Stocks and Bonds

Updated Dec 2020

We list excerpts from past market updates to illustrate how the mass mindset is always wrong. Even big shots like Bill Gross are not exempt from being sucked into this black hole, otherwise known as the mass mentality. Herd psychology indicates that the only time a market is going to crash is when emotions have hit a boiling point. In other words, the crowd is foaming with joy.

However, regarding bonds, one more factor needs to be considered. The element of control and that element has a name; it is called the Fed. They are the ones that will determine when rates rise, as they are holding it down for an unusually long period. The simple question that comes to one’s mind is, why? The answer is equally straightforward. The current economic recovery is nothing but smoke and mirrors; the Fed understands that the Crowd is aware of this phenomenon, but if the markets are driven up, a glimmer of hope emerges.

Hope springs eternal, even though the masses know all is not well.

This ray of hope that things will get better because the markets are soaring higher is what keeps them trudging along. Lost to them is that the markets are trending higher only because rates are being artificially kept lower, so this hope sets off a chain reaction. More hot money is needed to fuel the illusion that all is well. The only way to pull this off is to keep rates down at deficient levels.

Low rates create an environment that fosters speculation. In this environment, speculators are rewarded, and savers are punished. Unfair. Damn right, but that is life. So before you jump on the bandwagon of doom, understand that most of those naysayers are like broken clocks. Even a broken clock is right twice a day. You should strive to understand that every disaster is nothing but an opportunity to plant a big fat kiss on your cheeks. Embrace the bugger instead of kicking him to the curb, as most do.

Low rates foster Speculation in both Stocks and Bonds.

See the world for what it is and not what others (so-called) experts force you to see. March to your drumbeat and not to the drumbeat of the talking heads, whose sole function is to make a natural development appear scary and frightening. If you bought the nonsense, the world was going to end; the markets were supposed to crash, blah, blah. You would have lost your shirt, pants and knickers in the process. Do not give credibility to people who only employ the tool of fear to sell you a bag of magic bones.

The excerpts listed below and this chart will illustrate how dangerous it is to follow the doctors of doom.

Stocks and bonds: New Comments

New comments that appear between the excerpts are highlighted in green.

So what is going on in the bond markets? Is Bill Gross finally getting his act together and making the right call? The answer to the first question is nothing much to cry about, and the answer to the second question is no.

We are not stating that Gross is not brilliant despite the name; bright has nothing to do with being right in the markets. He has been predicting a collapse in the bond markets for quite some time, and one day, most likely, he will get it right. Rates have to be allowed to move a little. Otherwise, it will appear that the Feds are completely controlling everything; even though this is true, the masses do not believe this, so appearances must be maintained. Higher rates mean higher debt payments and higher costs to business and this must be avoided at all costs. Business is always given the best deal. America is bought and paid for by the corporate world. Market Update May 17, 2015

Navigating the Financial Landscape: Insights on Bond Trends and Potential Reversals

Now slowly, as the bears start to predict the worst, they should bottom out and start trending higher. As long as the weekly trend does not turn negative, bonds will be destined to test their old highs crash, but we will begin to focus on this when the trend changes.

Nothing much to add here other than regurgitating nonsensical financial data pushed out by so-called elite government agencies; as this data is corrupt, it makes no sense to waste time on dealing with fictional events, and we are also not in the mood to work with vomit.

Since we made these comments, bonds have rallied nicely, but we feel that they should (keyword should) retest their lows before moving higher and testing their old highs. The trend has not turned negative, and the reason bonds sold off is because too many fools had over-leveraged themselves in the futures markets, and when there was talk from the Feds that rate hikes would be inevitable, markets pulled back, and some of these long positions were so leveraged that some players were forced to liquidate their positions; this turned what would have been an orderly pullback into a short-term blood bath.

Market Update: Bond Reversal on the Horizon, Setting the Stage for a Rebound

This correction gave the Feds the impression that they were not manipulating the markets; some stupid fat greedy bulls were slaughtered, and the bears were pushed into opening new shorts, so everything has been set up for a rebound.

At this point in the game, bonds are still expected to reverse course and trade higher. Market Update May 31, 2015

After letting out some steam, bonds rallied as expected, and by the end of June, they had recouped almost the losses they incurred in May. Bill Gross was wrong once again. Never be one with fear; if you are, then a loss is the only thing you must look forward to.

Bond Market Insights: Unraveling Illusions and Predictable Fluctuations

Bonds pulled back strongly and not only did they test their lows; they dropped to new lows, fulfilling the illusion the Feds wanted to create that the markets are free. Most have failed to note that bonds have sold off several times during this bull market rally that started in 2008. In every instance, bonds recouped their losses. This pattern will stop one day, and the trend indicator will inform us of this in advance. Until then, let the good Samaritans try to help everyone, and the naysayers sing their infamous song of impending doom.

