Crash Alchemy: Turning Panic Into Profit

March 31, 2025

Every market massacre carries a secret. It was not whispered on CNBC or printed in the Wall Street Journal. It’s this:

The ones who buy while others are puking their positions walk away with 10x returns.

That’s not theory—it’s written into the bones of every major crash from 1929 to 2020.

And yet, the herd does the opposite. Every. Single. Time.

Here’s the edge: The game flips when 60% or more of the crowd is bearish. Risk becomes asymmetric. Your downside shrinks. Your upside explodes. That’s when you go in—not timid, but surgical—into the stocks that lead when the smoke clears.

But entry timing isn’t blind. That’s where technicals step in.

Look at monthly charts deep in oversold territory—psychological sinkholes where bottoms form. When does that align with extreme sentiment?

You’re looking at a generational buying zone.

So if you see fear off the charts, sentiment under 60, and long-term charts collapsing into exhaustion?

Stop watching. Start deploying.

Market crash history: 1973 to 1974 timelines

The developments during the above timeline are similar to what is happening now.

1973 oil crisis

It was an ongoing war (the Vietnam War). While a cease-fire was agreed upon on January 23, 1973, the war did not end until early 1975.

Self-inflicted Highly inflationary period

Erratic president. Nixon desperately did not want to be the 1st president to lose a war.

The Vietnam War and the Russian War

In its swift swings between lull and violence, hope and despair, the Vietnam War has often had a manic character to it. Never more so than in the latest extraordinary episode in which, within the space of 40 days, the World moved from a sense of peace at last at hand, to the most brutal U.S. bombing of the war, to Washington’s declaration late last week that the secret Paris peace talks would begin again on January 8. Rarely, if ever, before had a major power so openly used overwhelming force to extract concessions at the conference table or moved so swiftly from diplomacy to war and back; the episode almost evoked the end of the Thirty Years’ War, when fighting and negotiating accompanied each other in a dizzying blur. The news of the bombing halt was as puzzling as it was welcome,

Brutal acts of violence

Those acts of escalation, embodied in daily waves of U.S. bombers aimed at Hanoi’s heartland over a period of two weeks, had left the capital of North Viet Nam a stricken city, rapidly emptying of people, without electricity and in some places water, many of its streets and even whole quarters smashed and cratered by the ferocity of daily U.S. bombing raids. Once neat one-story houses lay flattened or lurched at odd angles, roofless and windowless. On one street, a young worker in a red helmet stared numbly into a pit that was once his home. In it lay children’s shattered copybooks, a dead black hen, and a mosquito net still hanging from an upright beam on one end.

On another street, relief crews tugged at the corpse of a dead nurse, buried under her blasted dispensary. An old man stood amid the ruins of his home, mechanically putting on his coat and taking it off as though the simple ritual might restore his past.

Children searched among the debris looking for parents, parents for children. At the Bach Mai hospital, patients were trundled piggyback from the smoldering rubble as the director ran frantically from one victim to another. The Bach Thai hospital for tuberculous patients was razed. The railroad station had been destroyed, and the Gia Lam airport runways were pocked. Stacks of coffins lay at street corners. Here and there on a wall, someone scrawled, “Nixon, you will pay this blood debt” and “We will avenge our compatriots massacred by the Americans.

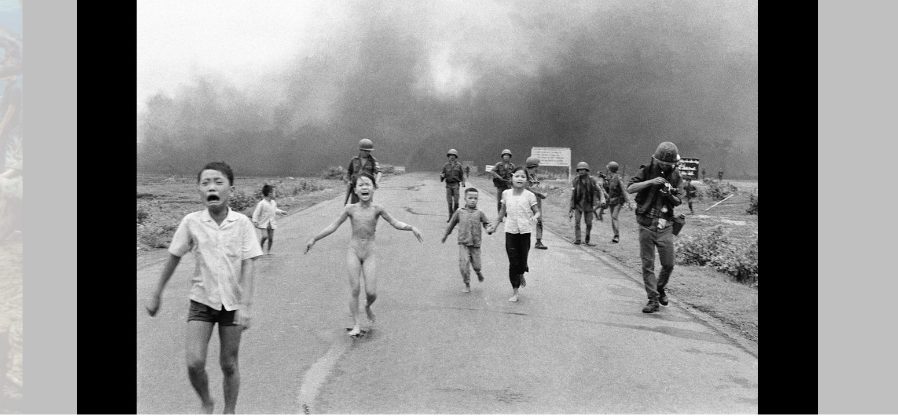

Terrified Children Running:

