Psychology Of Investing: Follow The Trend

Updated Jan 31, 2024

Repetition is the father of all sins, stupidity is the mother, and not knowing when to keep one’s mouth shut is the grandfather of them all. Sol Palha

If you understand the mechanics of the mass mindset, you can use it to your advantage when investing in the stock market. The mass mentality is often driven by fear and emotion, leading to hasty and irrational decisions that can negatively impact an individual’s investment portfolio. On the other hand, contrarian thinking involves going against the crowd and making informed decisions based on research and analysis.

By embracing a contrarian approach, you can potentially find opportunities for growth in the market when others are selling in a panic. However, it’s essential to understand that being a contrarian does not mean blindly going against the crowd; it requires careful consideration of market trends, company performance, and other relevant factors. The goal is to make well-informed investment decisions that are not swayed by the emotions and biases of the masses.

Hive Mentality

The masses repeat the same mistakes when investing, never learning from past experiences. It’s like the movie Groundhog Day, where the main character is stuck in a repeating cycle. The difference is that he eventually finds a solution, while the masses don’t even realize they have a problem.

Recognizing the problem is crucial to finding a solution; this is where the masses fail. The mass mindset can hinder investing, leading to poor decisions and missed opportunities. To be successful, it’s essential to understand the dynamics of crowd psychology and adopt a contrarian approach, breaking away from the pack mentality.

The Mass Mindset in Action

- The stock appears to be stagnating, indicating that it’s not worth holding. I should shift my focus to something more promising.

- The stock’s sudden plummet presents a fortunate opportunity to capitalize on its downfall.

- Despite lacklustre earnings, people are naively driving up the stock price. However, a reality check is due, and the stock will inevitably experience a significant correction.

- My intuition was correct; the stock had indeed crashed. Fortunately, I did not buy it, as I’ve escaped a potential loss. (Note: Those with a losing mindset focus only on negative aspects, failing to appreciate the positive.)

- This stock was supposed to fail, but it has somehow surpassed expectations. Perhaps I should have taken the risk and invested in it. (Note: Only halfway through the fifth stage will a losing mindset consider venturing out.)

- The stock is soaring, and I’m making a profit. Now is an excellent time to share the good news with others and consider further investing.

- Despite the stock pulling back, I remain undaunted. I’ll take advantage of the dip and invest more.

- I knew it would recover, and I’m now enjoying even greater profits. Next time, I’ll invest even more during a pullback. (Note: The losing mindset fails to recognize when a stock hasn’t reached a new high; instead, all that matters is that it’s going up.)

- The stock is dipping again, presenting an opportunity to buy in at a low price. With earnings looking favourable, now’s the time to increase my investment.

- Although the stock has experienced a significant setback, I remain optimistic it will recover. Blind faith is a mistake, but I’ll use this opportunity to buy more and average down.

- The outlook may not be promising, but I’ll hold onto the stock a little longer, hoping for a change. Although the stock previously skyrocketed and is now experiencing a significant pullback, the worst is over, and it’s bound to go up.

- The stock is dead in the water, and I must get out while I can. I knew it was garbage and should never have invested in it. (Note: Panic leads to poor decision-making, causing a losing mindset to bail out just as a stock starts to bottom out.) In other words, the secret programmed desire to lose syndrome has achieved its objective.

- Slowly but surely, the stock shows signs of a possible new uptrend, and the trader who missed out due to a losing mindset is no longer in the market. Regrettably, they let panic improve and failed to see the stock’s potential. Thoughts that were going through his mind before he pressed the sell button. I will never look at this or any stock like this again. Moreover, comparatively speaking, I knew it was garbage. Why did I ever buy it in the first place?

The Psychology of Investing: Contrarian Insights

Stock markets often continue reaching new highs for longer than most experts predict. If sceptics warn that the market is overvalued, it will likely climb higher. As the saying goes: “markets climb a wall of worry.” Traditionally, the market is believed to predict the future state of the economy. Therefore, current prices reflect future expectations rather than the present reality.

