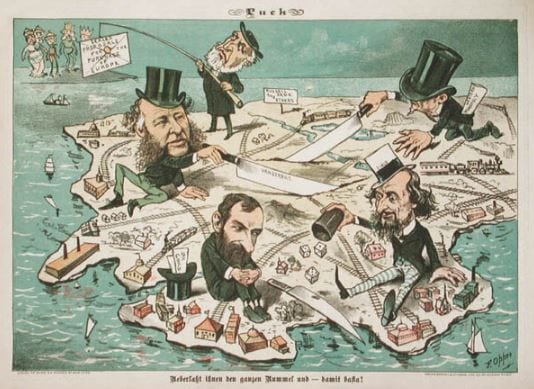

The Banksters Band: Preying on the Poor, Fueling the Wealth of the Rich

While some may argue that the Federal Reserve is vital in stabilizing the economy, others contend that its policies perpetuate economic inequality and subjugation. These critics point to the centralized control of the money supply and the opaque decision-making process of the Fed, which can lead to market manipulation and financial crises.

Furthermore, the Fed’s reliance on debt-based currency and fractional reserve banking creates a never-ending cycle of debt and inflation that disproportionately impacts lower-income individuals and small businesses. Despite these concerns, many continue to defend the Fed as a necessary evil in modern finance. However, the question remains: is the Fed genuinely serving the people’s best interests, or is it merely a tool of the elite to maintain their power and wealth at the expense of the masses?”

Must Read: DJI History: Profiting from the Past Market Trends

Banksters Band: Profiting from Poverty, Fueling Inequality

“The few who understand the system will either be so interested in its profits or so dependent on its favours that there will be no opposition from that class.” — Rothschild Brothers of London, 1863

“Give me control of a nation’s money, and I care not who makes its laws.”– Mayer Amschel Bauer Rothschild

“Most Americans have no real understanding of the operation of the international moneylenders. The accounts of the Federal Reserve System have never been audited. It operates outside Congress’s control and manipulates the United States’ credit.” — Sen. Barry Goldwater (Rep. AZ)

“Whoever controls the volume of money in any country is the absolute master of all industry and commerce.” — James A. Garfield, President of the United States

“Banks lend by creating credit. They create the means of payment out of nothing.” — Ralph M. Hawtrey, Secretary of the British Treasury

“To expose a 15 Trillion dollar ripoff of the American people by the stockholders of the 1000 largest corporations over the last 100 years will be a tall order of business.” — Buckminster Fuller

Unmasking the Banksters Band: Exploiting the Underprivileged, Empowering the Affluent

“Every Congressman, every Senator knows precisely what causes inflation, but can’t support the drastic reforms to stop it because it could cost him his job.” — Robert A. Heinlein, Expanded Universe

“It is well that the people of the nation do not understand our banking and monetary system, for if they did, I believe there would be a revolution before tomorrow morning.” — Henry Ford

“The regional Federal Reserve banks are not government agencies. …but are independent, privately-owned and locally controlled corporations.” — Lewis vs. United States, 680 F. 2d 1239 9th Circuit 1982

“We have, in this country, one of the most corrupt institutions the world has ever known. I refer to the Federal Reserve Board. This evil institution has impoverished the people of the United States and has practically bankrupted our government. It has done this through the corrupt practices of the moneyed vultures who control it.” — Congressman Louis T. McFadden in 1932

Article of Interest: Stock Market crashes are opportunities for the Rich to Fleece the Poor

“The Federal Reserve banks are one of the most corrupt institutions the world has ever seen. There is not a man within the sound of my voice who does not know that International bankers run this nation.” — Congressman Louis T. McFadden

“Some [Most] people think the Federal Reserve Banks are the United States government’s institutions. They are not government institutions. They are private credit monopolies which prey upon the people of the United States for the benefit of themselves and their foreign swindlers.” — Congressional Record 12595-12603 — Louis T. McFadden, Chairman of the Committee on Banking and Currency June 10, 1932

” The increase in the assets of the Federal Reserve banks from 143 million dollars in 1913 to 45 billion dollars in 1949 went directly to the private stockholders of the [federal reserve] banks.” — Eustace Mullins

“As soon as Mr Roosevelt took office, the Federal Reserve began to buy government securities at the rate of ten million dollars a week for ten weeks and created one hundred million dollars in new currency, which alleviated the critical famine of money and credit, and the factories started hiring people again.” — Eustace Mullins.

