Time in the Market vs Timing the Market: The Ultimate Test of Discipline

Nov 19, 2024

Introduction: Navigating the Turbulent Waters of Investment

In the intricate game of investing, the debate between time in the market and timing the market has long captivated strategists. This essay explores the delicate art of navigating this dilemma, emphasizing the importance of discipline and a nuanced understanding of market dynamics. By examining historical trends and employing the strategic insights of ancient philosophers, we will uncover a robust framework for making informed investment decisions. Prepare to embark on a journey that challenges conventional wisdom and equips you with the tools to thrive in the ever-changing financial landscape.

The Tale of Two Strategies

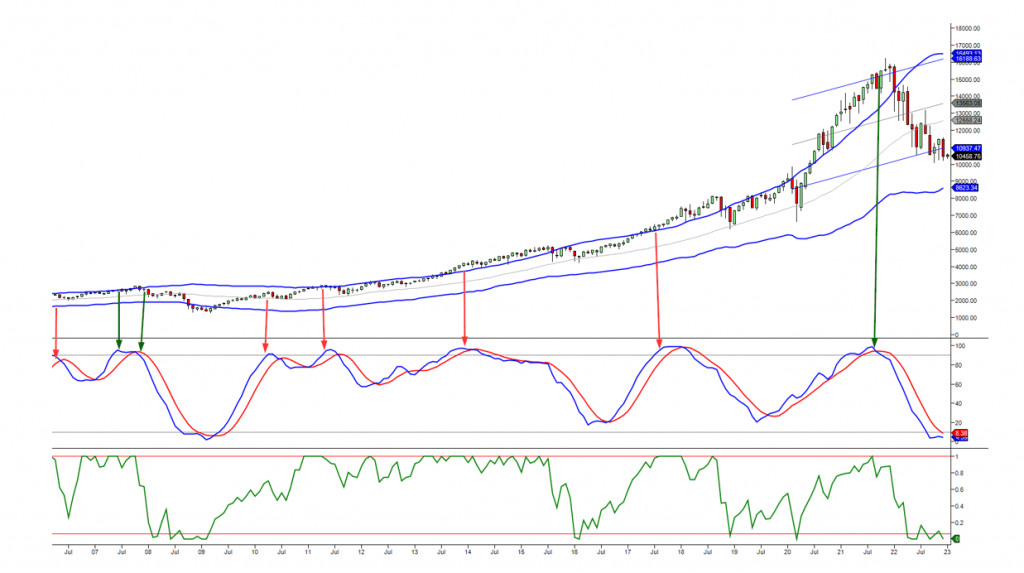

The graph below illustrates the significance of time in the market versus timing the market. It highlights how we refrained from bailing out despite predicting two corrections in 2022. This decision was guided by the understanding that market trends often culminate in a powerful tail-end move, which occurs approximately 90% of the time. This phenomenon underscores the impact of staying invested through volatile periods, as demonstrated by the red and green arrows on the graph.

The Discipline of Time in the Market

The time in the market strategy advocates remaining invested through market fluctuations, trusting in the long-term upward trajectory of the market. It requires discipline and tolerance for short-term volatility, recognizing that attempting to time the market precisely can be a futile exercise. As the graph illustrates, the tail-end move, when the market rebounds sharply, often occurs swiftly and unexpectedly, rewarding those who stayed the course.

Timing the Market: A Calculated Approach

On the other hand, timing the market involves attempting to predict and capitalize on market corrections. This strategy suits investors with a higher risk appetite and a keen eye for market indicators. It requires the discipline to act on buy and sell signals, recognizing that short-term gains can be substantial. However, as the graph shows, the challenge lies in predicting the precise bottom, as missing the tail-end move can significantly impact returns.

Navigating Risk and Preserving Capital

The key to successful investing lies in understanding your risk tolerance. As the essay excerpt notes, identifying your risk tolerance level is crucial. Low to medium-risk investors should embrace a more conservative approach, focusing on capital preservation. They must exercise patience and discipline, wait for clear buy signals, and accept that they may sacrifice some profits for safety.

“Safety comes at a cost. There are no free meals in the stock market. Our strategy for low-medium risk investors involves waiting for extreme overbought conditions before moving mostly into cash. It is a prudent approach, and we provide specific instructions to navigate these uncertain markets.”

Here, we encounter the wisdom of embracing prudence and sacrificing short-term gains for long-term stability. This is a strategic choice that recognizes that impulsive decisions driven by fear or greed can be detrimental to portfolio health.

Embracing Calculated Risks

The game takes on a different complexion for those with a higher risk tolerance. They embrace the adage, “No risk, no reward.” While they may sacrifice some safety, they seek to maximize returns by capitalizing on market fluctuations. This approach requires a keen understanding of market dynamics and the discipline to act on signals, knowing that timing is everything.

The Power of Indicators and Historical Perspective

The essay excerpt introduces the concept of indicators and their role in making informed investment decisions. By analyzing historical data and market sentiment, investors can identify extreme overbought or oversold conditions, providing valuable insights for timing the market. This strategic approach draws on the wisdom of ancient philosophers who understood the cyclical nature of human behaviour and its impact on markets.

Sentiment data and market indicators can be powerful tools for predicting turning points. However, their effectiveness is temporary, as market players eventually render them obsolete. This is the game within the game—an ever-shifting landscape that requires agility and a deep understanding of mass psychology.”

Here, we see the interplay of historical insight and market dynamics, recognizing that indicators must be used judiciously and adapted to the evolving behaviour of market participants.

