Being a Permabear is a recipe for disaster.

Updated Dec 31, 2023

In investing, stubbornness and a refusal to adapt to changing market conditions can be a recipe for disaster. This is particularly true for those who adopt a Permabear stance, a consistently pessimistic mindset about the future direction of the markets, regardless of prevailing conditions or trends. This kind of stubbornness, akin to a chess player refusing to adapt their strategy despite the changing state of the board, can lead to significant financial losses.

Being a Permabear is akin to having a death wish in the financial markets. It’s a special kind of stupidity and stubbornness that even a thousand hard slaps of reality cannot alter. This short-sighted thinking, driven by an unyielding belief in impending market doom, often leads to missed opportunities and poor investment outcomes. A simple examination of any long-term chart will prove once and for all that being a Permabear is never going to pay off. No long-term chart can demonstrate that taking a bearish stance has ever paid off in the long run.

For instance, the 100-year chart of the Dow Jones Industrial Average clearly illustrates the upward trend of the market over time. Regardless of the trend line used, the chart unequivocally shows that the market tends to rise over the long term, debunking Permabear’s constant prediction of doom and gloom.

It’s important to remember that investing is not always about being right but adapting to the market and making informed decisions based on current conditions. Stubbornness and a refusal to adjust, traits often found in Permabears, are not conducive to successful investing. As the saying goes, “The market can stay irrational longer than you can stay solvent.”

The game of investing, like chess, requires flexibility, adaptability, and a willingness to change one’s strategy based on the state of the board. Stubbornness and a refusal to adapt, traits often found in Permabears, can lead to significant financial losses. By understanding the dangers of a Permabear mindset and adopting a more flexible approach, investors can navigate the turbulent waters of the financial markets and thrive amid the chaos.

The Perilous Journey of a Permabear

The financial voyage of a Permabear, characterized by chronic pessimism and an unyielding expectation of market decline, is a risky endeavour. This mindset, resistant to evolving market conditions, often results in substantial financial losses and potential bankruptcy.

Instead of acknowledging the ineffectiveness of their strategies and contemplating a shift in approach, Permabears persistently implement the same failing methods. This repetitive and futile behaviour aligns with the definition of insanity: expecting different results from repeated identical actions.

The consequences of such stubbornness are severe. Some Permabears experience a metaphorical mental breakdown, symbolized by a straitjacket, while others confront financial devastation—bankruptcy.

Investing requires adaptability, given the dynamic nature of financial markets. A perpetual pessimistic outlook, despite market conditions, is a recipe for economic disaster. As the adage rightfully claims, “The market can stay irrational longer than you can stay solvent.”

The journey of a Permabear underscores the importance of learning from past mistakes and adapting strategies in response to market fluctuations. It serves as a stark reminder of the risks of rigidity in the ever-changing landscape of investing.

Simplicity in Market Success: Focus on Trends, Ignore the Noise, and Defy Fear

The solution to the problem isn’t as complex as one might think – it’s pretty simple.

The key is to pay close attention to the straightforward factors that help determine the trend. This would mean elements such as mass sentiment, which gauges the overall mood of the market participants, and extreme patterns, which are vital tools in technical analysis. These factors are readily visible on the charts, providing a clear-cut, stripped-down view of the market’s movements.

Moreover, it’s important to understand that the news isn’t essential to this equation. One might even go as far as to say that toilet paper holds more relevance than news. This might seem like a strange comparison, but allow me to explain. At least toilet paper serves a noble function in our daily lives, a concrete and undeniable utility. Unfortunately, the same cannot always be said about the information we get from the news. It can be noise, irrelevant details that distract more than they inform.

It’s also crucial to guard against those who promote fear as a motivator for action. Anyone who advocates for such a perspective should be, figuratively speaking, thrown headfirst out of the front door. They should never be allowed back into your house or, more importantly, into your mind. The reason for this is simple: fear never pays off. The only ones who gain from fear are its vendors, those who peddle it as a commodity. They stand to make a handsome buck from the sale of fear. On the other hand, the buyers – those who allow fear to dictate their actions – stand to lose significantly. They risk losing not just their pants and their shirts but their knickers too, in a manner of speaking. Fear can lead to poor decision-making and significant losses, so it’s best to steer clear of it.

So, remember: focus on the simple factors, ignore the noise, and never let fear dictate your actions. That’s the simple solution.

Seizing Opportunities Amid Crisis

In times of crisis, such as the current coronavirus pandemic, it can be wise to nibble at stocks with a long-term perspective. Rather than investing all your funds at once, consider supporting in smaller increments to average your entry price and protect against dips in the stock market.

