May 16, 2024

Trend Trader: Ditch the Chaos, Ride the Trend

Introduction

Successful investing often hinges on taking a long-term view, especially during market turmoil. Historical data shows that the most significant buying opportunities arise during moments of chaos. For instance, during the 2008 financial crisis, investors who bought quality stocks at a discount and held them for 6 to 24 months saw substantial gains, even if they were stopped out several times.

Trendline investing is a powerful tool for market analysis, particularly effective over short to medium timelines (6 to 15 months). By connecting highs or lows in price charts, trendlines help identify support and resistance levels, signalling potential entry and exit points. However, misinterpreting these signals can lead to false moves, emphasizing the need for accuracy and complementary indicators like volume, moving averages, and the relative strength index (RSI).

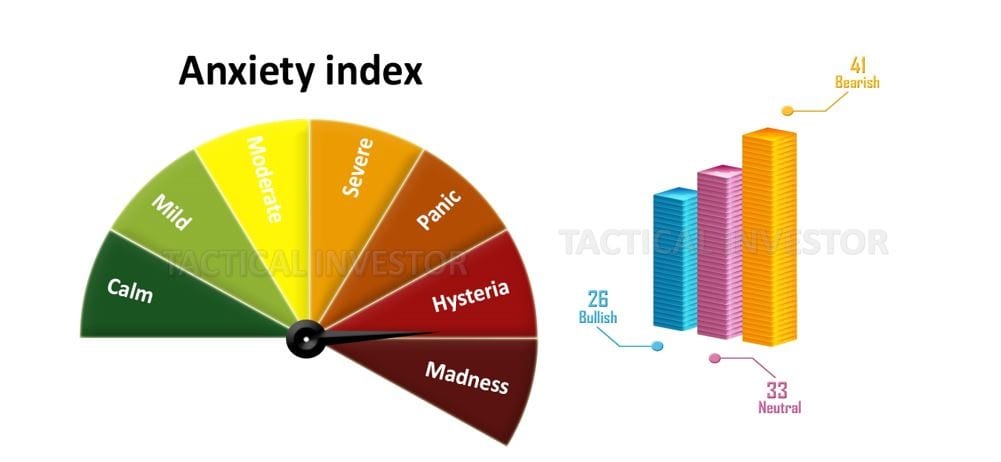

Mass psychology plays a crucial role in market dynamics. The emotions and behaviour of investors significantly influence market trends. Understanding the state of the masses can help identify potential market trends and make informed investment decisions. For example, when the masses are euphoric, it might be time to be cautious; when they are fearful, it might be an opportunity to invest. This principle, contrarian investing, is closely tied to mass psychology.

Expert Insights

Legendary trader Jesse Livermore emphasized the importance of trendlines and mass psychology. He noted, “Markets are never wrong; opinions often are,” highlighting the need to let the market confirm any trading thesis before acting. Livermore’s success during the Great Depression, when he made $100 million by shorting the market, underscores the importance of understanding market trends and investor psychology.

John Bogle, the founder of Vanguard Group, advocated for a long-term investment strategy. He believed in holding a diversified portfolio and staying the course even during market volatility. Bogle stated, “Impulse is your enemy,” advising investors to avoid emotional decisions and stick to a well-thought-out plan. His creation of low-cost index funds revolutionized investing, making it accessible and profitable for the average investor.

Combining Trendline Investing and Mass Psychology

Combining trendline investing with mass psychology provides a more comprehensive market view. Trendline investing offers technical analysis, while mass psychology helps understand the emotional state of the market. This combination can filter out false signals and enhance the profitability of valid signals, leading to a more efficient trading system.

Example

During the 2008 financial crisis, trendlines indicated a downtrend, signalling investors to sell. However, understanding mass psychology revealed widespread fear, suggesting a potential buying opportunity for contrarian investors. Those who combined these insights were able to make informed decisions and capitalize on the market recovery.

Combining trendline investing with mass psychology offers a balanced approach to market analysis. This strategy considers both the technical aspects of the market and investors’ emotional states, leading to more informed and potentially profitable investment decisions. By integrating these two powerful tools, investors can navigate the complexities of the stock market with greater confidence and precision.

Now, let’s examine this concept through a historical lens, for those who don’t learn from history are destined and doomed to repeat it again.

Trend Trader: Panic-based Selling Equates to Opportunity

We have seen panic selling play out many times, and the theme is always the same: create a crisis, induce panic, and watch the masses regret their decisions once the dust settles. Despite vowing to act differently next time, they often repeat the same mistakes, proving that the mass mindset is programmed to panic at precisely the wrong time.