While waiting until a stock has had a substantial increase before buying may seem tempting, it’s essential to consider why someone would pay more for the store in the future. Using the “Theory of Mind” thinking, which has been shown to improve investment performance, it’s essential to understand that other investors will also be aware of the stock’s growth potential. Therefore, the price is likely to continue increasing.

Those holding stocks are reaping the rewards of their investments, while those not in the market will likely eventually give in and get in. Even those who have sold the market short will ultimately have to buy back in, leading to built-in buying and price increases.

New highs tend to beget new highs – for longer than all the pundits say they will. An old saying is “Markets climb a wall of worry“, and therefore, as long as people are on TV talking about how now the market is too expensive, chances are, it will go higher.

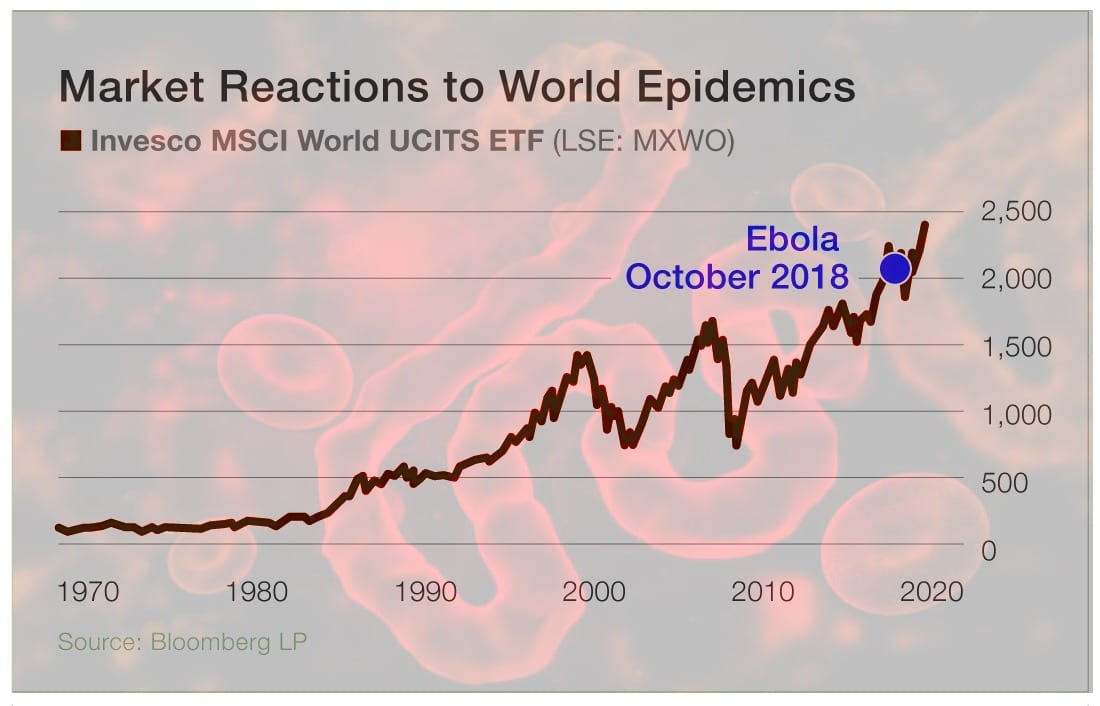

Psychology Of Investing and the Coronavirus

The first month triggers panic, and markets decline from mild to wild. The masses repeat the same cycle, as seen in the chart of the MSCI World Index. Mass psychology provides insight into market behaviour, allowing investors to recognize opportunities to buy low and sell high during crashes.

In market uncertainty, keeping a level head and avoiding the urge to follow the crowd is essential. By understanding the psychology behind mass behaviour, investors can make informed decisions and take advantage of market opportunities that others might miss.

