Updated Jan 27, 2024

Investing for Dummies: Stand Out, Don’t Follow the Crowd

We employ a historical backdrop to underscore a timeless principle: history is a profound teacher. Those who learn won’t repeat mistakes; fools repeat; wise men learn from others.

For a long time, we’ve advised viewing sharp pull-backs through a bullish lens.

‘View firm corrections through a bullish lens. This game plan will remain valid until the masses turn bullish or the trend turns negative. The stronger the deviation, the better the opportunity.Tactical Investor

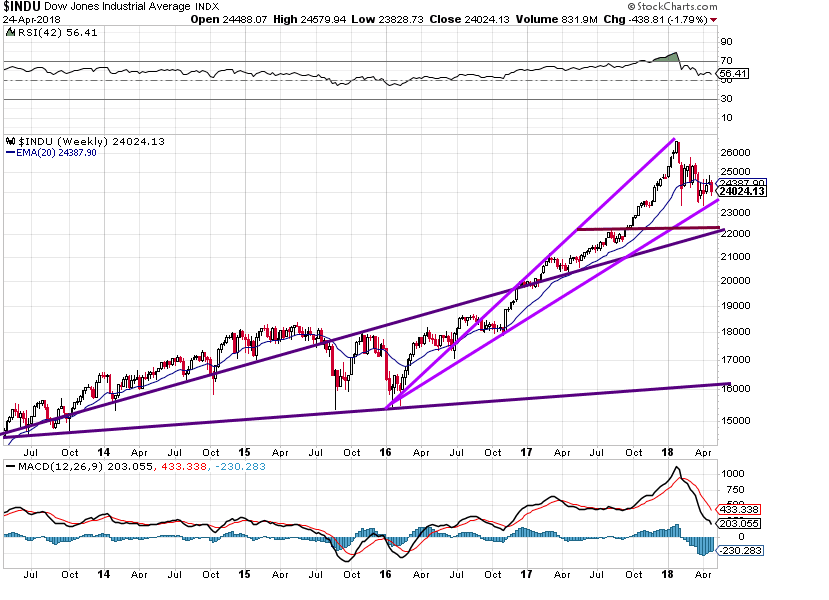

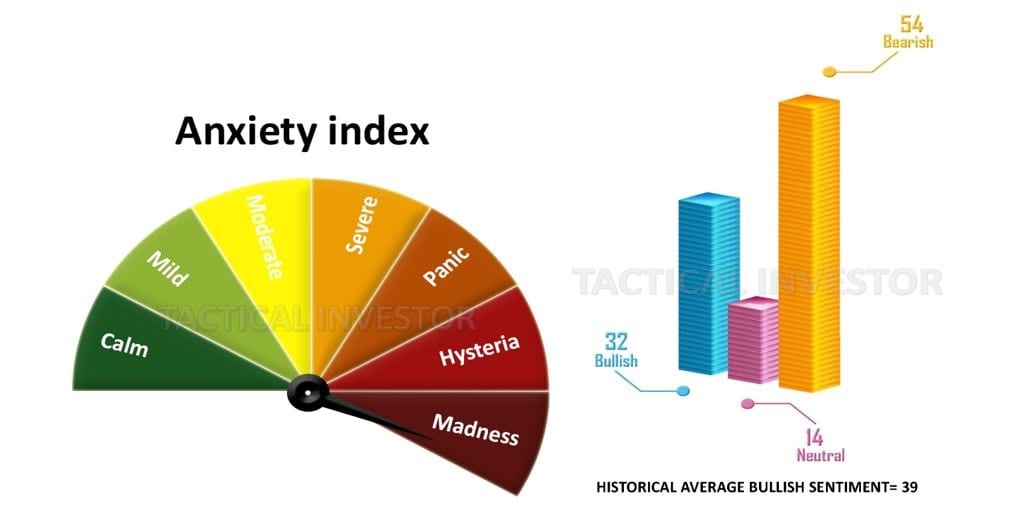

The article emphasized the need for a positive trend and cautioned against turning bullish. Until January 2018, the market soared on negative sentiment, showcasing ‘a market climbs a wall of worry.’ However, a sudden surge in bullish sentiment in January 2018 signalled a change. Until then, the market was soaring to new highs on negative sentiment, illustrating the principle of “a market climbs a wall of worry” to its fullest, but that all changed in January.

Investing for Dummies Tip 2: Fear – Your Secret Weapon for Smart Buys

Interestingly, the Dow missed the low-end targets we issued in Nov by 1400 points, so does that mean the upward journey is over? Before we answer that, understand that nothing trends in a straight line; a healthy market always lets out doses of steam on its upward journey; sometimes, the pullbacks are minor, and sometimes, they are powerful. At the time, we noted that the markets were extremely overbought and even went on to issue possible downside targets if the markets decided to let out some steam.

