; in the end, a person is just another number on a piece of paper.

Booms are facilitated via the Fed’s easy money program; they flood the markets with money. To create a bust they do the opposite; they suddenly remove liquidity and asset priced collapse.

That’s why every bull market ends off with a crash. For example, the dot.com bubble, the housing crisis of 2008, and the current hot money bubble.

Negative Rates are Godsend for the Greedy, unscrupulous corporate world

The Corporate world will embrace Negative rates with gusto as it will be akin to crack addict being given a new dose of super crack. History does not change, only the outfits change, but the con is always the same and the ones left holding the empty bag are the sheep (otherwise known as the masses). The Fed is trying to put on a brave act, but you can already see them backtracking from the strong stance they took last year. Now they are stating that all is not well, and the economic outlook is weaker than expected. They will have no option but to join the rat pack; in this instance, resistance is futile.

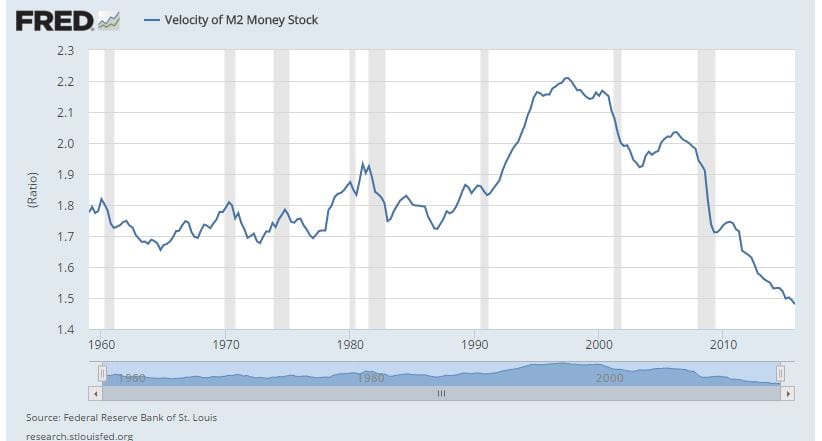

The markets are totally controlled and manipulated; every boom and bust cycle was planned in advance of the event. The chart below illustrates that the economy is far from healthy, in fact, it appears to be almost in a coma and is being forcefully kept a life through immense injections of hot money. Take away the hot money and this illusory economic recovery crumbles; if a market is healthy the velocity of money increases and vice versa. Look at the chart below, the velocity of money is dropping like a falling dagger. This means that the economy is in a coma, and the only reason it’s showing any signs of life is because of the massive injections of hot money it’s receiving.

