A Palestinian stone-thrower shot dead

The video below covers this issue, but this article focusses on what’s going with the stock market today

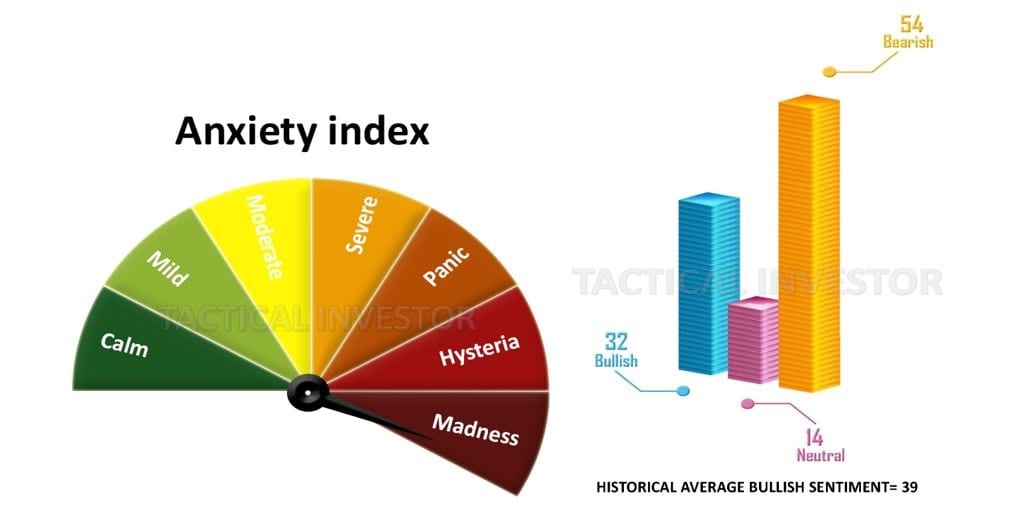

This bull market by any standards should be deemed mature and ready to experience a back-breaking correction, but no market has ever collapsed without mass participation. Hey, they have to dump the crap on someone, and the big guys do not want to try to trick each other. Killer whales would rather go after smaller prey than fight amongst themselves.

There is also a marked difference between contrarian investing and investing based on the principles of mass psychology. Contrarian shift position once the masses are on board, but we don’t follow that route, we wait for the masses to start frothing before we abandon ship. Mass psychology states that the masses have to be in a state of Euphoria and only after that stage is reached should you abandon the ship. Market Update August 31, 2016

The masses are not in panic mode, so strong corrections have to be embraced; use sharp pullbacks to open long positions in quality companies.

Keep this difference in mind, for contrarians, have been predicting the demise of this market for a very long time, and they are still waiting for their day in the sun. Bubbles only pop, when the masses embrace the market and turn Euphoric. Mass Psychology states that these two ingredients are necessary; they need to embrace the market, and they need to be euphoric. Fed Decision Limiting Market Downside Action

Unfortunately, A Palestinian stone-thrower shot dead By Soldiers

A Palestinian man throwing stones at Israeli cars was reportedly shot dead Wednesday evening by Israeli troops near the West Bank city of Bethlehem.

The Palestinian health ministry said Ahmed Manasara, 26, was shot dead near a checkpoint close to Bethlehem, by soldiers for repeatedly throwing stones at soldiers. Israeli troops responded with lethal fire.

Random video on Interaction between Israeli Troops and Palestinians

Other Stories of Interest

Tactical Investor Election Polls-Updated Constantly Until Election day (Oct 20)

Trump Trumps Clinton in second Debate (Oct 20)

Italy’s black economy-including Mafia-worth 13 percent of GDP (Oct 18)

China targets Muslim parents with religion rules in Xinjiang (Oct 12)

The American Way (Oct 12)

Consensus- Trump wins debate- media lose along with Hillary (Oct 12)

Sophie Gregoire-Trudeau to open TSX on Tuesday to mark International Day of the Girl (Oct 12)

Samsung says Galaxy Note 7 phones should be turned off (Oct 12)

As Hurricane Matthew moves out Zika could move in (Oct 12)

Hurricane Hillary-Tornado Trump (Oct 12)

Trump-Hillary Should be in Jail (Oct 12)

If these people are throwing stones, rocks, bottles, whatever, they are doing it to try to harm or kill. If they are throwing these articles, they are not unarmed – They are committing attempted murder. Equivalent force is not called for, overwhelming force is. If they were throwing stones at you, you would do whatever is necessary to stop them. Poor little Palestinian teenager {Terrorist}.

Good job!

a stone in a sling is a lethal weapon that can be more deadly than a bullet

freedom is indivisible. Israel occupies Palestine. Palestinians are struggling to free themselves without anyone helping them, esp USA backing Israel in its illegal occupation of Palestine. Israel conducts illegal kidnapping raids on Palestinian people and when they attack with tanks and machine guns, brave Palestinians only resist with stones, then they are shot dead, becoming martyrs in the cause of freedom for their land and their families. and to those who say otherwise, an eternal moral disgrace beckons on the thereafter.

what kind of ruthless animals rejoice at the murder of a 15 year of freedom lover who was resisting oppression by a foreign death squad oppressing his people and his family?