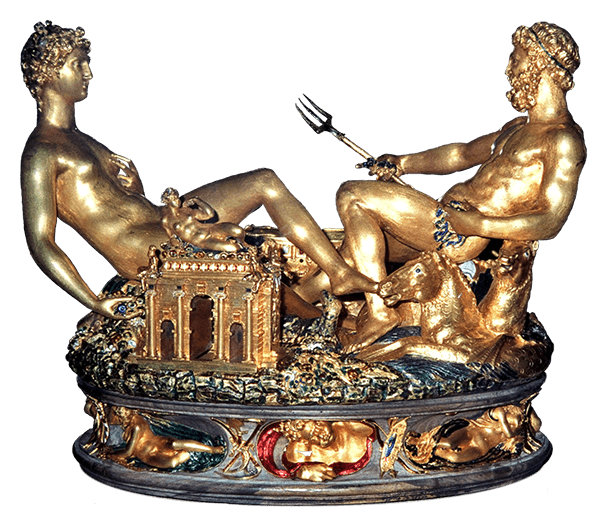

Paris erotic museum cleans up

Before we get to this topic, look at how realistic sexbots are becoming. Sales data indicates that sales are going through the roof and as the more realistic these robots, the more these numbers are expected to rise. At some point, these numbers will explode as sex will become a commodity

The Paris erotic museum cleans up

Other Articles of Interest

Dominant Stock Market Trends under President Trump (Nov 22)

Bears State Crude Oil Destined to Crash-Utter Rubbish (Nov 18)

50 Trillion in Cash illustrates Mass Anxiety-Dow Industrials will soar not Crash (Nov 16)

Trumps victory Does not Sink Global Markets Proving Experts are Jackasses (Nov 10)

Trump-The New Stock Market vix Factor (Nov 6)

Crude Oil Market-Higher prices or Market Crash (Oct 28)

American’s fear the Stock Market-Understanding Market Sentiment key to winning (Oct 24)

Foreign banks Dump whopping 356 billion in US Debt (Oct 20)

Corporate Americas Share buyback Binge only force Keeping Stock Market Bull Alive (Oct 13)

Stock Market Earnings Recession Nothing to Fear-Market Still Trending higher (Oct 7)

Fed Directly limiting Market Downside Action-Expect Stock Market rally not Crash (Oct 6)

Dow theory no longer relevant-Better Alternative exists (Sept 30)