Types of Trend Lines: Unlocking Their Power and Pitfalls

Introduction

Updated April 30, 2024

Trend-line investing, particularly effective on short to medium timelines of 6 to 15 months, leverages price action to forecast market movements, offering a robust tool amidst volatility. This method is less susceptible to manipulation, standing out even as other traditional tools decline in an era marked by perceived widespread market manipulation.

Machiavellian Insights for Trend Line Investing

Invoking Niccolò Machiavelli’s principles of adaptability and foresight, trend-line investing requires investors to be as cunning as the political strategist himself. Machiavelli might have likened this to warfare tactics, advising adversaries to alter strategies upon signs of predictability. In financial terms, this means adapting investment strategies responsive to shifts in market conditions signalled by trend line breaches.

Machiavelli valued ingenuity and efficacy, qualities essential in trend-line investing. Investors must precisely anticipate and react to market dynamics, akin to a prince readying for battle but keeping his strategies concealed. This secrecy prevents other market players from anticipating moves that could destabilize positions. Successful trend-line investing demands a Machiavellian blend of strategic flexibility and operational confidentiality, making it a powerful approach in a fluctuating market landscape.

Moreover, Machiavelli’s counsel to “act so your enemies do not know how you want to organize your army for battle” can be interpreted in the market sense as keeping one’s investment strategies and positions discreet to avoid tipping off other market participants, which could lead to adverse price movements.

Practical Application of Trend Lines

Trend lines are essential in market analysis. They connect highs or lows in price charts to indicate support and resistance levels. They help investors pinpoint potential entry and exit points: a break above a downtrend line may signal a buying opportunity, while a break below an uptrend line might suggest a sell-off.

Machiavelli’s Caution and Seneca’s Wisdom

Machiavelli would caution against overreliance on any indicator, including trend lines, highlighting the risks of self-deception and market manipulation. He’d advocate for a strategic approach, combining trend lines with indicators like volume, moving averages, and the relative strength index (RSI) to construct a more comprehensive market view. Seneca, the Stoic philosopher, would add the importance of stability and rationality. He emphasized the value of resilience and emotional stability amidst market fluctuations. Thus, while trend lines offer valuable insights, Seneca would advise maintaining a calm and rational demeanour and avoiding impulsive decisions driven by short-term market movements.

Integrating Machiavelli and Seneca

Combining Machiavelli’s strategic adaptability with Seneca’s stoic rationality offers a balanced approach to trend-line investing. Recognizing the limitations of any tool, investors are encouraged to adapt strategies based on comprehensive analysis and maintain resilience in volatile markets. This blend of historical wisdom and modern technical analysis equips investors to navigate the complexities of the stock market with a clear, strategic, and balanced perspective.

Types of Trend Lines and How to use them

As we stated, while trend line investing can be helpful, it can frustrate a newbie due to the many false signals it generates. Most of these false signals are due to misinterpreting the trend. Unfortunately, the newcomer will have to deal with this as it takes time to master the concept of drawing trend lines accurately.

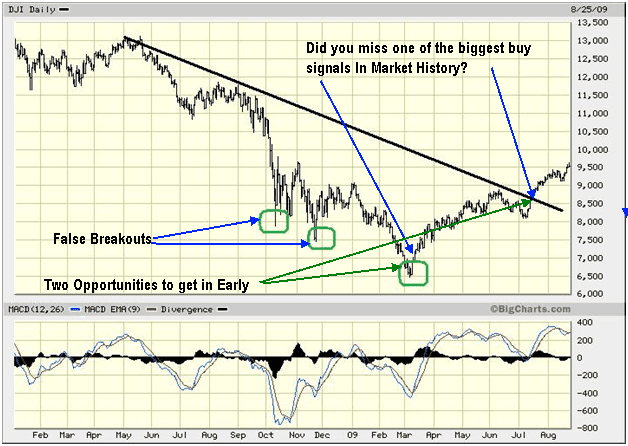

The most crucial aspect of Trend Line Analysis is identifying the points through which the line will be drawn. If you wrongly determine the facts, you could draw a trend line that gives you false entry and exit points. Even when you master this trait, waiting for the trend line to turn positive could cost you quite a lot in terms of profit. The limitations of trend lines can be seen below.

Seizing the first opportunity (March 2009) posed some risk, given that prices still trended below the primary downtrend line. However, factoring in mass psychology significantly mitigated this risk. During this period, bearish sentiment reached unprecedented heights, permeating widespread fear in the investment landscape. Almost everyone, from seasoned investors to the petite guy on the street, felt apprehensive or uncertain—uncertainty synonymous with a bearish stance.

