Gold Spot Price History: Is The Trend Still Strong

Take a chance! All life is a chance. The man who goes the furthest is generally

the one who is willing to do and dare. The “sure thing” boat never gets far from shore.

Dale Carnegie 1888-1955, American Author, Trainer

Updated April 2023

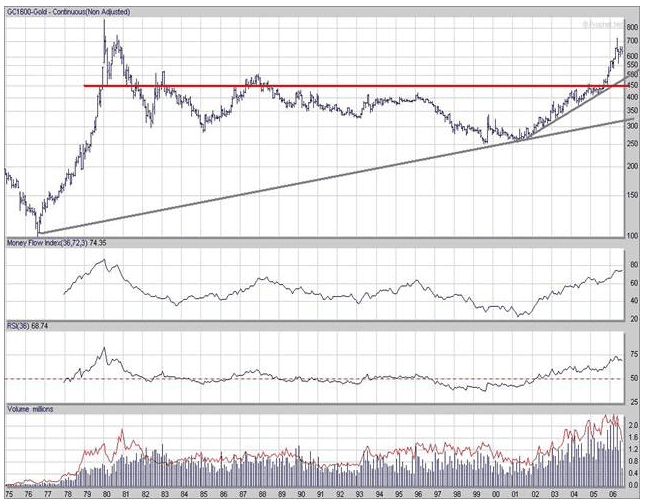

The 450 zones provided an incredible amount of resistance, and now that it has been overcome, the long-term picture looks rather interesting for gold. Usually, a break out such as this results in a test of the resistance zone; however, due to the current geopolitical situation, this might not occur. However, if the current geopolitical situation had to change even temporarily, Gold would most likely pull back very fast to test the 450 range; gold would then become a screaming buy. Please don’t sit there holding your breath for the above situation to unfold; should Gold drop to this level, look at it as a huge free bonus and load up.

Engaging Read: Technical Analysis Of Stocks And Commodities

Gold Spot Price History and New Targets

Please do not let these targets activate the greed demon within; running out there and dumping all your money into gold is not wise. No matter how good the investment looks, one should never put all their eggs in one basket. History so eloquently illustrates that those who fail to observe this simple rule usually have empty pockets. Remember that these are very long-term targets; hence do not expect them to be hit overnight.

Next zone Major of resistance is 720 (there are other zones in between, but we are looking at the long-term picture right now); a break past this should take gold to the 830-870 ranges.

2nd target will be a test of the old highs followed by a pretty rapid pullback and some sideways action; Gold will then be ready to test the 1200 zone.

The Extreme target, for now, is 1800 dollars.

General Themes Surrounding the Gold and Precious Metals Markets

While Gold is not at the ideal entry point, such points do not occur often; one such time was during the 2002- early 2003 period. In light of this, it would make sense to start nibbling at Gold now for those with no positions intending to add to these positions if Gold should correct further. Another major reason we are actually advocating the purchase of bullion after being neutral on it for so long (we were pounding the table on Gold from 2002-2003) is that it has entered the minimum oversold ranges of several of our indicators.

Last year Palladium looked more interesting than gold, and that’s where we advised our subscribers to invest their money; it turned out to be the best-performing precious metal in that time frame. We simply let our indicators examine the entire commodity sector and look for the best risk to reward investment. One must remember that it is a commodities bull, not just a precious metal bull. From Late 2003- to 2005, oil (black gold) was the best place to invest.

Remember that as each target is hit, there will be some rather hard and rapid corrections; the ride-up will not be one sweet journey. If it were, everyone would sell everything they have and buy Precious Metals. Nothing good ever comes easy; if it does, it’s usually not worth it. Our next article will look at Silver the poor men’s gold.

It is easy to be brave when far away from danger.

Aesop 620-560 BC, Greek Fabulist

Originally written in Aug 28, 2006, this piece has been regularly updated over the years, with the most recent update occurring in April 2023

Other Articles of Interest

Define Indoctrination: The Art of Subtle Brainwashing and Conditioning

The Statin Scam: Deadly Profits from a Pharmaceutical Deception

Copper Stocks: Buy, Flee, or Wait?

Dow 30 Stocks: Spot the Trend and Win Big

Coffee Lowers Diabetes Risk: Sip the Sizzling Brew

3D Printing Ideas: Revolutionize Your Imagination

Beetroot Benefits for Male Health: Unlocking Nature’s Vitality

Norse Pagan Religion, from Prayers to Viking-Style Warriors

Example of Out of the Box Thinking: How to Beat the Crowd

6 brilliant ways to build wealth after 40: Start Now

Describe Some of the Arguments That Supporters and Opponents of Wealth Tax Make

What is a Limit Order in Stocks: An In-Depth Exploration

Lone Wolf Mentality: The Ultimate Investor’s Edge

Wolf vs Sheep Mentality: Embrace the Hunt or Be the Prey

Best ETF Strategy: Avoid 4X Leveraged ETFs like the Plague

Dow Transports Validating Higher Stock Market Prices (Dec 30)

Global Trading Volume is Declining & It’s A Non Event (Dec 20)

Dogs Of The Dow Jones Industrial Average (Dec 10)

Trump Stock Market: Will Impeachment Hearings Derail This Bull (Nov 21)

Negative Thinking: How It Influences The Masses (Nov 15)

Leading Economic Indicators: Finally in Syn With The Stock Market? (Oct 28)

Dow Stock Market Outlook: Time To Dance or Collapse (Oct 25)

What Is Fiat Money: USD Is Prime Example Of Fiat (Oct 13)

Yield Curve Fears As Treasury Yield Curve Inverts (Oct 12)

Current Stock Market Trends: Embrace Strong Deviations (Oct 2)

Market Insights: October Stock Market Crash Update (Oct 1)

BTC Update: Will Bitcoin Continue Trending Higher (Sept 17)

Stock Market Forecast For Next 3 months: Up Or Down? (Sept 16)