Stock Market Forecast for the next three months: Sector Outlook

Updated Dec 7, 2023

This article includes our historical views on the market forecast for the next three months.

Navigating Market Trends: A Positive Outlook Amidst Volatility

The Santa Claus rally propelled the Dow to new highs, concluding the year positively. Despite a subdued start in January, with the first five days showing negativity based on the January barometer, the overall outlook remains positive as the market ended the month in the black. This indicates an upward trend with expected volatility. We anticipate a higher demand by the end of the year unless bullish sentiment remains at or above 56 for an extended period, in which case the outcome could change. For instance, the SPX might reach our target of 5340 to 5500, but the year-end result could be lower if bullish sentiment surges. Until such a scenario arises, further analysis will be deferred.

The AI sector sees remarkable gains, evidenced by NVDA’s 25% surge and META’s 200 billion market cap increase in a day. Despite short-term benefits, caution is advised. The masses’ hunger for AI-related assets may lead to immediate gains but poses long-term risks. Investors should recognize that while the overall AI sector trend is strong and corrections can be buying opportunities, panic-driven reactions during substantial drops can worsen outcomes. Astute investors might consider taking profits and waiting for a strategic redeployment during pullbacks exceeding 15 to 20 per cent, navigating the volatile landscape with a calculated approach.

Market Boosters: Driving Optimism and Price Support

Amidst lower inflation rates and the Federal Reserve’s intention to reduce rates in 2024, the pace of implementation remains uncertain. However, recent payroll and jobs data have added to the bullish sentiment in the market. The robust jobs report exceeded economists’ expectations and is a positive sign for the economy. In December, the United States added 216,000 jobs, surpassing the projected net gain of 160,000. This capped off another year of solid employment growth, with 2.7 million jobs added in 2023. While this figure is lower than the record-setting years of 2022 (7.3 million) and 2021 (4.8 million), it still ranks as the 25th highest on record since 1939, according to Bureau of Labor Statistics data.

Another positive factor contributing to market optimism is the significant amount of money, over $6 trillion, currently residing in money markets. The critical question is when this substantial sum will flow into equity markets. The Fear of Missing Out (FOMO) phenomenon suggests that individuals eager not to miss the ongoing rally may tap into these funds sooner than expected. This collective behaviour, where individuals buy when bullish readings are high and sell when bearish readings are high, offers valuable insights for strategic decision-making. It serves as an advanced signal for when to buy and withhold deploying new capital.

Economic Dynamics: FED Rates, Inflation, & Bullish Forecast

The FED’s determined efforts to combat inflation, fueled by Democratic stimulus spending, have left a distinct mark on the economy, particularly benefiting AI chip companies under the Chips Act. Despite initial concerns, market observers see this spending surge extending into 2024 and 2025, contributing to an optimistic outlook.

Against this backdrop, stock market advisors express confidence, interpreting the current situation as a promising rally rather than a dead end. The SPX exhibited a robust 11.2% rally in the fourth quarter, marking a 4.4% increase in December and a substantial 24.2% gain for the entire year. This performance in the last quarter of 2023 represented the most significant quarterly surge since 2020.

While some investors with the Fear of Missing Out (FOMO) may feel they missed opportunities, experts anticipate notable gains in various stocks. Projections suggest a potential 10% growth for the S&P in 2024, potentially surpassing 5000. However, this surge will materialize once the markets release substantial steam.

