Gold market analysis and predictions

Updated August 2023

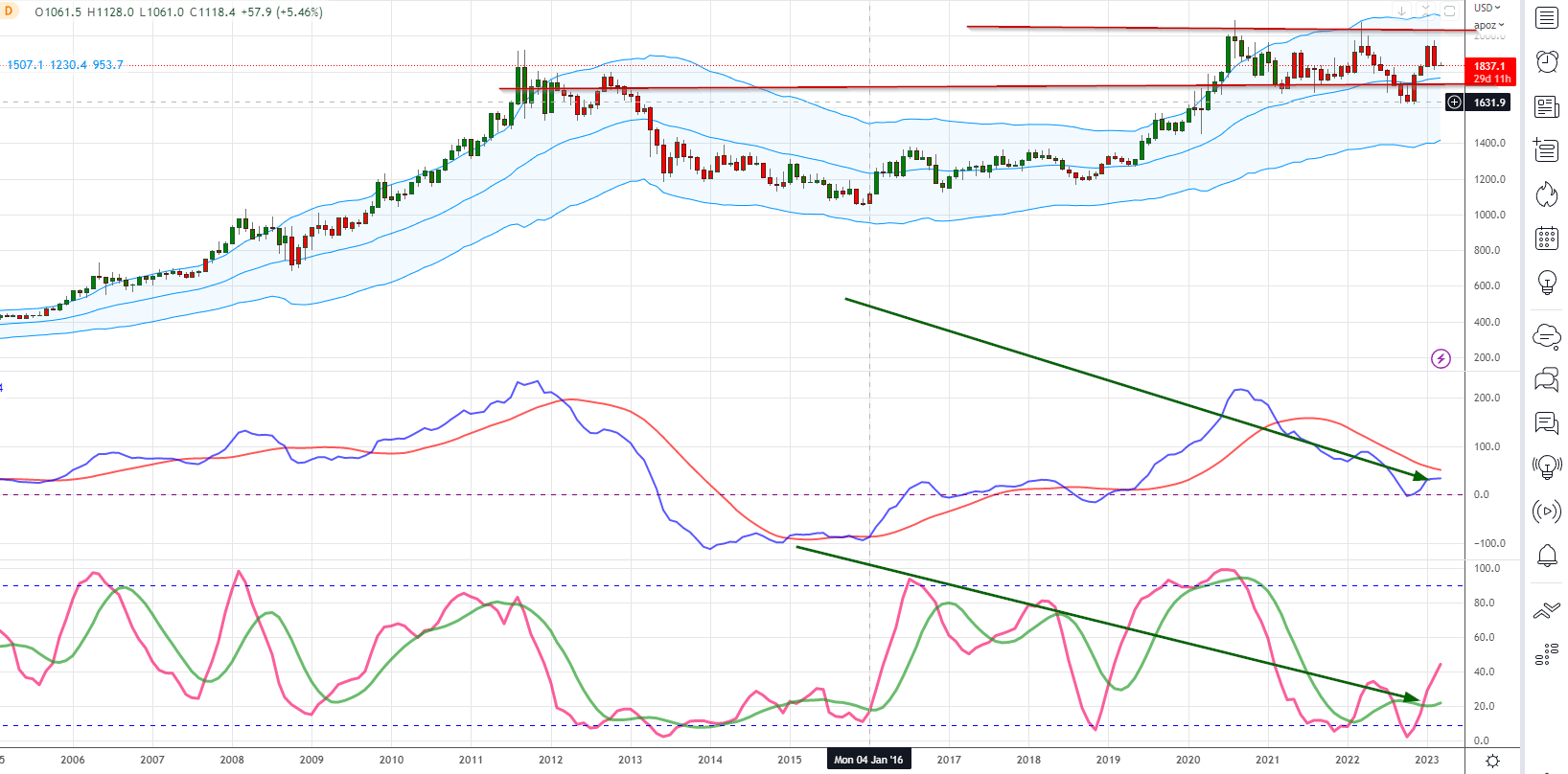

Experts often rely on patterns to predict market outcomes. Still, there is no guarantee that any pattern will work going forward, as free markets no longer exist due to the Fed’s consistent implementation of QE. While a pattern could lead to a big move in Gold, the focus should be on what is currently happening in the market.

In 2011, many signs suggested that all was not well in the Gold market. A variety of Key technical indicators were issuing negative divergence signals, the dollar was generating solid signals of an impending bottom, and many in the Gold market issued overly optimistic targets. As a result, we advised our clients to close their bullion positions and embrace the dollar, which proved to be a wise decision.

Gold Market Analysis and Predictions: What’s Next

From 2011 until today, gold experts have prophesied a bottom that never materializes. They have been disconnected from reality and have clung to the illusion that the Fed’s printing of more money would automatically cause gold to soar to new heights. If this were true, gold would already be trading north of $3,500.

Since its inception, gold’s primary, albeit indirect, function was to destroy the dollar. What’s different today is that the Fed has decided to intensify the process. It is essential to recognize that gold, like any other market, needs to release some steam. As it underwent a strong run-up, it was natural to anticipate that it, like any different market, would eventually experience a significant correction. Gold’s performance was rather dismal during the market selloff in August, as observed in the following statement.

How do things stack up now?

The current downside risk for Gold is quite limited as it has already undergone a significant correction. Shorting Gold at this stage would be unwise due to the unfavourable risk-to-reward ratio.

Despite some contrarians and Elliot wavers predicting a dramatic rebound, we remain cautious and do not share their optimistic outlook. While we would like a turnaround, we cannot rely on illusions becoming a reality. However, we believe the potential downside is limited from here and recommend long-term investors consider deploying some capital into bullion. We anticipate that Gold will trade considerably higher three years from now.

