Dow Jones Utility Average: Unveiling the Alternative Dow Theory

Dec 30, 2024

The Hidden Oracle of Wall Street: How Utility Stocks Predict Market Destiny

In the labyrinth of Wall Street indicators, one of the most overlooked yet powerful prophets of market direction isn’t found in complex algorithms or artificial intelligence – it’s hidden in plain sight within the mundane world of utility companies. The Dow Jones Utility Average (DJUA), tracking 15 of America’s largest utility providers, might seem like the wallflower at the market’s grand ball. After all, what could be less exciting than companies delivering electricity, gas, and water to our homes?

But therein lies the brilliant deception. While investors chase the latest tech unicorns and cryptocurrency phenomena, this index of essential service providers quietly serves as Wall Street’s crystal ball. These companies, including giants like Consolidated Edison and Duke Energy, don’t just keep our lights on – they illuminate the path of future market movements with uncanny precision.

The Tactical Investor theory has uncovered something remarkable: this seemingly boring index often moves ahead of broader market trends, acting as a silent sentinel warning of impending market shifts. Think of it as the market’s early warning system—when utilities start their dance, the rest of the market often follows suit. This phenomenon challenges conventional wisdom and forces us to question: Why do the most basic companies in our economy hold such prophetic power over market direction?

Dow Jones Utility Average: What Insights Can It Offer

The Dow Jones Utility Average can offer insights into market trends and potential signals for investors. Traditionally, the utility sector is considered a defensive sector known for its stability and reliable dividend payments. As such, fluctuations in the Dow Jones Utility Average can provide indications of market sentiment and risk appetite.

The upward trend in the Dow Jones Utility Average may suggest a more cautious and risk-averse market sentiment. Investors tend to allocate their funds towards utility stocks during uncertain or volatile market conditions, seeking stability and income generation. Conversely, a downward trend in the Dow Jones Utility Average may indicate a more optimistic market sentiment, with investors willing to take on higher-risk investments.

The Dow Jones Utility Average can provide insights into interest rate expectations. Due to their capital-intensive nature and reliance on borrowing, utility stocks are often sensitive to changes in interest rates. When interest rates are expected to decline or remain low, utility stocks may become more attractive to investors seeking higher dividend yields. Conversely, rising interest rates may lead to a decrease in utility stock prices.

Monitoring the Dow Jones Utility Average can give investors insights into market sentiment, risk appetite, and interest rate expectations, which can help inform their investment decisions.

To gain deeper insights into our utilization of the Dow Utilities for the conclusion above, consult the Tactical Investor Alternative Dow Theory. Explore the nuances and dynamics at play.

https://tacticalinvestor.com/alternative-dow-theory/

https://tacticalinvestor.com/dow-theory-no-longer-relevant-better-alternative-exists/

DJUA: Unleashing Opportunities with Contrarian Wisdom.

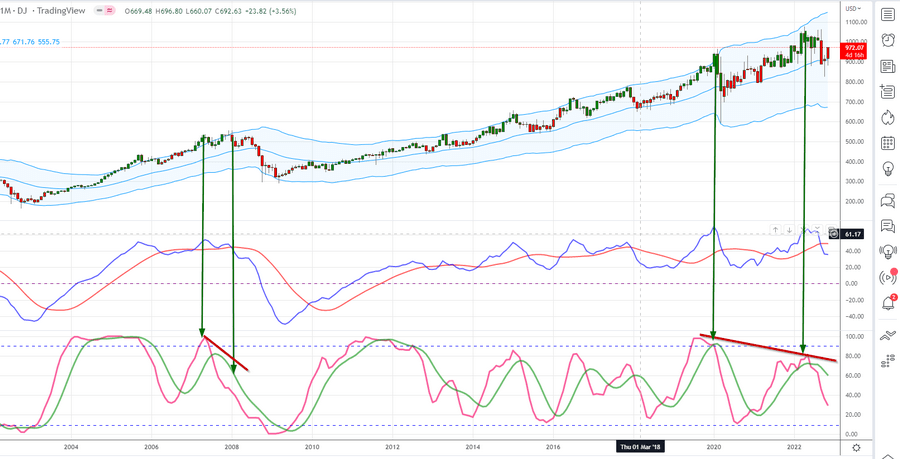

Using the DJUA as a contrarian indicator can enable investors to exploit market overreactions and uncover opportunities others may have missed. For instance, if the DJUA reaches its peak before the broader market, it could be interpreted as a signal to reduce exposure and wait for the market to experience a correction before making new investments.

When combined with mass psychology and technical analysis, the DJUA can be a powerful tool for investors. By understanding the power of groupthink psychology and avoiding the herd mentality, investors can potentially identify opportunities for long-term growth. Technical analysis can identify trends and support and resistance levels in the market.

