Market Timing Strategies: Embracing Opportunities Amidst Fear and Fluctuations

Updated May 04, 2024

Can you point to one market crash or so-called end-of-the-world financial event that lead to the demise of the world or the financial markets? Nobody can, even those loud-mouthed slick snake oil salesmen can’t. Sol Palha

The financial world abounds with doom and gloom predictions. Yet, history has demonstrated that no market crash or event has ever brought about the demise of the world or financial markets. Instead of succumbing to fear-mongering tactics, investors should focus on the opportunities that arise during every fall or crash. Regeneration is an inherent aspect of the market cycle, and those who position themselves appropriately can reap the rewards.

To avoid the most devastating events, it is essential to use tools such as trend indicators, mass psychology, and sentiment data. These tools aid investors in making informed decisions and avoiding losses. Additionally, it is crucial to secure profits from profitable positions and refrain from relying on commercial media, which often perpetuates fear and confusion.

The key to market success lies in avoiding herd mentality and focusing on the regeneration factor. By adhering to discipline and concentration, investors can conquer fear and capitalise on the opportunities that arise from market fluctuations.

Market Timing Strategies: Navigating Opportunity and Emotional Pitfalls

Saying that Could help fine-tune market timing strategies:

Before we continue, the following quotes from some brilliant individuals illustrate the value of keeping a cool head during the panic.

“the time to buy is when there’s blood in the streets.” – Baron Rothschild

Losing your head in a crisis is an excellent way to become a crisis. – C.J. Redwine

Sooner or later comes a crisis in our affairs, and how we meet it determines our future happiness and success. Since the beginning of time, every form of life has been called upon to meet such a crisis. – Robert Collier

Successful people recognize crisis as a time for change – from lesser to more excellent, smaller to bigger. – Edwin Louis Cole

It’s not always easy to do what’s unpopular, but that’s where you make money. Buy stocks that look bad to less careful investors and hang on until their real value is recognized. I’ve never bought a stock unless, in my view, it was on sale. Buy on the cannons and sell on the trumpets. – John Neff

To win as a contrarian, you need the right timing and have to put on a position in the appropriate size. If you do it too small, it’s not meaningful. If you do it too big, you can get wiped out if your timing is slightly off. The process requires courage, commitment and an understanding of your psychology. – Michael Steinhardt

I will tell you how to become rich…Be fearful when others are greedy. Be greedy when others are fearful. – Warren Buffett

To succeed as a contrarian, you must recognize what the crowd believes, have concrete justification for why the majority is wrong, and have the patience and conviction to stick with what is, by definition, an unpopular bet. – Whitney Tilson

One of the Best Market Timing Strategists

To buy when others are despondently selling and when others are euphorically buying takes the most incredible courage but provides the most significant profit. Bull markets are born in pessimism, grow on scepticism, mature on optimism and die on euphoria. Maximum pessimism is the best time to buy, and time of maximum optimism is the best time to sell.

If you want to have a better performance than the crowd, you must do things differently from the crowd. – Sir John Templeton

Humans are prone to herd because it is always warmer and safer in the middle of the herd. Indeed, our brains are wired to make us social animals. We feel the pain of social exclusion in the same parts of the brain where we feel real physical pain. So, being a contrarian is a little bit like having your arm broken regularly. – James Montier

Many give advice, but few offer guidance. – Anonymous

Market Timing Strategies and Navigating Panic:

In investing, panic is often viewed as an opposing force, leading to irrational decisions and financial losses. However, successful investors like Warren Buffett, Benjamin Graham, and Peter Lynch have demonstrated the power of harnessing panic to their advantage. Adopting a contrarian approach, they buy when others are selling in a frenzy, acquiring assets at a discount, and profiting during the market recovery. This strategy requires a strong stomach and a long-term perspective, going against the crowd.

During market turmoil, keeping a level head is crucial. As Buffett said, “The most important quality for an investor is temperament, not intellect.” It’s important to remember that panic often creates opportunities. When the masses sell, it indicates that the market is oversold and bargains are available. This is when insiders and the ultra-wealthy often step in, following Baron Rothschild’s famous advice, “The time to buy is when there’s blood in the streets.”