At the Tactical Investor, we focus on longer-term plays that typically span several months. However, in times of crisis like these, we’re seeing a surge in the potential for huge profits, so our time frames have lengthened accordingly. While the short-term market may seem like a bloodbath, it’s also a breeding ground for exceptional opportunities that can herald the next bull market.

It’s easy to invest when everything seems rosy, but unfortunately, that’s when most assets are already overpriced. When times appear bleak, that’s precisely when the best deals can be found. So, consider taking a closer look at the market during these volatile times, and you may discover some hidden gems. Tactical Investor Update March 18, 2023

Unmasking Fear Tactics: A Critical Look at Pessimistic Predictions

In the financial world, fear can be a powerful tool. Figures like Marc Faber, known for his publication, the Gloom, Doom, Boom Report, often employ fear to bolster their arguments. With a staggering 66% of the words in his report being negative, Faber capitalizes on the principles of herd psychology, influencing individual emotions and behaviours through collective sentiment.

Faber’s strategy hinges on the fear and uncertainty that often permeate financial markets, leading investors to make emotionally charged decisions rather than ones based on rational analysis. However, despite his persistent doomsday predictions, a review of his track record reveals a pattern of consistent inaccuracies, a common trait among those who rely more on sensationalism than solid data.

Similarly, another financial figure, Jim Rogers, frequently forecasts catastrophic market crashes. This repetition of impending doom can trigger a self-fulfilling prophecy as investors, influenced by mass psychology, panic and sell off their assets.

Heeding such fear-mongers can lead to financial disaster. It’s crucial to approach their advice with a healthy dose of scepticism and thorough research. While it’s not advisable to completely disregard these financial gurus’ warnings, it’s equally important not to accept them at face value.

A video analysis of Marc Faber’s predictions underscores the importance of critical thinking and independent decision-making in the face of fear-based tactics. It is a stark reminder that fear, while a powerful motivator, should not cloud our judgment.

Understanding the principles of herd psychology can help us navigate financial markets more effectively, enabling us to make decisions based on rational analysis rather than fear. After all, in investing, a clear mind and a well-informed strategy often yield the best results.

Then he goes on to state the party is going to end in 2018

Contrarian Wisdom: The Perils of Being a Permabear

Investing should not be a stressful endeavour. Succumbing to fear, a common pitfall for many investors can lead to dangerous outcomes. This is particularly true for those known as Permabears, investors who maintain a persistent pessimistic outlook, often leading to significant financial losses.

Investing is an art, not a science. It’s meant to be enjoyed, not feared. A prime example of the perils of fear-based investing was the COVID crash of 2020. Those who let fear dictate their decisions during this time of uncertainty often found themselves on the losing end when the markets rebounded.

Interestingly, despite the strong market recovery, many investors remained cautious, a testament to the power of herd psychology. This phenomenon, where collective sentiment influences individual behaviours, can lead to irrational decision-making, particularly during market volatility.

The key takeaway is the importance of maintaining a calm and rational mindset in the face of market volatility. Understanding the principles of herd psychology can help investors navigate the financial markets more effectively, making decisions based on logical analysis rather than fear. After all, clear thinking and a well-informed strategy often yield the best results in investing.

Diving into historical case studies, we unravel the dismal outcomes for those embracing a permanent bearish stance. This journey through financial history exposes the severe losses incurred by those who yielded to fear, illustrating the high cost of allowing fear to dictate investment decisions. In this exploration, we’ll witness how, time and again, the prudent choice is to resist the grip of fear and adopt a more rational and resilient investment approach.

Case Study: Unveiling the Triumph of the New Bull Market in 2009

This bull market is unlike any other; before 2009, one could have relied on extensive technical studies to more or less call the top of a market, give or take a few months; after 2009, the game plan changed, and 99% of these traders/experts failed to factor this into the equation. Technical analysis as a standalone tool would not work as well as before 2009 and, in many cases, would lead to a faulty conclusion.

Long story short, there are still too many pessimistic people (experts, your average Joe, and everyone). Until they start to embrace this market, most pullbacks ranging from mild to wild will falsely be mistaken for the big one.

The results speak for themselves; most of our holdings were in the red during the pullback, but now they are in the black, proving that one should buy when blood flows in the streets. It is a catchy and easy phrase to spit out but very hard to implement because the masses will opt for being shoved when push comes to shove.

Marc Faber: The Peril of Being A Permabear

This dude has predicted predictions calling for the mother of all crashes since the inception of this bull (2009), but the only thing that has crashed so far are his predictions of a crash. He would probably make an excellent science fiction writer, for he seems to spend a lot of time concocting scenarios that have a very low probability of coming to pass.