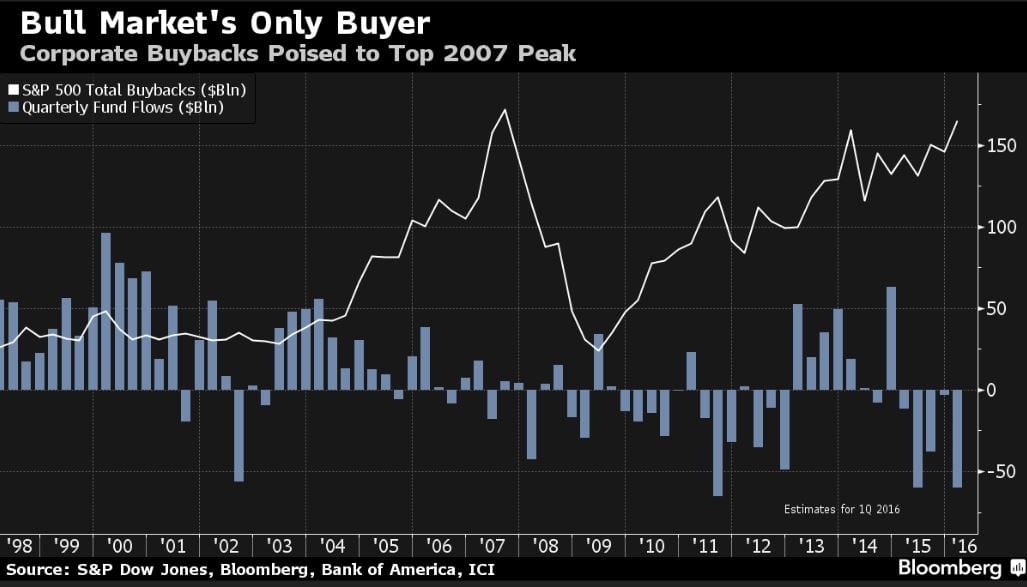

Share buybacks breaking setting new records every year

Last year share buybacks and dividends payments surpassed the one trillion dollar mark, this year they will probably surpass that level. Companies in the S&P 500 Index are poised to purchase over $165 billion of stock this quarter, bringing them dangerously close to taking breaking the 2007 record.

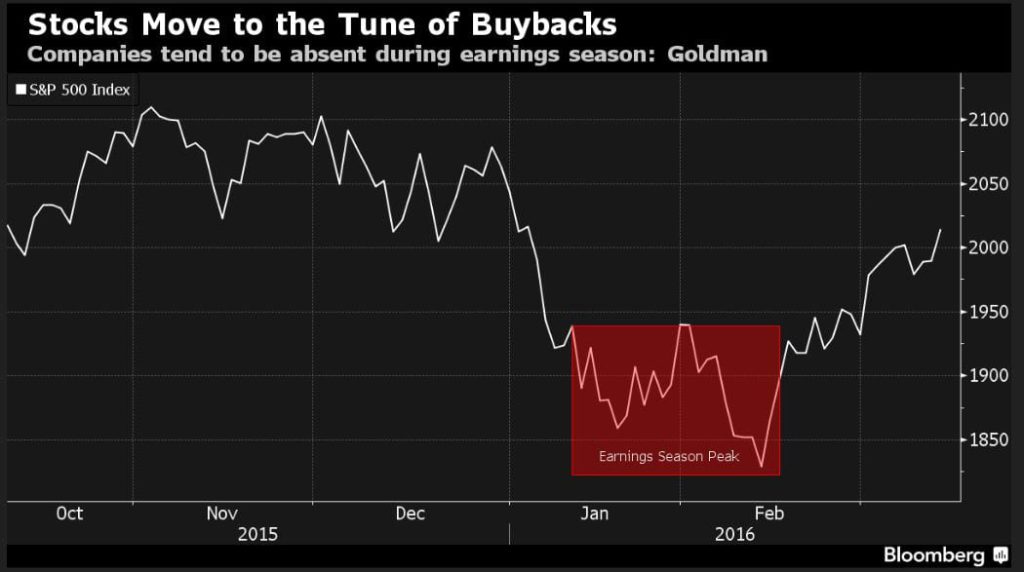

As more money floods the system, the higher the stock market trends; it’s simple math really. This economic recovery is an illusion, remove the money and the economy collapses. Hence the Fed will be forced on a course known as forever QE as the outcome of removing the supply of easy money will be far worse than the crash of 1929.

Low-Interest rates are forcing savers to speculate and when rates turn negative one can only imagine the type of bubble it will help foster. This party will end one day and it will end very badly, however as the masses are fast asleep, the day of reckoning is still a long way in the making.

Negative rates will be like giving a crack head super crack; in this instance, the crack head is the corporate world. Negative interest rates will create a share buyback binge off the likes this world has never envisioned and it will end off with a spectacular set of fireworks.

Buying back more shares leads to a boost in the EPS; a higher EPS mean a bigger bonus and so the corporate officers will repeat these steps for as long as they can. The bottom always drops out, but it’s the average Joe that is left holding the can. Nothing has changed, and nothing will change going forward

“Anytime when you’re relying solely on one thing to happen to keep the market going is a dangerous situation,” said Andrew Hopkins, director of equity research at Wilmington Trust Co., which oversees about $70 billion. “Over time, you come to the realisation, ‘Look, these companies can’t grow. Borrowing money to buy back stocks is going to come to an end.”’

