Always do what you are afraid to do.

Ralph Waldo Emerson

Bond Crash: The Bond Market Is Not Set To Crash

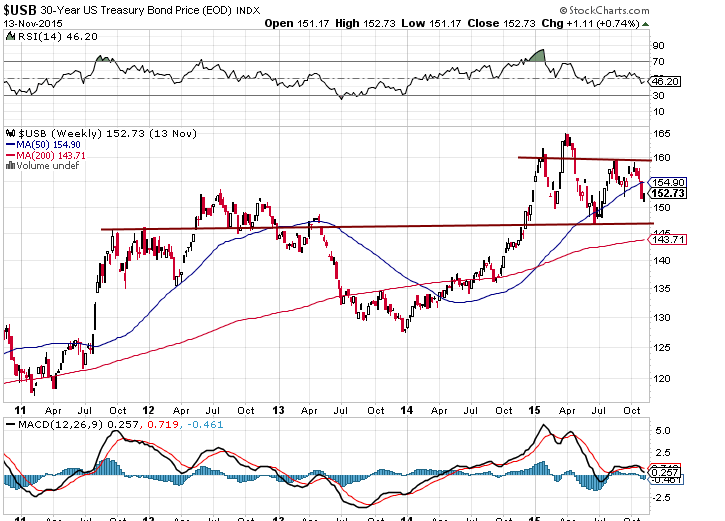

The trend in bonds was bullish for a long time, and one can see how bonds ran up during that time frame. Currently, it’s neutral and that also has to be viewed through a bullish lens as it should have turned negative given the run-up. Bonds need to close on a weekly basis above 160.00 relatively soon. In fact, there is a good chance that if the next run-up fails to take out the August highs of 161-23, bonds will be paving the way for a move down to the 152.00 ranges and then 147-148 ranges. Traders willing to take on a bit of risk could consider opening long positions at both levels. Some funds could be deployed at 152 or better and some at 148 or better. Market Update, Nov 1st, 2015.

Bond Crash Unlikely: Bond Bull More Likely

Bonds traded as low as 151-12, fulfilling the first requirement; the next stage calls for a rally that could take bonds to as high as 155. After, that bonds are expected to trade below 151-12 and as low as 147 before a tradable bottom takes shape. For now, the bond market is catering to the twaddle that the Fed is going to embark on a rate-hiking program.

Copper’s breakdown already is a sign that the illusory economic recovery is falling apart. If the Fed’s want to embark on the perfect scam, they will stabilize copper to give the illusion that all is well. Who knows they might still do this. For now, we believe that even if the Fed’s do raise rates, it will not be part of a new trend; the goal is to come out with another stimulus program.

Despite the current pullback, bonds are still rather overbought, so there is room for bonds to drop even lower, but this is not the end of the world as Bill Gross has been stating for some time. Look at the bombastic titles of some of his many recent articles. If you go back even further, you will see he has more been wrong more often than right, and yet the press favours his views like they are the word of God. Bonds will experience a very strong pullback one day, but waiting for that day could be disastrous.

Bill Gross: Capitalism ‘can’t survive’ at 0% rates Full story

Well it’s doing a pretty good job so far of surviving

Gross Says 100% Certain of December Rate Hike as Jobs Surge Full story

Maybe and then maybe not, but it won’t mark the end of the world. All the naysayers eventually died, and the world continued without their insane ramblings.

Bill Gross Says Bunds “Short Of A Lifetime”, As Mario Draghi Is About To Run Out Of Bunds To Buy (April 2015). Full Story

The only time something has a chance of being great is if it’s not known by many.As he is famous anything he states is broadcasted all over the place. However, if it was the short of a lifetime, which we are not sure it is, then why inform everyone, why not keep it to yourself and your clients. Remember you can be right and still end up broke. The question comes down to time. Do you have the staying power or time on this planet to bet on something because your guts tell you that its the thing to do?

Bull market ‘supercycle’ for stocks, bonds ending: Bill Gross

Gross, the manager of the $1.5 billion Janus Global Unconstrained Bond Fund, has made similar warnings on stocks and bonds before and acknowledged they’ve come too early.

In May 2013, Gross, who at the time was a manager of the Pimco Total Return Fund, the world’s largest bond fund, jolted Wall Street participants on social media with a

Twitter post saying: “The secular 30-yr bull market in bonds likely ended 4/29/2013.

“I merely have a sense of an ending, a secular bull market ending with a whimper, not a bang. But if so, like death, only the timing is in doubt,” Gross said. Full story

Yes death is a certainty, and only the timing is in doubt, but what he fails to state or notice, is that when you die timing matters not. Bottom line, never fall for the line that the world is going to end. The only time you start to make plans for a massive correction is when the Crowd has turned ecstatic, and this is not the case. People are turning to bonds out of desperation; that is a far cry from euphoria.

Other articles of Interest:

Dr Copper, economy and the markets no longer dance to the same beat (Nov 23)

Is Crude oil headed higher or lower? (Nov 20)

Is the Dow going to crash in 2015 (Nov 18)

predictions for wild weather, end of Multiculturalism & religious wars (Nov 14)

The Dow Industrials are not going to crash (Nov 11)

Oops we did it again- The Fed is setting up the masses for another stimulus program (Nov 9)

Palladium Bulls are getting ready to sprint (Nov 7)

Dow industrials set to defy naysayers and trend higher (Nov 6)

Dow continues to soar, doctors of doom wrong, what’s next (Nov 5)

Dr Copper time to buy, markets & psychological warfare (Nov 3)

World’s only Adult Index predicts rise in immoral behaviour (Nov 2)

Death Cross is not a bearish Omen for the Stock Market (Oct 30)

Market Timing Does it work (Oct 28)

Turkey shot down a Russian Drone (Oct 27)

Russia, Syria and the Religious war (Oct 27)

stocks and bonds will not crash in 2015 (Oct 25)

It’s not time to sell the DAX (oct 22)

The Dow is getting ready to Soar (Oct 21)

why its time to investing in banking stocks (oct 18)

Ignore the Yield Curve- bank stocks are a bargain (Oc 16)

Dr. Copper back from the dead; time to buy or blink (Oct 7)

China’s Stock Market Crash; time for panic or restraint (Oct 2)

Gold prices set to jump in 2015? (Sept 22)

What Happens If The Market Crashes?

Investment Journal: Charting the Course Toward Financial Triumph

Dow theory Forecasts: Alternative could be better

Contrarian Definition: Tactical Investor Trading Methodology

Herd Mentality: Understanding the Pros and Cons of Conformity

Projected Silver Prices: Setting Sail for Precious Metal Ascension

Which Of The Following Is A Cause Of The Stock Market Crash Of 1929

Stock Bubble: Act Quickly or Lag Behind

The Dow Theory: Does It Still Work?

Tactical Tools: Unleash the Power of Trend Prediction

The Pitfalls of Investing: Why People Lose Money in the Market

Stock Market Tips For Beginners: Surfing the Trends for Success

Panic Selling Mastery: Buying the Fear & Selling the Joy

Are Economic Indicators Finally In Sync With the Stock Market

Perception Manipulation: Mastering the Market with Strategic Insight