A Symphony of Opportunities – Are Bonds a Good Investment?

Updated Jan 4, 2024

As we delve deeper into 2024, the bond market is like a grand symphony, with each instrument uniquely creating a harmonious investment environment. The global economic stage is set, and the players are ready. The baton has been raised, and the performance is about to begin.

The corporate bonds are the robust brass section with higher yields, providing bold, resonant undertones. They are the backbone of the orchestra, offering a steady rhythm and a sense of security. The municipal bonds, tax-exempt and community-focused, are the woodwinds, offering a melody of social responsibility and potential profitability. Their notes are lighter but essential to the overall composition.

The bond market of 2023 is not just a static picture; it’s a dynamic, evolving entity. It’s a thrilling ride, a rollercoaster of interest rates, yields, and maturities. It’s a game of chess, where strategy and foresight are key. It’s a puzzle waiting to be solved by the astute investor.

As we stand on the precipice of this exciting journey, one thing is clear: the bond market in 2023 is a stage set for a performance that promises to be both intriguing and climactic. So, let’s dive in; let’s immerse ourselves in the rhythm, the melody, and the harmony of the bond market. Let the symphony begin!

The Plateau of Interest Rates and the Anticipated Decrescendo

As we moved into 2023, the bond market echoed with a new rhythm: the plateauing interest rates. This shift, comparable to a sudden pause in a musical masterpiece, altered the dynamics of the bond landscape, introducing an intriguing layer of complexity to our symphony.

The stabilizing interest rates are the percussion section of our orchestra, maintaining the pace and infusing steady energy into the performance. They are the heartbeat of the bond market, setting the rhythm and influencing every other instrument.

However, the plot thickens with the Fed’s recent statement indicating a potential lowering of these rates in 2024. The reasons behind this move are unclear, adding a sense of suspense to our musical score. Despite these lower rate expectations, there’s no guarantee that the Fed will be able to decrease rates as swiftly as they’ve indicated, particularly in light of the stronger-than-expected CPI report from December 2023. The job market, still buzzing with activity, adds another note of unpredictability.

This transformation is not merely a challenge; it’s an opportunity. It’s a chance for investors to showcase their adaptability and resilience. It’s a test of their ability to dance to this new rhythm and embrace and leverage the change.

As we traverse this captivating new dynamic, we are both observers and participants in the performance. We are part of the symphony. And as this suspenseful movement unfolds, so does our anticipation. What will the next movement bring? The curtain is rising, the stage is set, and the next act in our bond market symphony is about to begin. Let’s embrace this rhythm of stabilizing and potentially decreasing interest rates and see where this thrilling journey takes us!

Monetary Policies, Inflation, and High-Interest Rates: A Precarious Balancing Act

The years 2022-2023 marked a significant shift in global monetary policy as central banks, grappling with persistent inflation, tightened their policies quickly. The Federal Reserve led the pack with one of the fastest rate-hiking cycles in decades, raising interest rate targets by 225 basis points from 3% to 3.25%. Other major central banks, including the European Central Bank (ECB) and the Bank of England, echoed this trend.

However, these aggressive policies have resulted in a precarious economic landscape. Europe, with Germany at the forefront, is experiencing significant financial strain. The sanctions against Russia, intended to exert economic pressure, have had significant repercussions. Germany, Europe’s largest economy, is teetering on the brink of economic turmoil, a stark contrast to its usually robust financial standing.

Meanwhile, the United Kingdom grapples with escalating inflationary pressures. British debt has skyrocketed to dangerous levels, tying the hands of policymakers. Lowering rates too quickly could devalue the currency, as the yield needs to remain attractive for continued debt selling. Conversely, high-interest rates are suffocating the business environment, causing a chilling effect on the housing market. A rapid cooling of the housing market could have catastrophic consequences reminiscent of the 2008 housing crash in the United States.

In conclusion, central bankers in the US and Western Europe are trapped between the proverbial rock and a hard place. Rising debts and high-interest rates have made repayments burdensome. However, drastically lowering rates could deter investors from buying their debt. It’s a delicate balancing act, with the global economy hanging in the balance. The policy decisions made in 2024 will have far-reaching implications, and the world watches with bated breath.

Municipals Demonstrate Diversification Benefits

Municipal bonds exhibited greater resilience than taxable fixed income in 2022, supported by their unique tax advantages and characteristics.

Holding munis across rating categories allowed capturing some price upside as risk-off investor demand strengthened. Higher-grade general obligation bonds saw only modest drawdowns compared to peak volatility elsewhere.

The tax-exempt nature of muni interest income makes their yields more competitive after factoring in an investor’s tax bracket. For example, a 5% muni earns 7.7% for a combined federal and state tax rate of 35%.

