Projected Silver Prices: Navigating the Precious Metal’s Future

Updated May 1, 2024

Following the introduction, we will unveil our anticipated price targets for silver, providing a roadmap for what lies ahead. Subsequently, we will delve into various facets of the gold and silver market, comprehensively exploring current dynamics and potential opportunities.

Silver’s unique position as a precious and industrial metal sets the stage for its potential ascension in the intricate dance of silver and gold. As we cast our gaze forward, the interplay of supply and demand issues looms, with silver poised to trend higher amidst a confluence of economic shifts.

The US Dollar’s hegemony is under scrutiny as BRIC nations (Brazil, Russia, India, and China) explore alternatives to the greenback, potentially diminishing its global dominance. Historically, silver has thrived in environments where the dollar’s strength wanes, suggesting a bullish future for the metal should these trends continue.

Moreover, the demand for silver is on an upward trajectory, fueled by its indispensable role in various burgeoning technologies and renewable energy sectors. This demand is set against a backdrop of constrained supply, with mine production struggling to keep pace, laying the groundwork for a classic supply squeeze.

The BRIC currency issue further complicates the picture, as these nations seek to assert their economic influence and reduce reliance on the dollar. This shift could lead to increased demand for silver as a store of value and investment asset within these economies.

Historical precedents support silver as a prudent investment during currency fluctuation and economic uncertainty. Its dual appeal as a haven asset and industrial staple underpins its resilience and potential for growth.

The silver case becomes compelling as we stand at the crossroads of these economic forces. Investors may find wisdom in the adage that the best time to plant a tree was twenty years ago, and the second-best time is now. With silver, that time may very well be upon us.

Projected Silver Prices: Long-Term Targets

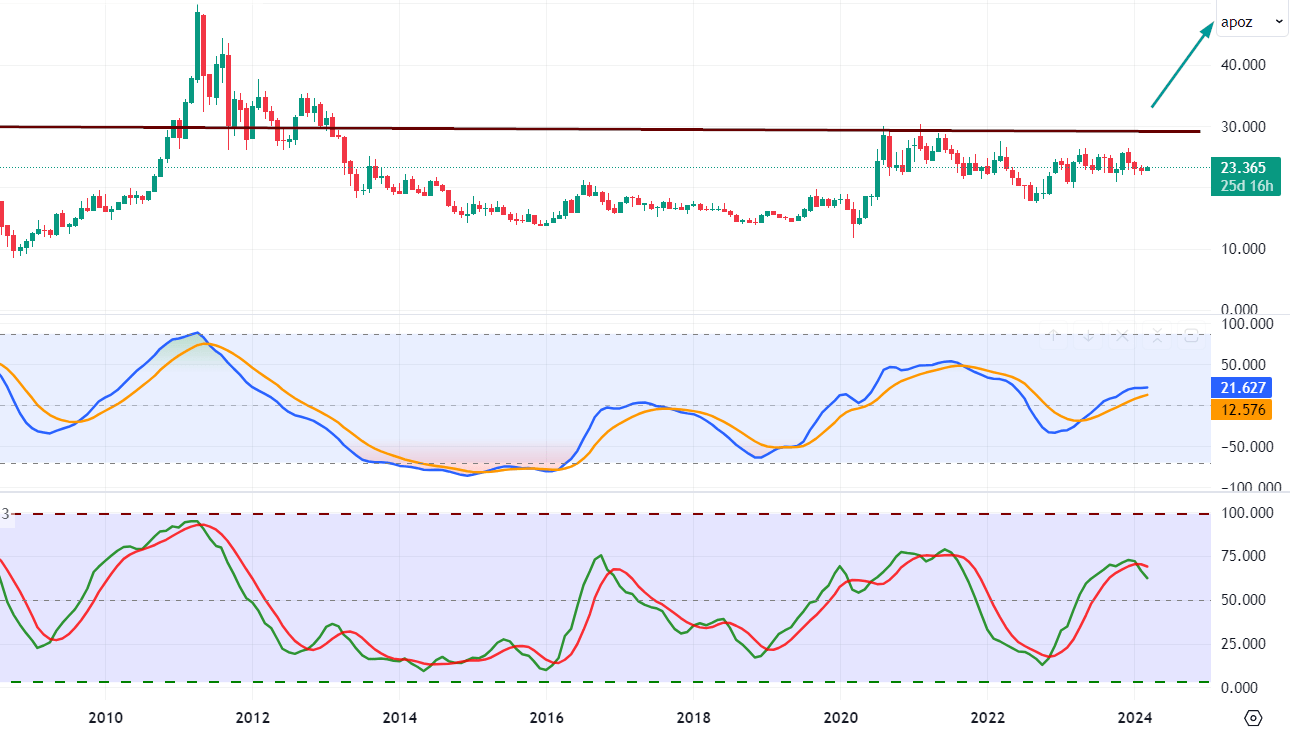

Navigating the financial landscape requires a blend of foresight and strategic patience. For silver, a monthly close above $29.50, but ideally breaching $30.00, would signal a strong potential for growth, setting the stage for a rise to the $42 to $45 range. Should momentum and market conditions align favourably, we might even witness a surge toward a significant high to the 60 to 65.00 range.

