Feb 6, 2024

China Quantitative Easing Strategy: Combating Economic Slowdown

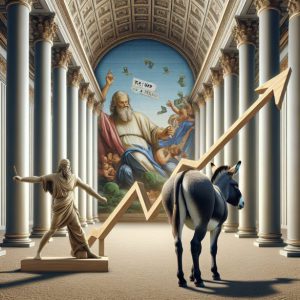

Introduction: As a financial analyst, it is essential to delve into the intricacies of global economies and understand the factors that shape their performance. China has faced economic challenges in recent years, and quantitative easing has emerged as a potential solution. In this discourse, we will explore the significance of China’s quantitative easing in battling its economic slowdown. By analyzing the Mass Psychology and collective behaviour of market participants, we can gain insights into the effectiveness of such measures while also considering the contrarian investing perspective.

Understanding China’s Economic Slowdown: Subtitle: China’s Economic Landscape

China, the world’s second-largest economy, has experienced remarkable growth over the past few decades. However, it has faced a slowdown in recent years due to various factors, including external trade tensions, domestic structural issues, and demographic shifts. These challenges have prompted policymakers to explore strategies to boost economic growth and maintain stability.

The Role of Quantitative Easing: Subtitle: Unleashing Monetary Stimulus

Quantitative easing (QE) is a monetary policy tool employed by central banks to stimulate the economy by injecting liquidity into the financial system. It involves purchasing government bonds or other financial assets, which increases the money supply and lowers interest rates to encourage borrowing and investment.

China, recognizing the need to combat its economic slowdown, has considered implementing its version of quantitative easing. By utilizing this tool, the Chinese government aims to stimulate domestic consumption, spur investment, and maintain overall economic stability.

Mass Psychology and Collective Behavior: Subtitle: Market Sentiment and Investor Behavior

Mass Psychology plays a crucial role in influencing market sentiment and investor behaviour. When faced with economic uncertainties, investors often exhibit herd-like behaviour, following the crowd and making decisions based on prevailing market sentiment. This behaviour can create momentum and amplify market movements, leading to potential bubbles or crashes.

Introducing China’s quantitative easing can significantly impact investor sentiment from a Mass Psychology perspective. The announcement of such measures could instil confidence, boosting market sentiment and encouraging investment. However, it is vital to consider the potential risks associated with excessive market vitality and the need for prudent risk management.

Contrarian Investing Perspective: Subtitle: Seeking Opportunities Amidst Pessimism

Contrarian investing involves taking positions that are opposite to prevailing market sentiment. Contrarians believe that markets often overreact, creating investment opportunities during times of pessimism or excessive optimism. Contrarian investors seek to capitalize on potential market mispricing by analyzing market fundamentals and identifying discrepancies.

In China’s quantitative easing, contrarian investors may be cautious, recognizing that market sentiment can be fickle and prone to overshooting. They may scrutinize the effectiveness of such measures, considering factors such as potential inflationary pressures, long-term sustainability, and the overall economic impact. Contrarian investors will carefully evaluate market conditions and seek opportunities where others may be overly pessimistic or optimistic.

The Effectiveness of China Quantitative Easing: Subtitle: Assessing the Impact

The effectiveness of China’s quantitative easing in battling economic slowdown relies on various factors. One crucial aspect is the implementation and coordination of policy measures. The Chinese government must carefully balance injecting liquidity into the system and avoiding excessive risk-taking.

Additionally, the intended outcomes of quantitative easing, such as increased consumption and investment, must materialize for the strategy to succeed. Robust monitoring and evaluation mechanisms are essential to measure the impact of such policies on the real economy, job creation, and sustainable growth.

Conclusion

China, quantitative easing has emerged as a potential strategy to combat the country’s economic slowdown. Understanding Mass Psychology and collective behaviour can provide insights into market sentiment and investor behaviour, while the contrarian investing perspective offers a balanced approach to assessing opportunities and risks. However, the effectiveness of quantitative easing depends on careful policy implementation, evaluation, and prudent risk management. As a financial analyst, it is crucial to consider all these aspects when analyzing the potential impact of China’s quantitative easing measures on its economic landscape.

Unlock New Ideas: Inspiring Articles

Define Indoctrination: The Art of Subtle Brainwashing and Conditioning

The Statin Scam: Deadly Profits from a Pharmaceutical Deception

Copper Stocks: Buy, Flee, or Wait?

Dow 30 Stocks: Spot the Trend and Win Big

Coffee Lowers Diabetes Risk: Sip the Sizzling Brew

3D Printing Ideas: Revolutionize Your Imagination

Beetroot Benefits for Male Health: Unlocking Nature’s Vitality

Norse Pagan Religion, from Prayers to Viking-Style Warriors

Example of Out of the Box Thinking: How to Beat the Crowd

6 brilliant ways to build wealth after 40: Start Now

Describe Some of the Arguments That Supporters and Opponents of Wealth Tax Make

What is a Limit Order in Stocks: An In-Depth Exploration

Lone Wolf Mentality: The Ultimate Investor’s Edge

Wolf vs Sheep Mentality: Embrace the Hunt or Be the Prey