“Corporate buybacks are the sole demand for corporate equities in this market,” David Kostin, the chief U.S. equity strategist at Goldman Sachs Group Inc., said in Feb. 23 Bloomberg Television interview. “It’s been a very challenging market this year regarding some of the macro rotations, concerns about China and oil, which have encouraged fund managers to reduce their exposure.” Full story

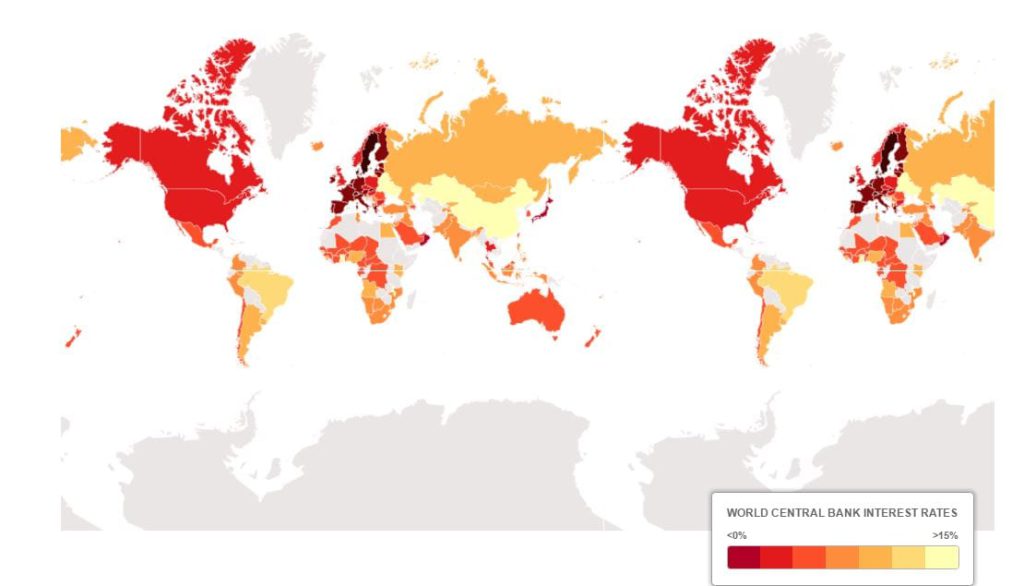

Map illustrating how central bankers worldwide are embracing the era of negative rates

Image source: The Telegraph

Suggested Strategy for Dealing With A Nefarious Federal Reserve

The good old days are gone; Manipulation is the order of the day and this trend has only just begun. We expect things to worsen significantly in the months and years to come.

The masses are infamous for responding slowly and when they finally do wake up, they will wake up in time to see all their savings vanish right in front of their eyes. Given the current trend, it would be quite easy to state that the US debt will soar to 100 trillion before the crowd wakes up. In the interim as the trend is positive, every correction ranging from mild to wild should be embraced.

Stock Market Update May 2019

Notice that this index is in a strong uptrend; it contains information on 30 of the world’s largest companies, providing an overview of the global trend. The trend shows no signs of weakening and the index would need to close below 8300 on a monthly basis to turn neutral and below 7200 on a monthly basis to turn negative. Over the short term, it is overbought so we would not be surprised if it pulled back and would actually view a pullback through a positive lens

This index has come a long way since its Dec lows, however, recall at the time while everyone was screaming that this was a bad development (BBC 30 breaking down in Dec 2018); we actually viewed it as a positive factor. Now this index is close to retesting its 12-month highs, and this could coincide with a short term top in the markets.

Other related stories:

Current Stock Market Trends: Embrace Strong Deviations (Oct 2)

Market Insights: October Stock Market Crash Update (Oct 1)

BTC Update: Will Bitcoin Continue Trending Higher (Sept 17)

Stock Market Forecast For Next 3 months: Up Or Down? (Sept 16)

Stock Market Crash Date: If Only The Experts Knew When (Aug 26)

Nickel Has Put In A long Term Bottom; What’s Next? (July 31)

AMD vs Intel: Who Will Dominate the Landscape going forward (June 28)

Fiat Currency: Instruments of Mass Destruction (June 18)

The Retirement Lie The Masses Have Been Conned Into Accepting (June 15)

Stock Market Bull 2019 & Forever QE (June 13)

Forever QE; the Program that never stops giving (May 31)

Trending Now News Equates To Garbage; It’s All Talk & No Action (April 24)

Americans Are Scared Of Investing And The Answer Might Surprise You (March 9)

Experts Finance Predictions for 2019