Updated June 2023

Stock Market Predictions 2023

Market crashes are associated with Panic and Fear

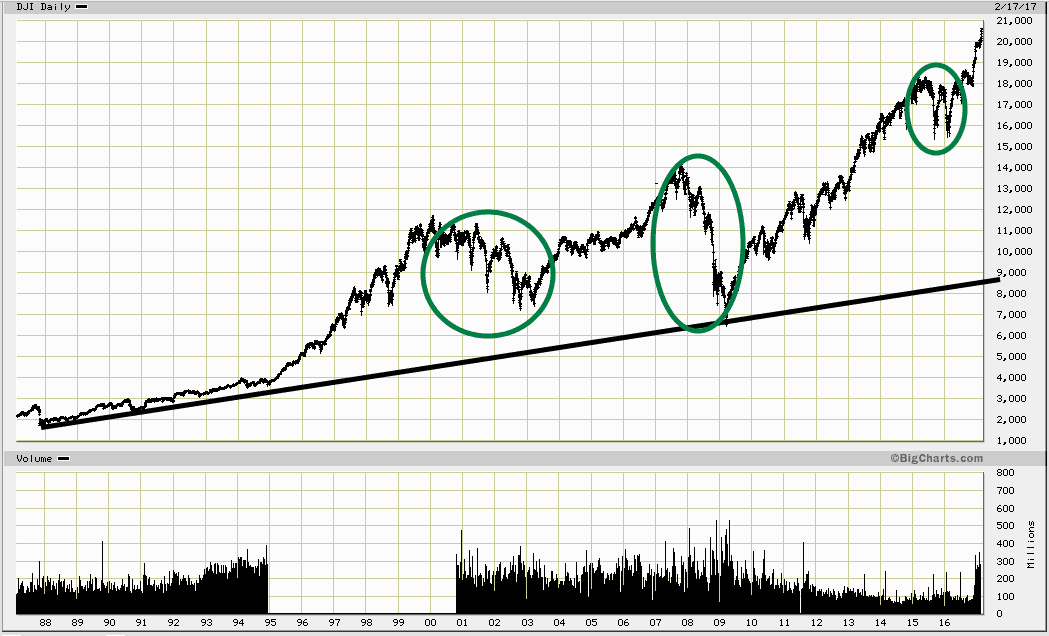

While market volatility can be unsettling, maintaining a calm and rational perspective is vital to long-term success as an investor. As the Dow Jones Industrial Average shows, short-term downturns often present opportunities for those willing to buy during periods of pessimism. Experience demonstrates that the best time to invest is usually when others are most worried. A contrarian mindset allows an investor to go against the crowd and seize opportunities that mass sentiment may overlook.

While collaboration has its place, the stock market ultimately rewards those who can think independently. There is room for many successful investors if each focuses on doing their research and making their assessments rather than following the herd or any particular guru. Staying informed yet thinking for oneself helps ensure decisions are grounded in facts rather than swayed by emotions or popular opinion. With patience and discipline, individual investors can achieve their financial goals over time by making choices suited to their unique situation.

Stock market predictions are a faulty science at best; focussing on the trend is the best option.

Experts Exploit Panic and Euphoria for Faulty Stock Market Predictions

As we have consistently emphasized, panicking is an unwise choice that disregards the lessons of history and leads to unnecessary losses. The same principle applies to euphoria. It is crucial to recognize that the market operates in three distinct phases: a time to buy, a time to sell (closing positions), and a time to hold cash (which can also be a position). For more aggressive traders, a time to short the markets.

Determining which phase the market is currently in requires practice and an understanding of mass psychology. While pinpointing exact dates may not be possible, having a general sense of the market’s stage is valuable. It is essential to acknowledge that fear is an unproductive emotion. Merely paying lip service to this idea is insufficient; one must confront fear head-on and dismiss it as an irrelevant distraction. Consequently, it is wise to approach stock market predictions with scepticism, as even experts frequently change their opinions, much like a chameleon changes its colour.

