Understanding the Significance of the October 24 1929 Stock Market Crash

Updated Dec 28, 2023

So what is the significance of the October 24 1929 Stock Market Crash

Instead of continuing that sentence, our response is, “Who cares?”. You looked shocked, but don’t be shocked; ask us why we decided to take that stance. From a long-term perspective, every crash has proven to be a buying opportunity, and today’s FED is ten times more reactive than its predecessors. In other words, when the markets start to tank, they will throw boatloads of money to stabilise the situation. For a case in point, look at what happened in 2008.

History is replete with Naysayers stating that the world is going to end. Even after one of the most horrific crashes in modern history, the Market Crash of 1929, the financial system recovered, and the market soared to new highs. In the long term, as long as Fiat is in play, a stock market crash should be viewed as a buying opportunity. The Tactical Investor would never focus on the “Is the stock market going to crash?” scenario. Instead, we would concentrate on What happens when the stock market crashes. The astute investor backs up the truck and buys all the top-quality stocks for pennies on the dollar.

What are the Dow and Nasdaq saying in terms of a Stock Market Crash

However, the answer is quite simple for those wanting to know why the markets crashed in 1929. in 1929, the stock market crashed because the masses were euphoric. When the masses are euphoric, mass psychology states that it is time to bail out, and the opposite is true when the crowd panics.

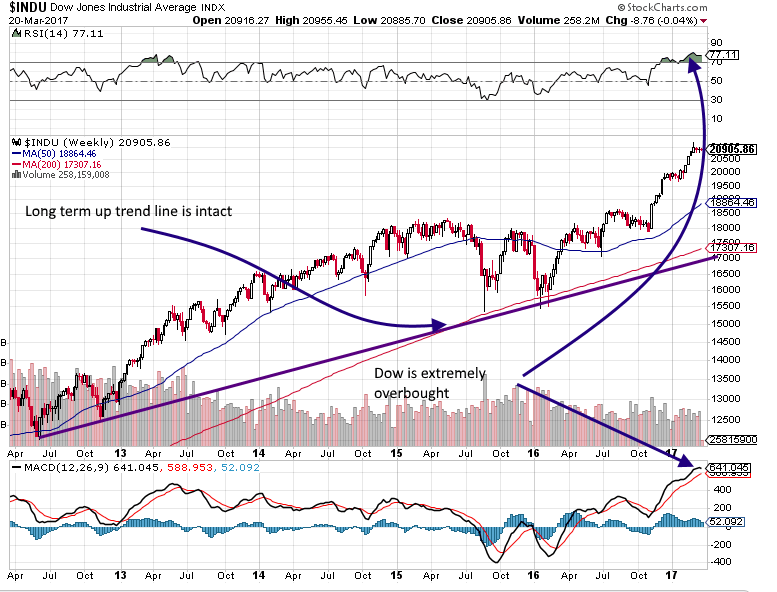

The Dow is overbought on the weekly charts but still has room to run on the monthly charts. As you can see below, the Dow is exceptionally overbought and looking for any reason to release some steam. In our opinion, this would be a positive development. Never listen to the Drs of Doom, for they make it look like they know exactly when a stock market crash is likely to occur.

If they knew this, they would not be screaming; they would be silently opening up short positions in anticipation of locking in massive gains. They have no idea when this market will crash, so they need to peddle nonsense, as that is the only way these penguins can make a buck. They also need gullible cows to sell this rubbish, and the world seems full of these lemmings. A Stock Market Crash is always a buying opportunity if the trend is up and the crowd is in panic mode.

Do not fixate on the crash factor; instead, focus on the opportunity

Captivating Article Worthy of Exploration: Decoding the Dow Jones Utility Average

Is the stock market going to crash?

Once again, in 1929, the stock market crashed because the masses were jumping up in joy. This is not the case presently, and until this crowd embraces this market with love, this bull market will not end.