This up-and-down process will further cement the view that the Fed is impartial. It is the classic story: strong correction, consolidation (lots of up and down movement) and a new breakout that leads to new highs. Market Update, June 19, 2015

Resilient Bonds: Reversal and Projection Amidst Greece’s Default Concerns

Bonds continued to correct, dropping to the low 147 range before reversing course and soaring higher on worries that Greece might default. At this point, bonds could trade up to the 152-153 ranges before pulling back. There is even a chance that they could trade below their recent lows before surging to and past the 156 range. As the trend has not turned negative, we must view the current correction (regardless of how strong it might or might not be) as a typical cyclical move in an otherwise healthy market. Market Update June 30, 2015

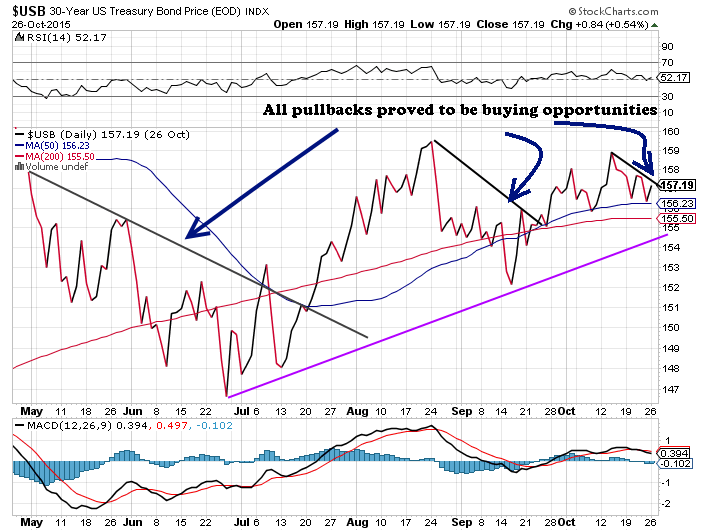

Once again, as expected, bonds fulfilled the stated projections. Our trend indicator was and is still bullish, so the trend remains up. Those that listened and viewed all strong pullbacks as buying opportunities did well.

So, while many well-educated but not market-savvy penguins stated that bonds were due to plunge even more, they recovered as expected. They traded past the 152-153 ranges and are now on the way to testing the 156 ranges. If they close above 156 every week, then they will challenge the old highs or at the very least, test them. The weekly trend is up; therefore, all pull-backs must be considered buying opportunities. Market Update July 31, 2015

Bond Market Insights: Navigating Volatility Amidst Speculations

Bonds traded as high as 159-28 before pulling back, setting up the path for a possible test of the old highs. The weekly trend is still up, so all pullbacks must be viewed as buying opportunities. We could recite more nonsense, but that would mean wasting good time on a pointless endeavour, so we will respectfully decline the offer.

Bonds will crash one day; however, we would instead not fixate on one day. We prefer to look at today; today is not the day they will crash. We still feel that there is a substantial possibility that the Feds will do something to stun the markets, and that is why the spin masters are flooding every news outlet possible with a never-ending stream of negative news.

If the stories are blown out of proportion well enough, and the crowd buys this theme of fear and destruction, it will provide the backdrop for the Feds to create a new stimulus plan. This game is not going to end well, so if it’s going to end badly, why not milk the cow as much as possible before the animal keels over? Additionally, the big boys never suffer. Economic boom or collapse is all the same to them.

China’s Currency Move and the Implications for Bonds: Market Update

The move by China to devalue its currency last week could very well be the excuse the Fed needed to leave interest rates untouched and then slowly build the notion that some sort of stimulus is needed. Market update August 19, 2015

Bonds rallied but failed to trade to new highs, yet, as the trend is still up, one can expect bonds to attempt to test their highs again. As equity markets and bonds diverge, a move to new highs by bonds would coincide with another corrective wave in the equity markets.

The monthly trend is showing signs of exhaustion and could turn natural. While we focus on the weekly trend, the fact that the monthly trend could turn neutral suggests that a failure by bonds to trade past their highs should be construed as a signal that a more substantial correction lies ahead. Market Update Sept 1st, 2015

Even if the Fed raises rates, and at this point, it’s a 50-50 shot a best, we expect the Feds to come out with some insane form of QE. Perhaps a QE for the people might be the next game plan; It sounds insane, well believe it or not, Jeremy Corbyn, Britain’s new Labour party leader, has proposed just this. You can read the full story here. Could we be wrong, yes, and if we are, we will admit to being so? However, note that QE is still going on in the form of share buybacks. Based on the number of share buybacks authorized this year, the total dollar amount is set to exceed $1 trillion, setting yet another new all-time record.

Market Update: Support Levels and Rational Approach Amidst Market Volatility

There is strong support in the 150-15 to 152 ranges, and the current consolidation should end there unless the Fed does something unexpected, in which case bonds could overshoot and drop down to the 145 ranges. At this point, opening long positions would be the astute thing to do. Market Update Sept 15, 2015

Try to recollect how you acted every time the markets sold off. Whether it’s the bond market or stock market, it’s irrelevant. Did you give in to fear? Did you panic and Join the herd as it stampeded towards the exit? A mind driven by fear cannot act rationally. Therefore, any action is bound to lead to an adverse outcome. The best thing to do is focus on what the crowd is doing and use technical tools to help determine entry or exit points. The masses produce extreme moves in the market; if you understand that fact, you can use it to your advantage. At the Tactical Investor, the game plan is simple; every pullback is buying opportunity as long as the trend (based on our trend indicator is up). The stronger the pullback, the better the buying

So what’s next for Bonds and stocks in 2015?