Amidst Crisis, Invest in Quality Stocks and Disregard Stock Market Predictions

In general, when blood is in the streets (or markets crash) it is time to buy; you will not get in at the bottom, but in the long run, you will walk away with huge gains. When the masses are euphoric, is it time to go into cash if you are conservative? If you are going to short the markets, then you need to improve your understanding of Mass Psychology and trend analysis.

The above chart illustrates that as long as Fiat is in play, all market crashes can be viewed as buying opportunities from a long-term perspective. In future updates (maybe the next one), we will zoom in and look at specific periods more closely.

Reflections on Stock Market Crashes, Panic, and Investment Strategies

In today’s interconnected world, it is essential to recognize that free market forces no longer operate independently. Manipulation permeates various aspects of our lives, from the food we consume to the information we receive. Understanding this reality empowers us to plan and adapt accordingly. The first step towards finding solutions is identifying the problem, which accounts for over 80% of the overall solution. Unfortunately, many individuals struggle because they lack a comprehensive understanding of the underlying issues.

This is precisely why our website stands out among the rest, as we cover a wide range of seemingly unrelated topics that are, in fact, intricately intertwined. By delving into subjects such as mass psychology, we equip ourselves with a powerful tool to discern the abnormal levels of manipulation to which the masses are subjected. Familiarizing yourself with concepts like ” Plato’s allegory of the cave.” can provide valuable insights into the nature of perception and reality.

Expanding our knowledge and embracing a holistic perspective allows us to navigate the complex web of influences that shape our world. This awareness enables us to make more informed decisions and take proactive steps towards achieving our financial goals.

Stock Market Predictions 2023 and the Influence of Mass Psychology

We teach how to use Mass psychology to your advantage, view disasters as opportunities, and not let the media manipulate you and direct you towards actions that could harm your overall well-being. Visit our website’s Investing for Dummies section; it contains many free resources and covers the most important aspects of mass psychology.

Secondly, subscribe to our free newsletter to keep abreast of the latest developments. Change begins now and not tomorrow, for tomorrow never comes. Understand that nothing will change if you do not change your perspective or mindset. If you cling to the mass mentality, the top players will continue to fleece you; the choice is yours: resist and break free or sit down and do nothing.

Stock Market Predictions: Feb 27, 2020 Update

It is a tragic reality that lives are lost every second worldwide. The global death toll continues to rise, with approximately 78,000 lives lost today alone, and this number will likely surpass 80,000 by the time you receive this update. So far this year, the number of deaths has reached 9.5 million and continues to increase relentlessly. Death can be seen as a pandemic in its own right, yet it often goes unnoticed amidst other pressing issues. For instance, smoking-related and cancer-related deaths are alarmingly high, with an estimated 16.6 million deaths expected this year (9.6 million from cancer and over 7 million from smoking).

In the current situation, it is worth noting that approximately 2,860 deaths have been attributed to the coronavirus. While we do not wish to downplay the seriousness of this situation, it is striking how much attention is focused on this particular cause of death compared to others. It is interesting that globally, there are twice as many new births as there are deaths. You can refer to the source provided for real-time data on world deaths, birth rates, coronavirus deaths, and more. http://bit.ly/32wVaQA

It is disheartening to observe that even individuals whom we once believed to be rational thinkers are now contributing to the dissemination of information with a singular objective: to incite panic and create a sense of urgency. Regrettably, they have succeeded in their efforts, as the masses tend to succumb to such tactics repeatedly. Once doubt is planted, the collective mindset resists objectively analyzing the available data. Eventually, this leads to a breakdown in rationality, and people begin to entertain far-fetched scenarios that may lack a solid foundation in reality.

Backbreaking corrections are mistaken for crashes

There is invariably at least one backbreaking correction that occurs before the conclusion of a bull market, and this particular bull market stands out due to its unusually prolonged duration. This market will probably undergo two such events before reaching its natural end. The ongoing correction could potentially fall into the category of a backbreaking correction.

