Editor: Vladimir Bajic | Tactical Investor

Stock market crash 2008 chart

The truth is that if you look at both the charts of 2008 and 2016, there are some similarities but what the experts fail to inform the masses is that 2008 proved to be the best time to open long term positions. Had you jumped in towards the end of 2008 or early 2009 and held, you would be very rich today.

Stock Crash 2016 is the new fad being pushed by the doctors of fears but before we get to the main article we would like to present you with a small video and a brief excerpt of an article that we think makes for a compelling read:

” The one year chart illustrates that all is well on the surface and that the process of flooding the markets with hot money, in general, is working rather well. The index could drop all the way down to 7200, and the short-term outlook would remain bullish. We are fully aware that this economic recovery is illusory, but complaining and whining about this does not provide one with any extra insights into the markets.

We need to focus on what is really going on and how the masses interpret that data. The truth is irrelevant if only you are aware of it; if the masses think otherwise, what appears as the truth to you could, in fact, be viewed as a lie by the crowd. The truth can set you free, but in most cases, it can be detrimental to your health and wealth; at least as far as the markets are concerned. ” BBC Global 30 Index Signals Dow Industrial Index will trend higher

The Stock Market Crash of 2016 is another joke; watch the video below for entertainment purposes. Never react to fear mongers for their advice is on par with rubbish.

Tactical Investor Update April 2020

It takes zero effort to panic and the reward is exactly zero; those that panic in the face of adversity are given what they deserve. In terms of the market that means less than zero, as the masses always sell at the bottom and buy at the top and nothing is going to change for another 1000 years.

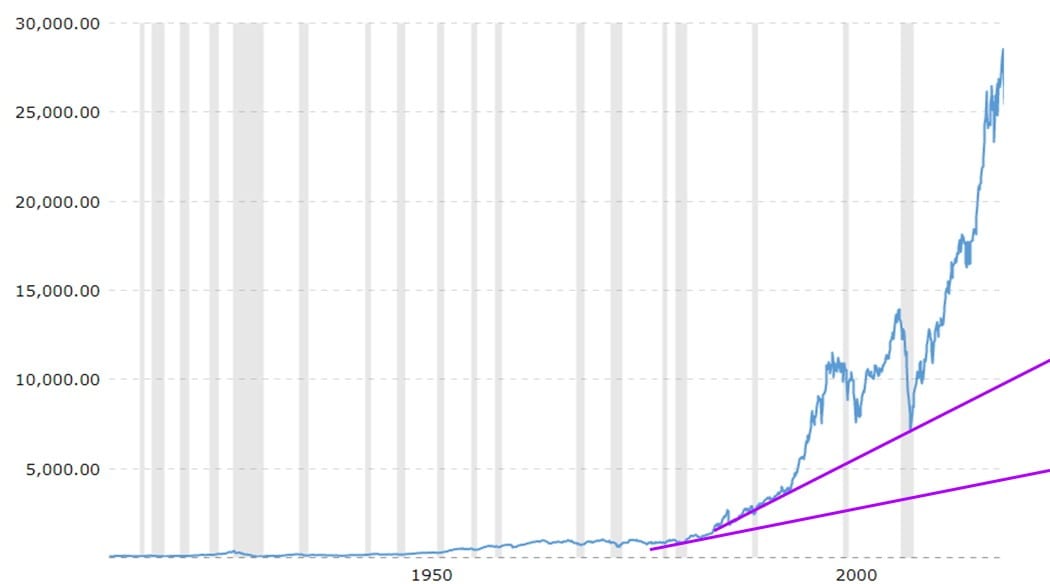

Stock Market Crash 2008 Chart bears a striking resemblance to what is taking place today during the coronavirus pandemic. However, we will look at that shortly, first, let’s take a look at the long term chart below.

Source: macrotrends

Try to spot the great depression, black Monday or any other sinister crash on that chart. What stands out? Each one of them marked the dawn of a new massive bull market. Being a permabear is a recipe for a short and miserable life. A prime example was the notorious crash of 2008, which proved to the mother of all buying opportunities. If you look at all those “end of the world events” closely, they are blips in an otherwise massive upward trend.

There are always going to be days, weeks and sometimes months when the markets are down, but ultimately the market has trended in one direction and that is “up”. Massive fortunes were made by viewing these disaster type events through a bullish lens. We also have Mass Psychology and the Trend Indicator on our side, both of which indicate that this downtrend at most could turn out be the backbreaking correction we spoke of recently. Every Bull Market will experience at least one massive correction and the crowd will falsely mistake it for the beginning of a new bear market.

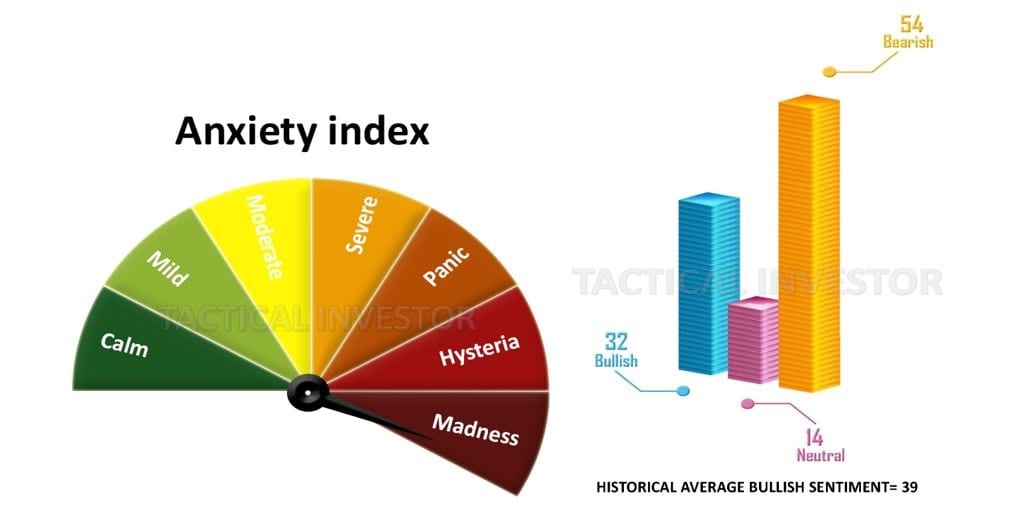

The Crowd is panicking

Therefore all sharp pullbacks should be viewed through a bullish lens and investors should use this opportunity to load up on quality stocks. Top-notch companies are being given away for almost nothing, hence, be wise, jump in and buy while the masses panic.

Other Articles of Interest

Current Stock Market Trends: Embrace Strong Deviations (Oct 2)

Market Insights: October Stock Market Crash Update (Oct 1)

BTC Update: Will Bitcoin Continue Trending Higher (Sept 17)

Stock Market Forecast For Next 3 months: Up Or Down? (Sept 16)

BIIB stock Price: Is it time to buy

Stock market crashes timelines

Dow theory no longer relevant-Better Alternative exists

In 1929 the stock market crashed because of

Apple Stock Predictions For 2020 and Beyond

Apple Stock Buy Or Sell: It’s Time To Load Up In 2020

Apple Stock Price Target: Is It Time To Buy AAPL

Anti Gmo: The Anti Gmo Trend Is In Full Swing?

From GMO Foods To GMO Humans: What’s Next