Black Monday Crash: Separating Hype from Reality

Updated Sept 2023

The infamous Black Monday crash of 1987 significantly impacted financial history. However, it’s important to note that today’s landscape is different. While there have been subsequent market downturns, such as the dot-com bust, the financial crisis of 2008, and the COVID crash, it’s crucial not to rely solely on the predictions of naysayers and self-proclaimed experts.

If individuals had blindly followed the advice of these so-called experts over the years, they would likely have faced multiple bankruptcies. It’s time to tune out the constant “death to the markets” song that some individuals have played for decades. One such example is Marc, who remains adamant that the market will crash, echoing sentiments he voiced back in 2016 when he predicted a Stock Market Crash in 2017. However, history has shown that the market’s resilience often surprises.

While a stock market crash could happen someday, it’s essential to recognize that today is not that day. Such an event may be a long way off. Astute investors should focus on the prevailing trend, just as they did during the Black Monday crash of 1987, rather than getting caught up in constant predictions of impending doom.

Navigating Contrarian Waters: Avoiding the Herd Mentality

In today’s financial landscape, it’s a familiar story—media headlines herald impending doom, backed by well-paid financial pundits ready to say anything for a price. This narrative may briefly rattle the markets, but it’s all part of the game. For astute investors, it presents a chance to snag well-managed companies at significant discounts.

History shows that markets have a knack for bouncing back from these episodes. While some might point to Japan’s long recovery, it’s crucial to recognize we’re now in the era of currency devaluation. Every nation seems eager to debase its currency, driven by economic pressures. In this environment, the usual rules don’t apply, and central banks often respond by injecting money into the markets.

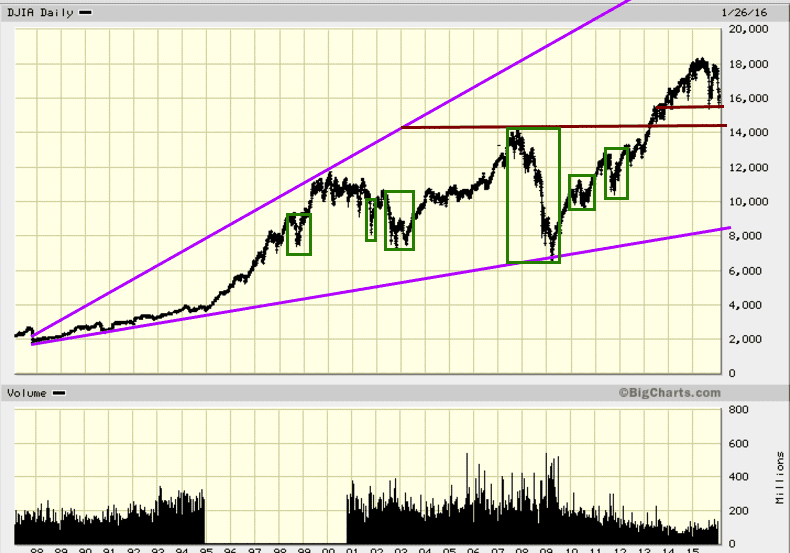

Amidst these uncertainties, a glance at the long-term Dow chart reveals a consistent pattern—every so-called disaster was, in reality, a buying opportunity. The lesson? Don’t follow the herd; trust in the resilience of well-run companies and the market’s ability to rebound.

Crashes as Opportunities: Black Monday and Beyond

Our investment strategy is straightforward: never buy at the peak. Instead, we adhere to a simple rule – buy during panic and sell when euphoria reigns. Will anything change this year or in the future? Unlikely. Masses tend to panic when they should buy and become euphoric when they should sell.

As our Volatility Indicator reaches record levels, we anticipate increased market volatility. But here’s the key: This should be seen as a positive sign, as the trend is upward. Market crashes, including the infamous Black Monday, equate to buying opportunities for those who follow this contrarian approach.

Market volatility is a two-way street, characterized by significant price swings in both directions. Considering the upward trajectory of the markets over the past seven years, the current correction, while robust, is not a cause for panic.

Unravelling the Enigma of Mass Psychology in Financial Markets

Mastering the principles of mass psychology can be a daunting task, as it challenges conventional financial wisdom, much of which could be considered obsolete. In the financial realm, there is only one absolute law – there are no laws. Emotions reign supreme, and when emotions surge, chaos often follows. This explains why the masses tend to panic during market sell-offs and flock to investments right before a bubble bursts, a pattern that has persisted for centuries since the Tulip bubble.

We’ve distilled the essence of successful investing to one crucial aspect: identifying market trends. Ask any seasoned investor about the most challenging part of investing, and they’ll likely tell you that determining the trend tops the list. It’s a complex process that involves analyzing numerous factors, synthesizing data from various sources, and blending them to discern the prevailing market trend.

Embracing the Trend: Your Investing Companion

Once you’ve identified the trend, the remaining steps in the investing process become comparatively straightforward. We offer a multitude of investment opportunities for a simple reason – to cater to a wide range of traders. Transitioning from old beliefs to embracing new ideas can be challenging and time-consuming. To facilitate this process, we provide a diverse selection of plays. Instead of feeling overwhelmed by the sheer number of options, remember that you don’t need to open positions in all of them. Select those that resonate with you, and disregard the others until you become comfortable with our methodology. As your confidence grows, you can allocate larger amounts of capital accordingly.

Mastering Black Monday: Sell-Off Strategies with Psychology & Contrarian Wisdom

In the ever-changing landscape of investments, the spectre of a “Black Monday Crash” can sow seeds of doubt and anxiety in investors’ minds. However, it’s crucial to realize that amid the tumultuous waves of market sell-offs, hidden treasures of lucrative opportunities often await those with the courage to seize them. This article delves into the intricacies of navigating stock market sell-offs, shedding light on why they need not be feared. With a long-term perspective and insights from mass psychology and contrarian investing, investors can transform these apparent challenges into financial growth and success catalysts.

Contrarian investing strategies are valuable, but the true power lies in the timeless concept of mass psychology. Instead of immediately opposing the crowd’s sentiment, a prudent approach involves understanding and leveraging the emotional dynamics of the market. When the masses enthusiastically embrace an investment, a savvy investor may join them, even increasing their stake in that sector. They patiently await the moment when euphoria reigns supreme before considering an exit.

Conversely, when a sector falls out of favour, a student of mass psychology exercises patience. They wait for fear levels to skyrocket before gradually acquiring shares. Fear takes time to recede, and the crowd’s tendency to overreact can lead to missed opportunities. Therefore, reserving some firepower for enticing moments is a prudent strategy.

Embracing the principles of mass psychology and contrarian investing empowers investors to navigate the tempestuous waters of a potential Black Monday Crash with confidence, turning market volatility into a strategic advantage.

Other related stories

Market Update Tactical Investor Past Calls: The Trend Is Your Friend

Dow Jones Industrial Average Stocks Soar Slaughtering the Bears

Gold buying Spree Russia & Russian Strength?

China’s corruption crackdown targets both big & small officials

China Corruption: Fast & Furious crackdown

The Big Picture: Lower oil & energy prices

Crude oil price projections: will oil prices stabilize

The Middle Class Squeeze: 4.00 in 1973 equates to 22.41 today

Syria War News: It Is All About Blood, Guns & Money

For Many Americans Great Recession Never Ended

Is VIX pointing to a stock market crash in 2016?

Belt & Road Initiative: Taking China’s culture beyond borders

EU stands to benefit by Granting China free market status

China cuts rates to boost green energy demand

China showcases its culture to the World