“By this means government may secretly and unobserved, confiscate the wealth of the people, and not one man in a million will detect the theft.” — British Lord John Maynard Keynes (the father of ‘Keynesian Economics’ which our nation now endures) in his book “THE ECONOMIC CONSEQUENCES OF THE PEACE” (1920).

Corporate Monopoly: Controlling Currency and Governing Power

“These 12 corporations together cover the whole country and monopolise and use for private gain every dollar of the public currency…” — Mr Crozier of Cincinnati, before Senate Banking and Currency Committee – 1913

“A great industrial nation is controlled by its system of credit. Our system of credit is concentrated in the hands of a few men. We have come to be one of the worst ruled, one of the most completely controlled and dominated governments in the world– no longer a government of free opinion, no longer a government by conviction and vote of the majority, but a government by the opinion and duress of small groups of dominant men.” — President Woodrow Wilson

“We are completely dependent on commercial banks. Someone has to borrow every dollar we have in circulation, cash or credit. If the banks create ample synthetic money, we are prosperous; if not, we starve. We are absolutely without a permanent money system. It is the most important subject intelligent persons can investigate and reflect upon. It is so important that our present civilisation may collapse unless it becomes widely understood and the defects remedied very soon.” — Robert H. Hamphill, Atlanta Federal Reserve Bank

Random reflections on the AI Mania: June 2023 update

As the world descends into chaos, there is a fervent rush to invest significant resources in AI, driven by the misguided belief that it will save humanity. However, for most people, AI will likely bring their downfall. Instead of discussing all the observed trends at once, we will gradually reveal them in manageable portions. Despite the impending dangers, there is a glimmer of hope: AI will not perceive everyone as a threat.

In the current era, the most effective way to deceive the masses is by instilling paralyzing fear, which has been achieved through the impact of COVID. This is followed by providing them with reasons to celebrate, such as the subsequent post-crash rally. Then, a state of perpetual anxiety is induced, exemplified by the prolonged correction of 2022. Lastly, a double-edged reward is bestowed upon them: the emergence of AI models like ChatGPT, promising vast profits and fueling the current artificial intelligence frenzy.

Unveiling the Hidden Agenda: Manipulating Freedom and Wealth for Mass Deception

Behind the scenes, a calculated plan is unfolding, involving implementing programs and passing laws aimed at systematically stripping the masses of their freedom. At the same time, their hard-earned wealth is being targeted through the creation of an unprecedented bubble that will inevitably burst, surpassing all previous bubbles. Further details about this concerning bubble will be shared in future updates.

The central idea revolves around keeping the masses preoccupied with trivial matters or luring them into envisioning a future of abundant wealth. Meanwhile, actions are taken in plain sight that would typically provoke rebellion if not for the aforementioned factors. For instance, during the Covid crisis, the masses hardly protested against the colossal and wasteful QE program, which saw an astonishing five trillion dollars squandered on frivolous endeavours.

Captivating Article Worthy of Exploration: Decoding the Dow Jones Utility Average

Suggested Strategy

Undeniably, knowledge is power, and one should start by immersing oneself in the history of money. Thereafter, one ought to delve into the intricacies of finance, learn how to spot sturdy companies and employ market psychology to one’s advantage. A simple yet indispensable lesson to remember is never to buy when the masses are beset by euphoria. Likewise, one should avoid selling when the masses are wracked with panic. Instead, buy when the groups are in despair and sell when they are jubilant.

To facilitate your journey towards enlightenment, we have proffered an extensive list of resources on our website. For novice traders, we suggest beginning with this section.

Securing Your Wealth: Navigating the Federal Reserve Challenge and Safeguarding Your Finances

However, it would be folly to launch an attack on the Federal Reserve without comprehending the intricacies of the problem. Even if one were to mount an assault, the best defence is a good offence. The Federal Reserve is too potent an adversary for one person to conquer. Therefore, one’s primary goal, for now, should be to safeguard one’s wealth.