The Psychology of the Mob: Anonymity and Influence in Group Dynamics

When individuals merge into a crowd, their identities often dissolve into a wave of collective behaviour, a phenomenon starkly illustrated by mob mentality. This psychological shift can lead to astonishing and sometimes devastating outcomes, as personal morals bend under the weight of the crowd’s influence.

Take, for example, the 2011 Vancouver Stanley Cup riots, where the defeat of the local hockey team led to widespread destruction. Commonly, law-abiding citizens found themselves swept up in the chaos, committing acts of vandalism and violence. The anonymity of the crowd provided a shield, encouraging individuals to act in ways they never would in isolation, a clear case of deindividuation at play.

Similarly, the lure of social acceptance can be overpowering. Consider the infamous 1971 Stanford prison experiment, where participants adopted abusive roles to conform to expectations. This experiment starkly depicted how the desire to fit in could push individuals to override their ethical boundaries, a sobering example of conformity’s dark side.

Leadership’s role in guiding mob behaviour cannot be ignored. Charismatic figures can steer the collective will, often with alarming ease. History is rife with examples, from the persuasive speeches of cult leaders to the incendiary rhetoric of political extremists, where influence begets action, frequently to a dangerous degree.

Dissecting the mechanics of mob mentality—where anonymity, social conformity, and influential leadership intertwine—helps us better understand how groups operate. This knowledge equips us to counteract the potential hazards of collective behaviour, promoting a society where individual conscience is not lost in the crowd.

Conclusion on the Psychology of Investing

In summary, understanding the mass mindset and its impact on investing is crucial for successful decision-making in the stock market. By recognizing the repetitive nature of mistakes, breaking away from the pack mentality, and embracing contrarian thinking, investors can navigate the challenges posed by the mass mindset. The examples in the Mass Mindset chart illustrate the various scenarios where the mass mindset influences investment decisions, highlighting the importance of informed analysis and avoiding impulsive actions.

Fear, Opportunities, and Investment Success: Contrarian Thinking Unveiled

Contrarian thinking offers valuable insights into market dynamics, as markets often climb a wall of worry, and prices reflect future expectations rather than the present reality. Understanding the psychology behind market behaviour and recognizing opportunities during market crashes can lead to good investment decisions. The COVID-19 pandemic is a notable example, where panic-induced selloffs presented opportunities for those who remained calm and made informed decisions.

Against the herd, it is essential to remain calm and patient, trusting in the eventual recovery. History has shown that rebounds follow selloffs, and those who resist the fear-driven panic tend to reap the rewards in the long run. While experts may spread fear and doom, relying on informed analysis and maintaining a long-term perspective is essential.

In conclusion, the psychology of investing plays a significant role in navigating the stock market. Understanding the mass mindset, recognizing its influence on decision-making, and adopting a contrarian approach can help investors make informed decisions and capitalize on market opportunities. By remaining calm and patient, investors can overcome the masses’ repetitive mistakes and ultimately succeed in their investment endeavours.

Enrich Your Knowledge: Articles Worth Checking Out

Warren Buffett Economy Unveiled: Mastering Financial Wisdom

Stock Market Predictions 2020: Focus On The Trend

Volatility Trading & Stock Market Trends

Seizing the Copper Shortage Opportunity

Uranium Price Chart: Unveiling a Thrilling Long-Term Opportunity

Revamping the 60 40 Rule: Unleashing New Strategies for Success

Current Stock Market Trends: Buying Fear, Selling Euphoria

Best Time To Buy Stocks: Embrace Panic & Seize Opportunity

Cracking the Pack Mentality: Group Dynamics in Financial Markets

Stock Market Crash 2023: Navigating the Turbulence Ahead

Permabear: The Unique Mindset of Challenging Optimism

Stock Market Cycle Dynamics: From Fear to Fortune in the QE Era

Market Bear: Unraveling the Myths and Realities of a Bear Market

The Level of Investment in Markets Often Indicates Key Trends