Updated March 2020

Dow Jones Stock Report: Embrace The Trend

We are barely into the middle of 2018, and there is already a slew of articles stating that the markets are going to crash in 2018. What is amusing is that these very same individuals have been making the same prediction for nigh on ten years. You would think that by now they would have had some sense knocked into them; especially since they have taken such a massive drubbing. No such luck, the same experts keep mouthing the same nonsense hoping desperately for a new outcome. Will The Stock Market Crash In 2018?

Forget the noise and focus on the Trend

The masters of deception AKA experts take delight in concocting all sorts of fables as to how the markets are destined to crash. They go on to state the markets will remain in a downtrend for years to come. Let’s stop right there, the only thing that has crashed is their ego, and the only downtrend insight is their dismal forecasting record.

From a Mass Psychology perspective, bear markets are nothing but buying opportunities as they will spawn the next bull market. When you hear these nutcases posing as experts stating that the financial world is going to collapse, ignore the noise and focus on the facts. In almost every instance, these chaps are only predicting their demise. History indicates that markets trend upwards for much longer periods then they trend downwards. Additionally had an investor purchased top-rated companies when the masses were dumping their stock during the so-called crash phase, they would have made a fortune over the years.

The trend is your friend; the rest is nothing but noise

To be fair one does not jump in as soon as the masses start to sell or buy as soon as the masses turn bullish. One looks for extreme shifts in emotion; when the crowd is euphoric it’s best to take profits and sit on the sidelines; if you are aggressive, you can short the markets. When the panic readings soar to the stratosphere, and there is a talk that the outlook can only worsen then the prudent call of action is to start establishing positions in top-rated companies.

Every time the Markets sell off these lunatics posing as experts start raving about the next crash and a plethora of articles are frantically penned as the experts are desperately hoping that things will pan out differently. Is this not a clear example of insanity in action; regurgitating the same rubbish in the hopes that the outcome will suddenly change. One thing these guys are good at is writing fiction, and it makes you wonder why they don’t make a career out of that as they are pretty darn good at it; reality seems to elude them. When did the stock market crash is actually a very stupid question: the truth is that it never crashed as the difference between a crash and a correction comes down to perception. Astute investors view strong pullbacks as corrections, while panicked investors view them as crashes. So If the Dow Jones Stock Market crashes, then jump in and load up all the quality stocks among the 30 plays that make up the Dow Jones Industrials.

