Gold as a hedge against inflation

Updated March 2023

We were jolly bullish on gold starting from 2002, and our bullishness persisted until the beginning of 2011. In 2011, we began to express concern as the gold camp chanted “Kumbaya, my love,” and almost every Tom, Dick and Harry in the gold market were busy issuing higher targets. By the middle of 2011, there were many indications that all was not well.

Key technical indicators were giving negative divergence signals; the pound was generating solid signals that a bottom was close at hand. As mentioned, the gold camp was just too exciting for our taste. We advised our clients to close the bulk of their bullion positions and to embrace the pound as it was getting ready to break out; the rest, as they say, is history.

Fast forward to the present

From 2011 to today, gold experts have continued to proclaim that a bottom is close at hand; on each occasion, their hopes failed to materialise. Detached from reality, they held onto the illusion that gold would soar to new heights just because the Fed was printing more money. If this were true, gold should already be trading north of 3,500.

Since its inception, gold’s sole function, albeit indirectly while boldly proclaiming to do other good deeds, was to hedge against inflation. The only difference between yesteryear and today is that the Fed has decided to turbocharge the process.

One must understand that gold is very much like any other market out there. This means that, like all markets, it needs to let out some steam. As it experienced a strong run-up, it was only natural to expect gold, like any other market, to experience a back-breaking correction eventually. Gold performed relatively poorly during the market selloff in August, as noted in the following statement.

How do things stack up now for Gold prices?

We were bullish on gold from 2002 to the beginning of 2011, but by mid-2011, we advised our clients to close most of their bullion positions and embrace the dollar, as gold was experiencing a back-breaking correction. Since then, many gold experts have failed to predict a bottom, and although some contrarians are expecting a stunning turnaround, we do not share their sentiment.

However, we do believe that gold has let out a lot of steam, and the downside risk is limited from here. Shorting gold at these levels would be imprudent, as the risk-to-reward ratio is unfavourable.

If you have not invested in gold yet, now may be an excellent time to invest money into bullion as insurance against a future currency crisis. With the ongoing currency war, another crisis will likely occur at some point in the future.

Gold as a hedge against inflation: Nibble Now

Although we do not pander to naysayers who predict the end of the world, we do acknowledge that another financial disaster is bound to happen. We see this as an opportunity, not a call to flee and hide in a bunker. The astute understand this and wait for these pristine moments to present themselves.

Gold is very much like any other market and needs to let out some steam. However, if you have a long-term view, gold will trade much higher three years from now. Consider the money you put into gold bullion now as a hedge against inflation and insurance against a possible future event. Just like when you purchase insurance for your house, you do not do it because you are sure it will burn down, but you are protected in case it does.