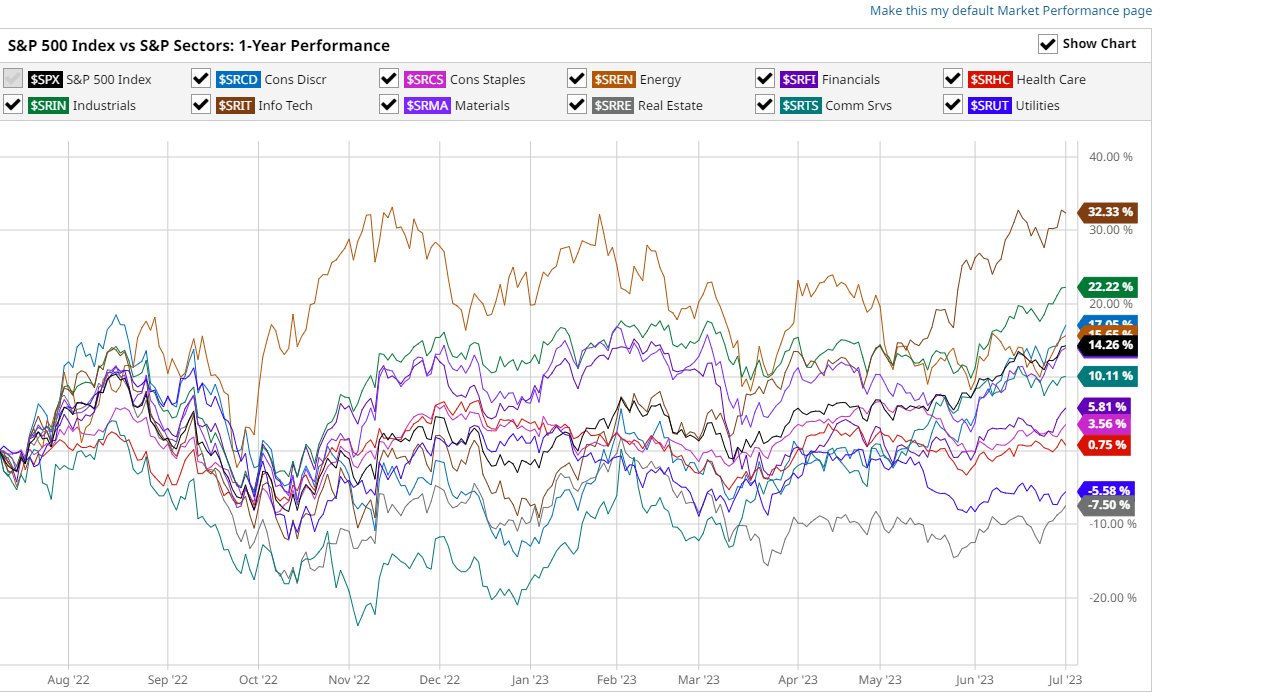

As of June 30, 2023, the AI-driven frenzy has temporarily disrupted market forces. Notably, the S&P 500 and Nasdaq have primarily relied on the influence of approximately nine major players. Meanwhile, other sectors have experienced underperformance. However, examining the one-year charts indicates that former highflyers like energy and other commodity players are poised for a resurgence. This expectation is driven by the Federal Reserve’s commitment to continue raising interest rates despite a slight retreat in inflationary pressures. While the situation does not warrant a complete halt, the Fed remains vigilant.

Those willing to take calculated risks might find potential gains by allocating funds to energy companies like OXY, a favoured choice even by Warren Buffett, who consistently expands his position in this play. The copper, steel, and precious metals sectors are also expected to perform well. The next US dollar rally is anticipated to reach a multi-year high.

Which Sectors Will Lead in Stock Market Growth in the 2023 Forecast?