While the Dow trades in the extremely overbought ranges, any pullback will likely end in the 21,000-21,500 range. For the correction to pick up steam, it would need to close below this level on a weekly basis. As the trend is still positive, the odds of the Dow crashing are very low. At the most, the Dow would test its breakout point, which falls in the 18,900-19,200 range unless the trend were to turn negative or the masses suddenly embraced the market with gusto. At this point, the trend is strong and showing no signs of weakening. Remember that the markets can remain irrational for much longer than most traders can remain solvent by betting against them. Tactical Investor

The Stock Market had to let out steam, but

Instead of releasing steam, the markets defied expectations and continued to surge to new highs almost every week until January 2018. As mentioned, bullish sentiment increased during this period, with the masses enthusiastically embracing the markets. In January, bearish sentiment dropped to a multiyear low of 15%, while bullish sentiment soared to 60%.

Now, returning to our earlier question: Does this surge signal the end is near? This remains the billion-dollar question, and articles that seem more sensational than realistic, like the ones mentioned, don’t contribute to improving the outlook for the average person. It’s important to note that both pieces were published on CNBC.

The stock market looks ‘pretty fantastic’ despite rising yields: Art Hogan

‘Epic’ market bubble is ready to burst, and stocks could plunge, strategist warns

A stock market crash is not likely because the market has pulled back sharply several times since January, and the masses are nowhere as bullish as they were in January 2018. Given the colossal run this bull has experienced, the action, though painful from an emotional perspective, is well within the norm. The equation must balance; no market can trend in a straight upward line forever. We expect volatility to remain an issue until bearish sentiment surges past 50%; a move to the 60% range would be ideal.

While the bearish sentiment still has some way to go before it hits the 50% mark, bullish sentiment has pulled back strongly, and the number of neutrals has surged. Neutrals are bears with no teeth and bulls with no ba**s. Contrast the above reading to those of January 2018.

Bearish sentiment is rising.

In January of this year, bearish sentiment reached a multiyear low. Based on those sentiment readings, the current pullback is relatively minor. It’s crucial to resist getting caught up in the “hysteria” and to remember how far this market has risen; it is merely taking a well-deserved breather.

Given the extended duration of this pullback, the market action is expected to remain volatile until bearish sentiment climbs well past the 50% mark. From a psychological standpoint, the most effective way to undermine the current surge in bullish sentiment and ensure a more gradual rise would be to diminish the masses’ morale significantly. This appears to be the ongoing scenario.

The masses want to know what to expect, and uncertainty sets in when they don’t. Uncertainty is fantastic in the markets, for the masses keep jumping from one camp to another; each jump demoralises them more and more. This demoralising effect is very powerful, providing the investor with no emotional stake with an unbelievable long-term opportunity. The other way to demoralise the crowd (which does not occur often) is for the markets to pull back extremely strongly; for example, losses of 30% or more over a very short period. Market Update April 17, 2018

This correction will likely end in the 23,400-23,800 range, with a possible overshoot to the 22,500 range. The Dow would need to close below 22,000 on a monthly basis to indicate that the outlook is set to worsen.

The Dow is likely to trade over a wide range, and the moves are expected to be very volatile; be ready to deal with intraday moves of as much as 1200 points in a day. The markets need to move to the extremely oversold ranges, and if you look at the MACDs on the above chart, you can see that they still have room to trade before getting into that zone.

The best time to buy is when the masses are in panic mode, and when one feels far from certain about the future of the markets; certainty is the secret word for failure when it comes to the stock markets. Market Update Feb 28, 2019

The Elusive Neutrals: Unwavering Amidst Changing Tides and Political Turmoil

What is striking is that over the past several weeks, the number of individuals in the Neutral camp has hardly budged and is gently trending upwards. Since the last update, we have two sets of new readings. Last week, the number of individuals in the neutral camp stood at 39. This week, they increased to 41. So far in 2019, the number of individuals in the neutral camp has always surpassed those in the bullish or bearish camps, which is very revealing. It indicates that the masses suffer from a long-term bias and that the political landscape is messing with their ability to distinguish reality from fiction.

Regarding the stock market, as long as the Federal Reserve maintains its current stance, any significant market downturn should be seen as an opportunity to buy, while major market corrections should be considered rare occurrences that happen once in a lifetime. However, this assessment is valid only if the overall trend is positive. Our role is to keep you informed about whether the trend is positive (upward) or negative (downward).

