Black Monday Crash: Separating Hype from Reality

Updated April 30, 2024

The infamous Black Monday crash of 1987 significantly impacted financial history. However, it’s important to note that today’s landscape is different. While there have been subsequent market downturns, such as the dot-com bust, the financial crisis of 2008, and the COVID crash, it’s crucial not to rely solely on the predictions of naysayers and self-proclaimed experts.

If individuals had blindly followed the advice of these so-called experts over the years, they would likely have faced multiple bankruptcies. It’s time to tune out the constant “death to the markets” song that some individuals have played for decades. One such example is Marc, who remains adamant that the market will crash, echoing sentiments he voiced back in 2016 when he predicted a Stock Market Crash in 2017. However, history has shown that the market’s resilience often surprises.

While a stock market crash could happen someday, it’s essential to recognize that today is not that day. Such an event may be a long way off. Astute investors should focus on the prevailing trend, just as they did during the Black Monday crash of 1987, rather than getting caught up in constant predictions of impending doom.

Navigating Contrarian Waters: Avoiding the Herd Mentality

In today’s financial landscape, it’s a familiar story—media headlines herald impending doom, backed by well-paid financial pundits ready to say anything for a price. This narrative may briefly rattle the markets, but it’s all part of the game. For astute investors, it presents a chance to snag well-managed companies at significant discounts.

History shows that markets have a knack for bouncing back from these episodes. While some might point to Japan’s long recovery, it’s crucial to recognize we’re now in the era of currency devaluation. Every nation seems eager to debase its currency, driven by economic pressures. In this environment, the usual rules don’t apply, and central banks often respond by injecting money into the markets.

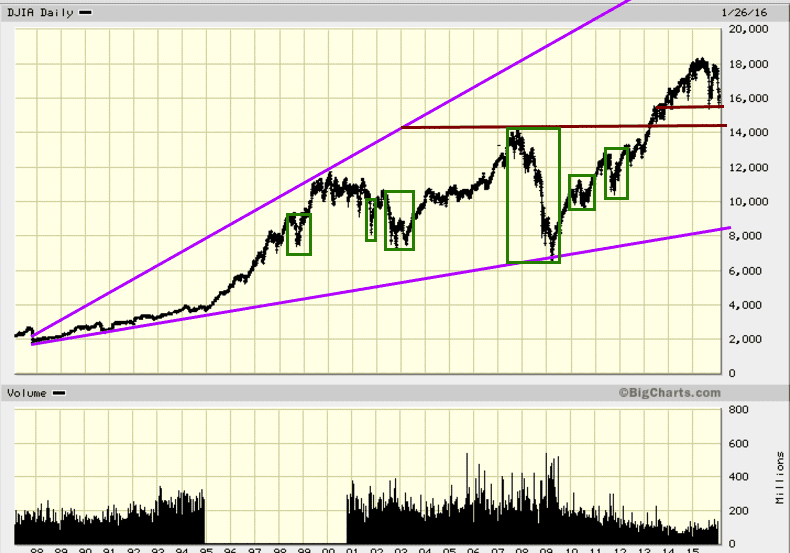

Amidst these uncertainties, a glance at the long-term Dow chart reveals a consistent pattern—every so-called disaster was, in reality, a buying opportunity. The lesson? Don’t follow the herd; trust in the resilience of well-run companies and the market’s ability to rebound.

Plato once advised, “Wise men speak because they have something to say; fools because they have to say something.” This wisdom rings true in today’s market dynamics, where the crowd’s noise often drowns out rational discourse. Similarly, Machiavelli’s observation that “Whosoever desires constant success must change his conduct with the times” underscores the importance of adaptability in investment strategies. Charles Munger, a modern sage in the investment world, echoes this sentiment with his philosophy of “invert, always invert,” urging investors to think differently from the masses to achieve superior results. These guiding principles from past and present thinkers fortify the contrarian approach: observing quietly, adapting strategically, and acting independently when opportunities arise.

Amidst these uncertainties, a glance at the long-term Dow chart reveals a consistent pattern—every so-called disaster was, in reality, a buying opportunity. The lesson? Don’t follow the herd; trust in the resilience of well-run companies and the market’s ability to rebound.

Crashes as Opportunities: Black Monday and Beyond

Our investment strategy is straightforward: never buy at the peak. Instead, we adhere to a simple rule – buy during panic and sell when euphoria reigns. Will anything change this year or in the future? Unlikely. Masses tend to panic when purchasing and become euphoric when they should sell.

As our Volatility Indicator reaches record levels, we anticipate increased market volatility. But here’s the key: This should be seen as a positive sign, as the trend is upward. Market crashes, including the infamous Black Monday, equate to buying opportunities for those who follow this contrarian approach.

Market volatility is a two-way street characterized by significant price swings in both directions. Considering the markets’ upward trajectory over the past seven years, the current correction, while robust, is not a cause for panic.