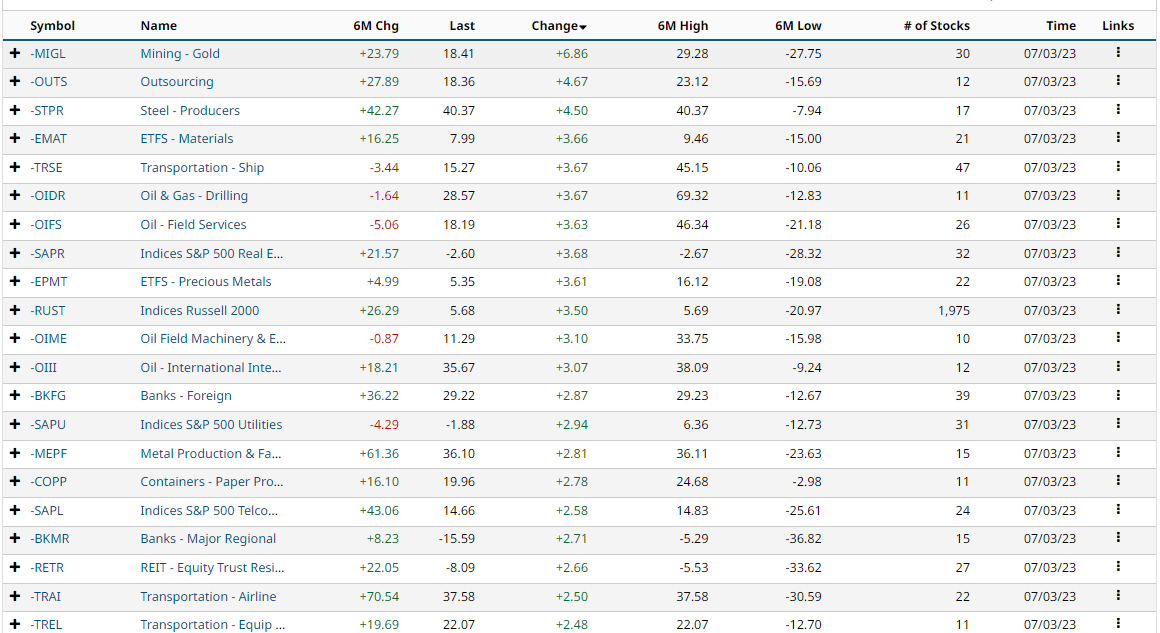

As of July 5, 2023, a glance at the chart below reveals the dominance of commodities, energy, and several cyclical sectors among the top 20 performers over the past 6 months. This trend persists when extending the timeframe to one year. Notably, many stocks within these sectors have experienced significant pullbacks and are trading in the oversold range on the monthly charts. Prominent examples include OXY, VALE, STLD, GEF, EMR, and more. These stocks are highly anticipated to exhibit substantial growth over the next 3-6 months.

One effective approach for utilizing this data involves initially identifying the strongest sectors spanning a period of 6 to 12 months. Subsequently, attention can be focused on stocks that have experienced pullbacks. Analyzing the technical aspect using monthly charts proves advantageous as each bar on such a chart represents a month’s worth of data.

Longer-term charts are preferable as they help filter out extraneous market fluctuations. The key objective is to identify stocks currently trading within significantly oversold ranges. An exemplary illustration can be found in the machinery-electrical sector, where EMR stands out. The likelihood of this stock trading above 106 within the next 6 months is relatively high. Similarly, PBR presents excellent investment opportunities within the steel, VALE, and energy sectors.

Charting Your Course: Avoid the Noise by Buying the Dip

Currently, we have two groups of players in the market: those who have investments and those who have cash. The ones with investments are very optimistic, as all types of assets like bonds, stocks, precious metals, and Bitcoin are increasing in value simultaneously. This is quite unusual because usually, different markets don’t rise together like this. It suggests that a correction might be coming, but don’t worry.

This period of uncertainty is the exact opportunity we’ve been waiting for. Of course, most people will panic because that’s what they tend to do. But it’s important not to follow the crowd, as they usually lose. Although it’s difficult to predict the Stock Market Forecast for the Next 3 months due to the current volatility, the long-term trend is definitely positive. Therefore, it would be wise to embrace significant market corrections with excitement. The overall trend is positive, so it’s smart to welcome strong corrections enthusiastically, even if you don’t like it.

The Crowd is on the brink of making hasty decisions that will have consequences for years to come. We’ve witnessed this before in the crash of ’08, but history tends to repeat itself, and people never seem to learn from their mistakes. They will always be unknowing pawns in a game they don’t understand. Don’t forget to keep a trading journal; the best time to take notes is when blood is flowing freely on the streets.

