Bull flag Stocks: Stocks Will Perform Very Well Going Forward

The markets have reacted to Trump’s win in a positive light; as markets are forward-looking beasts the powerful rally illustrates that they at least view the Trump administration under a favourable light.

Trump’s decision to knock off two rules on the book for every rule created should contribute to creating a more friendly business environment. Many sectors will perform well under Trump, and we think Energy, Transportation and Banks will be among the top performers. All these sectors are already experiencing healthy gains; the banking sector could soar significantly higher as Trump will most likely gut Dodd-Frank Act. This will pave the way for banks to speculate and that will provide more a lot of fuel for one of the most hated bull stock markets in history.

This Bull Market is destined to last for years as it’s going to be fulled by lower interest will lead to a massive surge in the supply of hot money.

Bull flag Stocks: The Game Plan

In a previous article, we made the following comments and these comments still hold true.

From a contrarian angle (and not a political point of view) a Trump win could be construed as a positive development; non-contrarians will demand to know why? Mass Psychology clearly states that the masses are always on the wrong side of the equation. A Trump win will create uncertainty, and the lemmings will flee for the exits; markets will pull back sharply and viola the same old cycle will come into play. The cycle of selling based on fear which equates to opportunity for those who refuse to allow their emotions to do the talking. Tactical Investor

In general, we have stated for the past few years that as long as the trend is up, all substantial pullbacks should be viewed as buying opportunities.

Other random thoughts

We explore various topics that on the surface might appear to be unrelated but in reality they are all interconnected; Free market forces ceased to exist after 2008; the markets were never free, but any remnants of freedom vanished after the Fed decided to prop the markets indefinitely by forcefully maintaining an ultra-low rate interest rate environment. All the information today is manipulated; from the food, you eat to data you are provided. If you are aware of this, you can plan accordingly.

Identifying the problem is over 80% of the solution, and this is why most people do not know what to do because they do not understand the problem. Now you know why we are the only financial website that covers such a wide array of topics that on the surface appear to be unrelated but are in fact, deeply interwoven. Mass psychology is a very powerful tool, and if employed correctly can help you spot the abnormal levels of manipulation, the masses are subjected to. We strongly recommend that you take a look at Plato’s allegory of the cave.

Tactical Investor Update Aug 2019

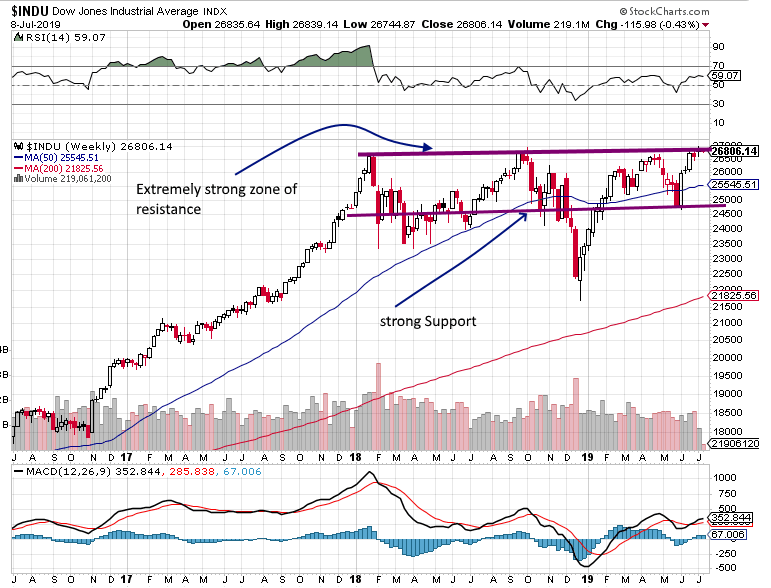

The Dow has tried to trade above 26,800-27,000 ranges almost 19 months. Furthermore, these attacks have been widely spaced out. Hence, the Dow is now at an inflexion point”; it either blasts above 27,000 and in doing so former resistance turns into strong support.

Alternatively, if it fails to hold above 27K (after trading above it) the pullback could range from medium to strong. A medium pullback would end in the 25,500-25,800 ranges. A strong pullback could take the Dow all the way down to 24,5K (plus or minus 200 points).

In the short term, we expect the markets to be very volatile, however, the long term trend is intact. Hence all strong pullback should be embraced.

Other stories of Interest

Religious wars being used as a pretext to destroy currencies on Global basis (Dec 7)

Central Banks Prime Directive-Rob the Poor to Pay the Rich (Dec 5)

Brexit on Steroids-Trump Wins Triggers Massive Stock Market Rally (Nov 29)

Unaffordable Obamacare-50 per cent cannot afford over 100 per month (Nov 19)

China factory activity at 22-month high & High Tensions in Libya (Nov 15)

Sofia the Humanoid Robot That Looks and Talks Like a Human (Nov 12)

CNBC Tears Down Elon Musk’s Snarky Response To A Coal CEO (Oct 21)

Freedom & Independence-almost extinct & forgotten concepts (Sept 23)

Observer or Participator determines your outcome (Sept 23)

Classic Article Clipping Coinage; prelude to Fiat & Central Bank Abuse (Sept 21)

Gold 25K plus-experts making those predictions will be dead before Gold hits those targets (Sept 20)

Mass Media Busted; Britain faring better After Brexit (Sept 5)

Listening to Main Stream Media guarantees Stock Market Losses (Sept 3)

Psychological & Economic Deception Wall Street’s Weapon of Choice (Sept 1)

Brexit Success: Manufacturing Activity Surges to 25 year high (Sept 1)

China’s new 2.8 Billion Chip Maker will shake up Global Semiconductor Industry (Aug 30)

Stupid Hedge Funds Panic & Dump Apple & Netflix; buy baby buy (Aug 30)

Foolish Deutsche bank states stock market crash needed to fix Economy (Aug 30)

You should love most hated Stock Market Bull In History (Aug 29)