Backbreaking corrections are always arduous and painful, hence the term “backbreaking.” However, unlike in the past, it has become increasingly challenging to determine which correction will ultimately prove to be the backbreaking one. Over the past decade, the market has repeatedly deceived bearish investors who attempted to short it. Astonishingly, around 90% of these short positions resulted in substantial losses as the market swiftly reversed course. Even if one manages to achieve a significant gain on a single trade, it is unlikely to offset the losses incurred by the majority of bearish investors. Furthermore, it is doubtful that most bears had the fortitude to remain steadfast until their bets paid off.

The markets are now predominantly influenced by automated trading systems or machines. These machines are programmed to initiate selling when specific price targets are reached, triggering a chain reaction of further selling until the cycle concludes. It is important to note that humans program the machines. The key distinction today is that instead of humans manually executing sell orders, machines are executing these actions.

Ultimately, the bull market will come to an end, and historical patterns suggest that bull markets typically conclude on a note of certainty rather than uncertainty. However, it is crucial to bear in mind the significant role played by automated trading systems and the human programming behind them in shaping market dynamics.

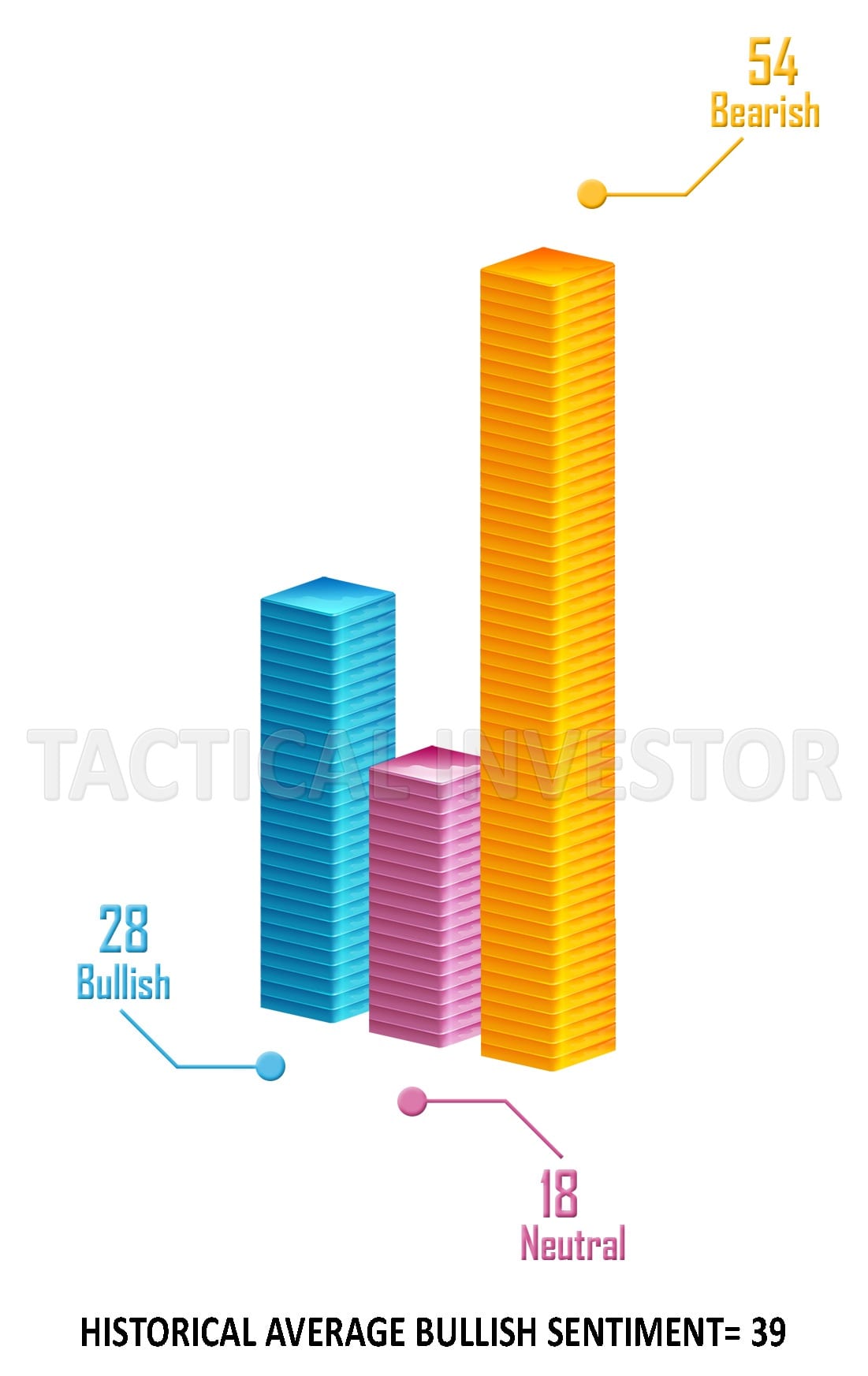

Given that the masses are not currently experiencing euphoria, it is important to recognize that strong pullbacks and so-called crashes should be viewed as opportunities rather than causes for concern. In fact, the greater the deviation from the norm, the more favourable the opportunity becomes. Embracing these market fluctuations can lead to advantageous positions and potential gains. By maintaining a level-headed approach and recognizing the potential for significant deviations, investors can position themselves to capitalize on these opportunities.

Stock Market Outlook Update July 2020

In the current market environment, it is evident that the markets tend to rally on bad news and experience significant surges when even the slightest glimmer of hope emerges. This phenomenon has created a market characterized by disorder, where traditional patterns and order seem to be disrupted. However, despite the initial concerns this may raise, it can actually be seen as a positive long-term development. The unpredictability of this market keeps everyone guessing about its future direction, which can present unique opportunities for astute investors.

