Poverty Rate Worldwide

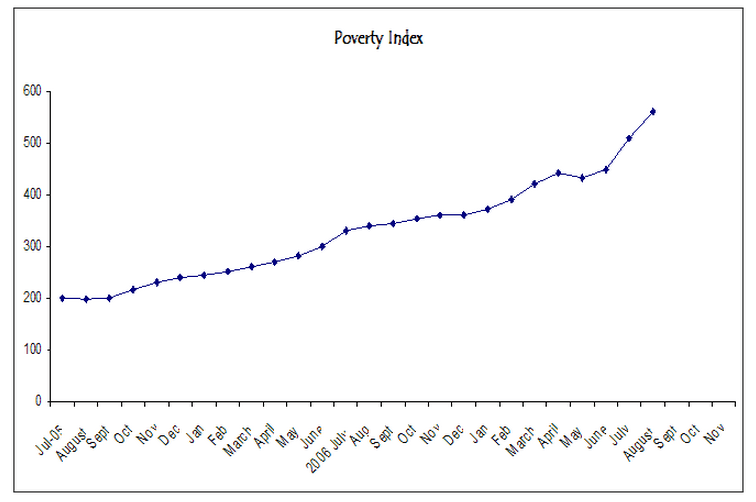

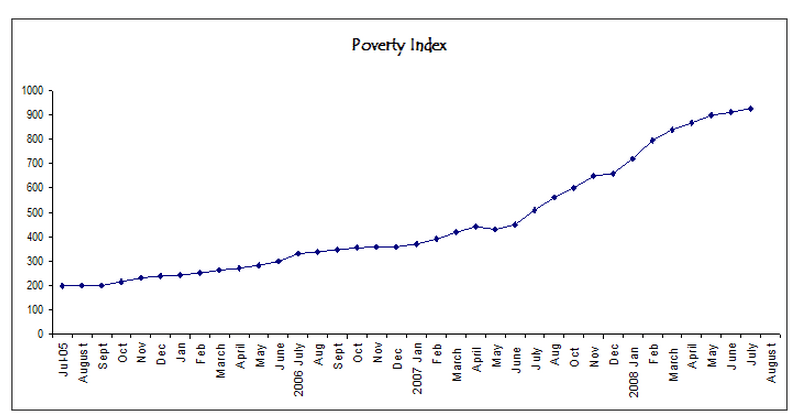

Two data sets for the poverty index are going to be provided below. The 1st chart is from June 2005 to Nov 2007. Our subscribers receive updated versions of these charts every few months. Moving forward to 2019 and nothing has changed; the poverty rate, despite massive gains in the stock market, continues to rise, indicating the gap between the rich and the poor continues to widen.

This index so far appears to be working hand in hand with the Adult index, and note that in the last two months, it has mounted a vast move upwards. In July, it jumped 60 points to 510; in September, it jumped another 50 points to 560; that’s a 24% jump in just two short months. This index illustrates that Americans are getting poorer and poorer, or at least more and more of them believe they are. Most Americans do not know the meaning of true poverty, at least not yet.

Poverty Rate Worldwide: The Poor Keep Getting Fleeced

They feel they are getting poorer because they can no longer afford most of the junk and garbage they used to buy with the money they did not have; they used credit and then depended on their weekly paycheques to make their monthly payments. Thus, a lot of them feel poorer now simply because they cannot go out and buy all this nonsense as they have used up their credit and or they have to cut back because their salaries have fallen due to losing their old jobs or being fired, etc.

Thus, you have individuals who think they are poor and, as a result, are convincing themselves that it’s okay to do whatever it takes to service their rising debts. Too many individuals feel that they must have a brand new car, the best Televisions out there, the latest DVD players, the latest fashions, etc.; it’s called keeping up with the Joneses syndrome, and they are willing to bankrupt themselves to keep up this illusion. Our advice for a long time has been to live 1-2 standards below your current level; if your friends and family start to make fun or begin to give you a hard time.

Our advice is to get rid of them, for when you are in the gutter, they will be the last ones to help you. Remember, there is a saying that God helps those that help themselves, to which we added a small extra piece, and the Devil helps all those that fall in between.

Data from June 2005 to August 2008

The sense of feeling broke will hit many individuals because, for too long, they lived a life well beyond their means, and now that they are forced to live within their means, it feels like poverty. Remember, if you are used to drinking wine instead of water, then if you are suddenly forced to drink tap water instead of bottled water, the psychological blow is very hard. For many, living within their means now is akin to leading a life of hardship.

We wonder how most Americans would react if they had to pay 12.50 plus a gallon of gas. While this might seem like a terrible joke, the reality is that individuals in Turkey are currently paying this and more for a gallon of gas. When we refer to a gallon, we are referring to the American version of the gallon, which is 3.89 litres; if we refer to the British version of a gallon which is 5 litres, then the figure would be more than 15 dollars. The most exciting part is that individuals there have adapted to this trend instead of rioting and crying. Roughly 80% of all cars driven have engines that are 2 litres or more minor (1600CC to 2000CC); in fact, we found the most common engine was the 1600CC engine.

Continue to live 1-2 standards below your means and put this money aside into AA-rated stocks or stocks that continue to lead the way with innovative ideas. Some examples are AAPL, NFLX, NVDA, NTES, SOHU, etc. Use strong pullbacks to add to or open new positions.

Other articles of interest:

A clear Illustration of the Mass Mindset In Action