“Stock Market Bull 2019: Rumble or Resilience?

Updated Dec 2023

The rewards are starting to flow in for those who followed our suggestions of not giving into fear and stampeding with the crowd. First, we scored our first home run for the year, closing half our position in AMKR calls for almost 125% in gains. Fear never pays off; learn to deal with it today, or risk paying the fear premium for life. To learn to fish, you must understand that fear has no place in the equation of life; this is something almost every service out there purposely ignores because they do not want to teach their subscribers how to fish. Sadly, even worse, many do not know how to fish themselves.

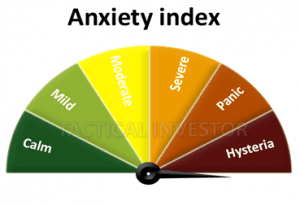

The Masses are still nervous.

Overall, the masses are still nervous, as can be seen by looking at the sentiment data above. While the number of bulls has risen, too many individuals remain in the neutral camp. Additionally, the markets are climbing a wall of worry, a very bullish development. Trade wars, government shutdown, political infighting, and other events; despite this, the markets are trending upward, slowly but surely. Eventually, when one or two of these negative factors are eliminated, there is every reason to believe that the markets will explode. Fear does not pay, and we once again proved that in real time; when the markets were pulling back sharply, we refused to give in and to all of you who took a similar path, congratulations are in order. Until the masses turn euphoric, the stock market bull 2019 will remain in play.

Stock Market Bull 2019 Will Fool Market Timers.

Now, most market timers fail because they are trying to time the markets, and therein lies the mistake. They should be timing the emotion. Emotions drive the markets; everything else is noise. Identify the emotion, and you identify the trend; then the rest is history.

The masses are always wrong in the long run, and therefore if they are euphoric, it’s time to move to cash or short and vice versa. Remember, mass psychology is not about identifying a change in emotion but identifying extreme changes, and that is where it differs from contrarian investing. We do not take an opposite stance until the emotion driving the masses hits a boiling point. The bottom line, there will be a lot more nonsense thrown out there, but until the masses are ecstatic, this market is unlikely to crash.

The mass mindset is wired for failure.

The average trader often possesses a complex perspective on the financial markets and the world in general. They tend to manipulate the definitions of risk and opportunity to align with their current viewpoint. When prices are low, they believe it’s the wrong time to buy, anticipating further declines. Conversely, when prices skyrocket, they perceive it as the ideal time to buy, assuming the upward trend will continue indefinitely. Risk versus reward is disregarded, as they claim to seek low-risk opportunities, but their actions contradict their statements. Bull markets typically do not end with fear; they end when the crowd is consumed by euphoria.

It is crucial to distinguish between a battle and a war. Winning or losing individual battles does not guarantee winning or losing the overall war. The key lies in assessing the amount of damage incurred rather than focusing solely on winning or losing specific battles. By minimizing the damage, it is possible to lose multiple battles consecutively, regroup, and ultimately emerge victorious in the larger scheme of things.

Every bull market experiences at least one sharp pullback (shakeout)

The exact timing of a market top is unpredictable. A shakeout phase should not be confused with a market reaching a long-term peak. Significant market players require willing buyers to sell their stocks before they exit their positions.

In contrast to a shakeout phase, the topping phase can be identified by analyzing market sentiment. During this phase, the masses exhibit an unusual level of resilience even when the market undergoes a sharp correction. They have been influenced to believe that every market pullback presents a buying opportunity. When this belief becomes widespread, it is a clear signal to exercise caution and consider taking protective measures.

A notable example is Bitcoin, which experienced a substantial decline while the masses remained bullish. Despite its significant decline, some experts continue to issue overly optimistic price targets, even when Bitcoin is trading below $5,000. This suggests that the likelihood of Bitcoin reaching $3,000 is higher than it reaching $15,000.

Tactical Investor Aug 2019 Update

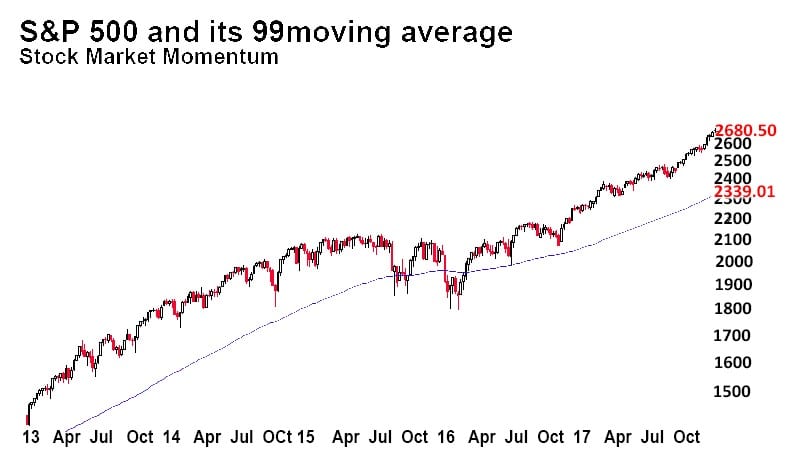

When the S&P 500 Index (SPX) trades significantly above its 99-day Exponential Moving Average (EMA), it tends to experience either a pullback or consolidation. As a result, our indicators indicate oversold conditions, allowing us to take on higher levels of risk. Our risk-to-reward models consider the current market conditions to adjust entry points accordingly.

These indicators fall into the second category; we don’t assign excessive importance to them. While they can identify minor anomalies, they are not particularly useful in determining the overall market trend. Many of these secondary indicators, including the one mentioned, suggest that the markets are trading in extremely overbought territory. However, it is important to note that trading in overbought ranges does not necessarily guarantee a market pullback. It is worth remembering that when analyzing the monthly charts, the markets are still trading within oversold ranges, so significant corrections should be viewed with a bullish perspective.

From Classics to Current: Articles That Cover a Spectrum of Timeless Topics

Long-Term Trends & Bull Market Bear Market Nonsense (Jan 16)

Bull & Bear Market 2019: which one will prevail (Jan 14)

Stock Market Crash-Media Lies And Ignorant Experts (Jan 11)