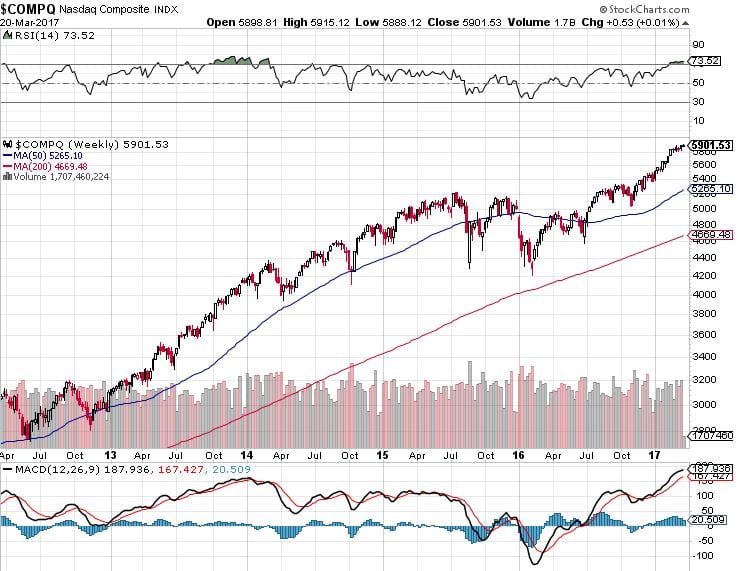

The overall trend is still up (based on our proprietary trend indicator), and thus, all sharp pullbacks need to be viewed through a bullish lens. The Nasdaq is also trading in the extremely overbought ranges on the weekly charts, but what is interesting is that on the monthly charts, there is plenty of room for the Nasdaq to run before it hits the overbought ranges. We could have a friendly tug-of-war here. The NASDAQ could have a limiting effect on any correction, or we could witness a divergence.

The Dow and SPX are correct firmly, while the NASDAQ experiences a minor correction. Until the trend changes, do not focus on the “Will the stock market crash” scenario but on the trend. All sharp corrections have to be viewed through a bullish lens.

Nasdaq is the most robust Index and should outperform Dow and SPX.

A stock market crash is unlikely, at least for the time being. The Nasdaq is in a strong uptrend, and until the trend turns negative, the odds of a stock market crash are not that high. It, therefore, makes no sense to focus on the will the stock market crash scenario. If you are going to do this, you might as well focus on the what if you leave the house and get hit by a truck scenario.

The NASDAQ will outperform the Dow, which usually occurs in the last phases of a bull market. However, we could also be witnessing something new here in the era of hot money. The entire world is lowering rates. Despite the misery Brazil is facing, its rates have lowered once again. Can the trend change and favour higher Interest rates? Yes, it can, but until it does, we will not jump on the high-interest rate bandwagon.

The US, for now, is the only nation that has raised rates twice. If hot money continues to power this market, then we could have an irrational exuberance phase that lasts for a long time; it is too early to dig into this topic now; we will save it for another day.

The Nasdaq broke past 5,000 for the first time in 15 years in 2016

Thus a stock market crash is unlikely at this stage. It took the Nasdaq 15 years to test its old highs and trade past them, but until July of 2016, it was unable to hold above 5K for any period. It would need to trade to the 6600-6900 ranges to trade on par with its 2000 highs on an inflation-adjusted basis. The bull market for the NASDAQ has just started; it has the potential to trade to 10K. Again, this is a topic for another date.

We do not like discussing extreme targets until specific key turning points are touched. The 1st point to keep your eyes on is 6200. A monthly close above this level will signal a move to the 6900 range and beyond. The Nasdaq indicates that the “Is the stock market going to crash?” question, for now, is a silly question.

October 24 1929 Stock Market Crash and its Resonance in 2019

Bullish and Neutral readings came in at 36 this week, which is very telling as it indicates that the masses are still a long way from embracing this bull market. Secondly, it provides ammunition to the new hypothesis we are putting forward.

One thing sticks out sorely when we look at market sentiment; bullish readings have hardly traded past their historical averages. It, therefore, forces us to consider another possibility that would make no sense under different conditions.

We hypothesise that when the bears are asleep and the bulls are barely awake (as is the case presently), the market will tend to drift towards the direction of least resistance, and the path of least resistance is up. Therefore as we have stated before, while we would like the markets to let out a nice dose of steam, there is no rule that says that they have to comply with this request. And that is why are continue to issue new plays, as we never put all our eggs in one basket.

If the market pulls back, it’s a bonus, and this is why we also adopt the stance that when the trend is up, the stronger the deviation, the better the opportunity. Extracted from the July 24, 2019, Market Update

Navigating Stock Market Crashes: Strategies Inspired by the October 24, 1929 Crash

June 2023 update

Investing in the stock market during periods of market volatility can be intimidating, especially for newcomers. The feeling of fear is a natural response to uncertainty and rapid market changes, commonly experienced by investors. However, it’s important to recognize that fear often triggers irrational behaviour, causing investors to sell stocks and hastily miss out on substantial growth prospects. Interestingly, some of the most promising investment opportunities tend to arise during these fearful times.

Seizing Opportunities in Market Corrections: The Wisdom of Warren Buffett

Renowned billionaire investor Warren Buffett is credited with one of the most famous quotes in the investing world: “Be greedy when others are fearful.” This statement underscores the significance of investing when stocks are available at discounted prices during market corrections. During market downturns, composed and confident investors can take advantage of lower stock prices to acquire high-quality stocks, leading to substantial long-term gains.

The Key to Successful Investing in Turbulent Times: Navigating Market Corrections

Investing during periods of market fear necessitates adopting a long-term investment mindset and the patience to weather volatile conditions. It’s crucial to comprehend that stock market corrections are a normal part of the market cycle and are typically followed by periods of growth. Over the long term, the stock market consistently delivers strong returns, even when accounting for these corrections.