Astute investors recognize that market trends are interconnected across time frames. Investors can identify bullish or bearish reversals by analyzing hourly, daily, weekly, and monthly charts and making informed decisions. Technical analysis indicators, price action, and volume patterns also provide valuable insights into market sentiment and potential shifts in direction.

In conclusion, while panic can be intimidating, it is often short-lived. Investors who master the art of patience and discipline, focusing on long-term prospects, will be rewarded. As Buffett wisely noted, “The stock market is a device for transferring money from the impatient to the patient.”

If you want to rob a man, the best way is to polarise those around him. If you’ll steal from the masses for decades to come, the best approach is to induce a state of helplessness via hysteria. Please step back and look at how easily the crowd has allowed Congress to rob them blindly for decades.

Market Timing Strategies and the Mass Mindset:

In the world of investing, the behaviour of the masses can provide valuable insights and opportunities. As the saying goes, “Be thankful for the morons of the world, for they provide investors with data to increase their net worth.” The panic and emotional decision-making of the crowd often presents savvy investors with lucrative moments to buy. When the masses are nervous and selling, it is a signal for contrarian investors to start buying. Though seemingly counterintuitive, this strategy has been employed by successful investors who recognize that market trends are interconnected across time frames.

As the wise man Baron Rothschild noted, “The time to buy is when there’s blood in the streets.” This sentiment is echoed by the ancient Chinese general Sun Tzu, who advised, “Amid the chaos, there is also opportunity.” Their wisdom underscores the importance of maintaining a disciplined and rational approach, even when others are gripped by fear.

The perils of emotional investing are well documented. During market downturns, it is common for investors to make impulsive decisions, often selling at the worst possible time. This behaviour is driven by the mass mindset, a powerful force that can lead to herd mentality and irrational choices. As the saying goes, “Misery loves company, and stupidity demands it.” Those who give in to the emotional tide often regret it, as they sell at a loss only to see the market recover soon after.

The key to success lies in adopting a different approach that may invite criticism from the masses. As Master Oogway, the wise mentor from the Kung Fu Panda franchise, said, “The journey of a thousand miles begins with a single step.” Investing can be interpreted as taking the first step towards a disciplined and patient strategy, even if it goes against the grain.

Investors can make informed decisions by understanding mass psychology and recognizing the opportunities presented during moments of panic. Those who can maintain a level head, go against the crowd, and focus on the long-term prospects will be rewarded. As the ancient Greek philosopher Heraclitus wisely stated, “The only constant in life is change,” reminding us that market trends will shift, and those who adapt and learn from the masses will be poised to succeed.

Other Articles of Interest

The Mob Psychology: Why You Have to Be In It to Win It

What Is Collective Behavior: Unveiling the Investment Enigma

What is the Rebound Effect? Unlock Hidden Profits Now

Dividend Collar Strategy: Double Digit Gains, Minimal Risk, Maximum Reward

Dividend Capture Strategy: A Devilishly Delightful Way to Boost Returns

BMY Stock Dividend Delight: Reaping a Rich Yield from a Blue-Chip Gem

Define Indoctrination: The Art of Subtle Brainwashing and Conditioning

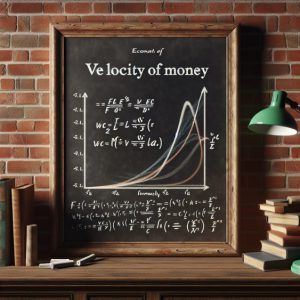

What Is the Velocity of Money Formula?

What is Gambler’s Fallacy in Investing? Stupidity Meets Greed

Poor Man’s Covered Call: With King’s Ransom Potential

How to Start Saving for Retirement at 35: Don’t Snooze, Start Now

The Great Cholesterol Scam: Profiting at the Expense of Lives

USD to Japanese Yen: Buy Now or Face the Consequences?

How is Inflation Bad for the Economy: Let’s Start This Torrid Tale

Copper Stocks: Buy, Flee, or Wait?

Investment Pyramid: Valuable Concept Or?