In navigating these turbulent waters, the wisdom of historical figures can be particularly enlightening. Warren Buffett, a modern investment guru, famously advised, “Be fearful when others are greedy, and greedy when others are fearful.” This aligns perfectly with our strategy of buying during panic. From a philosophical standpoint, Aristotle’s notion that “Knowing yourself is the beginning of all wisdom” encourages investors to deeply understand their risk tolerance and investment philosophy. This self-awareness is crucial when deciding to buy during market lows. Additionally, Benjamin Graham, often considered the father of value investing, emphasized the importance of an analytical approach and defensive investing, especially during market turmoil. His principles reinforce our strategy of seeking undervalued securities in downturns.

By integrating these timeless strategies with our understanding of market cycles, we position ourselves to capitalize on opportunities that others might miss due to fear or misunderstanding. This approach aligns with historical wisdom and practical investment strategies that have stood the test of time.

Unravelling the Enigma of Mass Psychology in Financial Markets

Mastering the principles of mass psychology in financial markets is a formidable challenge, as it requires moving beyond outdated financial doctrines. In finance, emotions often dominate, leading to chaotic market behaviours during sell-offs or just before bubbles burst. This pattern, evident since the Tulip Mania, underscores the irrational behaviours that can dominate market movements.

The essence of successful investing hinges on the ability to identify and follow market trends, a task that even seasoned investors find daunting due to its complexity. This involves profoundly analysing various factors and synthesizing information from multiple sources to gauge the prevailing market direction accurately.

Embracing the Trend: Your Investing Companion

Once the trend is identified, the path of investing becomes clearer. We provide a broad spectrum of investment opportunities for diverse trading styles and preferences. Transitioning from traditional beliefs to new, innovative strategies is essential but challenging. To aid this transition, we offer various options, allowing investors to engage at their comfort level and gradually increase their involvement as confidence builds.

In navigating these complex waters, the insights of renowned thinkers can be invaluable. Daniel Kahneman, a pioneer in behavioural economics, highlights how biases and heuristics shape financial decisions, suggesting that understanding these can lead to more rational investment choices. Friedrich Nietzsche’s philosophy that “he who has a why to live can bear almost any how” reminds us of the importance of having a solid investment philosophy to guide decisions in tumultuous times. Lastly, the strategic insight of Sun Tzu in “The Art of War” teaches us that knowing when to engage and when to avoid battles is crucial in capitalizing on market trends.

These diverse perspectives provide a robust framework for investors aiming to master the psychological complexities of the market and leverage these insights to make informed, strategic decisions. By blending historical wisdom with modern financial strategies, investors can navigate market psychology more effectively, turning potential vulnerabilities into strengths.

Mastering Black Monday: Sell-Off Strategies with Psychology & Contrarian Wisdom

In the ever-changing landscape of investments, the spectre of a “Black Monday Crash” can sow seeds of doubt and anxiety in investors’ minds. However, it’s crucial to realize that amid the tumultuous waves of market sell-offs, hidden treasures of lucrative opportunities often await those with the courage to seize them. This article delves into the intricacies of navigating stock market sell-offs, shedding light on why they need not be feared. With a long-term perspective and insights from mass psychology and contrarian investing, investors can transform these apparent challenges into financial growth and success catalysts.

Contrarian investing strategies are valuable, but the true power lies in the timeless concept of mass psychology. Instead of immediately opposing the crowd’s sentiment, a prudent approach involves understanding and leveraging the emotional dynamics of the market. When the masses enthusiastically embrace an investment, a savvy investor may join them, even increasing their stake in that sector. They patiently await the moment when euphoria reigns supreme before considering an exit.

Conversely, when a sector falls out of favour, a student of mass psychology exercises patience. They wait for fear levels to skyrocket before gradually acquiring shares. Fear takes time to recede, and the crowd’s tendency to overreact can lead to missed opportunities. Therefore, reserving some firepower for enticing moments is a prudent strategy.

Embracing the principles of mass psychology and contrarian investing empowers investors to confidently navigate the turbulent waters of a potential Black Monday Crash, turning market volatility into a strategic advantage.

Other related stories

Can China attract foreign talent via green card Program

China Corruption Still Running Rampant

Currency Wars & Negative Rates Equate To Next Global Crisis

China’s Rural Transformation creating Boom Towns

Control Group Psychology: Stock Crash of 2016 Equates To Opportunity

Erratic Behaviour Meaning:Dow likely to test 2015 lows

India vs China: Can India surpass China

Interest rate wars-Fed stuck between a hard place & Grenade

India overtaking China just a pipe dream

Wealth Tax & The War On Wealth

American Woes Push USA towards Russia Engagement

The Smart Investor IS buying While The Dumb Money selling

Working Poor: Masses struggle while Fed Bails Out Banksters

India will never Dethrone China: Jim Rogers agrees, exits India

Syrian Army Gains Control Over Strategic Heights in Raqqa Province