Stock Investing for Kids: The Smart and Easy Way

March 31, 2025

Most people think making money in the stock market is complicated, but that’s not true. Some of the biggest mistakes come from following the crowd instead of thinking for yourself. As Mark Twain put it, “Whenever you find yourself on the side of the majority, it is time to pause and reflect.” Smart investors learn to think differently and stay patient—two skills that can help you build wealth over time.

Lesson 1: Patience Pays Off

Patience is one of the biggest secrets to investing success. Many people try to get rich quickly, which often leads to big mistakes. Instead, the best investors wait for the right opportunities.

Peter Lynch, one of the most successful investors ever, said: “The key to making money in stocks is not to get scared out of them.” Stocks go up and down, but if you’ve chosen wisely and hold on, they usually go up over time. Think of it like planting a tree—if you keep digging it up to check if it’s growing, it will never take root!

Lesson 2: Discipline is Your Superpower

Being patient is great, but it only works if you also have discipline—sticking to a smart plan no matter what. Imagine you’re playing a video game. If you panic and mash all the buttons when things get tough, you’ll probably lose. But if you stay calm and follow a strategy, you’ll have a much better chance of winning.

Warren Buffett, one of the richest investors in history, put it simply: “The stock market is a device for transferring money from the impatient to the patient.” This means those who jump in and out of the market usually lose money, while those who stay disciplined make the real gains.

Lesson 3: Think for Yourself

A lot of people lose money because they blindly follow trends. If everyone is buying a stock because it’s popular, that doesn’t mean it’s a good investment. The best investors do their own research and make decisions based on facts, not emotions.

Socrates once said: “To find yourself, think for yourself.” This applies to investing too! If something sounds too good to be true, it probably is. A smart investor asks questions and looks at the bigger picture before making a move.

Bonus Tip: Save First, Spend Later

Want to build wealth faster? Follow this simple rule: Save before you spend. Instead of spending money first and saving whatever is left, flip it around. Set aside money for investing, then spend what remains. Buffett’s advice? “Do not save what is left after spending, but spend what is left after saving.”

By practising patience, discipline, and independent thinking, you can make smart investment decisions that grow your wealth over time. Remember: investing isn’t about luck—it’s about strategy!

Have a Long-Term Game Plan: The Path to Financial Independence

Retirement isn’t about doing nothing—it’s about doing what you love. As Archimedes said, “Give me a lever long enough and a fulcrum on which to place it, and I shall move the world.” Your long-term plan is the lever in finance, and disciplined investing is the fulcrum. The goal? Breaking free from the 9-5 grind and gaining financial independence.

Control Your Financial Destiny

Nathan Rothschild famously stated, “Who controls the money supply of a nation controls the nation.” The same applies to personal finance. Taking charge of your financial future means making decisions based on passion, not necessity. This requires discipline and a clear investment strategy.

Master Emotions for Market Success

Investing is as much an emotional game as a financial one. Market downturns trigger fear, and bull runs create euphoria—but reacting emotionally leads to poor decisions. Archimedes’ “Eureka!” moment applies here: when you master emotional discipline, you unlock financial success.

Think Like a Contrarian

Following the herd rarely leads to wealth. Baron Rothschild advised, “Buy when there’s blood in the streets.” Market downturns offer buying opportunities, while euphoric rallies signal caution.

Financial independence is within reach by sticking to a well-thought-out plan, managing emotions, and making informed decisions. As Archimedes noted, “There are things which seem incredible to most men who have not studied mathematics.” In investing, the incredible is achievable—with discipline and knowledge.

Mastering Emotions and Knowledge: The Keys to Successful Investing

To succeed in investing, control your emotions and build knowledge. Impulsive decisions lead to losses; patience and rationality drive success. Baron Rothschild’s timeless advice—”Buy when there’s blood in the streets”—reminds us that fear creates opportunity.

Knowledge is Power

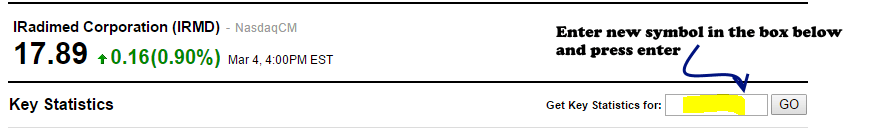

Understanding investments is crucial. Focus on industries you find interesting. Look for companies with strong earnings, high revenue growth, and unique products. Tools like Yahoo Finance provide key statistics and financial data.

Essential Investing Facts:

- Emotional discipline prevents impulsive decisions.

- Contrarian investing often leads to success.

- Research tools like Yahoo Finance help in making informed choices.

Mastering these principles allows you to navigate the stock market confidently. Financial success isn’t about luck—it’s about discipline, patience, and knowledge.