Aristotle’s wisdom on virtue and practical knowledge is relevant here. He stated, “Virtue makes the goal right, practical wisdom the things leading to it”. While the masses may act impulsively, those who exercise practical wisdom can navigate crises more effectively. Aristotle emphasized the importance of moral virtue and practical knowledge in making sound decisions, which can be applied to investing by maintaining a rational and disciplined approach during market turmoil.

Solon, the Athenian statesman, also offers valuable insights. He believed true happiness and success come from living a balanced and virtuous life, not from reacting impulsively to external events. Solon’s advice to Croesus, who later acknowledged its wisdom, underscores the importance of long-term thinking and resilience in facing adversity.

The most significant factor we see here is not the coronavirus but hysteria. The hysteria is building up, and everyone from the janitor to movie stars has suddenly become an expert on the topic. Like the flu, many individuals will not go to the doctor or seek medical attention unless the conditions worsen.

Hence, the individuals going to hospitals or visiting doctors are generally the ones feeling the worst, which means the current fatality rate could prove to be too high. What is true is that the current strain of coronavirus is more virulent, but its mortality rate is far from certain. For the record, the coronavirus has been around for a long time; the only difference is that this strain is different from the previous strains.

John Bogle, the founder of Vanguard Group, emphasized the importance of staying the course and avoiding impulsive decisions. He stated, “Impulse is your enemy,” advising investors to stick to a well-thought-out plan even during market volatility. Bogle’s low-cost index funds revolutionized investing, making it accessible and profitable for the average investor.

Combining the wisdom of Aristotle, Solon, and Bogle, we see that successful investing requires a blend of practical knowledge, long-term thinking, and emotional resilience. By understanding mob psychology and maintaining a disciplined approach, investors can turn panic-based selling into opportunities for significant gains.

The masses are far from bullish, and they were far from bullish when this correction started; hence, all pullbacks should be viewed through a bullish lens.

Let’s look at the situation from a rational point of view.

To provide some perspective, consider the following: If cancer were a virus, it would be one of the most deadly viruses in history. Yet, it seems that the loss of 9.6 million lives each year to this devastating disease goes unnoticed. Until comprehensive testing is conducted on a large scale and the data is analyzed by factors like age group and pre-existing conditions, the alarming death projections issued by experts should be viewed with scepticism.

The only option being presented seems to succumb to panic and hastily retreat. However, this holds only if you are part of the crowd. Such action may offer temporary relief but comes at the expense of substantial long-term gains for those who take a more strategic approach. Insiders within a company have unparalleled knowledge of its internal operations, and their unprecedented actions during this sell-off suggest that it represents an opportunity rather than a disaster.

Insiders are buying stocks hand over fist; the sell-to-buy ratio stands at 0.32, which suggests these guys are devouring these stocks. Hence, a trend trader should not back down just because the masses are giving into fear; instead, the trend trader should view this massive correction as a once-in-a-lifetime buying opportunity.

Significant liquidity has already been injected into the market, but brace yourself because the real surge is yet to come. Helicopter money is on the verge of becoming a tangible reality. Despite the repeated mantra that things will be different this time, the truth remains that no one can resist the Federal Reserve’s determination to unleash an unprecedented bailout package.

Conclusion

The real problem is the hysteria the media and medical experts are creating out of this issue. Once mass testing gets underway, which should happen much faster than most expect, the masses will discover that this virus, while more contagious, is not that deadly. When that realization finally sinks in, the masses will change their minds just as fast as they panicked, and the markets will mount a stunning rally that will catch 90% of the players off guard. Until that moment, expect wild bouts of volatility.

Once the panic subsides, we can expect an unprecedented feeding frenzy in the market. The combination of near-zero interest rates, massive injections of two trillion dollars by the Federal Reserve, and additional billion-dollar stimulus packages aimed at boosting the economy will result in a remarkable upward surge in the market. The market will reach heights that are unimaginable by today’s standards. Moreover, the zero interest rates will compel many individuals with fixed incomes to engage in speculative investments, as they have substantial cash reserves waiting on the sidelines.

Despite all this doom and gloom, we see no reason to panic and are not even one inch closer to changing our stance. As per our “trend indicator” and not from drawing trend lines, the trend is positive, and the masses are far from bullish. Hence, individuals should stick to the original plan. The stronger the deviation, the better the opportunity

Articles of Interest

Stock Market Crash Myths and Realities