Bitcoin Price Prediction Demystified

Updated Nov 10, 2023

Let’s start by looking at this topic through a historical lens, highlighting how past events shape our understanding. We’ll then move to the present, covering the latest thoughts and perspectives as of November 10, 2023. This approach combines historical depth with current insights for a comprehensive examination.

Gold reached its bottom in 2002, and it took almost a decade for its trade to reach a high of approximately $1900 in September 2011. On the other hand, Bitcoin has shown gains of over 11,000% in less than one-third of that time. While it took nine years for Gold to show gains of about 700%, it has given up a significant portion of those gains.

We bailed out of Gold in 2011 for two reasons:

- Gold was trading at highly overbought levels, and the Gold Bug Camp was ecstatic as they believed the sky was the limit. However, they soon realized that the ground was much closer than anticipated.

The general public did not accept gold as a currency and was not interested in investing in it. Only the hard money supporters continued to believe in gold as a currency, but their numbers are decreasing every day.

Conversely, Bitcoin is viewed as a secure and trendy investment option by the masses. Gold has struggled to achieve this status and is unlikely to do so in the near future. In investing, perception is everything, and Bitcoin seems to have an edge over gold in this regard.

Does this mean the precious metals sector is dead?

Whether or not gold is considered “dead” depends on the term’s definition. Gold’s performance has been abysmal since it peaked in 2011. Even though the money supply increased dramatically during this period, the value of gold plummeted, which is not a good sign. By failing to behave as expected, gold reinforced the belief that it is an outdated relic that has no place in today’s monetary system.

It is often observed that our perception of gold’s worth is influenced by the general public’s views rather than our own analysis. We tend to follow popular trends instead of taking a personal approach. There could be various reasons behind gold’s underperformance since 2011, one of which is the lack of movement in the velocity of the money supply. However, most people are not concerned with such technicalities and prefer straightforward cause-and-effect explanations. They believe that since the money supply increased, but the value of gold did not, investing in gold is not a wise decision. This is a somewhat simplistic view of the matter.

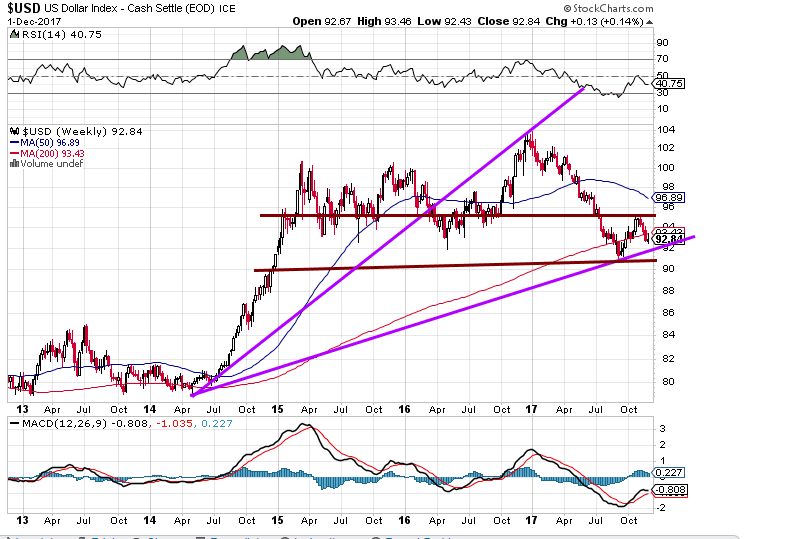

The Dollar appears to be putting in a base.

The dollar reached its peak in early 2017. However, gold did not show any significant movement. Despite the expectations of surging to new heights, it could not even surpass its July 2016 highs. In contrast, the dollar has been going through a well-deserved period of consolidation after a stunning rally in 2011. The dollar tested support and held, and as long as it does not close below 90 on a monthly basis, the outlook will remain bullish. Therefore, a monthly close above 94.50 can open up the possibility of testing the old highs.

Bitcoin Price Prediction Trends

The value of the US dollar is expected to rise soon, and as a result, the demand for gold is decreasing. Despite the weaker dollar, gold has not surpassed $1350. On the other hand, the Bitcoin market is flourishing, especially among millennials who find it more exciting and rewarding than gold. All these factors suggest that gold is not looking good. Unless it trends upwards in line with the dollar, it will likely fall within the $1000 range.