Gold Unveiled: Navigating the Unpredictable Terrain

Now, let’s delve into the labyrinth of gold market analysis and predictions. Many wise minds wax poetic about the latest trends, but, my dear reader, relying on such practices can be a fool’s errand. What once worked like a charm might now be worth less than a hill of beans.

In this market game, guarantees vanished when the Fed embarked on its QE shenanigans. But fret not over patterns and possibilities, for I’m here to share insights into the current state of the gold market.

In ’02, we were bullish on gold, and that optimism endured until the dawn of ’11. Yet, whispers of trouble began to circulate in the gold camp. Technical indicators emitted ominous signals, the dollar signalled a comeback, and the gold hype reached fever pitch. Sensing the impending storm, we advised clients to ditch their bullion positions and embrace the dollar; it was the right call.

You have to be in it to win it.

But since then, we’ve seen many folks still holding out hope for a gold resurgence, even though the reality doesn’t match their dreams. They keep preaching about the Fed printing more money and how gold’s bound to hit new highs any day now, but if that were true, we’d be seeing gold trading north of $3,500 already.

Gold’s just like any other market, and it needs to blow off some steam now and then. And after that strong run-up, it was only natural that we’d see a correction. But now that it’s had a chance to cool down, the downside risk looks somewhat limited. If you ask me, shorting gold at these levels will be an absolute fool’s errand.

Sure, you got some contrarians calling for a turnaround, but we aren’t singing that tune. We think the downside action is limited, and if you’re a long-term investor, putting some money into gold bullion isn’t a bad idea. But don’t expect any miracles in the short term. Look at it like you’re taking out an insurance policy against some possible future event. We’re in the midst of a currency war, folks, and another currency crisis is bound to come knocking sooner or later.

Contrarians continue to Chant.

Now, some folks like to paint a picture of doom and gloom, like the world’s end is just around the corner. But that’s a bunch of hogwash if you ask me. We’ve weathered plenty of storms before and will endure plenty more. It’s all about seizing the opportunities that come with these crises instead of hiding in a bunker and waiting for the end to come.

So, my advice to you is this: when the opportunity comes knocking, be ready to grab it by the horns instead of turning up your nose and slamming the door in its face. And when you take out an insurance policy, you aren’t doing it because you’re sure the house will burn down. You’re doing it so you’re protected, just in case it does.

Gold market analysis and predictions: 2023

Investors note that owning gold in 2023 looks like a smart move. The dollar is expected to hit a long-term top, while gold is gaining momentum and set to trade higher. While the dollar may reach new heights in the short term, it’s likely to decline for years to come. On the other hand, gold is expected to trade in the range of $2,500 to $2,900, with a possible overshoot to $3,600 before a multi-month top takes hold.

Investors should consider deploying new capital into long positions during sharp pullbacks, focusing on blue-chip gold stocks and bullion to exploit this potential. This way, they can benefit from the upside potential in gold while hedging against market volatility. With a potential currency crisis, owning gold could be a valuable form of insurance in your investment portfolio.

Random Stock market reflections 2023

Contrarians, driven by their unique perspective, often experience bouts of nervousness as they continuously monitor their positions, seeking confirmation that the market has hit its lowest point. However, once the sector begins to rally and generate returns, their nervousness dissipates, and they transition into a state of extreme bullishness—a phase known as euphoria. This is where mass psychology comes into play. It is crucial for astute investors to recognize this shift and take appropriate action. While it may not be possible to sell at the absolute peak, exiting the market at this stage can bring one remarkably close to it.

Understanding mass psychology is an integral component of a successful trading system. Recognizing the collective emotions and behaviours that drive market trends provides valuable insights for making informed investment decisions.

Another key aspect is mastering multiple Technical Analysis (TA) tools and avoiding their standardized use. By embracing the principle that each tool offers subjective interpretations, traders can harness their flexibility and adaptability. This allows for a more nuanced understanding of market dynamics and enhances the effectiveness of TA in decision-making.

Furthermore, patience and discipline are essential traits for traders to cultivate. Recognize that there may be periods where one must wait for months before entering a position. However, exercising patience can yield substantial rewards in a matter of weeks. The ability to withstand the waiting game while adhering to a disciplined approach is crucial for long-term success in trading.

In summary, unravelling the phases of contrarian behaviour, understanding mass psychology, utilizing TA tools subjectively, and cultivating patience and discipline form a solid foundation for success in the dynamic world of trading.

Originally published on September 23, 2015, this article has undergone multiple updates over the years, with the most recent update in March 2023

Articles That Inspire Fresh Thinking

The Golden Symphony: Unveiling the Dynamics of the Gold to Silver Ratio

South China Sea Showdown: Intensifying Heat on the Horizon

Will the Stock Market Crash: Analyzing Possibilities and Implications

China Quantitative Easing: Battling Economic Slowdown

What is Data Manipulation: The Dark Side?

Corruption in China: Government’s Aggressive Crackdown on Wrongdoings

These Are The Things That Scare Americans The Most

The Observer vs. The Participator: Shaping Change

Exotic Art: The Fusion of Art and AI Brilliance

Inductive vs Deductive Approach: The Path to Massive Gains

China Stock Market Live News: Stay Informed for Smart Investing

China Super Power? Unveiling the Extraordinary Journey

Raytheon Company To Buy or To Flee

Iceland Porn: Tackling the impact of porn on youths

The AI Future of Work: Transforming Industries and Empowering Individuals

Stock market crashes timelines

Dow theory no longer relevant-Better Alternative exists

In 1929 the stock market crashed because of