However, wisdom dictates focusing on the immediate goal—the $42 to $45 range—before considering more ambitious targets. Only once the $45 mark is surpassed should we turn our analytical prowess to the prospect of reaching the $60 to $65 range. The current state of the market, slightly overbought on the monthly charts, suggests we may encounter heightened volatility in the short term. Yet, this should not deter the long-term investor.

In the vein of the great investor Buffett, one must view the market’s ebb and flow, understanding that the long-term horizon matters most. Short-term fluctuations are part and parcel of the journey, not a deterrent. Hence, investors with a long-term outlook should interpret pullbacks as advantageous moments to strengthen their positions in silver bullion and silver-related stocks.

Projecting Silver Prices: Fed’s Influence Unveiled

The projected silver prices and the Federal Reserve’s impact on precious metals are closely intertwined. The Federal Reserve’s monetary policies significantly shape the overall economic landscape, including the performance of precious metals like gold and silver.

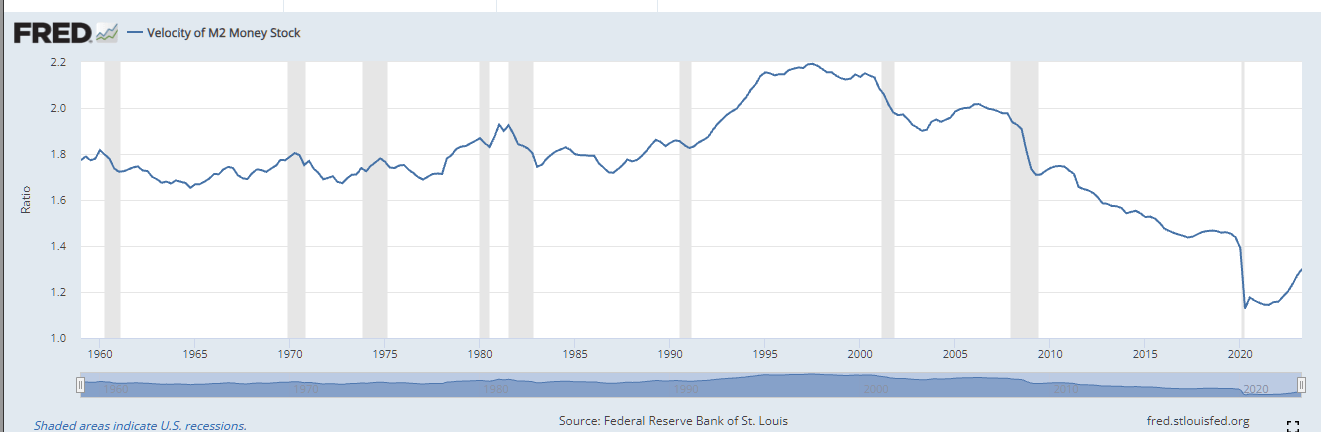

The Federal Reserve can influence the velocity of money through its monetary policy decisions. When the velocity of money slows down, as mentioned earlier, it can hinder the upward momentum of gold prices. This is because slower money circulation indicates reduced economic activity and can dampen the inflationary pressures that typically drive gold prices higher.

For projected silver prices, it is vital to consider the broader macroeconomic context and the Federal Reserve’s stance on monetary policy. Suppose the Federal Reserve maintains an economic policy that keeps the velocity of money at a standstill and allows deflationary forces to persist. In that case, it may impact the upward trajectory of silver prices. However, if there are indications of a change in monetary policy that leads to an increase in the velocity of money, it could potentially support a rally in silver prices.

Monitoring indicators such as M2, which reflects the money supply, can provide insights into potential shifts in the Federal Reserve’s monetary policy and its impact on precious metals. If M2 starts upward, it suggests an expansionary monetary policy that could support gold and silver prices.

The Illusion of Economic Health

The perception of economic health and the role of market manipulation elicit diverse opinions and perspectives. While various factors can influence market cycles and economic conditions, it is important to approach such claims with a balanced view.

Many factors influence markets, including government policies, central bank actions, investor sentiment, and global economic conditions. While some argue that markets are entirely controlled and manipulated, it is crucial to acknowledge that market dynamics are complex and often driven by a combination of factors rather than solely by deliberate planning.

Central banks commonly inject liquidity, or “hot money,” into the economy to stimulate economic growth and mitigate crises. These measures aim to encourage lending, investment, and consumption. However, the long-term effects and potential consequences of such actions are the subject of ongoing debate among economists and policymakers.

The velocity of money, which measures how quickly money circulates within the economy, is an essential indicator of economic activity. A healthy market typically experiences an increase in the velocity of money, reflecting robust economic transactions and a vibrant business environment. A decline in the velocity of money can indicate reduced economic activity or other structural factors affecting money circulation.

Silver Prices and Precious Metals: A 2023 Update

As of 2023, the analysis suggests a mildly positive trend for silver prices, following a bullish MACD crossover on the monthly charts. However, it is essential to note that market conditions can be dynamic and subject to change.

