Successful Investing: Harness the Power of Trends for Unmatched Results

Success in the stock market requires a delicate balance of emotional control and utilizing emotions to your advantage. On one hand, it is important to have control over your emotions and avoid getting caught up in market euphoria or panic. This can be achieved through self-observation and education by reading the right books. On the other hand, emotions can play a key role in successful investing and offer valuable insights into your biases and decision-making process.

What is the biggest tragedy in one’s life? Your death. Yet no one obsesses over it. The contemplation of death and stock market crashes serves to illustrate the significance of maintaining a long-term perspective in investment. While death is an inevitable fact of life that most individuals do not dwell on constantly, the same level of acceptance is often not extended to stock market crashes. This disparity is intriguing and highlights the importance of adopting a more level-headed approach to investing. By accepting that crashes are a natural part of the market cycle and focusing on long-term goals, investors can better navigate market fluctuations and avoid succumbing to short-term emotions.

Investors accept death as inevitable but they cannot apply the same logic to stock market crashes preventing them from profiting from these rare events. The only difference is that death is permanent while crashes are temporary in nature. Sol Palha

By embracing the emotional side of investing and combining it with rational analysis, you can tap into the full range of information available to make informed investment decisions. By balancing emotional control with emotional intelligence, you can put yourself in a better position for long-term success in the markets.

Visionary Investing: Navigating Volatility for Unfathomable Succes

Market crashes are an inevitable part of the stock market and should be viewed as an opportunity for growth and recovery. While the masses tend to focus on the potential for the market to trend downwards, leading them to miss out on opportunities, a long-term perspective and disciplined investment strategy can better navigate market fluctuations and avoid succumbing to emotional responses. In addition, incorporating a comprehensive understanding of market cycles and historical trends can provide valuable insights and inform informed investment decisions.

It’s crucial to understand that market crashes are only temporary and followed by a recovery phase that is often more robust and profitable than the crash itself. By adopting a more logical and informed approach to investing, combining a long-term perspective, an understanding of market cycles, and a disciplined investment strategy, investors can better navigate market crashes and capitalize on the inevitable recovery phase. In conclusion, the stock market is a dynamic and ever-changing entity that requires a combination of emotional control, discipline, and education to be successful

The masses promise never to succumb to fear, but when the market crashes, herd instinct takes over and they repeat the same thing over again. The sad part is that while they will make the same promise again, they will react in the same manner the next time the market pullback. Sol Palha

Pandemic Prosperity: Capitalize on COVID Opportunities

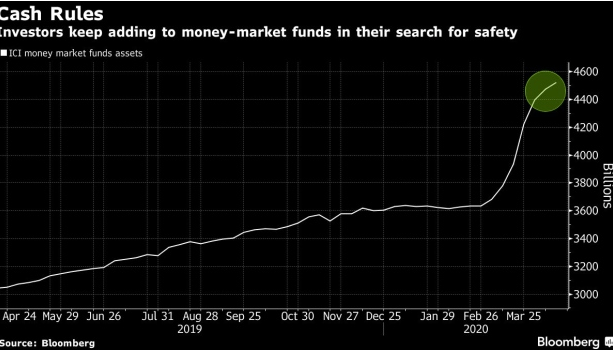

Weekly flow data from Bank of America Corp. and EPFR Global continue to show a clear investor preference for money-market funds. Assets under management in this category have swelled to $4.5 trillion following seven weeks of inflows that added $877 billion to the cash pile. Bloomberg

Contrarian Investing: Capitalizing on Market Mood Swings for Success

The masses’ tendency to hoard cash during market fluctuations provides a unique opportunity for the contrarian investor to take advantage of the ensuing buying frenzy when these individuals eventually enter the market.

Thank goodness for the mass mindset for as they seek safety, we will do the opposite and keep buying. These brilliant minds are holding 4.5 trillion in cash, what a feeding frenzy this will create when these enlightened (us being sarcastic) individuals finally realise it’s time to jump in. Market Update May 2, 2020

Investors in China poured more than $141 billion into domestic money-market mutual funds in the first quarter, bringing the sector’s total assets under management near a record high. https://yhoo.it/3bTuu0y

The same phenomenon is occurring in China, indicating that distance is not a limiting factor when dealing with the mass mindset. The more the crowd derides this market, the happier you should be.

The clueless Masses

Shortly after this stampede, the markets bottomed. Mass psychology in real-time. We hope your chaps kept a trading journal as suggested, for this crash will be remembered as one of the biggest B.S. crashes of all time. Or if we put it in terms of Aesop’s fables. This is a turbocharged version of the boy that cried wolf one too many times. Market Update May 2, 2020

The masses are totally clueless, they panic when they should not and when they should panic, they buy like there is no tomorrow. The herd is flocking into money market funds just when they should be buying everything in sight. Sol Palha

Investment behaviour is a complex and multifaceted phenomenon that has been the subject of extensive research and analysis in the fields of finance, economics, and psychology. Despite the availability of information and resources, the masses are often prone to making mistakes in their investment decisions, often due to a lack of understanding, emotional biases, and herding behaviour.

The crowd is always wrong

However, as the old adage goes, “the crowd is often wrong.” While the masses are busy following conventional wisdom and making investment decisions based on emotions and herding behaviour, there is an opportunity for contrarian investors to exploit these biases and achieve out-of-the-box success.

Contrarian investors adopt a forward-looking perspective and focus on fundamentals, rather than following the crowd and succumbing to emotional biases. By going against the herd, contrarian investors can identify undervalued assets that have the potential for long-term growth, and capitalize on market inefficiencies created by the masses’ irrational behaviour.

Moreover, contrarian investors often have a high tolerance for risk, as they are comfortable navigating market turbulence and taking advantage of short-term volatility. This approach requires a strong understanding of market dynamics, as well as a long-term perspective and an unwavering commitment to one’s investment strategy.

While the masses are prone to making mistakes in their investment decisions, contrarian investors have the opportunity to take advantage of these biases and achieve out-of-the-box success by adopting a forward-looking perspective, focusing on fundamentals, and having a high tolerance for risk.

Conclusion

The stock market is a dynamic and ever-changing entity that requires a level of emotional control and discipline to be successful. By combining a long-term perspective, an understanding of market cycles, and a disciplined investment strategy, investors can better navigate market crashes and capitalize on the inevitable recovery phase. Embracing a more academic and informed approach to investing can potentially lead to greater success in the stock market.

Other Articles of Interest

Investment Pyramid: Valuable Concept Or ?

Market Timing Strategies: All fluff or?

Strong Buy Stocks: Focus on The Trend & Not the Fear Factor

Dow Jones Industrial Average Index Set To Defy Naysayers

Smart Money Acting Like Dumb Money

Market Crash 2020 Or Is This A Manufactured Crisis?

Dollar Strength Or Dollar Crash

The Angry Mob & The New Polarised World

Social Unrest And The US Dollar

Stock Buying Opportunity Courtesy Of Coronavirus

Market Trends: Focus on Fact And Not Fiction

Insider Buying And The Coronavirus Pandemic

Market Correction 2020; Long-Term Trend Still Intact

Stock Trends & The Corona Virus Factor