Stock Market Crash 2020: Understanding the True Impact and Implications

A man profits more by the sight of an idiot than by the orations of the learned. Arabian Proverb

Updated Aug 30, 2024

They got the stock market crash story wrong from 2008 to 2020. So far, nothing has changed, as we have one expert after another predicting that it is time for the markets to crash; mind you, these same chaps sang this terrible song of Gloom countless times before. It never changes: “Flee for the world is going to end.” Hahaha, what utter rubbish.

One crucial factor, though a few former Bulls have joined the pack, is whether this now means the markets will crash. Before we answer that question, remember.

Stock Market Crash today; same old rubbish with a new name

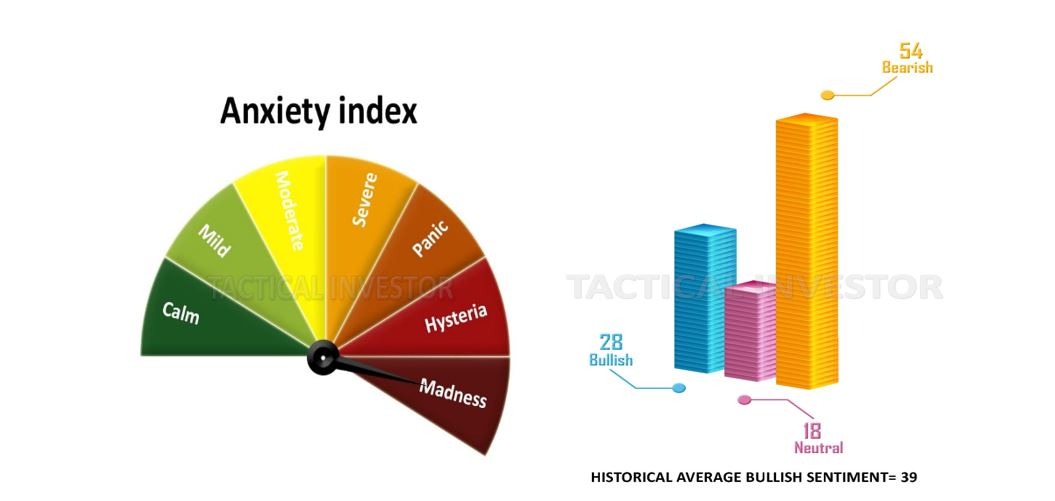

In the last update, the neutral readings came in at 42. Before that, it was 37, and the one before that came in at 41.00, and you can go back to Jan of this year to see that after bottoming out at 18 (Jan 1, 2019 update), the readings have steadily risen. However, in that same update (Jan 1, 2019), the bearish readings came in at 53; since then it appears that individuals from the bullish and bearish camps have been migrating over to the neutral camp.

The unexpected factor is that no one would have expected this to occur in a rising market. In the 1st week of Jan, the Dow was trading in the 23,000 range after dropping below 21,500 towards the end of Dec 2018. Those holding out for a “crash-like scenario” might be sorely disappointed, as crashes occur when the masses least expect. The sharp pullback in Dec 2018 was something most did not expect as the markets had already pulled back from Oct to Nov 2018 and the follow-through caught many with their pants down. Now, everyone is expecting a strong move, and they might get a minor pullback.

Those who hold out for a meaningful correction might be sorely disappointed. On the monthly charts, the Dow is trading in extremely oversold ranges, which could limit the downside action. Individuals who use the term significant or sharp when referring to a correction and who are not familiar with the concept of Mass Psychology usually have floating targets.

For example, before the correction starts, they might be satisfied if the Dow sheds 1500-2000 points, but after the masses are in full-blown panic mode, these guys will jump on the panic train and lower their targets. History illustrates that they will keep lowering the targets until the markets suddenly reverse course, catching them off guard once again. The crowd never wins, and that’s one of the main lessons investors need to understand when investing. Market Update May 7, 2019

Market Crashes are nothing but perceptions.

Stock Market crashes are all based on perceptions; when you embrace this market, the pullback could range from a collision to a correction. For Astute investors, a crash is nothing but the market letting out a well-deserved dose of steam. So, the stock market crash in 2017 or 2018 will prove to be a buying opportunity as long as the trend is up. It’s a monumental disaster for others; these investors dump the baby with the bathwater. In doing so, they provide astute investors with a once-in-a-lifetime opportunity.

If you have actively participated in the bullish market since 2016, a pullback in the range of 10% to 15% might feel significantly more drastic, resembling a crash. However, if you joined the market from 2009 to 2011, a similar pullback would appear as a mild and well-structured correction. The perception of the severity of market fluctuations is relative and depends on one’s entry point and experience within the market.