You should seek quarterly earnings growth or revenue rates exceeding 10%. A simple measure is:

15%-20% = Good

25%-40% = Very good

50% plus = Excellent

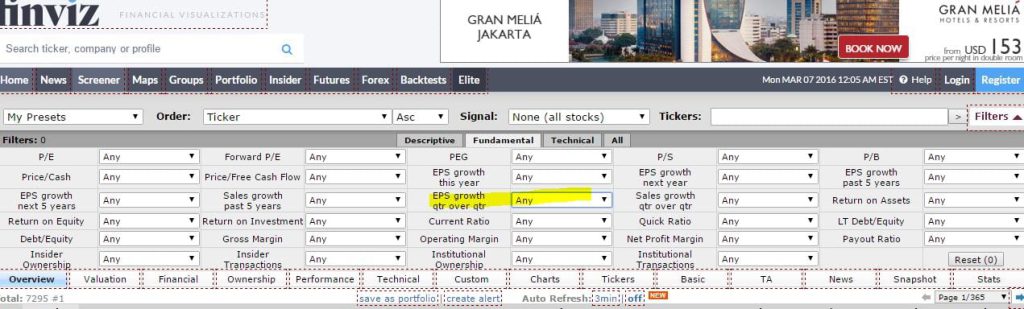

However, the above process could be cumbersome unless you are familiar with some fast-growing companies. Most individuals will need to find a good stock screener. Finviz is a site that provides a reasonably robust stock screener, and it has both Fundamental and technical analysis screening tools built in.

Investing for Kids: Mastering Stock Screeners, Portfolio Management, and Stops

Stock screeners help identify investment opportunities by filtering stocks based on market cap, dividend yield, and P/E ratio. However, they’re just a starting point—further research is essential.

Patience and discipline are key. Wait for significant pullbacks before deploying capital. As Warren Buffett said, “Be fearful when others are greedy, and greedy when others are fearful.” Market downturns often present the best buying opportunities.

A well-managed portfolio is diversified and regularly reviewed. As Peter Lynch advised, “Know what you own, and know why you own it.” Risk management is equally critical—using stop-loss orders prevents small losses from turning into devastating ones. As Benjamin Graham put it, “The essence of investment management is the management of risks, not the management of returns.”

Key Takeaways:

- Stock screeners help filter stocks but require deeper analysis.

- Diversification spreads risk and strengthens a portfolio.

- Stop-loss orders protect against significant losses.

Mastering these principles gives young investors a solid foundation to navigate markets with confidence and discipline.

Mastering Technical Analysis: Insights from Market Legends

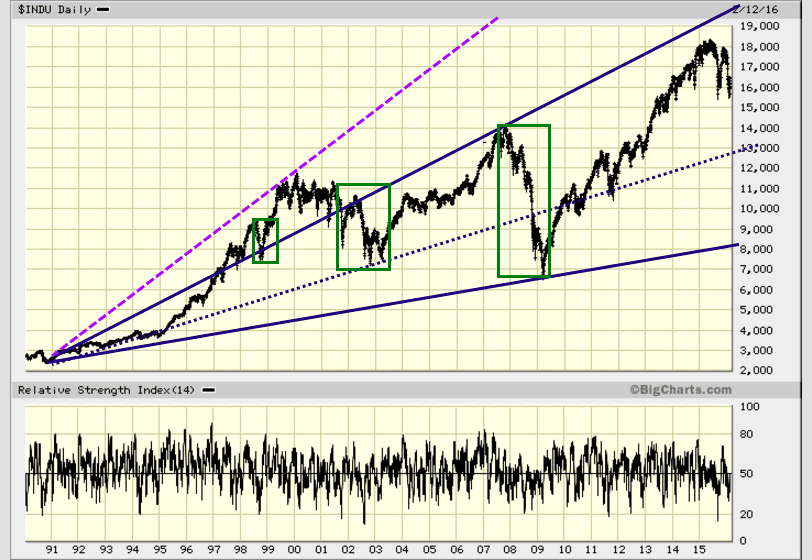

Technical analysis examines price patterns and volume trends to forecast future price movements. It assumes that market prices reflect all available information and that historical trends can help predict future behavior.

While not infallible, technical analysis helps identify optimal trade entry and exit points. Standard tools include:

- Chart patterns

- Trend lines

- Support & resistance levels

- Moving averages

- Indicators (e.g., MACD, RSI)

Influential Market Technicians:

- W.D. Gann used geometric angles and time cycles to predict trends, believing mathematical relationships could forecast price movements.

- Richard Wyckoff developed a method focused on market structure, supply & demand, and price-volume relationships, influencing modern trading strategies.

Gann angles and Wyckoff’s accumulation schematic remain widely used today. However, technical analysis works best when combined with fundamental research and strict risk management. Stop-loss orders, for example, help limit downside exposure.

Introduction to Technical Analysis is a great starting point for those new to technical analysis.

Here’s the refined version of your text, made clearer and more concise:

Conclusion: Essential Factors for Success

Once you’ve identified top stocks, wait for significant market pullbacks before adding or opening new positions. Long-term charts show that markets always rebound and climb higher after substantial dips.

Don’t rush in when markets first pull back. Wait for panic levels to peak, then start buying your selected stocks. Strong pullbacks should always be seen as opportunities, not threats.

Other related articles:

Mastering Finance: Beware the Pitfalls of Fear Selling