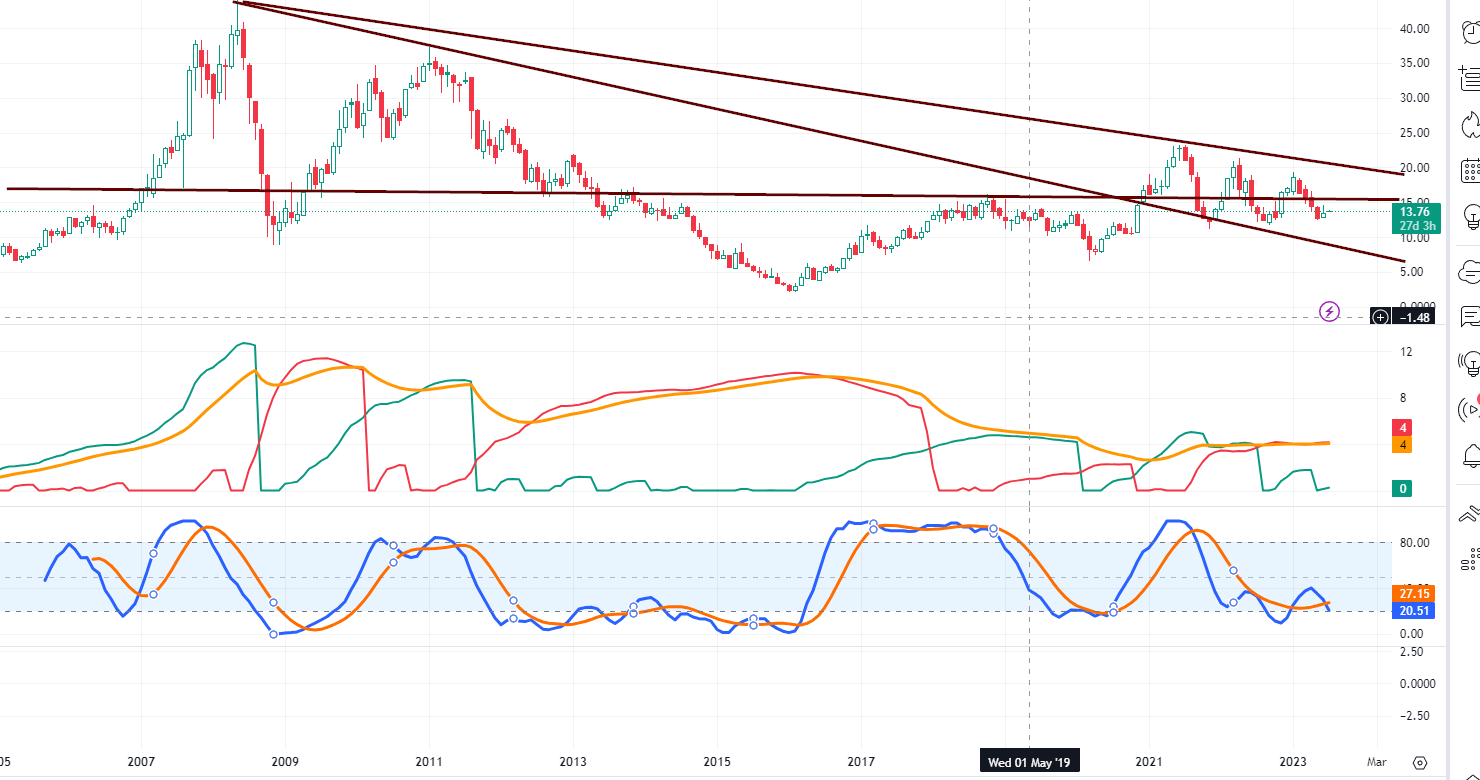

What’s in Store for VALE: A Market Forecast for the Next 6 Months

Achieving a monthly closing at or above 16 should lead to a test of the range between 20, 40, and 22, while a monthly closing at or above 22 will signal a series of new 52-week highs. In the short term, the market outlook remains volatile as the markets are oversold and searching for opportunities to release some pressure.

We anticipate volatile market activity from July until roughly the end of August 2023. Beyond that period, the markets will likely establish a bottom and initiate a strong rally until the end of November or early December. Stocks like VALE, PBR, and OXY are expected to perform exceptionally well during this upward trajectory.

The State of the Stock Market: A Quarterly Review and Outlook

3rd Quarter Overview and 4th Quarter Outlook

Investors entered the third quarter with growing confidence in the absence of a recession, attributed to a robust job market and consumer spending. However, the outlook for aggressive rate cuts in 2024 has dimmed despite signs of impending inflation relief.

The “Magnificent Seven” stocks, the market’s mainstay, retreated. Instead, value stocks, particularly dividend payers, outperformed. Energy stocks shone due to rising oil prices.

US equities encountered weakness in Q3. Initially optimistic about the Fed’s skilful economic soft landing, investor sentiment shifted as higher interest rates loomed, reflected in the revised Fed “dot plot.”

Despite the resilient US labour market, the unemployment rate rose to 3.8% in August, with 6.4 million unemployed individuals. The US composite flash purchasing manager’s index (PMI) fell slightly to 50.1 in September, signalling a cooling economy.