Associated Press photographer Nick Ut photographed terrified children running from the site of a Vietnam napalm attack in 1972. A South Vietnamese plane accidentally dropped napalm on its own troops and civilians. Nine-year-old Kim Phuc, centre, ripped off her burning clothes while she ran. The image communicated the horrors of the war and contributed to the growing U.S. anti-war sentiment. After taking a photograph, Ut took the children to a Saigon hospital.

MANFLATION: 1974 Called—It Wants Its Chaos Back

This isn’t inflation. It’s Manflation—a testosterone-fueled replay of 1973–1974. War? Check. Supply shocks? Check. Policy confusion? Oh yeah. We’re living through a macro déjà vu soaked in fear, bad decisions, and hidden opportunity.

The Bottom That Dare Not Speak Its Name

The S&P has already whispered its intent—4200 to 4500 is now within range. You just have to look past the smoke. The June 29, 2022 update laid it out: we had a technical bottom, and the beast stirred.

And here’s the kicker—individual stocks sniffed out the turn long before the indices:

- Tech giants like GOOGL, AMZN, and IBM quietly reversed course.

- Defensive and legacy plays—JNJ, VZ, SBUX—joined the party.

- And then came the wild east: BABA, BIDU, FXI, DQ—not just bouncing, but blasting out positive divergence signals strong enough to shatter glass. These weren’t rebounds. These were early escapees from the wreckage.

Three Days of Fury

The market surged three consecutive days on clean, powerful “Up” volume, which doesn’t lie. No algorithms are masking it, and there are no options for gamma games—just raw institutional footprints pressing the gas.

Meanwhile, The Crowd? Still Terrified.

- Bullish sentiment? Trapped below 20 for nearly five straight weeks.

- Anxiety index? Deep in the red zone—for months.

- Technical oscillators? Monthly charts oversold. Weekly charts? Beyond rational—it’s bloodbath territory.

In this climate of despair, the first buy signal quietly fired off. But for this fire to become a blaze, we needed more:

Trigger Points to Watch

- DOW: Weekly close above 31,500

- NDX: Close above 12,540 weekly (twice is better), or end-of-month above 12,490

- SPX: Needs a weekly close above 3951

These levels aren’t just technical checkboxes—they’re psychological thresholds. Once crossed, fear gives way to FOMO.

History Doesn’t Repeat, It Reloads

Back in 1973, the market tanked… then bottomed in August. Rally? Sure—until October. Then came the real pain: a second crash, deeper and more vicious, ending in December 1974.

But when that ended?

- One of the strongest rallies in history ignited.

- It ran until late 1976.

- No QE. No “infinite liquidity.” Just market mechanics and mass psychology.

Today? The hot money isn’t just flowing—it’s drowning the system. We’re not in 1974 anymore. We’re in 1974 on steroids, with trillions of liquidity and algo-driven accelerants.

What’s Next? MOAB or FOAB?

Chinese equities are telegraphing strength: BIDU, BABA, JD, DQ, FXI—these aren’t flukes. They’re weather vanes for global capital rotation.

- If a second buy triggers soon?

→ Markets should rally hard into Sept/Oct. - If the full 1973–74 fractal plays out?

→ The odds of triggering the Mother of All Buys (MOAB) shoot to 90%. - But if the Kansas City Financial Stress Index (KCFSI) matches 2008–09 levels?

→ We’re staring down the Father of All Buys (FOAB)—a signal so rare it’s basically a financial eclipse.

FOAB odds jump to 81%, and that’s not just high—that’s near-fatal certainty for anyone betting against the market.

Final Word

This isn’t the time for cowardice or blind hope. It’s the time to read fear like a playbook.

When the masses panic, the smart prepare.

When the charts scream oversold and sentiment bleeds red, it’s not a warning—it’s an invitation.

Manflation is the fire.

You either melt or forge something out of it.