Investing: Biding Time to Strike

May 21, 2024

Introduction:

In the world of investing, timing is everything. The art of biding one’s time and striking at the right moment can make all the difference between a profitable investment and a costly mistake. As the renowned investor Sol Palha once said, “Markets can remain overbought or irrational for much longer than most bears can remain solvent.” This wisdom highlights the importance of patience and strategic thinking in navigating the complex landscape of financial markets.

The current market conditions are a testament to the irrational exuberance that can persist for extended periods. The Federal Reserve’s support and encouragement of corporate borrowing have created an environment where companies can manipulate their earnings per share (EPS) through share buybacks. While this practice can artificially inflate stock prices, it is not sustainable in the long run.

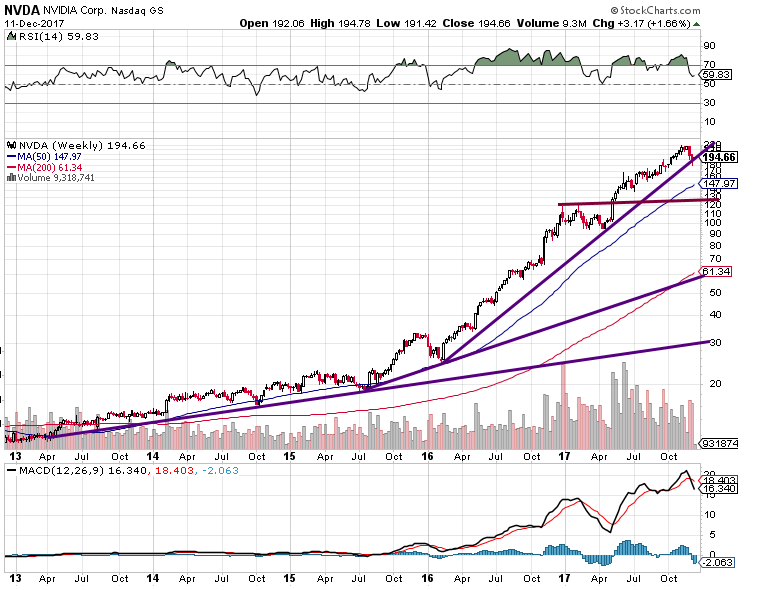

Many experts have warned about the market’s overvaluation for years, yet the bull market defies expectations. The weekly chart of the stock NVDA serves as a prime example of how a stock can remain in overbought ranges for an extended period while continuing to soar higher. Traditional technical analysis would have suggested shorting such a stock but doing so would have led to significant losses.

Examples of Bidding Time to Strike

One powerful example of biding time to strike is using mass psychology to buy during market crashes. When panic grips the markets, and investors sell in a frenzy, savvy investors recognize the opportunity to acquire quality assets at discounted prices. By going against the herd mentality and embracing the fear, these investors position themselves for significant gains when the market inevitably recovers.

Here are some examples of bidding time to strike in investing:

1. Warren Buffett’s investment in Goldman Sachs during the 2008 financial crisis: Amid the market turmoil, Buffett’s Berkshire Hathaway invested $5 billion in preferred shares of Goldman Sachs, recognizing the company’s long-term value despite the short-term panic. This strategic move paid off handsomely as the market recovered.

2. John Templeton’s foray into Japan in the 1960s: Templeton, a renowned value investor, identified the Japanese economy’s immense growth potential while recovering from World War II. By investing in undervalued Japanese companies, Templeton positioned himself for significant gains as Japan’s economy surged in the following decades.

3. Michael Burry’s bet against the housing market before the 2008 crash: Burry, featured in the book and movie “The Big Short,” analyzed the housing market and concluded that it was a bubble ready to burst. He used credit default swaps to bet against subprime mortgages, and when the market eventually crashed, his fund reaped substantial profits.

4. George Soros’ bet against the British pound in 1992: Soros, a legendary hedge fund manager, recognized that the British pound was overvalued and vulnerable to a devaluation. He built a massive short position against the currency, and when the British government was forced to withdraw the pound from the European Exchange Rate Mechanism, Soros’ fund pocketed a staggering $1 billion profit in a single day.

These examples demonstrate how astute investors bide their time, conduct thorough research, and strike decisively when opportunities arise, often going against prevailing market sentiment. These investors have achieved remarkable success in the financial markets by having the patience to wait for the right moment and the courage to act when others are fearful.

Now, considering history, learning from it can prevent repetition.

The weekly chart of the stock NVDA

Look at how long it has traded in the extremely overbought ranges, and the stock has continued to soar higher and higher. If one applied traditional Technical analysis to this stock, one would have been inclined to short this stock long ago and would have wound up breaking in the process. We are not stating that the Dow will follow this path, but nothing can stop it from taking a similar path. Remember, the main force behind this market is “hot money”. NVDA has traded in the overbought ranges on the slow-moving charts since Dec of 2013.

Tactical Investor Market Watch Aug 2019 Update

This bull market is unlike any other; before 2009, one could have relied on extensive technical studies to more or less call the top of a market give or take a few months; after 2009, the game plan changed and 99% of these traders/experts failed to factor this into the equation. Technical analysis as a standalone tool would not work as well as did before 2009 and in many cases would lead to a faulty conclusion. Long story short, there are still too many people pessimistic (experts, your average Joes and everything in between) and until they start to embrace this market, most pullbacks ranging from mild to wild will falsely be mistaken for the big one. Market Update Feb 28, 2019

Until the supply of easy money is cut off, the markets will trend higher, and corporations will continue to borrow money and use this money to buy back shares. Share buybacks artificially boost EPS, and corporate officers can walk away with huge bonuses for doing next to nothing. Rates would have to approach the 4% mark before the supply of hot money starts to ease off. Until this occurs, every strong pullback should be viewed through a bullish lens.

Until the Fed changes its mind, all sharp corrections have to be viewed as buying opportunities, and backbreaking corrections have to be placed in the category of “once-in-a-lifetime events”, provided the trend is positive. That is why we are here to inform you if the trend is positive (Up) or negative (down).

The world is going to witness a Fed that has decided to make a cocktail of Coke, Heroin, Crack and Meth and take it all in one shot. Imagine what a junkie on this combination of potent drugs is capable of doing, and you will have an idea of where the Fed is heading in the years to come. Market Update Feb 28, 2019: Forever QE & Stock Market Bull 2019

The markets are pulling back, and we are getting triggered into some of these plays. Don’t let market volatility change the angle of your perception. The masses complain about better prices when their wish comes true; they panic and flee to the hills, which they call investing. They either oscillate between misery or euphoria, and both have a dangerously short lifespan.

Conclusion: Biding Time to Strike

Bidding one’s time and striking at the moment are hallmarks of successful investing. As the legendary investor Warren Buffett once said, “The stock market is a device for transferring money from the impatient to the patient.” By embracing patience, discipline, and a long-term perspective, investors can navigate the market’s irrationality and emerge victorious.

The path to investment success is not always smooth. Still, those with the wisdom to wait for the right opportunities and the courage to act decisively when they arise will find themselves well-positioned for long-term prosperity. In a world where instant gratification often takes precedence, biding time and striking at the perfect moment remains a timeless strategy for those seeking to build lasting wealth.

Markets can remain overbought or irrational for much longer than most bears can remain solvent. Sol Palha

Perspectives Unveiled: Uncommon Insights and Ideas

Lowering Blood Sugar: A High-Fiber Diet Seems Essential