Inflation, though edging up in August, continued its downward trajectory. The Fed hinted at another rate hike by year-end, and the dot plot raised the 2024 median rate projection to 5.1%.

Energy stocks remained resilient, contrasting with the decline of the “Magnificent Seven,” including Apple, Microsoft, and Amazon. The information technology (IT) sector and real estate and utilities struggled.

The S&P 500 declined by 3.3% in Q3, primarily due to rising interest rates, with September recording a nearly 5% drop. The Nasdaq maintained a year-to-date solid return of 27.1%.

Sector performance varied, with energy and communication services rising, while real estate and utilities faced quarterly decreases. Communication services, technology, and consumer discretionary sectors led year-to-date.

The US outperformed developed and emerging markets, partly due to a strong US dollar, with Japan being the only other country to see a modest increase. The Pacific region declined by 4.1%, and emerging markets experienced minor decreases in all three areas: EMEA (-1.8%), Emerging Asia (-2.2%), and Latin America (-2.7%).

How Will Fed Policy Influence Stock Market Trends in the Second Half of 2023?

The Federal Reserve’s monetary policy continues to be a key factor influencing the stock market’s trajectory. As we look ahead to the rest of 2023, it is vital to consider the latest data and trends in Fed policy.

The anticipated rate hikes by the Federal Reserve are indeed a response to the inflationary pressures that have been building up in the economy. The Fed aims to balance promoting economic growth and controlling inflation. While higher interest rates can potentially dampen growth and impact valuations in the stock market, they are also a tool to prevent the economy from overheating.

It is important to note that the stock market’s reaction to Fed policy changes can be complex and multifaceted. Investors closely monitor the Fed’s decisions and statements for insights into future interest rate movements. Any surprises or deviations from market expectations can lead to volatility and fluctuations in stock prices.

As we move forward, it is crucial to stay informed about the latest developments in Fed policy and their potential impact on the stock market. Economic indicators, such as inflation data, employment figures, and GDP growth, will be closely watched for signals of the Fed’s future actions.

Understanding Inflation Outlook and Its Impact on the Market

The Federal Reserve’s monetary policy plays a significant role in shaping the stock market’s trajectory. The anticipated rate hikes are a response to the inflationary pressures that have been building up in the economy. The Fed’s strategy aims to balance economic growth and inflation control. While higher interest rates can dampen growth and affect valuations, they are also a tool to prevent the economy from overheating.

Inflation is indeed a double-edged sword for the stock market. The impact of inflation on corporate profits and stock prices depends on its magnitude and the response of the Federal Reserve. If inflation remains moderate and the Fed adopts a measured approach to rate hikes, it can provide stability and confidence to investors. However, if inflation accelerates rapidly and the Fed responds with aggressive rate hikes, it can create uncertainty and volatility in the market.

Investors will closely watch inflation data and the Fed’s response to it. The latest data on the consumer price index (CPI), producer price index (PPI), and wage growth will be key indicators to gauge the inflation outlook. Additionally, market participants will closely analyze the statements and actions of the Federal Reserve officials, looking for clues about their stance on inflation and future monetary policy decisions.

One should remember that market expectations and sentiment can also influence stock prices in response to inflation. If investors perceive that the Fed effectively manages inflation and maintains a balanced approach, it can instil confidence and support market performance. Conversely, any surprises or deviations from market expectations in the Fed’s actions or communication can lead to increased volatility and fluctuations in stock prices.

As always, investors must stay informed and monitor the latest developments in inflation and the Federal Reserve’s monetary policy. Consulting financial experts and reliable financial news sources can provide valuable insights and guidance in navigating the market implications of inflation and the Fed’s actions.

What Lies Ahead: Market Forecasts and Potential Volatility?

Analysts’ forecasts for the S&P 500, Dow Jones, and Nasdaq suggest a positive outlook for the rest of 2023. However, these projections are not set in stone and could change based on new developments. Factors such as geopolitical tensions, corporate earnings reports, and economic indicator changes could introduce market volatility. Investors should be prepared for potential fluctuations and make investment decisions based on risk tolerance and long-term financial goals.

In short, the Federal Reserve policy, inflation trends, public health developments, and market forecasts are all key factors shaping the stock market outlook for the second half of 2023. Investors should closely monitor these factors and adjust their strategies accordingly.