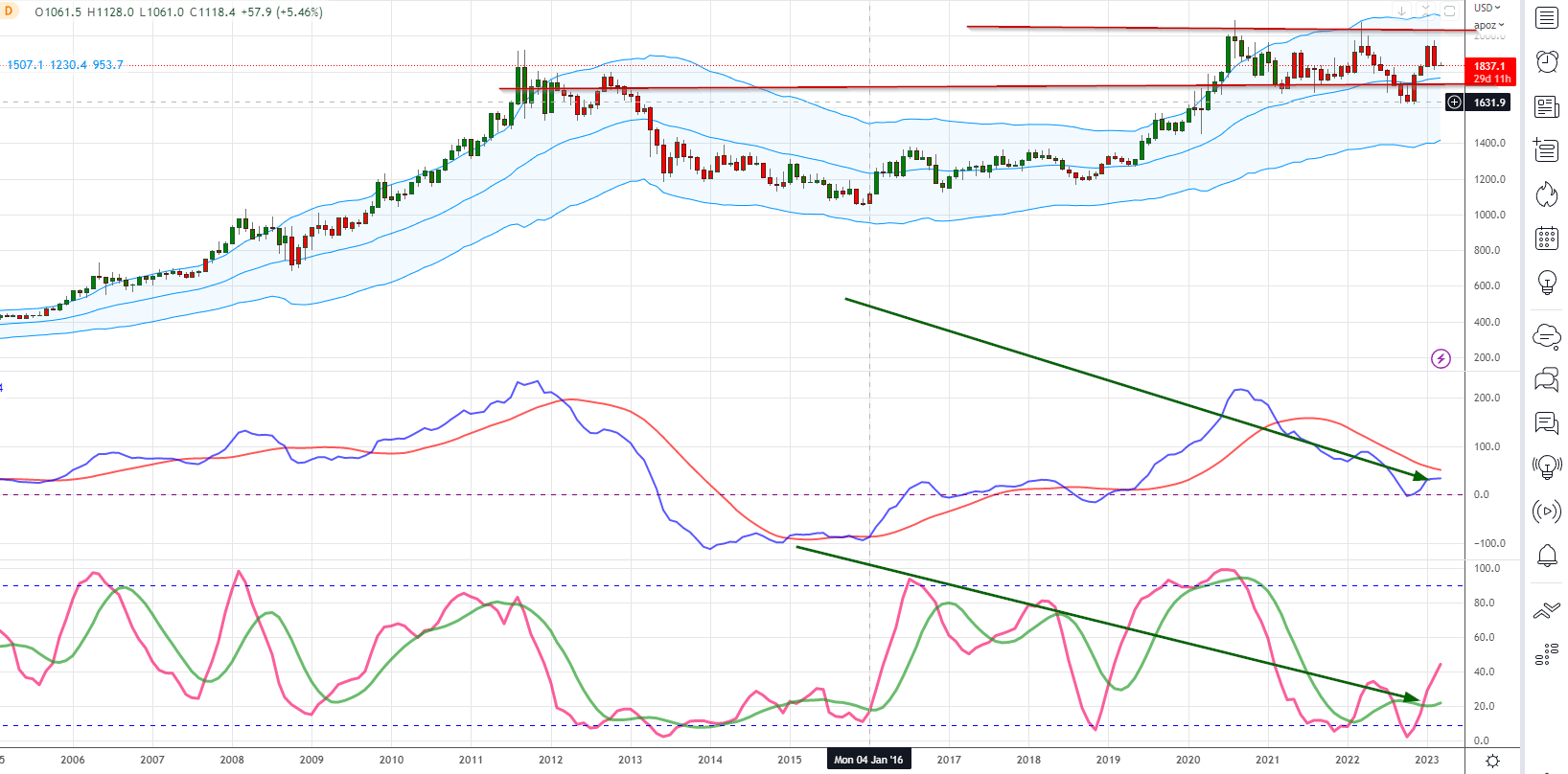

Technical Outlook for Gold Prices

Verily, the trend for Gold remains uncertain, and until it turns positive, it shall find it arduous to make any significant progress. As we have said, the risk-to-reward ratio does not favour the gold markets’ shorting. From a long-term perspective, deploying some money into Gold bullion would be prudent. The short-term chart depicted above illustrates that Gold lingers around a resistance zone.

To suggest that it has a chance of testing the $1200 range, it needs a weekly close above $1150 to $1160. The short-term uptrend shall remain valid as long as Gold doth not trade below $1100 on a closing basis. A close below $1100 shall break the higher low formation that Gold attempts to maintain, indicating that a further retest of the lows is highly probable. Should Gold close above $1160 on a weekly basis, it shall set the stage for a test of the $1220 range.

Five Year Chart Outlook

The five-year chart doth perfectly depict the harsh correction that hath befallen Gold. Diverse levels of resistance doth come into play hither. To signify that a long-term bottom hath been established, Gold requires a monthly close exceeding $1200. Until such a feat is achieved, each rally will likely falter—another crucial and significant level of resistance lieth in the $1550 range.

It will be ready to surge to new heights upon Gold trading beyond this line. Although we doth expect Gold to encounter substantial resistance in this zone, it shall prove a vital inflexion point. Wise traders ought to take heed of this area. Once Gold doth conquer this obstacle, the upward trajectory shall gain pace.