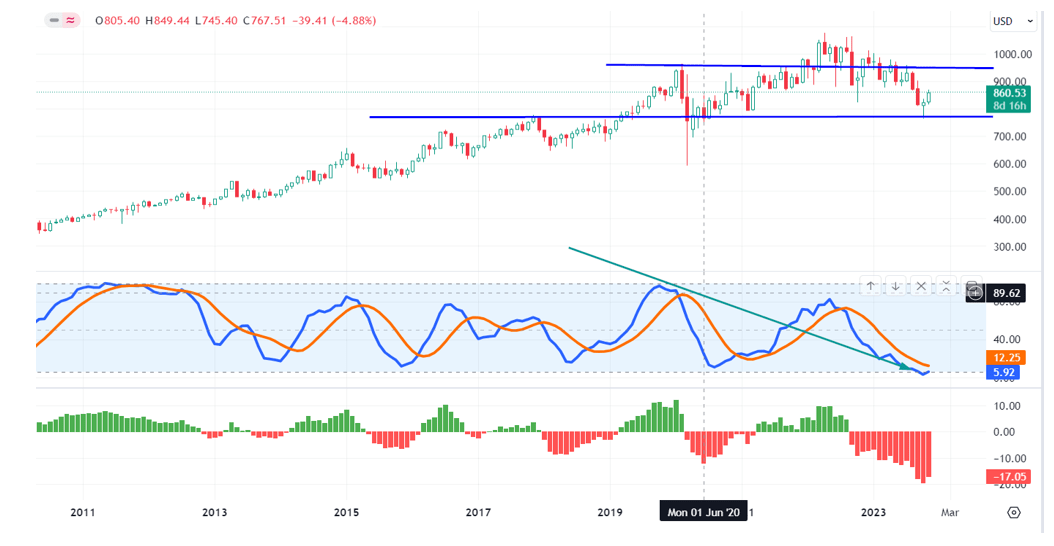

Source:tradingview.com

The above chart supports that the markets are headed for one more corrective wave based on historical patterns. We advised our clients to be prepared for solid waves of volatility, and this outlook came true. We also stated that the markets would likely rally firmly well into 2023.

Is the Dow Jones Utility Average a Reliable Market Tops and Bottoms Indicator?

Using the Dow Jones Utility Average as an indicator of market tops and bottoms can be illustrated with some examples. Let’s consider a hypothetical scenario:

The Dow Jones Utility Average consistently shows an upward trend during economic uncertainty, when investors are concerned about market volatility and potential downturns. Utility stocks, known for their stability and reliable dividends, attract increased investor interest as investors seek safer investments. This increased demand for utility stocks can be seen as a signal that the broader market may be reaching the top or experiencing a correction. Investors interpret this as a reflection of risk aversion and a desire to protect capital.

Conversely, during economic recovery and market optimism, the Dow Jones Utility Average underperforms or shows a downward trend. This could indicate that investors are shifting their focus towards more growth-oriented sectors, such as technology or consumer discretionary stocks, which exhibit more robust performance during bullish phases. In this scenario, the relative weakness of utility stocks may be interpreted as a signal that the broader market is reaching a bottom or entering a bullish phase.

Dow Utilities and Stock Market Outlook: Nov 2023 update

They have generated a substantial positive divergence signal on the weekly charts. While this is not as powerful as a positive divergence signal on the monthly charts, all sharp pullbacks should be embraced until one of the following occurs.

- Until the trend changes, this usually won’t occur for several weeks in a row. Looking at historical records, the intermediate trend is unlikely to change for at least six weeks.

- IDU surges to the 86 to 90 range, or DJU rushes to the 990 to 1002 range; at that point, the situation would need to be re-examined to determine if the pattern on the monthly charts changed. The odds of the way changing are relatively low as the Dow Utilities are trading in the highly oversold zone on the monthly charts, as evidenced by the monthly chart below.

Dow Utilities should exhibit outstanding performance after generating a positive divergence signal. This, in turn, could catalyze the broader market, particularly undervalued sectors. It’s a strategic shift from the dominant tech giants to exploring overlooked opportunities. Overall, as of Nov 2023, the prevailing path appears upward.

Incorporating Technical Analysis (TA) with a pivotal focus on “combining” and intertwining it with the profound insights of Mass Psychology creates an unparalleled and robust strategy. Although short to mid-term market fluctuations spanning 6 to 20 months may seem notable, their significance fades compared to the enduring effectiveness demonstrated by Mass Psychology over decades of observation.

This harmonious fusion of TA and Mass Psychology empowers investors and analysts to leverage historical wisdom while navigating the present complexities. By adopting a Mass Psychology-rooted long-term perspective, one gains a profound understanding of market behaviour, enabling more informed and confident decision-making that transcends momentary market noise.

In essence, the skilful blending of these potent disciplines offers a masterful approach to comprehending and engaging with financial markets, leading to superior outcomes and strategic advantages for those who embrace it. With this time-tested and refined strategy, you can navigate the ever-evolving economic landscape with renewed assurance and conviction.

Other Articles of Interest