All the power that we exercise over others depends on the power we exercise over ourselves.

Cotvos

Share Repurchase Binge Keeps Bull Market Going?

Share repurchase programs are nothing new; they have been around for decades, and in most cases, one would view this type of action under a favourable light. However, for the past few years, companies have used this technique as a ploy to hide stagnating earnings or even falling profits. The idea is very simple, and the rewards are lucrative as most corporate officers have incentive-based rewards.

Corporations borrow money for next to nothing and then use this to purchase huge blocks of shares; the number of outstanding shares drops and the EPS magically rises. Each year for the past six years the amount of money allocated towards share buybacks has soared because as we stated, this is the fastest way to increase EPS without doing a single thing magically.

In the good old days, companies would invest the cash they accumulated or the money they borrowed into activities that would improve the bottom line and not resort to financial gimmickry to create the illusion that all is well. Instead of investing in their own business, corporations have been funnelling huge amounts of cash towards share buyback programs.

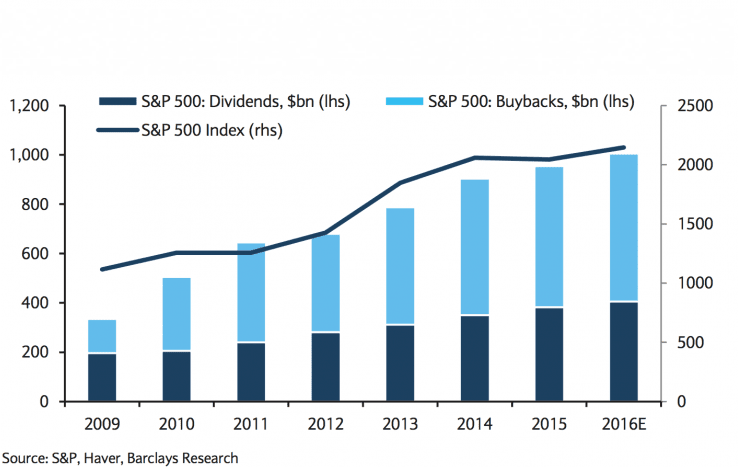

Total payouts to shareholders which include dividends and share buybacks have increased at an unbelievable rate of 20% per year for the S&P 500 since 2009. As we stated in 2015, 2015 and now in 2016, this trend is not going to stop. It will continue to gather momentum because it is an easy fix to an otherwise unfixable situation. The economy is in bad shape; if the outlook were bright as the BLS claims corporations would be investing larger amounts in their business and not squandering billions on financial shenanigans.

“We estimate total payouts for the S&P 500 will reach $1 trillion for the first time ever in 2016. This will include approximately $400 billion in dividends and $600 billion in gross share repurchases and will culminate six years of substantial growth in payouts. As recently as 2010, total payouts were just $500 billion per year”, stated Jonathan Glionna of Barclays

Share repurchase programs: Companies using them in an unscrupulous manner

This shady activity would be okay if corporations were only using cash on hand, but they are not; they are borrowing money to fund these purchases. One day they will have to pay this money back, and as they invested nothing into their business, they might not be in a position to service this increasingly large mountain of debt. However, that is a story for another day. The trend is in full swing and showing no signs of letting up, and as negative rates have yet to hit the US, we can state that we are far from reaching a blow-off top. In other words, even though this mountain of debt looks huge today, it might look tiny and manageable compared to what it is going to look like 3-5 years from today. Take a look at the chart below

Money Allocated To Share repurchase programs continues to rise

Every single year since 2009, the total money committed to dividends and buybacks has increased, and we believe that they will continue to grow at this crazy clip and could even gather momentum when negative rates finally debut in the U.S. Translation, this bull market is not going to hit a brick wall yet. This market will experience corrections along the way ranging from mild to strong, but each one will prove to be a buying opportunity. The amount of money that will continue to hit this market is going to increase in the years to come and not decrease.

On the psychological front, no bull market has ever ended without mass participation. The masses have not embraced this market and more importantly, the sentiment is decidedly negative. Bull markets end on a note of joy and the masses are nowhere close to joyful at present. The latest AAII sentiment survey illustrates that 25% of investors are bullish. Our proprietary anxiety gauge also shows that investors are one step away from the hysteria zone.

The chart below illustrates how the payout ratios have been skyrocketing over the years and as of late they have been outpacing earnings. Companies have been making up for this shortfall by borrowing money.

Is this trend sustainable?

“Over the last few years payouts have exceeded earnings for the S&P 500, which is rare,” Glionna observed. “It almost happened in 2014, when the total payout ratio was 99%. In 2015, it did happen. It will happen again in 2016, based on our estimates, as net income is likely to be less than $900 billion against $1 trillion of dividends and buybacks.”

“Prior to 2015, companies in the S&P 500, in aggregate, had paid out more than they earned only six other times during the last 50 years,” Glionna said.

Many experts will state that this is unsustainable. If you apply the rules of logic, that assumption would be pretty accurate. However, reality ceased to exist after the Fed decided to knock out any aspect of free-market forces. The Feds control this market, and it will crash when the Fed stops supporting it. Chances of that taking place anytime soon are next to zero.

You have better odds of finding Gold in your backyard then of the Fed allowing free market forces to exert their effects on this market. As we stated before, corporate debt is to soar to levels that will make those of today appear sane in nature. Easy money is addictive, and the corporate world is addicted to it; they are not going to stop unless someone forces them to stop. This is why the most hated bull market continues to trend higher despite all the evil thoughts thrown in its direction.

Conclusion

The crowd has not embraced this market, and the sentiment is extremely negative; history clearly indicates that such developments usually occur during market bottoms and not tops; hence, the market is more likely to trend higher a year from today than it is to crash.

The higher it trends, the more volatile the ride is expected to be; experts have been confusing volatility for the commencement of the next bear, and on each occasion, they have had their heads handed to them. Don’t fight the Fed or the trend as you are bound to lose. Throw in the corporate world’s love for share buybacks, and you have all the ingredients in place for this market to trend a lot higher. All sharp pullbacks have to be seen through a bullish lens; the stronger the deviation, the better the opportunity.

A cock has great influence on his own dunghill.

Publilius Syrus

Other Articles of Interest

BIIB stock Price: Is it time to buy

Stock Market Forecast for Next 3 months

Next Stock Market Crash Prediction

Dow theory no longer relevant-Better Alternative exists