Time in the Market vs Timing the Market

Apr 12, 2023

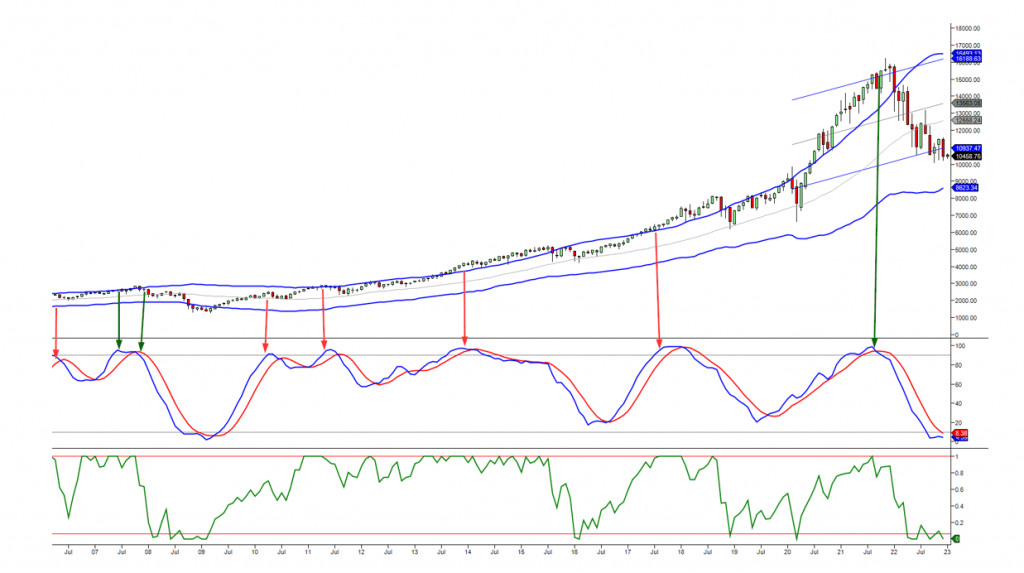

This graph (posted below) explains why we did not bail out of the Market in the past year, despite predicting two corrections in 2022. It highlights the importance of Time in the Market vs timing the Market, as the Tail-end move, a powerful phenomenon that occurs 90% of the Time, can impact the success of different strategies. The red and green arrows on the graph demonstrate when getting out of the Market or waiting for the Tail-end move to complete would have been the most effective approach.

The Importance of Time in the Market vs Timing the Market

While there have been a few instances in the past 15 years where bailing out after the indicators were trading in the extremely overbought ranges would have been beneficial, we advise that this method is best suited for low to medium-risk investors who have the patience and discipline necessary to wait for the next buy signal to trigger. The importance of identifying your risk tolerance level and sticking to it cannot be overstated, as impulsive decisions can have a negative impact on your portfolio.

Sacrificing Profit for the Sake of Safety

We acknowledge that the above strategy may require sacrificing some profits for the sake of safety, but it is essential to remember that there is no such thing as a free meal in the stock market. Therefore, individuals with higher risk tolerance will receive different instructions, and we have fine-tuned our format to better incorporate the above strategy for low-medium risk investors.

Incorporating the Above Strategy for Low-Medium Risk Investors

We will now wait for the indicators in both the monthly and weekly charts to trade in the insanely overbought ranges before advising low-medium risk investors to move mostly into cash. This new format accounts for the above strategy and ensures that low-medium risk investors are better equipped to handle the Market’s uncertainties.

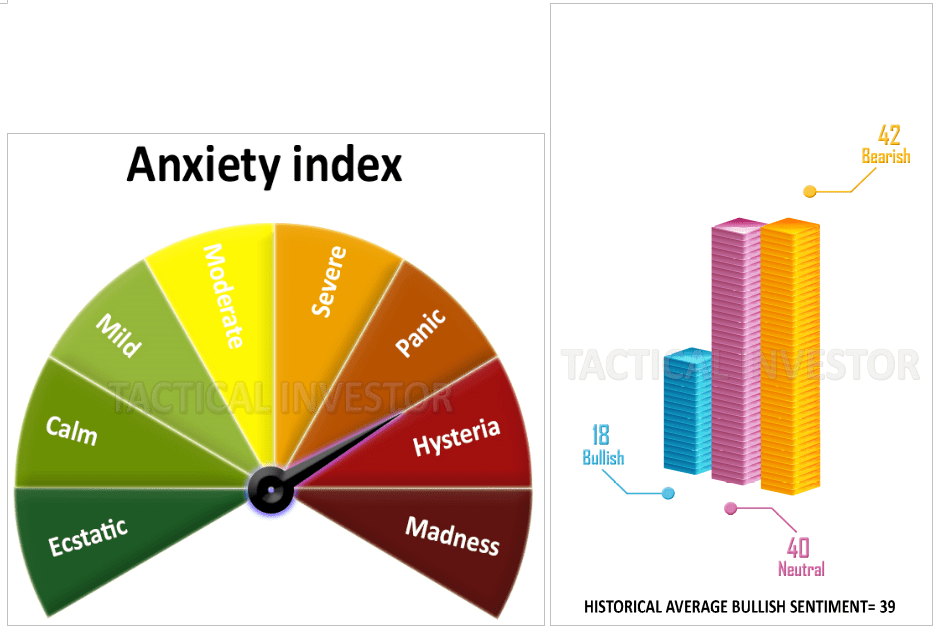

The gauge is almost in the hysteria zone. Let’s see if the Needle moves into the madness zone (a zone that has never been hit): based on sentiment data, this could yield another signal in favour of a FOAB (father of all buying opportunities)

Out of the blue, sentiment data will be pretty helpful in determining stock market turning points. When too many people begin to use a tool/indicator, the big players go out of their way to render it obsolete, albeit temporarily. However, once the mass mindset is burned, it takes a long time to recover, and this is precisely the outcome the big players seek.

Conclusion

It is crucial to identify your risk tolerance level and not modify it until you can take on more risk. If you fall into the low-medium risk category, do not chastise us for issuing instructions to move into cash. Safety comes at a cost, and we have adopted a new format to account for this. For those willing to take on higher risk, we will continue to provide guidance and issue new trades, with the warning that we are now trading in “high-risk” mode. Remember, no risk, no reward.

Expand Your Mind: A Selection of Intriguing Articles

Global warming hoax proof? Top US Scientist Resigns

Stock Market Patterns and Donald Trump’s Chances Of Winning

Two Professors with Incredible Track Record Predict A Trump Win

Trump-The New Stock Market vix Factor

Millennials Would Work For Less With Socially Responsible Company

Trey Gowdy States Harry Reid on Drugs regarding Hillary Email Scandal

Crude Oil Market-Higher prices or Market Crash

Trump Meltdown: The Establishment’s Attack on a Political Outsider

Tactical Investor Election Polls-Updated Constantly Until Election day

Trump Trumps Clinton in Third Debate