Lastly, consider subscribing to our free newsletter, which will equip you with the tools to master the information indispensable to protect your financial well-being. Remember, in these uncertain times, those who are prudent with their investments shall emerge victorious.

FAQ – The Banksters Band: Preying on the Poor, Fueling the Wealth of the Rich

Q: What is the Federal Reserve, and why is it controversial?

A: The Federal Reserve is a central banking system in the United States. It is controversial because some believe its policies perpetuate economic inequality and subjugation, citing centralized control of the money supply, opaque decision-making processes, market manipulation, and financial crises.

Q: How does the Federal Reserve impact lower-income individuals and small businesses?

A: Critics argue that the Fed’s reliance on debt-based currency and fractional reserve banking creates a never-ending debt and inflation cycle, disproportionately affecting lower-income individuals and small businesses.

Q: Is the Federal Reserve serving the best interests of the people?

A: The question of whether the Fed genuinely serves the people’s best interests or functions as a tool of the elite to maintain power and wealth at the expense of the masses is a matter of ongoing debate.

Q: What are some historical quotes highlighting concerns about the Federal Reserve?

A: Some notable quotes include the Rothschild Brothers’ statement about control of a nation’s money, Barry Goldwater’s remark about the Fed’s unaccountability, and President James A. Garfield’s assertion about the control of money leading to mastery over industry and commerce.

Q: Are the Federal Reserve banks independent institutions?

A: Yes, the regional Federal Reserve banks are independent, privately owned, and locally controlled corporations, according to the ruling in the Lewis vs. United States case.

Q: What criticisms have been made against the Federal Reserve?

A: Congressman Louis T. McFadden famously criticized the Federal Reserve Board, accusing it of corrupt practices, impoverishing the American people, and bankrupting the government. Other critics have raised concerns about the lack of audits, credit manipulation, and serving international bankers’ interests.

Q: How do stock market crashes relate to the wealth gap?

A: Some argue that stock market crashes provide opportunities for the rich to exploit the poor, further widening the wealth gap.

Q: How can individuals navigate the challenges posed by the Federal Reserve?

A: It is suggested that individuals start by educating themselves about the history of money and finance, learning to spot sturdy companies, and understanding market psychology. It is also advised to be cautious in buying during euphoria and selling during panic. Safeguarding one’s wealth is considered important, and resources are available on the website for further guidance.

Q: Can one person successfully challenge the Federal Reserve?

A: The Federal Reserve is seen as a powerful adversary, and it may be challenging for one person to conquer it. The focus should be on safeguarding one’s wealth rather than launching a direct attack.

Q: How can individuals protect their financial well-being in uncertain times?

A: It is recommended to stay informed by subscribing to a free newsletter that provides tools and information for protecting financial well-being. Prudent investment strategies are emphasized for success in uncertain times.

Originally published on August 28, 2020, this article has been continuously updated, with the most recent update in June 2023.

Other Related Articles:

Muslim outrage over meme

Wilders found Guilty of speaking out against Islam-WTF

Saudi Support Extremism in Germany

Where is Islam Illegal-Growing list of nations banning Islam

Slovakia Toughens Church Registration Rules to Bar Islam

Sexual Morality: Sextortion Is The New Con Game In Town

Chinas UnionPay surpasses Visa-become worlds biggest credit card firm

Bull Flag Pattern: Forget Patterns & Buy Strong Dips

New Turkish Bill Seeks To Expand President Erdogan’s Powers

Donald Trump Stock Market Trends and Outlook

Gold Price Prediction: Up Or Down

Bull flag Stocks: Expect To Find Many As Trump Bull Set To Go Ballistic

Religious war: The Pretext to destroy currencies on Global basis

Uncovering the Influence of Drug Company Payments on Healthcare

Central Banks Prime Directive-Rob the Poor to Pay the Rich

Investment Pyramid: Valuable Concept Or? (Sept 2)

Successful Investing; Never Follow the Crowd (Sep2)

Define Fiat Money: The USD Is A Great Example (Aug 13)

Deflation Economics: The Art of Twisting Data (Aug 12)

BTC vs Gold: The Clear Winner Is … (Aug 11)

Cash is king during Coronavirus Pandemic Based Sell off (Aug 10)

Russell 2000: Great Buy Signal In the Making (Aug 9)