Mass Sentiment Drives The Market

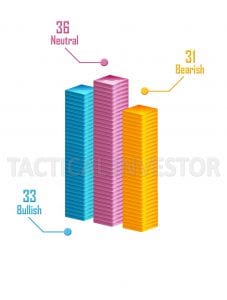

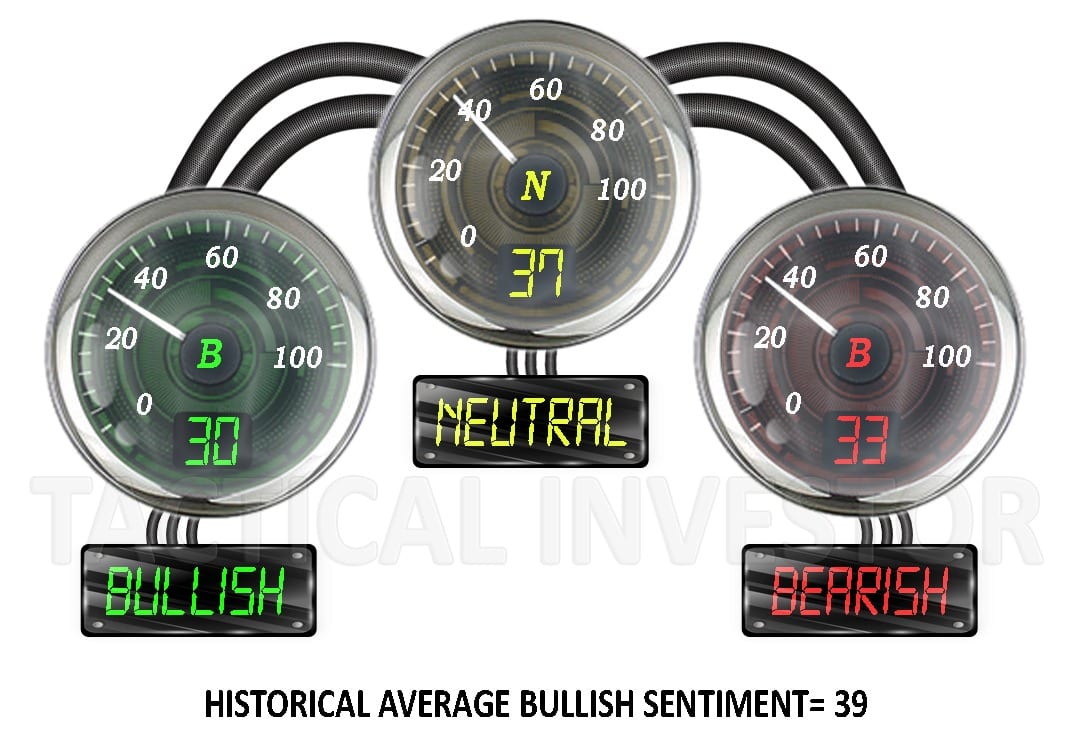

Since the inception of this bull market we have repeatedly stated that until the sentiment turns decidedly bullish and for an extended period, this bull market is unlikely to end. In Jan the bullish sentiment soared past the 60% for the 1st time in years. This could have marked the end of the bull, but the markets let out a massive dose of steam over a very short period and negative sentiment soared. Bullish sentiment has continued to trend downwards from its high of 60 in Jan 2018. Therefore, for now, a crash has to be ruled out, but the markets will continue trending in a wide range until they moved to an oversold state. So the question should be how to make money from a stock market crash and not when did the stock market crash.

The gauges below clearly indicate that the masses are far from bullish and one of the founding principles of mass psychology is that you never take a position against the masses unless sentiment readings hit the extreme zone.

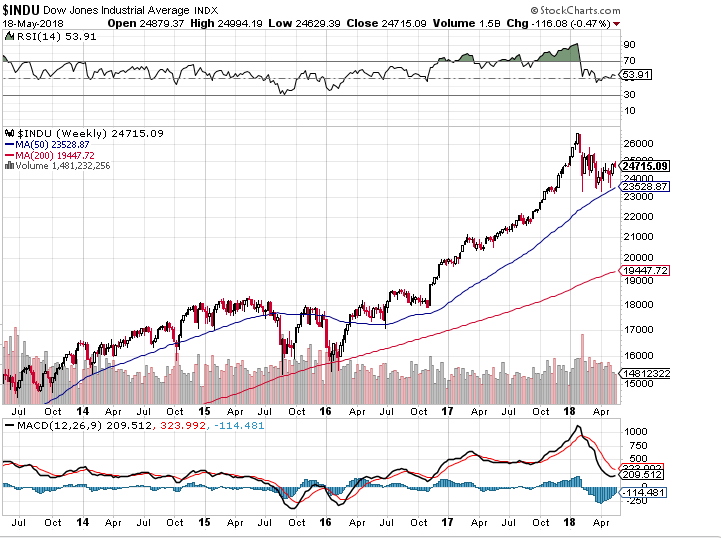

The weekly chart of the Dow

While the Markets are trading in the oversold ranges on the weekly charts, they are still trading in the extremely overbought ranges on the monthly charts. Therefore we expect the action to remain volatile until the weekly and monthly charts are in alignment. Until then the Dow is likely to remain range-bound.

