The Evolving Stock Market Outlook Today: A Futile Endeavor

Updated Aug 2023

Let’s begin by taking a step back into history, a realm we’ve been exploring for over two decades. In doing so, we aim to shed light on two vital lessons. Firstly, people often fail to grasp the teachings of history, leading them to repeat past mistakes. Secondly, though history doesn’t exactly replay, its echoes closely resemble original events. These insights underline the importance of learning from history to make informed decisions.

Furthermore, understanding history empowers us in the realm of investments. It helps us recognize patterns, anticipate market trends, and avoid pitfalls that have ensnared others before. As we journey through these historical parallels, we gain wisdom that can potentially guide us to better outcomes. Our quest doesn’t end there; we’ll conclude by offering fresh insights into today’s markets, combining the wisdom of the past with the dynamics of the present.”Updated Insights as of August 2023

One thing to keep in mind is when the coronavirus pandemic hysteria subsides. The media will find another item to focus on. They are already directing the focus on Trump’s threat to issue new tariffs. Remember what we stated that the Coronavirus is going to be made to look at the straw that broke the camel’s back. The US will use this to mount a full-scale attack on China; the attack will most likely be in the form of media and economic warfare, with a minor chance of a warm encounter. Hence, regardless of whether Trump wins or loses, the future narrative is already etched in stone.

While the media will do its best to trigger a stampede, until the trend turns negative, every pullback, regardless of intensity, should be embraced, especially now that the Fed has openly declared war on the bears. Forever QE is here to stay until the masses wake up, and right now, you have a better chance of winning the lotto.

What is the Stock Market Outlook Today? The Same As Yesterday

Insiders are loading up on shares.

The excerpt below shows that insiders are loading up on stocks left, right and centre. The astute investor would do well to follow in their footsteps; use strong pullbacks to load up on quality shares.

Insiders have been using this massive pullback to purchase shares, and one way to measure the intensity of their buying is to check the sell-to-buy ratio. Any reading of 2.00 is considered normal, and below 0.90 is considered as exceptionally bullish. So what do you think the current ratio is; well, it’s at a mind-numbing 0.35, which means these guys are backing up the truck and purchasing shares.

Based on very heavy transaction volume, Vickers’ benchmark NYSE/ASE One-Week Sell/Buy Ratio is 0.33, and the current reading is 0.35. Insiders are not just buying shares; they are back the truck up. Insiders behaved in a similar fashion in late December 2018. In early 2016 when stocks also corrected; and in late 2008/early 2009, at the depths of the Great Recession correction. Insiders seem to be telling us that today offers a similar opportunity. https://yhoo.it/2TV0cE2

Frenzy Amidst a Singular Focus on the Stock Market Outlook Today

‘Don’t be fooled by the recent rebound in stocks; the investment scene is beginning to resemble the 1929 market crash and the early 1930s Great Depression.’ To me, it’s like 1929 when stocks first fell, then rallied before plunging anew as the Great Depression set in. In his Bloomberg piece, Shilling pointed to the 48% plunge in the Dow Jones Industrial Average from Sept. 3 to Nov. 13 back in 1929, a pullback which may have “seemed like a reasonable correction” at the time, since the blue chips had rallied 500% in the eight years leading up to it. https://yhoo.it/3aVVY42

We hope these guys keep publishing articles like this, for it will add to the volatility creating lovely opportunities along the way up, to open even more positions at a discount. You have to love these guys; they preach gloom and doom when the Fed openly states they will do whatever it takes to support this market. You don’t fight the Fed when it puts the pedal to the metal.

Now, these wise guys that felt so smart by blasting the hell out of us during the market meltdown will weep tears of blood shortly if they are not already doing so. They made the same mistake before, promising never to fall for the fake news/hysteria that made them dump their shares at the bottom.

But like mentally deranged individuals, they did precisely the same thing at the worst possible time, and what was their excuse; “it’s different this time”. Well, it will always be different, and that’s the excuse the masses will use forever to justify the fact that they let emotion overrule logic and sold when they should have been buying. In the end, this story will be repeated again and again because the mass mindset knows no better. Hence the saying misery loves company, and stupidity simply demands it. Success is based on taking an approach that is bound to draw shouts of criticism from the masses. The only saying that comes to mind is the truth hurts, and boy does it.

What is the stock market doing today? Going Back to Dec 2006

The moving averages of new highs and new lows we maintain have once again suddenly changed direction. In fact, the 20 days moving average of new lows completely thrashed the 20 days moving average of new highs; it has now issued one of its highest readings in over 90 days, and this is taking place when the Dow is trading in record-high territory. Clearly the smart money is selling into strength, but this will prove to be a long term opportunity as the overall trend is still positive.

The Lower Standard Deviation bands on the Dow actually lost value; only the positive bands gained value. Such developments are usually bearish.

We have now established that a relationship exists between the Dow industrials, the Dow utilities and the Dow transports. This relationship is different from that of the Dow Theory; in fact, we are not true believers of this theory. We have also shown that this relationship has existed for a rather long time.

According to this relationship, the utilities lead the way up or down; there is usually a lag period of anywhere from 90-180 days between the utilities, the Transports and ultimately the Dow industrials. The charts below reveal that the Utilities have already started to pull back after putting in a series of new highs, though we don’t think they will correct seriously yet as they already experienced a rather hard correction after putting in a new high back in Oct 2005. Market Update Dec 2006

Dow Transports Breaking down

The exciting development is that the Dow transports have started to break down while the industrials are putting in new highs. As the Utilities corrected rather firmly after putting a new all-time high back in Oct 2005, the Transports and the Dow have to play catch up. The Dow utilities went on to put another new all-time high after Oct 2005, but they only did so after experiencing a relatively strong correction. This means that the Transports and then the Dow need to first correct and then if the relationship holds, rally one more time. To put it simply, the pattern appears to be having as the Transports were the next in line to correct and then the Dow should follow.

