Navigating the Impacts: Understanding the US Trade War and Its Consequences

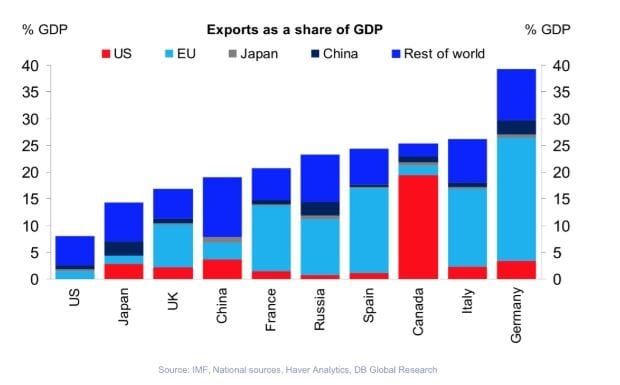

Lots of noise is being made about this trade war with the US, but the exciting part is that the US has already won the trade war against China. Furthermore, it will also win the trade war against the EU, and the simple reason for this is that the US is not an export-based economy. On the other hand, China and Germany would get hammered if their exports took a big hit. Torsten Slok, a chief international economist at Deutsche Bank, seems to concur with this outlook.

“The point is that trade is not important for the U.S. economy. However, it is significant for Europe and Asia and EM,” Slok stated in an email to Yahoo Finance.

“Growth in the U.S. depends more on domestic consumer spending and domestic CapEx spending than on exports,” stated Slok. “Whereas for countries such as Germany, exports are a very important driver of GDP growth.”

The chart below indicates that exports make up only 10% of the US GDP, but in the case of Germany, they account for almost 40% of Germany’s GDP

Trade Disputes Unveiled: Exploring the Dynamics of the US Trade War

Exports account only for a small part of the US GDP. This limited exposure is due to our sizeable domestic consumer market and our blessed with many natural resources. This gives the Trump administration a lot of room to manoeuvre; throw in the fact that the US dollar is the world’s reserve currency, and there is almost no way that China or, for that matter, the EU can win a trade war with the US. Germany will be the first to buckle over and come to the table, but the outlook for China is far from bright. The longer China holds out, the harsher the punishments dished out by the Trump administration will be.

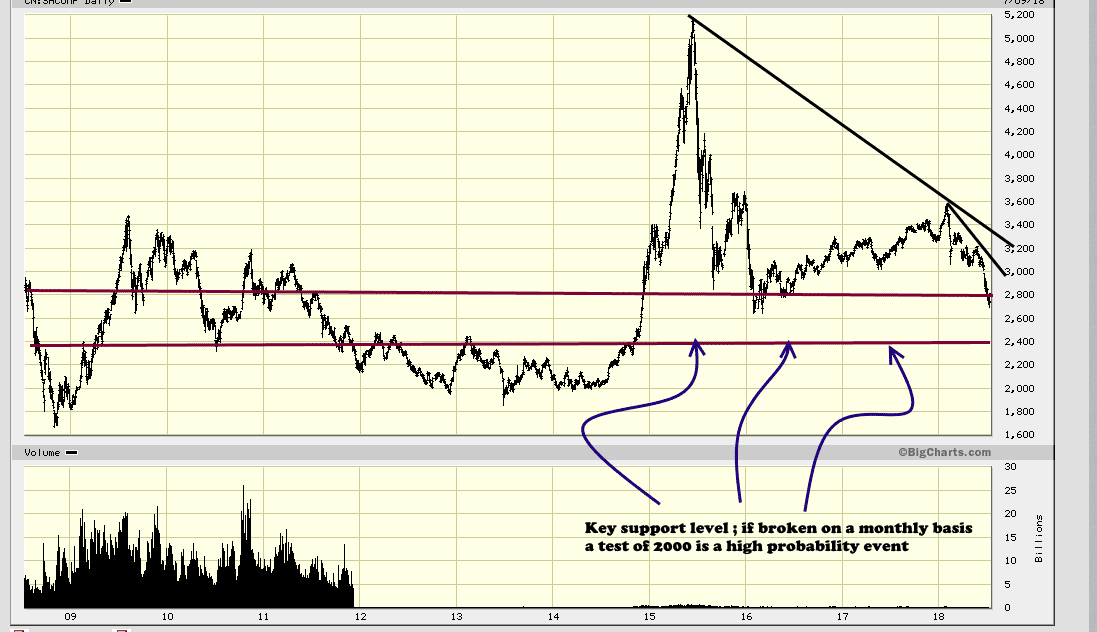

Markets are forward-looking beasts, and Chinese Markets have all but agreed that China had lost the trade war. The Shanghai index is plunging, the Yuan has lost a significant portion of its value, and now Chinese investors are bailing out of the markets.

US Trade War: Stock Markets Indicate China is on the losing end

The Shanghai Index is likely to trade as low as 2400 with a possible overshoot to the 2000 ranges before the dust settles down, and the longer China holds out, the greater this fallout will be.

Finally, please take a look at the US stock market; it’s holding up remarkably well, and after this consolidation period, we expect this bull market to soar higher. The chart below is a few months old, but the reason for using it is to bring across the point we have made for several years; this bull market will not end until the masses fully embrace it. The Nasdaq is in a solid uptrend and is more likely to test the 10,000 range than trade below 5,000.

Engaging Article Worth Exploring: Next Stock Market Crash Prediction: Hype Or Hope

While there is a chance that the Nasdaq could test the 5000-5500 ranges before blasting off to 10K, the odds are low, and if it does come to pass, we will view it as a splendid buying opportunity.

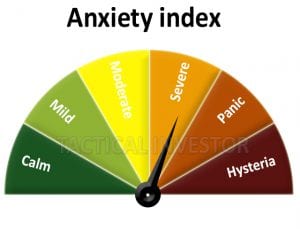

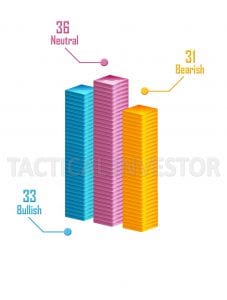

What drives the markets? Most individuals will state that it is either the fundamentals or the technical structure of the market; sadly, communicating both groups are wrong. Emotions drive the markets, and even though machines perform a large part of the daily market transactions, their programmers are humans.

US Trade War: America is Winning & Stock Markets Support This Fact

Only when machines start programming machines might we arrive at the day when emotions play a minor role. For the record, there is a way to track machine behaviour using the principles of Mass psychology. Logic is nothing but a perception, and that perception is based on an emotional construct. What’s logical to one could appear utterly illogical to another human, which will apply to AI one day.

Overall, the outlook is bullish for the US stock market, indicating that the markets are not worried about the consequence of a trade war on the US markets. The sentiment is far from bullish; hence sharp pullbacks should be viewed through a bullish prism. The Trade war is just another sideshow, so focus on the trend and forget the noise.

Other Articles of Interest

Ron Paul- Biggest Stock Market Bubble in History (July 20)

Stock Market Bull 2018 Still In Play; Buy The Dip (July 15)

Stock Market Crash 2018 Revisited (July 12)

Uranium Bull Market 2018; The Crowd Psychology Outlook Updated (July 2018)

Stock Market 2018 Playbook; Follow The Trend (June 29)

Bear Market Fears-are they overblown? (May 28)

Stock Market Crash: Imminent or does this Stock Market Bull still have legs? (Apr 25)

Good Time To Buy IBM or Should You Wait? (Mar 15)

the Level Of Investments In A Markets Indicates

How to win the stock market game

Next stock market crash predictions