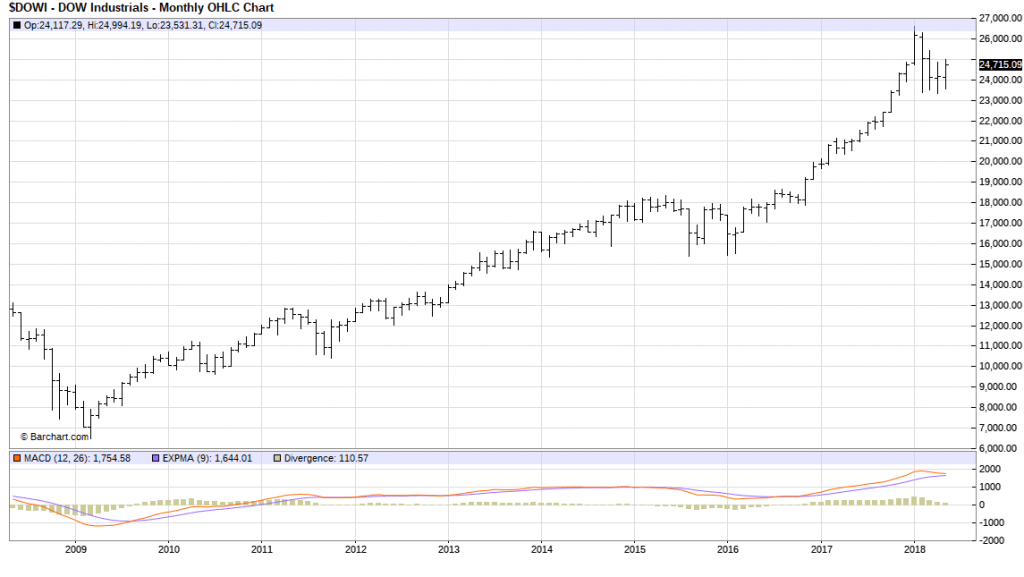

The Monthly chart of the Dow

The trend is showing no signs of weakening so all strong pullbacks should be viewed through a bullish lens. For those who are hell-bent on focussing on the bear market or crash factor; remember that the markets can remain irrational for much longer than most traders can remain solvent by betting against it.

When did the Dow Jones Stock market crash? Irrelevant Question

The naysayers have been calling for a bear market for decades, and so far each bear has met a miserable death. For example, the bears were screaming that the end was nigh when the Dow was trading below 20k, and then they made the same noise when it breached 21K and so on; the story is the same it never changes.

Instead of wasting precious time listening to these broken records, take a look at their track records. The results are quite startling; over 90% of them have laid claim to the same silly story over the years, and they are still around. What does this tell you? Well if these Dr’s of Doom followed a shard of their advice, they would have bankrupted themselves several times over. As they are still around, it means that they are trying to market their faulty information to you for a certain fee, the information they would be loath to follow.

Focus on the Trend Instead of trying to figure out when the market is going to crash

Determine the trend and pay close attention to market sentiment; if the masses are not euphoric then shorting the markets is a recipe for disaster and vice versa. Fundamentals and technical’s are both useless when used in separation. Examine the emotion driving the markets. What are the masses thinking or doing? Stock markets always crash on a note of euphoria and the masses are for now are far from happy.

Until the trend turns negative, don’t listen to the experts for at best they are making uneducated guesses that they don’t even believe. Anything that comes from mainstream media should be taken with a jar of salt and a shot of whiskey. Until Fiat is eliminated, every massive correction should be viewed through a bullish lens for the Feds will pour even larger amounts of money to resolve the next created financial disaster. Until the masses are ready to reject Fiat, boom and bust cycles are here to stay. The stronger the market deviates from the norm, the greater the buying opportunity.

Dow Jones Stock Report Nov 2019

It takes zero effort to panic and the reward is exactly zero; those that panic in the face of adversity are given what they deserve. In terms of the market that means less than zero, as the masses always sell at the bottom and buy at the top. The astute individual that does not panic walks away with a huge reward and that is how it’s been for millennia and nothing is going to change for another 1000 years.

There is no law or set rules when it comes to the markets other than having the ability to adapt to a given situation. We are dealing with emotions and when emotions do the talking, chaos is set free. And that is why like cattle, the lemmings always stampede when the markets sell-off. The masses also tend to jump in when the markets are about to crash. Hundreds of years have passed since the Tulip bubble and nothing has changed.