Harnessing the Power of Disciplined Investing: Strategies for Market Corrections

Successful investing during market corrections entails more than just buying low and selling high; it also entails investing in quality. During times of market fear, investors often sell both high-quality and low-quality stocks, presenting an opportunity to acquire quality stocks at discounted prices. High-quality stocks, with their proven track records of delivering robust returns, tend to be less impacted by market volatility compared to lower-quality stocks.

To manage risk effectively and capitalize on market opportunities, it’s crucial to maintain a diversified portfolio comprising a blend of stocks, bonds, and other investments. This approach enables investors to benefit from stock market growth while mitigating overall risk exposure.

In Conclusion: The Art of Navigating Market Corrections

Investing during market corrections demands discipline, patience, and a long-term perspective. By investing in high-quality stocks when fear grips the market, investors can leverage discounted prices and tap into the long-term growth potential of the stock market. Market corrections, being a natural part of the market cycle, provide opportunities to purchase quality stocks at lower prices. With a focus on the long term and a diversified portfolio, investors can seize growth prospects while managing risk exposure.

It’s important to note that investing in the stock market carries inherent risks, and seeking professional financial advice before making investment decisions is always prudent. While investing during market corrections can yield significant long-term gains, understanding the associated risks and maintaining a long-term focus are essential factors for successful investing.

This article was initially published in July 2016 and has undergone multiple updates over the years, with the most recent update being in Dec 2023.

FAQ: On the significance of the October 24 1929 Stock Market Crash

Q: What was the significance of the October 24 1929 Stock Market Crash?

A: The Stock Market Crash of October 24 1929, holds great significance as it marked the beginning of the Great Depression and had profound economic consequences worldwide.

Q: What factors caused the Stock Market Crash of 1929?

A: The crash was triggered by a combination of speculative trading, excessive borrowing, overvaluation of stocks, and the absence of government regulations. These factors created a stock market bubble that eventually burst, leading to widespread panic and a rapid decline in stock prices.

Q: How did the Stock Market Crash of 1929 impact the financial system and the market?

A: Despite the severity of the crash, the financial system eventually recovered, and the market rebounded to new highs. Over the long term, stock market crashes have often presented buying opportunities, especially when central banks take proactive measures to stabilize the situation, as demonstrated in the 2008 financial crisis.

Q: What do the Dow and Nasdaq indicate regarding the possibility of a Stock Market Crash?

A: Currently, the Dow and Nasdaq present mixed signals. While the Dow appears overbought on weekly charts and seeks to release some steam, the Nasdaq remains in a strong uptrend. It is important to focus on the overall trend rather than fixating on the possibility of a crash. All sharp pullbacks should be viewed optimistically in a bullish market.

Q: Is a stock market crash likely to happen?

A: Presently, the likelihood of a stock market crash is low. The Nasdaq’s strong uptrend suggests that the market is not currently in a crash-prone state. Concentrating on the opportunities presented by the market’s trend is more productive rather than dwelling on the possibility of a crash.

Q: What does history teach us about stock market crashes?

A: History has shown that despite significant crashes like the one in 1929, the financial system can recover, and the market can reach new highs. From a long-term perspective, stock market crashes can often be viewed as buying opportunities, particularly when the trend is upward and the crowd is in panic mode.

Q: How does market sentiment influence the direction of the market?

A: Market sentiment, reflected in bullish and bearish readings, provides insights into the emotions and attitudes of investors. When bullish readings fail to surpass historical averages, and the bearish sentiment is subdued, it suggests that the market tends to drift towards the direction of least resistance, which is often upward. This supports the idea that opportunities can arise even when the market does not conform to expectations of a pullback.

Q: What stance should investors adopt during a bullish trend?

A: In a bullish trend, investors should consider deviations and pullbacks as opportunities rather than reasons to fear. While a market pullback is seen as a bonus, it is essential to diversify investments and not rely solely on one approach. The key is to focus on the overall trend and take advantage of favourable deviations.

Other stories of interest

Graceful Money Moves: 6 Powerful Tips on How to Manage Your Money

The Prestigious Journey to Financial Wellness: How to Achieve Financial Wellness with Distinction

What is Inductive and Deductive Reasoning: Unveiling the Mystery

Savings Bonds 101: How Do Savings Bonds Work for Dummies

Finessing Your Finances: How to Manage Your Money When You Don’t Have Any

Copper Stocks to Buy: Seizing Wealth Opportunities In The Metal’s Market

Unveiling the Mysteries: How ESOPs are Typically Invested in and Why It Matters

I’m Never Going to Be Financially Secure, So Why Try?

Boost Your Financial Freedom and Secure a Home Equity Loan with a 500 Credit Score

Stock Market Investing for College Students: Navigating the Path to Financial Grace and Poise

Which Situation Would a Savings Bond Be the Best Investment?

How to Start Saving: Effective Strategies to Achieve Your Savings Goals

Stock Investing For Children: Ensuring Their Financial Success

Investing for Income in Retirement: Refined Strategies for Financial Grace

What Is a Contrarian Investor? Embrace Unconventional Thinking