Muni options also provide exposure beyond national-level government debt. The local project funding they support for schools, hospitals, and infrastructure creates an income stream tied to communities nationwide.

Defaults remain exceedingly low, given the essential nature of funded services. According to major rating agencies, less than 0.5% of muni issuers were distressed in 2022.

While rising rates may challenge some upcoming maturities, historically robust demand provides liquidity to long-term holders able to invest outside periods of short-term price dislocation.

Overall, munis demonstrated the benefits of tactical sector selection, showing that fixed income can deliver valuable diversification within periods of bond market stress. Active managers unlocked further opportunities from temporary valuation distortions.

Strategies for Investing with Bonds in a Dynamic Macro Environment

One can explore these strategic insights for optimizing one’s bond investments within the dynamic landscape of today’s macroeconomic environment.

1. Lengthen Duration Selectively

In the context of lengthening duration selectively, it’s important to emphasize the importance of balance. While longer-dated Treasuries may carry potential downsides with rising interest rates, they offer the prospect of higher yields. Conversely, short-term bonds face reinvestment risk, as they may need reinvestment at lower rates. Combining short and long-dated bonds, the barbell approach resembles a risk management strategy. By diversifying across different maturities, investors can optimize their portfolios to capture potential yield increases while hedging against rising rates.

2. Favor Higher-Quality Credit

Focusing on higher-quality credit involves a meticulous selection process. Investment-grade corporate and municipal bonds offer safety and stability that can be particularly reassuring in uncertain economic times. Stable, well-known issuers are less likely to default, providing a cushion against lower-quality, high-yield bond risks. The key here is to prioritize quality over yield, making it crucial to conduct thorough credit research before including any bonds in your portfolio.

3. Ladder Maturities

The strategy of laddering maturities is not just about diversification; it’s also a prudent approach to maximize returns potentially. Investors can benefit from the natural ebb and flow of interest rates by having bonds mature regularly over the next 5-10 years. As bonds mature and rates rise, you can reinvest at more favourable terms. This staged approach helps capture the benefits of rising yields while providing a degree of liquidity as bonds mature, which can be crucial for capitalizing on new opportunities.

4. Emphasize Floating Rate Notes

Floating rate notes (FRNs) offer a dynamic way to manage interest rate risk. These bonds have variable coupons linked to short-term benchmark rates, such as LIBOR or the federal funds rate. The advantage is that they tend to be less affected by rising interest rates than fixed-rate bonds. By emphasizing FRNs in your portfolio, you can effectively reduce your vulnerability to interest rate hikes, making them a valuable tool for managing risk.

5. Consider Active Management

Active management in the bond market can be a strategic choice in times of volatility. Actively traded funds and managers with the flexibility to adjust allocations offer a tactical advantage. They can swiftly respond to market developments, seizing opportunities and mitigating risks as they arise. The active approach is especially beneficial when market conditions are shifting rapidly, allowing for a more dynamic and responsive investment strategy.

6. Keep Powder Dry

Maintaining a cash reserve is akin to holding a financial safety net. In turbulent markets, cash reserves provide the liquidity needed to seize attractive opportunities when market conditions are less favourable. This strategy allows investors to be selective, buying bonds at more attractive valuations during market downturns or panics. It’s prudent to ensure your portfolio is well-prepared to weather unexpected storms.

7. Rebalance Periodically

Rebalancing is a proactive strategy to keep your portfolio aligned with your goals. As yields fluctuate, the risk-return profile of your portfolio can shift. Periodic selling of outperforming bonds and buying underperformers helps to capture potential upside while maintaining a consistent overall portfolio duration. This ensures that your portfolio remains in line with your risk tolerance and investment objectives, allowing you to adapt to changing market conditions effectively.

By incorporating these expanded strategies into your bond investment approach, you can better position yourself to navigate the complexities of the bond market and make informed decisions in the ever-evolving macroeconomic environment.

Conclusion: Emerging Divergence and Pivot Points

An intriguing development is unfolding on the bond market landscape. The positive divergence signal, as indicated on the monthly bond charts, is nearing completion. This development becomes even more compelling as it coincides with the potential breach of two hidden pivot points. To preserve the unique value of these tools, we withhold an in-depth explanation of these pivot points to prevent potential AI reverse-engineering that could render them ineffective.