As always the masses are panicking at precisely the wrong time. We also see new subscribers overreacting to the current pullback, and this informs us that we are on the right side of the markets. While the trend is up, there are going to be hiccups along the way as no market trends in a straight line. The higher it moves the more volatility one can expect. Volatility is a Trend player’s best friend; in this case, it’s up so astute players can use strong pullbacks to add to current positions or open new positions.

Dow Jones Stock Market Crash Outlook March 2020 Update

Huge amounts of liquidity are already being added to this market, but you have seen nothing yet. Helicopter money is about to become a reality and regardless of the mantra it’s different this time, nobody can fight a fed that is determined to unleash the mother of bailout packages

It appears that markets are experiencing the “backbreaking correction” one which every bull market experiences at least once and is often mistaken for the end of the bull. In today’s manipulated markets, one cannot tell which correction will morph into the backbreaking correction, as free-market forces have almost been eliminated from today’s markets. While it feels like the end of the world, such corrections always end with a massive reversal. Given the current overreaction to the coronavirus, there is now a 70% probability that when the Dow bottoms and reverses course; it could tack on 2200 to 3600 points within ten days. Interim update March 9, 2020

Dow Jones Stock Report: Crash Equates To A Once In A Life Time Event

Based on our indicators the markets were expected to let out some steam, but mass hysteria turned a normal correction into a bloodbath in the short term timelines and a generational buying opportunity when viewed from a long term perspective.

Typically, the markets would pullback sharply then tread water until our indicators moved into the extremely oversold ranges. If the sentiment is still trading in the maddens zone when our technical indicators hit the extremely oversold ranges, there is a 90% chance; it will trigger the father of all buy signals.

There is one massive indicator validating the outlook that this current makes for a great opportunity. It’s insider activity, and the readings on this indicator are off the charts.

Insiders have been using this massive pullback to purchase shares, and one way to measure the intensity of their buying is to check the sell to buy ratio. Any reading 2.00 is considered normal, and below 0.90 is considered as exceptionally bullish. So what do you think the current ratio is; well, it’s at a mind-numbing 0.35, which means these guys are backing up the truck and purchasing shares.

So what are the readings today? Based on very heavy transaction volume, Vickers’ benchmark NYSE/ASE One-Week Sell/Buy Ratio is 0.33, and the Total one-week reading is 0.35. Insiders are not just buying shares, they are devouring shares. Insiders behaved in a similar fashion in late-December 2018, after stocks crashed on Christmas Eve; in early 2016 when stocks also corrected; and in late 2008/early 2009, at the depths of the Great Recession correction. Those were spectacular times to buy stocks. Insiders seem to be telling us that today offers a similar opportunity. https://yhoo.it/2TV0cE2

Other Stories of Interest

Current Stock Market Trends: Embrace Strong Deviations (Oct 2)

Market Insights: October Stock Market Crash Update (Oct 1)

BTC Update: Will Bitcoin Continue Trending Higher (Sept 17)

Stock Market Forecast For Next 3 months: Up Or Down? (Sept 16)

Stock Market Crash Date: If Only The Experts Knew When (Aug 26)

Nickel Has Put In A long Term Bottom; What’s Next? (July 31)

AMD vs Intel: Who Will Dominate the Landscape going forward (June 28)

Fiat Currency: Instruments of Mass Destruction (June 18)

Is this the end for Bitcoin or is this a buying opportunity? (Jan 24)

Stock Market Insanity Trend is Gathering Momentum (Jan 10)

Is value investing Dead (Jan 9)

Irrational markets and Foolish Investor: perfect recipe for disaster (Jan 5)

Stock market Crash Myths and Realities (Jan 3)

Bull-Bear Markets & Arrogance (Jan 1)

Will The Stock Market Crash In 2018 (Dec 11)

Has US Dollar Finally Hit Bottom (Dec 6)

BitCoin Has Done What Precious Metals Never Could (Dec 4)

Experts Making Stock Market Crash Forecasts usually know nothing (Nov 17)

1987 stock market crash anniversary discussions- nothing but rubbish ( Oct 24)

when did the stock market crash: who the hell knows and who the hell cares