The world is going to witness a Fed that has decided to make a cocktail of Coke, Heroin, Crack and Meth and take it all in one shot. Imagine what a junkie on this combination of potent drugs is capable of doing, and you will have an idea of where the Fed is heading in the years to come. Market Update Feb 28, 2019, Investing For Dummies

Market Update March 2020

Those individuals who have been predicting the world’s downfall since ancient times will likely pass away long before even a fraction of their predictions come true. The current market crash should be seen as an opportunity to buy, and the coronavirus outbreak is a test to observe how swiftly social media can influence and manipulate the masses. So far, it has successfully created a sense of panic without thorough fact-checking.

This could be an excellent investment opportunity for traders willing to take risks. It’s essential to shift the focus from short-term fluctuations to the long-term perspective. Historical data shows that markets possess a remarkable tendency to trend upward. Bears, consistently bearish on the markets, will likely experience a downfall and have a poor long-term track record. Once the chaos settles, markets will resume their upward trajectory, as they have previously done.

It’s worth considering the daily deaths caused by other factors and the current situation.

Consider how many people die each day from other causes and the flu. https://www.worldometers.info/

There is now a 70% probability that when the Dow bottoms and reverses course, it could tack on 2200 to 3600 points within ten days. Interim update March 9, 2020

Investing for Dummies Tip 3: Uncertainty Equates To Profits.

The general public is still unsure about the situation, so any sudden drops in the market should be seen as positive for long-term investors. Ignoring distractions and concentrating on the overall market direction is essential. Create a list of excellent companies that you would like to invest in. When the market experiences a significant downturn, you will be prepared to buy these companies at a substantial discount. The combination of low interest rates and massive government stimulus will likely lead to a rapid and significant increase in the market.

Decoding Stock Market Psychology Through Charts: A Primer for Beginners

Grasping stock market psychology is a crucial stepping stone in investing. This field of study involves understanding the emotions and perceptions that investors experience when participating in the market. Emotions such as fear, greed, optimism, and pessimism can significantly sway buying and selling decisions, often leading to observable patterns on price charts. This concept can be likened to the plot twists in a novel.

Let’s break this down to a beginner’s level. Picture technical analysis as a detective’s method to decode these patterns. By examining price charts, akin to studying fingerprints at a crime scene, analysts can identify trends and abrupt changes in the market’s direction, believed to be the result of stock market psychology. For instance, a dropping open interest in a stock could indicate that winners are cashing in their profits and stepping back, similar to a successful gambler leaving the roulette table while ahead.

Several technical indicators, like signposts on the road, offer insights into the market’s sentiment. For instance, the Moving Average Convergence Divergence (MACD) might sound like a mouthful. Still, it simply shows the shifts between optimism and pessimism in the market, like a pendulum swinging between hope and fear. Other indicators, such as Rate of Change (RoC) and Williams %R, can offer similar insights.

Support and resistance levels, another crucial aspect of technical analysis, act like invisible floors and ceilings in the market that indicate when a trend is likely to pause or reverse. Imagine an elevator that slows down or stops at particular floors where people are waiting (support) or the elevator is full (resistance). These levels are primarily influenced by collective human emotion and psychology.

A familiar market psychology cycle exists, shining light on how emotions evolve and affect our decisions, much like the stages of a theatrical play. By understanding these stages, novice investors can better manage their emotional responses to market movements.

In conclusion, understanding stock market psychology and how it manifests in price charts and technical indicators can be a powerful tool for beginners investing. It can help them make more informed decisions, like using a roadmap on a journey, potentially improving their investment outcomes.

All the king’s horses and all the king’s men can’t put the past together again. So let’s remember: Don’t try to saw sawdust. Dale Carnegie

“Originally published in April 2018, this article has undergone multiple updates, with the latest refresh completed in January 2024.”

Intriguing Reads Worth Your Attention

Is Inflation Bad for the Economy? Only if You Don’t Know the Truth

Contagion Theory: Unleashing Market Mayhem Through Panic

What is the Minsky Moment? How to Capitalize on It

Dunning-Kruger Effect Graph: How the Incompetent Overestimate Their Skills

Schrödinger’s Portfolio: Harness It to Outperform the Crowd

Allegory of the Cave PDF: Unveiling Plato’s Timeless Insights

What is Relative Strength in Investing? Unleash Market Savvy

Dow 30 Stocks: Spot the Trend and Win Big

Out-of-the-Box Thinking: Be Wise, Ditch the Crowd

Stock Market Psychology Chart: Mastering Market Emotions

Stock Market Forecast for Next 3 Months: Trends to Watch, Predictions to Ignore

Lone Wolf Mentality: The Ultimate Investor’s Edge

Copper Market News: Distilling Long-Term Patterns

Unleashing the Power of Small Dogs Of the Dow

Inductive vs Deductive Analysis: The Clash of Perspectives

How to win the stock market game

Next stock market crash predictions