Is the Market Bear Growling?

Updated Dec 2023

Analyzing this article, we will first adopt a historical perspective. Those who neglect to learn from history are destined to relive it. Additionally, this article provides real-time insights into the positions we took and our performance. We believe that those who talk the talk should walk the walk, and this piece serves as a testament to our actions matching our words.

Throughout history, dating back to the Tulip Bubble, a recurring theme echoes loudly: experts claim to predict market crashes precisely. Curiously, these same individuals were oblivious to when the market would surge, yet they now position themselves as authorities on impending stock market crashes.

Amidst this rhetoric lies an often-overlooked theme, one that eludes the masses. Otherwise, these dubious characters would have gone out of business long ago. They’ve been wrong so many times that blindly following them could have led to financial ruin. Remember, even a broken clock is correct twice a day, depending on whether you follow standard or military time. Hence, even if they eventually get it right, you would have suffered substantial losses long before.” The scary Stock market crash that experts are overhyping

Market Bear: How To Deal With The BS Bear Market Fables

This article we penned some time ago adequately deals with the hysteria surrounding bear markets.

So you ask why? It’s a prelude to a massive bull run. Stock market crashes represent opportunity, but they require a change in the angle of observation.

It all depends on what side of the fence you sit on. It would be considered a tragic event if you decided to pour all your money into the market close to the top. If, on the other hand, you got in early and, as the market trended higher, you banked some of your profits, then it would be viewed as a splendid opportunity. Crisis investing dictates that all disasters are nothing but opportunities. Change the lens, and the picture changes.

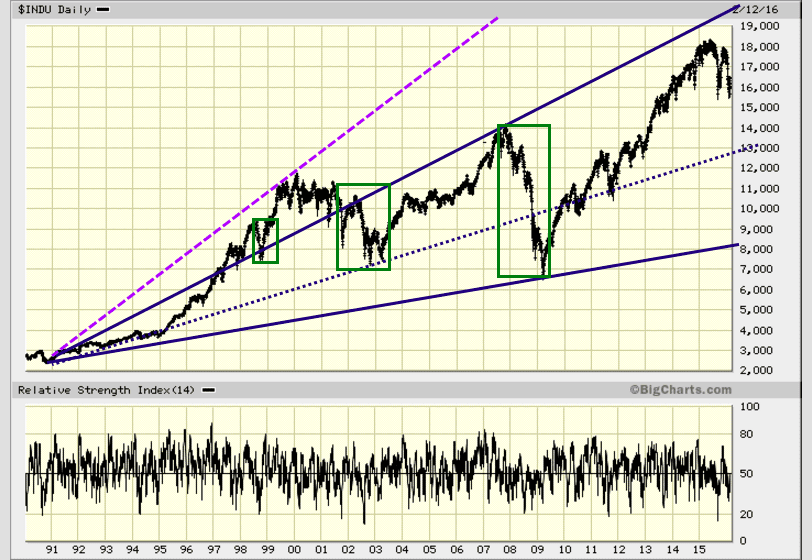

The primary uptrend line is represented by the solid blue line, as seen in the chart above. However, we’ve included a dotted navy blue line for those who might argue for an alternative secondary point. Regardless of the chosen uptrend line, the principle remains consistent: the greater the deviation, the more favourable the buying opportunity. The chart above shows that from 1990 to 2016, the bulls triumphed over the bears. This chart clearly illustrates that the ‘Doctors of Doom’ profit by selling the masses products they wouldn’t consider using themselves.

The Distinction Between a Substantial Correction and a Backbreaking Correction

A substantial correction, like the one witnessed in February of this year, is characterized by a rapid and pronounced pullback, causing a significant surge in fear levels. In contrast, a backbreaking correction is distinct. The term itself conveys the difference—it involves an exceptionally strong pullback accompanied by intense volatility, creating a market environment that seems bipolar. Chaos becomes the norm, prompting even steadfast bulls to question their positions.

Every bull market undergoes such a correction, but pinpointing in advance which one will be backbreaking is impossible. Attempting to make this determination carries a high opportunity cost. Breaking out of the prolonged “anxiety stage” is challenging, and those who anticipate a powerful correction often find themselves too paralyzed by fear to act. They persist in believing that the market will continue its descent, unable to capitalize on potential opportunities.

Misery Loves Company, But It Tends to Pay Poorly in the Long Run

It looks grim, the media is pumping end of the world type scenarios, strong bulls are showing signs of weakness, and even contrarian investors are starting to break. Pure contrarians are smarter than the masses, but they do have flaws; the most intelligent investors are the ones who put the principles of mass psychology into play.

They observe the mass mindset and understand that even when fear starts to creep into the equation, they are compelled to ask this question: Was the crowd euphoric when the market topped out? If the answer is “no”, no matter how terrible the picture might look, the end game is that the crowd is being set up for a false downward move. And the standard response would be, “Why?”. Simple answer: this is an advanced form of Pavlovian training.

When the market does put in a bottom after experiencing a backbreaking correction and then mount a powerful rally, the crowd imprints the following data in their minds. Buy the pullback, because it is a fake trap to drive us out; they also start to believe in the following mantra “The stronger the pullback, the better the opportunity”.

Markets Provide Warning signals when all is not well.

Next time the market hits its peak, watch for the persistence of bullish sentiment; it’s the warning sign Mass Psychology students need for an impending, skull-crushing correction. Reflect on the not-too-distant Bitcoin bull market, it soared 11,000%, yet the prevailing assumption was that it could only go up. The crash that followed shattered this illusion.

Look at the above sentiment data; right now, the number of individuals in the bearish and neutral camps adds up to 68. No market has ever crashed on a note of uncertainty and the masses are far from certain or bullish; hence, the least path of resistance is up. Market Update Dec 2018

Bear Stock Market Update Oct 2019

As we have stated many times in the past, the hysteria over Stock market crashes and bear markets are permabear doomsters (yes, this is a made-up word, but we are using it to indicate how stupid these so-called experts are)that have too many time on their hands and very little in terms of mental capacity. We will list a host of factors that paint a bullish picture for the markets going forward and put this bear stock market theory rubbish to rest.

Copper continues to put in a bullish pattern, and once the MACDs on the monthly charts experience a bullish crossover, we suspect it will not be too long before the markets explode.

According to the Tactical Investor alternative Dow Theory, if the Dow utilities trade to new highs, it is a good omen of things to come. In other words, the Dow industrials will follow the same path sooner or later. The Dow utilities surged to new highs in September, and as a result, the Dow industrials and transports are expected to follow suit. The transport sector is expected to outperform the overall market. We are looking at both IYT and XTN as possible future candidates, and we might even add TPOR to our list, but it will be placed under the secondary candidates and will be labelled as a high-risk play (3X leveraged ETF)

Significant capital outflows from the market signal a panic among the crowd, historically a precursor to a potential opportunity. The current market pattern closely mirrors that of 2009, suggesting that if this pattern repeats, it could pave the way for a powerful upward surge.