Reflecting on the so-called “end of the world” crash from March to April 2020, it is worth considering how one navigated through that challenging period. At the Tactical Investor, we consistently cautioned our subscribers that this crisis was manufactured and that the markets would eventually recover. Looking back, it is evident that our perspective has proven accurate. The Dow is now only a few thousand points away from challenging its previous highs, while the Nasdaq has already reached new record levels. It serves as a reminder that the crowd often loses in such situations.

Therefore, it is essential to remember this lesson when experts predict market crashes and doom. More often than not, these predictions prove to be unfounded, and the egos of these dubious experts go up in smoke rather than the markets themselves. Investors can position themselves for long-term success in this dynamic market environment by maintaining a discerning approach and not succumbing to fear-driven narratives.

Unveiling Stock Market Success Strategy

- Comprehend the Influence of Mass Psychology: Gain an edge by understanding the collective sentiment that propels market behaviour. Grasp insights into prevailing majority perspectives.

- Adopt Contrarian Investing: Embrace a unique standpoint and capitalize on opportunities others avoid. Learn to spot undervalued assets poised for potential growth.

- Foresee Emerging Trends: Maintain a lead by identifying sectors on the verge of breakthroughs. Identify emerging trends prior to their widespread adoption.

- Identify Promising Stocks: Uncover the technique for recognizing resilient stocks within these promising sectors. Unearth the criteria that set the winners apart from the rest.

- Master the Essentials of Technical Analysis (TA): Elevate your decision-making process with technical indicators. Fine-tune your entry and exit points using the potent tool of TA.

Success in investing does not come with a one-size-fits-all solution. The sole guarantee for success lies in focusing on the long term. In the short term, losing money is simple because emotions take over while money makes its exit – slipping away from your grasp. Therefore, concentrate on the verifiable facts of the prevailing trend and silence the noise. Over the long term, it’s nearly impossible to falter if your attention remains on sound companies.

Originally published on February 25, 2017, this content has undergone multiple updates, with the most recent revision completed in June 2023.