The statement implies that gold is expected to play a significant role in driving silver prices. If gold manages to close above 1500, it could trigger a test of the 1800 range, with a potential overshoot to 1920. This indicates a bullish outlook for gold, which could positively spill over silver prices.

While silver is described as a laggard in this analysis, it is anticipated to gain momentum once action intensifies in the gold markets. This suggests that silver may experience a delayed but potentially more vital upward movement compared to gold bullion regarding percentage gains.

It is important to remember that forecasting precise price levels and movements in the financial markets can be challenging and speculative. Market dynamics are influenced by a wide range of factors, including economic conditions, geopolitical events, supply and demand dynamics, investor sentiment, and regulatory changes. These factors can interact in complex ways and lead to unexpected outcomes.

The Impact of the Dollar on Precious Metals Pricing

In the short to intermediate timelines, precious metals are currently trading in overbought territory. This suggests that a period of consolidation, likely spanning several months, is on the horizon.

Adding an intriguing twist to the equation, the US dollar indicates reaching a bottom and potentially embarking on a rally over the next 6 to 9 months.

The critical question is whether precious metals can sustain a rally in the face of a resurgent dollar. This scenario can potentially redefine the landscape, signifying a transition into authentic bull markets for Gold and silver. In such a transformation, the dollar’s influence on price trends may diminish, marking a significant shift in the precious metals market dynamics.

Investors and market observers should closely monitor this interplay between the dollar and precious metals, which could lead to noteworthy developments in the coming months. The evolving relationship between these critical factors can offer valuable insights for those navigating the intricate world of investing in precious metals.

Gold’s Price Forecast Analyzed Through GLD’s Chart

First and Foremost, once the consolidation phase subsides and Gold can successfully achieve monthly closures above the pivotal 2400 level, a compelling opportunity for Gold’s ascent to the challenging 3000 to 3300 price range begins to take shape.

Considering the current landscape in 2023, Gold’s price has oscillated within the band of 1800 to 1900, offering glimpses of a potential breakout on the horizon. This scenario suggests an impending shift in the precious metals market, a development that investors should monitor closely.

The promising outlook for both Gold and Silver hints at opportunities and potential rewards for vigilant investors who remain attuned to the intricacies of the market. Keeping a watchful eye on these precious metals is advisable as the financial landscape continues to evolve.

Projected Silver Prices and M2: A Precious Metamorphosis

In financial analysis, the relationship between the Velocity of M2 Money Stock (M2) and precious metals has been a long-standing indicator of market dynamics. Historically, a significant uptick in M2 often signified a bullish phase for precious metals, mainly Gold and Silver. However, the winds of change are sweeping through the financial landscape, and precious metals seem on the brink of a remarkable transformation.

One can observe a modest uptick in VM by examining the chart below. Time will reveal if this marks a new trend or a brief deviation.

Traditionally, a substantial surge in M2 was the precursor of the ascent of precious metals. But the current scenario tells a different story. Gold, the age-old standard of wealth preservation, is poised to make a groundbreaking move by surpassing the $2,100 mark. This impending milestone carries a harbinger of change in the precious metals market.

Silver, often seen as Gold’s more volatile counterpart, is now positioned to steal the spotlight. The recent surge in silver prices suggests it may lead to the charge before gold. If Silver and Gold both mount more potent breakouts, the synergy between these two metals could be the catalyst that defies conventional wisdom.

Conclusion

In conclusion, the intricate dance of Silver and Gold in finance is poised for a fascinating transformation. The historical relationship between these precious metals and M2, the money supply, has been a reliable indicator of market dynamics. Traditionally, a surge in M2 signalled the ascent of precious metals, mainly Gold and Silver.

However, the current landscape tells a different story. Gold, the quintessential store of wealth, is on the verge of a historic breakthrough, with the potential to surpass the $2,100 mark. This signifies a shift in the precious metals market, a development that has captured the attention of investors and analysts.

Silver, often viewed as Gold’s more volatile sibling, is ready to take centre stage. Recent surges in Silver prices suggest it might lead the charge before Gold, setting the stage for a potential synergy between the two metals that defies conventional wisdom.

The relationship between M2 and precious metals is evolving, and this transformation promises to reshape traditional market indicators and reactions. As we navigate this uncertain path, one thing is sure: the world of finance and precious metals will become even more intriguing. It’s a landscape where careful observation, informed decisions, and adaptability will be the keys to success in the ever-changing financial markets.

Other Intriguing Stories Worth Exploring

Inside the Market Psychology Cycle: Unveiling Trends and Tactics

If powerful forces in Asia begin a sudden liquidation of dollar-denominated equities and bonds, won’t that also ignite Dollar velocity, albeit temporarily?

It could but too much emphasis is placed on Asian forces liquidating massive amounts of dollar-denominated assets and like you stated already the effect would be temporary. We believe the Fed will increase the velocity of money by lowering lending standards and making it suddenly easier for the small guy to get home and small business loans.