We view Crashes through a bullish lens.

As long as the underlying trend is positive, the trend indicator determines the trend; it is unique in that it determines the trend in advance. As the trend increases, we can state with certainty that the naysayers are creating smoke out of nothing. Until the trend changes, we feel that all stock market corrections or crashes should be embraced, and the greater the deviation, the better the opportunity.

Presently, the markets are letting out a well-deserved dose of steam, and there is no action better than Yo-Yo type action (up-down market action) to break the backs of both the bulls and the bears. When both camps don’t know what to expect, the path of least resistance is almost always upward.

Experts Wrong As Evidenced by History

They made similar claims in 2018, 2019, 2020, etc. They are even pushing the rubbish story in 2024. If the stock market crash story comes to pass and the trend is positive (solid and showing no signs of weakening), then view strong pullbacks through a bullish lens.

Many experts often attempt to impose their biased viewpoints on others, sometimes even with a sense of delight. However, it is crucial not to blindly follow their lead simply because they label a market movement as a crash. History has shown that experts frequently make incorrect predictions. Surprisingly, experiments have demonstrated that monkeys randomly selecting stocks can outperform Wall Street experts. Therefore, it is wise to approach their so-called sage advice with a healthy dose of scepticism and not solely rely on their recommendations.

The stock market crash story might or might not come to pass, but what about all the market crash predictions made countless times before? Had you listened to them, you would have been bankrupt already. If these experts were so astute, why have most of them missed one of the biggest bull markets ever? Moreover, they want to convince you that it is time to short the market after failing to embrace it. How can one trust these penguins? If they could not identify the bull market in the first place, how can they suddenly predict the top?

Stock Market Crashes are Based On Perceptions

Hence, every stock market crash story should be taken with a glass of whisky and a pinch of salt. Mass psychology is evident in the markets; the masses need to embrace them before one can claim a top is close at hand. So far, the masses have refused to adopt this market for a prolonged period.

Perception indeed plays a significant role in shaping our understanding of various situations. Even a slight change in the angle of observation can alter how something is perceived. What may appear bullish to one person could be seen as a highly bearish development by another, highlighting the subjective nature of perception.

In investing, it is essential to consider the prevailing views held by the masses, regardless of their validity. The distinction between truth and deception is also influenced by perception. If most people lean towards a particular outlook, history has shown that taking a contrary position often proves beneficial.

Monitor The Crowd

For the first time, the masses have embraced this bull market. From a mass psychology perspective, this alone is not a huge negative. Mass Psychology dictates that the masses need to turn euphoric before one abandons the ship. It is not the time to abandon ship, but to take a breather and let the storm clouds pass.

The Dow industrials exploded upwards and have experienced a near vertical move over the past two months. Under such conditions, one should not be shocked if the markets release a more potent dose of steam than they have over the past 24 months. Tactical Investor

See Opportunity instead Of Disaster If Market Crashes.

Instead of pulling back, the markets have continued to trend higher, and at this stage of the game, patience is called for. Ideally, the markets will let out a large dose of steam, but markets do not usually cater to your needs; barring a substantial pullback, a nice consolidation would suffice. Market consolidations drive key technical indicators into the oversold ranges, allowing the market to build up steam for the next upward leg.

This rapid change in Crowd sentiment validates what we stated last year: that the final part of this ride will be highly volatile. It also confirms that all sharp pullbacks must be viewed through a bullish lens, regardless of the intensity, until the trend changes. The trend is still up, and the masses are far from euphoric. Let’s not forget that Trump continues to inject a massive dose of uncertainty into the markets. Regarding the markets, uncertainty is a bullish factor, which means volatility will soar, and volatility is a trader’s best friend.

Focus on Today, for Tomorrow never comes.

Stock Market Crash 2019 could become a reality or remain a dream. The Stock Market could have crashed in 2016, 2015, or 2014. Could have, would have, and should have are pathetic arguments put forward by individuals who thrive on fear.

When it comes to the markets, fear is the most useless emotion, for it yields no positive result. One day, the markets will crash, but today, the bandwagon is not buckling under its weight, and the masses are not euphoric.

Experts Only Focus On The Fear Factor

The crowd is getting anxious because they do not know what to expect. Markets climb a wall of worry and plunge over a slope of Joy. If the Crowd is Euphoric, then caution is warranted, and vice versa, until then crashes should be embraced.