Discovering the Route to Stock Market Triumph: Unveiling the Winning Approach

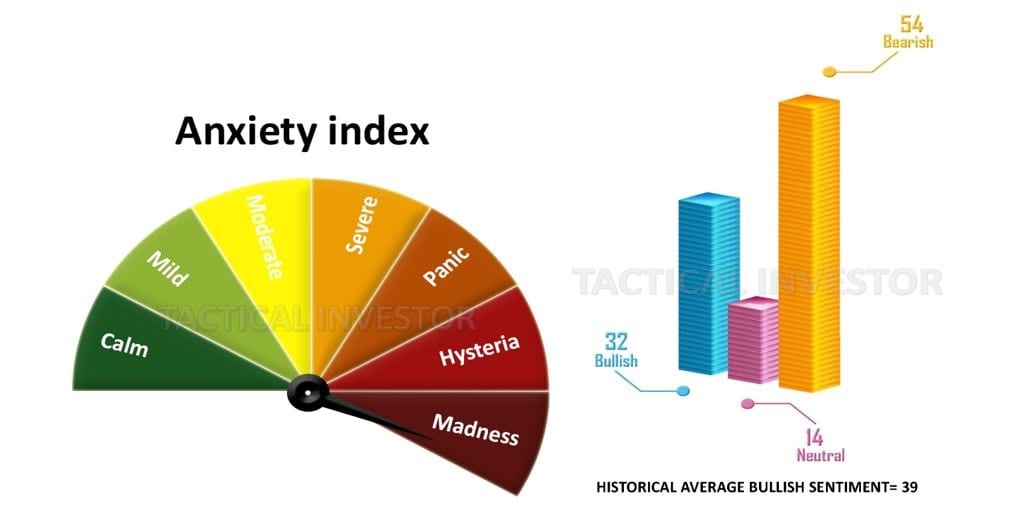

Begin by setting aside the notion of the stock market outlook for today, as it holds limited significance. Instead, fixate on the prevailing trend and sentiment. Over extended periods, the trend consistently points upward. Now, direct your attention to several other pivotal factors of importance.

- Comprehend the Influence of Mass Psychology: Gain an upper hand by understanding the collective sentiment steering market behaviour.

- Embrace Contrarian Investing: Adopt a distinctive viewpoint and seize opportunities that others avoid. Learn to recognize undervalued assets poised for potential growth.

- Foresee Emerging Trends: Stay ahead by identifying sectors on the verge of breakthroughs. Identify emerging trends before they enter the mainstream.

- Identify Promising Stocks: Unearth the methodology for pinpointing robust stocks within these promising sectors. Discover the criteria that set winners apart.

- Master the Basics of Technical Analysis (TA): Enhance decision-making with technical indicators. Refine entry and exit points using the potent tool of TA.

There is no holy grail in investing; the only assurance of success lies in focusing on the long term. In a short time, emotions can lead to losses as money flees while emotions speak. Focus on facts, trends, and not the noise. In the long term, it’s virtually improbable to lose if the focus is on solid companies.

Avoiding Common Pitfalls in Investment: Nurturing Your Strategy

One prevalent mistake among novice investors and those with market experience is the failure to learn and educate oneself genuinely. Mere consumption of irrelevant news or blindly adhering to others’ trading ideas hampers growth. It’s vital to recognize that what proves effective for others might not align with your unique risk tolerance, mindset, and discipline (or lack thereof). The journey demands crafting a tailored strategy to suit your individuality.

While integrating successful traders’ insights into your trading approach can be advantageous, uncritically mirroring their every move is a path to eventual losses. Embrace simplicity and focus on the bedrock principles. Beginners should commence by identifying trends. Investors gain a comprehensive grasp of market performance and direction by dissecting long-term trends and patterns. This facilitates informed choices, eschewing reliance on speculation or hearsay.

Remember, the road to triumph involves nurturing a personalized strategy. Devote time to learning, adapting, and progressing, setting you on the course to realizing your financial aspirations within the intricate landscape of the markets.

Originally published in June 2015, this article has remained a work in progress, consistently updated to reflect the latest information. The most recent update was performed in August 2023.

Articles of interest

Inflation Meaning; Its The Silent Tax That Kills The Middle Class

Bull Stocks Today: Stock Market fools-Market Crash next video?

Feds Interest Rate Stance equates to Nonsense-Video article

Why Invest in Gold: Fly or Fall?

UK economy resilient at end of 2016-manufacturing jumps

Stock Market Crash 2020: reality or all Hype

George Soros loses 1 billion betting Trump would tank markets

Observer Vs regular perspective regarding Russia’s alleged hacking of US elections

Economic recovery is nothing but a joke so why did Yellen Hike rates

Trump announces strict scrutiny of visitors from Pakistan

Gold Price Outlook: Soar Or Slide?

Gang Rape Live Streamed On Facebook Leads To 3 Arrests

Stock Market Bull And Bear: Possible But This Is A Bull

California Law Allowed 800K Undocumented Immigrants To Get Driver’s Licenses

Manus Island: Australian minister questions NYE bashing of refugees

Why Mechanical and Technical Analysis Systems Fail

The Limitations of Trend Lines

Contrarian Investment Guidelines

Inductive Versus Deductive reasoning

Portfolio Management Suggestions

The Good And the Ugly On Trading Futures