The first breakthrough occurred in March 2009 amidst extreme negativity and the market trading in an exceptionally oversold range. Employing shorter-term trend lines during this phase allowed for early entry. For traders seeking additional confirmation, a more conservative approach would be to wait until July 2009, when prices breached the downward trend line. Even at this juncture, bearish sentiment persisted, and the contingent falling into the neutral camp, colloquially dubbed “nervous Nellies,” remained substantial. Combining both groups meant that over 80% of participants leaned towards a bearish outlook or were hesitant to enter the market. From a long-term perspective, the prevailing conditions unequivocally signalled a compelling buy.

Trendline Investing and Mass Psychology: A Powerful Combination

Investing requires a deep understanding of various strategies and tools. One such tool is trendline investing, which can yield significant results if used correctly. However, it can sometimes generate false signals, underscoring the importance of accurately drawing trend lines. Trendline Investing Trendline investing is most effective in short to medium timelines (6 to 15 months) and when combined with other technical indicators. It is considered a powerful tool in market analysis because it relies on price action, which is less susceptible to manipulation. However, misinterpreting the trend can lead to false entry and exit points, and waiting for the trend line to turn positive could cost potential profit.

Mass Psychology

Mass psychology plays a crucial role in the market. Investors’ emotions and behaviour influence market trends. Understanding the masses’ state can help identify potential market trends and make informed investment decisions. For instance, when the masses are euphoric, it might be time to be cautious; when they are fearful, it might be an opportunity to invest. This principle, contrarian investing, is closely tied to mass psychology.

Combining Trendline Investing and Mass Psychology

Combining trendline investing with mass psychology provides a more comprehensive view of the market. Trendline investing offers a technical analysis of market trends, while mass psychology helps understand the emotional state of the market. This combination can help filter out false signals and make working signals more profitable, leading to a more efficient trading system.

Expert Insights

John Murphy, a well-known technician, emphasizes the utility of trendlines in technical analysis, noting that they are one of the most valuable tools for studying market trends. Behavioural finance expert Daniel Kahneman highlights how emotions like fear and greed can significantly impact investment decisions, reinforcing the importance of understanding mass psychology.

Example

Consider the 2008 financial crisis. During the crisis, trendlines indicated a downtrend, signalling investors to sell. However, understanding mass psychology revealed widespread fear, suggesting a potential buying opportunity for contrarian investors. Those who combined these insights were able to make informed decisions and capitalize on the market recovery.

Combining trendline investing with mass psychology offers a balanced approach to market analysis. This strategy considers both the technical aspects of the market and investors’ emotional states, leading to more informed and potentially profitable investment decisions. By integrating these two powerful tools, investors can navigate the complexities of the stock market with greater confidence and precision.

Unlocking the Door to Freedom: The Power of Knowledge

If you seek freedom, the 1st task is to attain financial freedom to break free from the clutches of the top players who seek to enslave you. They want you to run in a circle like a hamster that runs on a spinning wheel. The hamster thinks the faster it runs, the further it will go, but sadly, it is going nowhere.

Investing can be challenging, but you can gain a significant advantage by understanding the role of mass psychology. We teach you how to use mass psychology to your advantage and view disasters as opportunities. By subscribing to our free newsletter, you’ll stay up-to-date on the latest developments and be ready to take advantage of new opportunities.

To succeed in investing, you must resist the mass mentality and alter your perspective. Subscribe to our free newsletter and start your journey to becoming a confident, booming, and independent investor. The choice is yours – will you resist, break free, or do nothing?

Mass psychology is a potent tool, and if employed correctly, it can help you spot the abnormal levels of manipulation the masses are subjected to. We strongly suggest that you view or read or view Plato’s allegory of the cave.

Alternative Articles Worth Exploring

How to define recency bias?

Currency Devaluation Wars: Navigating the Global Economic Battlefield

Investor Anxiety; Rocket Fuel for Unloved Stock Market Bull

Bear Market Bottoms: Turning a Falling Dagger into a Blazing Sword

Mastering Market Reflexivity: The Key to Outperform and Win Big

Does it make sense to invest in the stock market?

Market Perception: How Misguided Views Lead to Costly Losses

How to Make It Through the Valley of Despair?

Mastering the RSI Divergence Indicator: Your Ultimate Edge in the Market

Logical Thinking vs Critical Thinking: Your Edge to Beating the Markets

What is Market Turbulence? It’s Just Opportunity in Disguise

The Importance of Saving and Investing: Secure Your Future with Smart Moves

Why You Should Invest in the Market: The Path To Lasting Wealth

Valley of Despair Atomic Habits: Transforming Challenges into Triumph

The Pitfalls of Fear Selling: A Path to Pain and Financial Miser

Stock Market Crash Michael Burry: Hype, Crap, and Bullshit

What is Emotional Discipline?

Nature created the masses to serve as cannon fodder