Meanwhile, Bitcoin is still experiencing an upward trend, although the market is ripe for a correction. After this correction, Bitcoin is likely to continue on its upward trajectory. Although gold will probably never experience a similar move to that of Bitcoin, it still has the potential to be a good investment in the future. For now, the trend is neutral. A weekly close below $1100 would darken the outlook for gold, but a monthly close above $1350 would indicate that it is ready to trend higher.

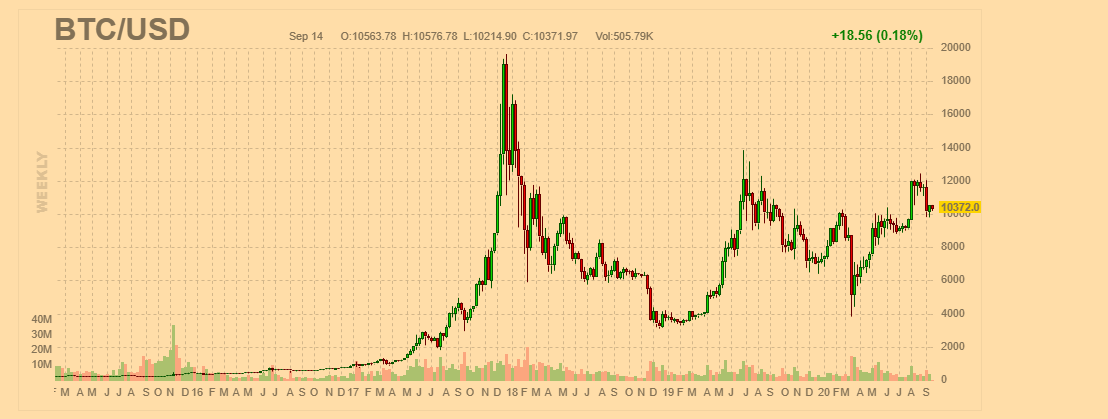

Bitcoin Price Prediction September 2020 Update

Bitcoin is currently consolidating and gaining momentum to move higher. If it successfully closes above 1200 on the monthly chart, it may test the 19,900 range and even reach as high as 24,000 before experiencing a sharp correction.

Although Bitcoin is not moving as fast as it did in the past, it is still an investment worth considering. The masses are not paying close attention to Bitcoin now, making it an excellent time to invest when it appears that nothing is happening. Bitcoin is currently trading at extremely oversold levels on the monthly charts, and therefore, investing small amounts of money each time it sheds weight may be a wise decision. Building a position slowly instead of taking one colossal bite is recommended.

Bitcoin Price Prediction 2023: Unveiling the Future

The weekly chart of GBTC

While Bitcoin (BTC) holds the potential to surge to 45K and beyond, it’s currently trading in a highly overbought range on the weekly charts. We believe it could benefit from a cooling-off period, particularly GBTC, which has advanced too rapidly.

There are two possible scenarios at this point. In the first scenario, GBTC could surge beyond the 29 to 30 range, turning the former resistance zone into support. If this pattern plays out, then GBTC is unlikely to drop below 24; even if it does, it may only be intra-day.

The second scenario involves Bitcoin and GBTC experiencing a strong pullback while our indicators also pull back. However, we are primarily looking for one key development: our indicators returning to the oversold range on the weekly charts. Whether BTC experiences a strong pullback or not, we focus on this indicator-driven approach.

If the first scenario unfolds, the odds of Bitcoin surging as high as 51K would increase to 65%. From Market Update Nov 5, 2023

Word to the wise

It’s crucial to avoid getting emotionally attached to any investment. Ultimately, the trend matters the most since no sector can continue to rise indefinitely. The chances of the Dow trading at 29,000 are much higher than those of Gold trading at $1,900.

Originally published on December 5, 2017, this content has evolved over the years, with the most recent update conducted on November 10, 2023.

There is no absurdity so palpable but that it may be firmly planted in the human head if you only begin to inculcate it before age five by constantly repeating it with an air of great solemnity. Arthur Schopenhauer

Pushing Boundaries: Exceptional Insights

Experts Making Stock Market Crash Forecasts usually know nothing

1987 stock market crash anniversary discussions- nothing but rubbish