The crowd is getting anxious because they do not know what to expect. Markets climb a wall of worry and plunge over a slope of Joy. If the Crowd is Euphoric, then caution is warranted, and vice versa, until then crashes should be embraced.

Given that this market has experienced such a massive run-up, it needs to experience one relatively sharp correction; ideally, this correction would fall within the 15%-20% range. We know; now all the bears will rush out and scream, “We told you so”. Our response to these agents of misery would be, “Go crawl back under the rock you came from”. Just look how far the markets have rallied from their 2009 lows; to view a 15-20% pullback as the end of the world is an act of insanity.

Every Bull Market Experiences A strong Correction.

Every strong bull market has to experience one adamant correction, and we do not think this market will be an exception.

An even more powerful rally will follow this pullback, and towards the tail end, the masses will embrace this market with gusto. Sentiment readings will soar, and everyone will dance up and down in Joy. That is when the hammer will fall, ending this bull market and triggering the first phase of a stock market crash.

For now, caution is warranted, but shorting this market is not something the prudent investor should consider, at least not until the stock market experiences a trend change. Ideally, the market will shed a hefty dose of steam, and in doing so, they scare the living daylights out of the masses.

Stock Market Update

The average person’s brain is automatically attracted to adverse events. Negativity sells and creates opportunities in the financial markets for the big players, who use this ploy to stampede the crowd. This trick has worked marvellously for generations and will continue to work for generations.

At the Tactical Investor, we examine psychological data from all fronts (from our regular sources, friends, family, associates and subscribers). We gauge the stress responses to events/developments that can impact the financial markets. As we stated in the last update, many new subscribers were nervous. Coupling this data with the sentiment data we tallied in the previous update confirmed that the crowd was sitting on the wrong side of the fence. If the market pulls back again, do not give in to fear and run from the very opportunity you were waiting/begging for before the markets started to pull back.

Regardless of whatever the media spouts, these situations are engineered to look worse than they are. Take any financial disaster, and if you move past the initial knee-jerk reaction where shorting the markets might have been paid off if one was nimble, the result is that the astute investor who used the sell-off to buy is the one who made out like a bandit.

Naysayers Exposed: The Truth Behind Their Rubbish Claims

Those individuals who have been predicting the world’s downfall since time immemorial will likely pass away long before even a fraction of their predictions come to fruition. Instead of succumbing to fear, the current market crash should be viewed as a potential opportunity for savvy traders willing to take calculated risks. It is important not to get caught up in short-term fluctuations; throughout history, markets have demonstrated a remarkable tendency to trend upward over the long term. Those who persistently bet against the markets often have disappointing long-term results. Once the chaos subsides, markets typically resume their upward trajectory, and this situation is unlikely to be an exception.

Take a look at how many people die a day from other causes and the flu https://www.worldometers.info/

Given the ongoing uncertainty among the general public, it is essential to approach sharp market pullbacks with an optimistic perspective. Rather than being swayed by the noise and panic, it is crucial to focus on the overall trend and prepare a list of high-quality companies that you would like to invest in. When the markets experience a substantial decline, you will be well-prepared to seize the opportunity and acquire these companies at a significant discount. Maintaining a long-term view and strategic planning allows you to use market fluctuations to build a robust investment portfolio.

Stock Market Crash Outlook

Considering the current intensity of the market sell-off, a rally is likely. However, it is essential to note that the initial rally attempt often fails. Based on historical patterns, once this initial rally loses momentum, it could lead to another downward wave, potentially resulting in new intraday lows. Implementing a short-term put play or opening a strangle position with different strike prices could be considered in such a scenario. Market update, March 12, 2020

Maintaining a trading journal is recommended, especially during market volatility when significant opportunities arise.

Notably, the public’s hysteria surrounding the coronavirus will dissipate rapidly once the objective of reducing interest rates and approving multi-billion-dollar bailouts is achieved. Data on the coronavirus indicates that the high mortality rate primarily applies to older individuals, and further analysis will likely reveal that these individuals already have existing health conditions. In other words, the higher risk is associated with those not in optimal health.

.

While the masses may currently be gripped by panic and lack a bullish outlook, it is essential to approach the significant market pullback with enthusiasm. The greater the deviation from the norm, the better the opportunity it presents. It is essential to recognise that the crowd may regret their hasty actions of selling off assets without considering their long-term value in about six months. They might realize that they have discarded valuable opportunities amidst the chaos.

People deal too much with the negative, with what is wrong. Why not try to see positive things, to just touch those things and make them bloom?

Thich Nhat Hanh

The Art of Discovery: Articles that Open New Worlds