Waiting for Extremes: A Machiavellian Perspective

The strategic mind recognizes the value of patience and the art of waiting for extremes. This approach draws on the cunning wisdom of a renowned philosopher who advised, “It is better to be feared than loved if you cannot be both.” Applied to investing, this suggests that it is prudent to wait for extreme market conditions, such as hysteria or madness, before making bold moves.

“The hysteria and madness zones, rarely reached, signal potential turning points. They represent the culmination of fear or greed, and the subsequent reversal can be sharp and lucrative. Thus, we wait, like a predator stalking its prey, for these extreme conditions to present lucrative opportunities.”

Here, we witness the fusion of strategic discipline and psychological insight, creating a powerful framework for calculating investment decisions.

The Evolution of Discipline: Adapting to Market Dynamics

The market is a dynamic arena, demanding adaptability begin=new dynamic and unpredictable. To thrive, investors must embrace flexibility, drawing on the strategic principles of a military mastermind. This ancient philosopher understood the importance of adaptability, noting, “The general who wins the battle makes many calculations in his temple before the battle is fought. The general who loses makes but few calculations beforehand.”

“Success lies in carefully calculating and adapting to market dynamics in the investment arena. We must be like water, fluid and formless, ready to flow into opportunities that others may miss. This requires a disciplined yet flexible mindset, constantly gathering information and refining strategies.”

Here, we see the interplay of discipline and adaptability, recognizing that successful investing requires a nuanced understanding of market forces and the agility to act on them.

Learning from History: The Strategic Advantage of Hindsight

History is not just a record of past events; it’s a treasure trove of lessons for those astute enough to learn from others’ triumphs and follies. In the grand theatre of investing, history often repeats itself, and the patterns of human behaviour remain remarkably consistent. To navigate these cycles with finesse, one must take on the role of the strategic thinker, blending patience with cunning and foresight.

The Tech Bubble: Euphoria Meets Reality

Cast your mind back to the late 1990s—a period drenched in the intoxicating promise of the internet age. The world was captivated by the meteoric rise of technology companies, many of which had yet to profit or even generate revenue. Stock valuations soared to dizzying heights, fueled by speculation and a pervasive belief that traditional metrics no longer apply. Newspapers heralded a new era, and investment seemed like a one-way ticket to wealth.

Yet, amidst the frenzy, a select few observed with scepticism. These disciplined investors recognized the hallmarks of a classic bubble: extreme overvaluation, rampant speculation, and a detachment from fundamental realities. They recalled past manias—the Dutch Tulip Craze and the South Sea Bubble—where irrational exuberance led to catastrophic ends.

When the bubble inevitably burst in the early 2000s, it wiped out trillions in market value. Companies that were once Wall Street darlings vanished overnight. However, those who had maintained discipline, resisting the siren call of easy gains, were rewarded. They preserved their capital and were poised to seize opportunities in the aftermath, purchasing solid assets at significant discounts.

The Housing Market Collapse: A Masterstroke of Strategic Insight

Fast-forward to the mid-2000s, and another storm was brewing—this time in the housing market. An era of easy credit and lax lending standards fueled a property boom. Housing prices skyrocketed, and homeownership seemed an infallible investment. In their hubris, financial institutions repackaged risky mortgages into complex securities, spreading the impending doom across the global financial system.

Enter a new set of disciplined strategists. Investors like the enigmatic Dr. Michael Burry delved deep into the mortgage-backed securities market. Scrutinizing the data with meticulous care, they identified the unsustainable nature of the housing boom. Burry, convinced of an impending collapse, made bold moves by purchasing credit default swaps against the housing market—a bet that few understood and even fewer dared to make.

When the housing bubble burst in 2008, it triggered a global financial crisis of unprecedented scale. Markets plummeted, and fear gripped the world. Yet, Burry and those like him reaped colossal rewards for their foresight and unwavering discipline. Their success wasn’t born of luck but of relentless analysis, strategic positioning, and the courage to defy conventional wisdom.

The Flash Crash of 2010: Seizing Opportunity in Chaos

Consider also the Flash Crash of May 6, 2010—a day when the U.S. stock market plunged nearly 1,000 points within minutes, only to recover just as swiftly. High-frequency trading algorithms malfunctioned, and panic ensued. Many investors were bewildered, their screens awash in red.

However, seasoned traders with historical knowledge and strategic insight saw this as a momentary dislocation—a glitch in the matrix. They swiftly moved to buy quality stocks at artificially depressed prices. By the day’s end, as markets rebounded, these cunning individuals had secured significant profits, capitalizing on the fear and confusion that paralyzed others.

Conclusion: The Ultimate Discipline – Knowing Thyself

In the final analysis, the ultimate discipline in investing is knowing yourself. As the essay excerpt emphasizes, identifying your risk tolerance is paramount. It is the foundation upon which your investment strategy is built. Embrace the wisdom of self-awareness, for it is the key to making informed and disciplined investment decisions.

“Know thyself, and thou shalt know the market. “Understanding your risk tolerance is the cornerstone of successful investing. It guides your strategy, helps you navigate turbulent times, and ensures that your investment journey aligns with your goals and temperament.

Here, we are reminded of the ancient philosopher’s emphasis on self-knowledge, applied to the modern context of investing. It is a powerful reminder that the discipline of self-reflection is the foundation of all strategic endeavours.

In the words of a cunning strategist, “The essence of strategy is choosing what not to do.” Apply this wisdom to your investment approach, focusing on calculated decisions that align with your risk tolerance and long-term goals.

May your investments be prosperous, your discipline unwavering, and your understanding of market dynamics ever-evolving.