During a heated exchange, an exasperated nation confronted Faber’s consistent bearish predictions since 2012. Nations argued that those who invested in stocks during that period saw substantial gains, questioning Faber’s accuracy. Faber defended his call in response, citing a 2012 correction as evidence. He remained resolute, believing that his warnings would ultimately be appreciated. Faber brushed off the criticism, stating that he is accustomed to detractors. The clash highlighted the contrasting views on market trends, leaving the question of who will ultimately prove right.

“I tell you when all is over people will love me for having warned them to have all their money in stocks,” added Faber. “I’m used to people like you who always attack me.”

“You’re accusing me of being wrong? I laugh at it,” Faber concluded. CNBC

Interesting Must Read: The Rich Get Richer And The Poor Get Poorer: War On Wealth

Case Study 3: The 1987 Crash

The 1987 crash, also known as Black Monday, is a classic example of the dangers of succumbing to fear. On October 19, 1987, the Dow Jones Industrial Average fell by 22.6%, the most extensive one-day percentage loss in history. The crash was triggered by many factors, including a rapidly rising market, high interest rates, and computerized trading that accelerated the sell-off.

Many investors, overcome by fear, sold their stocks in a panic, resulting in massive losses. Permabears, those who are consistently pessimistic about the market, were vindicated in the short term, but their victory was short-lived. The market began to recover by the end of 1987; by 1989, it had regained all of its losses. Those who panicked and sold their stocks during the crash missed this recovery. The 1987 crash is a stark reminder of the dangers of fear-based investing. Even in the face of severe market downturns, it’s crucial to maintain a calm and rational approach to investing.

Case Study 4: The Dot-Com Bubble Burst of the Late 1990s

Another notable example is the dot-com bubble bursting in the late 1990s. Leading up to the crash, investor enthusiasm for internet-based companies had driven tech stocks to dizzying heights. However, by 2000, it became clear that many of these companies were overvalued, and the bubble burst.

Permabears who had warned of an impending crash seemed to be proven right, and fear again gripped the markets. Many investors panicked and sold their stocks, leading to significant losses. However, those who held onto their investments or invested in companies with solid financials and business models could weather the storm.

In the aftermath of the crash, many tech companies, such as Amazon and Google, emerged more robust and have since become some of the most valuable companies in the world. This serves as another reminder of the dangers of fear-based investing. Even in the face of market downturns, making investment decisions based on rational analysis rather than fear is crucial.

FAQ on Permabears and Market Downturns

Q: What is a Permabear?

A: A Permabear is an investor with a consistent bearish stance on the market, often predicting declines and favouring defensive strategies.

Q: Why is being a Permabear criticized?

A: Criticism arises because the stock market has historically trended upwards, suggesting that Permabears may miss out on growth opportunities by focusing on potential downturns.

Q: What evidence challenges the Permabear perspective?

A: Long-term market trends typically show upward trajectories, indicating that a bearish outlook may not be the most profitable stance over time.

Q: What should be considered when determining investment trends?

A: Investors should consider overall market sentiment, technical analysis patterns, and long-term trends rather than making decisions based on fear or news alone.

Q: What is the perspective on investing during crises?

A: In times of crisis, adopting a long-term view and investing incrementally can be wise, as such periods may offer unique profit opportunities.

Q: What approach is suggested during market downturns?

A: The suggested approach is to consider investing when the market is down, as this is often when valuable opportunities arise, potentially leading to significant long-term gains.

Other Topics Of Interest

Volatility Harvesting: The Badass Guide to Rock It

Is Inflation Bad for the Economy? Only if You Don’t Know the Truth

Contagion Theory: Unleashing Market Mayhem Through Panic

What is the Minsky Moment? How to Capitalize on It

Dunning-Kruger Effect Graph: How the Incompetent Overestimate Their Skills

Schrödinger’s Portfolio: Harness It to Outperform the Crowd

Allegory of the Cave PDF: Unveiling Plato’s Timeless Insights

What is Relative Strength in Investing? Unleash Market Savvy

Dow 30 Stocks: Spot the Trend and Win Big

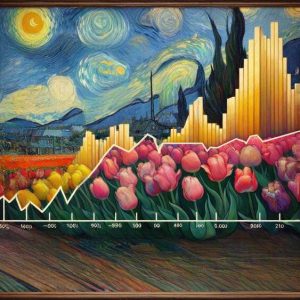

Blooms and Busts: Navigating the Tulip Bubble Chart Phenomenon

Out-of-the-Box Thinking: Be Wise, Ditch the Crowd

Stock Market Psychology Chart: Mastering Market Emotions

Stock Market Forecast for Next 3 Months: Trends to Watch, Predictions to Ignore

Lone Wolf Mentality: The Ultimate Investor’s Edge