Do not listen to the doctors of doom as predicted; they were wrong and will continue to be wrong. One day they will be correct, but that is the same thing a broken clock can lay claim to. As predicted by our trend indicator, all strong pullbacks were to be viewed as a buying opportunity and in every case, that came to pass.

Do not listen to the Doctors of Doom. Understanding the psychology of the masses is essential to being a successful trader. When you combine technical analysis with the powerful concept of mass psychology, it becomes easy to understand what the masses will and will not do. One can then use the indicators to fine-tune one’s entry point. This leads to the trend indicator, the perfect combination of technical analysis and mass psychology. For the record, we do not expect stocks to crash we expect the opposite.

Stocks and Bonds

Overall, the bond market is far more overvalued than the stock market, and we believe that it would be best to sit on the sidelines regarding bonds. Ideally, they will test the 149-150 ranges, with a possible overshoot to the 147 ranges. At that point, one could take a closer look at them. The reason for this view is simple. Stocks are far from overvalued, and the bullish sentiment is not trading in the high ranges.

Therefore, every strong pullback has to be viewed as a buying opportunity. We expect the Dow to experience another withdrawal, the final strong pullback for the year. It is expected to test the 15800-16000 ranges, with a possible overshoot to the 15500 ranges. If this comes to pass, we will view it as a splendid buying opportunity, as the Dow should end the year in the black. Next year, the Dow index is expected to trade to new highs; this was covered in a recent article titled; The Dow is getting ready to soar.

FAQ

Q: What is the mass mindset when it comes to market updates?

A: The mass mindset often tends to be wrong when it comes to market updates. Even experienced individuals like Bill Gross can be influenced by herd psychology, which is driven by emotions and optimism.

Q: How does the Federal Reserve (Fed) influence bond rates?

A: The Fed controls interest rates and determines when they rise or fall. They have been keeping rates artificially low for an extended period. This is done to maintain the illusion of economic recovery and prevent higher debt payments and business costs.

Q: Why do low-interest rates foster speculation?

A: Low-interest rates create an environment that rewards speculators and punishes savers. Speculation becomes more attractive in such an environment, leading to increased market activity and potentially higher asset prices.

Q: Should one follow the crowd’s mindset or have an independent perspective?

A: It is advisable to have an independent perspective and not blindly follow the crowd’s mindset. It is essential to see the world for what it truly is and not let others, especially fear-driven experts, influence your decision-making. March to your own drumbeat and make informed decisions.

Q: How accurate are market predictions and forecasts?

A: Market predictions and forecasts can be unreliable; even well-known individuals can make incorrect calls. Understanding that every disaster or market fluctuation presents an opportunity rather than a reason to panic is crucial.

Q: How does the market react to fear and negative news?

A: Fear and negative news can create a backdrop for the Federal Reserve to implement new stimulus plans. By exaggerating and spreading fear, the Fed can manipulate the markets to its advantage, potentially leading to more intervention and monetary policies.

Q: Can bonds be expected to reverse and trade higher?

A: Bonds can experience reversals and trade higher based on market trends and indicators. While temporary corrections may occur, the overall trend and historical patterns suggest that bonds have the potential to recover and reach new highs.

Q: What is the significance of technical analysis and mass psychology in trading?

A: Understanding the psychology of the masses and combining it with technical analysis can help predict market behaviour and make better trading decisions. It identifies potential entry or exit points based on the crowd’s actions.

Q: Are stocks or bonds more overvalued in the market?

A: Bonds are considered to be more overvalued compared to stocks. It is suggested to exercise caution with bonds and potentially wait for a pullback before considering investments. On the other hand, stores have more potential for growth and are viewed as buying opportunities during pullbacks.

Q: What is the outlook for the stock market and the Dow index?

A: The stock market, particularly the Dow index, is expected to experience a final strong pullback before the end of the year. However, it is anticipated to rebound and reach new highs. The Dow index is predicted to perform well in the coming year.

Q: Are market updates and predictions consistently accurate?

A: Market updates and predictions should not be relied upon blindly, as they can often be inaccurate. It is crucial to approach them rationally and independently, considering multiple factors and indicators before making investment decisions.

Originally published Aug 5, 2015

Other items of interest:

It’s not time to sell the DAX (Oct 22)

why it time to invest in banking stocks (Oct 18)

Ignore the Yield Curve- bank stocks are a bargain (Oc 16)

China’s Stock Market Crash; Time for Panic or restraint (Oct 2)

Gold prices set to jump in 2015? (Sept 22)

Market Sell off; is it Time to panic (Sept 12)

Forever Quantitative easing continues unabated (Sept 10)

Currency wars detonate (Aug 27)

The Gold Bull is Dead (Aug 21)

Market Timing Strategies: Debunking Flawless Predictions

Top Sectors 2016: Historical look

Canadian pension plan shell game