A monthly close beyond this level shall pave the way for a swift and speedy move to the $1850-$1900 range. As Gold presently tradeth nowhere near this level, there is no point in discussing higher targets.

Gold Bullion Outlook 2023

Gold is gaining momentum and poised to trade higher, whilst the dollar is approaching a multi-year peak. Whilst the dollar may test the highs of 2022 and even reach the 114 range, it will likely decline for years to come. In contrast, we anticipate gold will trade in the range of £2,500 to £2,900, with a possible overshoot to £3,600 before a multi-month top takes hold.

Investors should consider using sharp pullbacks to deploy new capital into long positions, with a focus on blue-chip gold stocks and bullion. By doing so, they can benefit from the potential upside in gold whilst hedging against the market’s volatility.

Gold Stocks Suggestions For 2023

Verily, the American dollar. Aye, the dollar hath been experiencing a massive bull run, something we did prophesy in advance. In sooth, nearly two years ago, we boldly proclaimed that the USD would trade on par with the Euro, and lo, this hath now come to pass.

The dollar presently doth trade in a highly overbought range and is poised to reach a multi-year peak that could endure for up to 11 years. Wherefore, wise investors should acquire positions in precious metals like Gold, Silver, and Palladium without delay. Time waiteth for no man, so ’tis best to take action today. Remember, today is the tomorrow that thou didst promise thyself thou wouldst change yesterday. There be several good stocks to consider in this sector; two that come to mind are RGLD and DRD.

Conclusion

Midway through 2011, there were numerous signs that all was not well. Key technical indicators were signalling negative divergence, and the dollar exhibited robust signs that the bottom was nigh. As previously mentioned, the gold camp was too jubilant for our liking. We advised our clients to liquidate the bulk of their bullion positions and adopt the dollar as it was poised to break out. As the old saying goes, the remainder is a matter of history.

From that year to now, gold experts have continued to declare that a bottom is imminent. However, on each occasion, their visions have failed to materialize. Disconnected from reality, they persist in clutching to the delusion that gold is destined to soar to new heights merely because the Federal Reserve is printing more money. If this were true, gold should already be trading north of $3,500. Since its inception, gold’s sole function, albeit indirectly while boldly proclaiming to do other good deeds, has been to undermine the dollar. The only difference between yesteryear and today is that the Fed has decided to turbocharge the process.

Remember

It must be understood that gold is much like any other market. As such, like all markets, it must release some steam. With its substantial rally, it was only natural to expect that gold, like any other market, would eventually undergo a back-breaking correction. Gold performed relatively poorly during the market selloff in August, as noted in the subsequent statement.

Gold has released significant steam, so the downside risk is somewhat limited. Shorting gold at these levels would be imprudent, for the risk-to-reward ratio is unfavourable. While many contrarians, including some Elliot wavers, predict that gold is on the verge of a stunning turnaround, we do not share the same sentiment. We would like to, but as they say, what one wants and will get is different. However, we do believe that the downside action is limited from here. If one has not invested in gold, deploying some funds into bullion would not be a bad idea, particularly for long-term investors.

Gold as a Hedge Against Inflation: Why it Should be Viewed as Insurance

Consider the money invested in gold bullion as insurance against possible future events. As the world is embroiled in a massive currency war, or what we like to refer to as the “devalue or die era fondly,” it goes without saying that we will experience another currency crisis at some point in the future. Although some may proclaim that the world is ending or that we are on the brink of a financial catastrophe, the likes of which we have never seen, we reject such pessimistic notions.

Such lamentations have been sounded for decades, yet the world endures. We acknowledge that another financial calamity is bound to occur, but rather than view it as a harbinger of doom, we see it as a disguised opportunity. The astute know this and await these propitious moments to present themselves. The next time opportunity comes knocking, be prepared to seize it instead of shunning it. When one purchases insurance, it is not because one is confident that the house will burn down but because one desires protection if it does. And indeed, gold has served as a hedge against inflation throughout history.

Other Articles of Interest

How to win the stock market game

Following stock market crash predictions

Market Timing Strategies: Debunking Flawless Predictions

How to boost your immune system: Simple Ideas