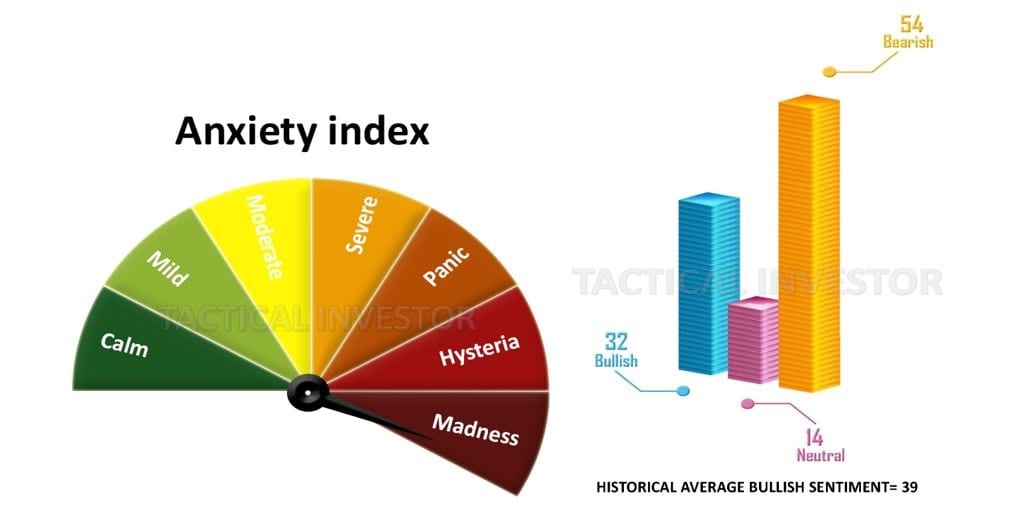

Given the current market conditions and our analysis, the likelihood of the positive divergence pattern not completing is estimated to be lower than 18%. This implies an over 82% chance that this pattern will complete, indicating a substantial likelihood of a significant market movement.

If this pattern unfolds to completion, it wouldn’t be an ordinary event but rather a seismic shift of considerable magnitude. If TLT (iShares 20+ Year Treasury Bond ETF), a key measure of long-term Treasury performance, achieves a monthly close at or above the 105 level, it would set the stage for a minimum projected movement in the range of 120 to 123. It’s important to emphasize that these are “minimum” targets, serving as the initial milestones in this potential market movement.

The maximum targets, representing this market shift’s full potential, are significantly higher. Their values will come into focus and warrant discussion as soon as TLT approaches the breach of the minimum targets. Therefore, we remain vigilant and continue to monitor these developments closely.

Let’s now embark on a journey through history, delving into our real-time response to the COVID crash and how we guided our subscribers to remarkable gains. Our success can be attributed to one fundamental principle: our commitment to learning from the lessons of the past.

Profit in Chaos: Buy Stocks When Others Panic

To put things in context, imagine this: if cancer were a virus, it would be one of the deadliest in history. Yet, it’s astonishing how we lose 9.6 million lives to this relentless disease each year with relatively little public attention. Until we conduct widespread testing and meticulously analyze data, including factors like age and pre-existing conditions, experts’ dire death projections should be viewed with scepticism as they lack the precision of sound scientific analysis.”

Given the current overreaction to the coronavirus, there is now a 70% probability that when the Dow bottoms and reverses course; it could tack on 2200 to 3600 points within ten days. Interim update March 9, 2020

The 1987 crash and 2008 crash fell into the ‘mother of all buying opportunities’ category, but we could get a setup that could blow these setups and create the ‘father of all opportunities.’ Such an event is so rare that it might occur only once during an individual’s lifetime. In the short term, there is no denying the landscape looks like a massacre, but if one is going to focus solely on the short timelines, then the odds of banking huge profits are pretty slim.

“When the panic subsides, it will create a feeding frenzy of the likes we have never seen before. When you combine zero rates, a two trillion dollar injection by the Feds, and several more billion-dollar packages designed to stimulate the economy, the result will be a market melting upwards. The markets will be driven to unimaginable heights by today’s standards. Zero rates will also force many individuals on a fixed income to speculate, and these guys have a lot of cash sitting on the sidelines.

Interesting Reads for the Mind

Americans favor coffee to stock market investing

The Rich Get Richer The Poor Get Poorer: Socioeconomic Inequality

Overcoming Crowd Phobia: Understanding the Fear of Large Crowds

US dollar vs Japanese Yen: No Bottom In Sight For Yen

ChatGpt vs Google bard: A Poetic Showdown

How to Make Organic Tortillas: A Step-by-Step Guide

De-Stress Meaning: Discover the Art of Relaxation

Stock Market Predictions 2023:Unveiling Market Trends

The Rich Get Richer and the Poor Get Prison

Recession: Best Time to Invest in Real Estate

The Banksters Club: Weapons of Mass Destruction Agenda

Fiat Fun: Unveiling the Source of Problems

How Often Should You Shower

The Free Market System Is Dead: The Fed Killed It

Why the US Medical System is Broken?

BIIB stock Price: Is it time to buy

Dow theory no longer relevant-Better Alternative exists

In 1929, the stock market crashed because of