Is the Stock Market Outlook for 2023 Promising? Expert Opinions

BCA Research’s optimistic near-term market outlook relies on momentum continuing in the direction of the prevailing trend. Their bias is to ride the wave of positive sentiment. This is understandable, but markets driven by greed and euphoria can reverse course rapidly.

A contrarian investor would be more sceptical of the sustainability of further gains when sentiment is so positive. Markets tend to move to extremes of overvaluation or undervaluation, driven by the mass psychology of fear and greed. The contrarian aims to take the opposite side by selling or shorting overheated markets and buying when panic reigns.

Rather than just predicting market direction, the contrarian focuses on price and intrinsic value discrepancies. While BCA expects the index to reach 4500 based on momentum, the contrarian would ask if fundamentals justify that target. If not, it would represent a selling opportunity.

No forecast will be right all the time. The contrarian philosophy helps avoid catching up in herd mentality at market extremes. By focusing on value, the contrarian improves results not by picking market direction but by buying low and selling high relative to rational value ranges.

Combining discipline, patience, and conviction in one’s analysis to take positions counter to the herd is how great investors like Warren Buffett have generated outstanding long-term returns. Understanding mass psychology is critical to successful contrarian investing.

Financial Markets Rollercoaster 2023: What Drives the Ups and Downs?

The financial markets, often likened to a rollercoaster ride, are subject to a complex interplay of factors. Investor sentiment can shift dramatically, particularly regarding corporate earnings, interest rates, and the banking sector’s stability. These elements are key players in determining the direction of the market.

As of July 7, a simultaneous stock and U.S. Treasury bonds decline. This drop coincided with the Federal Reserve’s expected quarter-point increase in the fed funds rate, driving the critical 10-year Treasury bond yield to a peak of 4.09%.

Since then, the 10-year benchmark yield has experienced fluctuations, hitting a low of 3.73% on July 19, despite standing at around 3.25% just three months prior. Recent weeks witnessed renewed selling pressure on long-dated Treasuries, briefly pushing the 10-year yield to a high of 4.36%, as per Cboe market data.

On July 26, the Federal Reserve ended its brief pause in monetary tightening, implementing a quarter-point increase in the fed funds rate. This move elevated the target range for overnight loans to large banks to 5.25%-5.5%, reaching its highest level since March 2001.

During the Federal Reserve’s interest rate meeting on September 19-20, the central bank maintained the fed funds rate at its current level. However, the Summary of Economic Projections (SEP) unveiled significant shifts in the thinking of Fed officials. They raised the median GDP growth forecast for 2024, indicating reduced recession risks. Additionally, they no longer anticipated four quarter-point rate cuts next year but possibly only two.

At a gathering of central bank leaders in late August in Jackson Hole, Wyoming, Fed Chief Jerome Powell they reiterated the Fed’s unwavering commitment to achieving a 2% inflation rate. This commitment implies that more rate hikes may be on the horizon.

These developments undoubtedly influence the rollercoaster ride of the financial markets. The Fed’s decisions, especially regarding interest rates, shape market dynamics significantly. Rate hikes can impact borrowing costs, affecting business investment and consumer spending. Furthermore, higher interest rates may make bonds more attractive than stocks, potentially altering investor sentiment.

However, it’s crucial to recognize that the Fed’s actions are grounded in a thorough analysis of economic indicators. They aim to strike a balance between fostering economic growth and maintaining price stability. Thus, while the prospect of rate hikes introduces uncertainty, it also underscores the Fed’s proactive approach to financial management.

Staying well-informed about monetary policy and market trends is imperative in this ever-evolving landscape. It empowers investors to navigate the intricate world of financial markets and make informed decisions. As we continue our journey through the twists and turns of this financial rollercoaster, it promises to be an exciting ride filled with challenges and opportunities.

6-Month Market Forecast & the Market Roadmap for 2023

While some may believe that the Federal Reserve is hesitant to face another financial crisis akin to 2008-2009, we reject this notion. The Fed is not afraid; instead, they are the “big bad wolf,” existing to intimidate the masses. Let’s not forget that they enabled the 2008-2009 crisis. In our view, the Fed’s current actions are designed to give the impression that everything is under control when laying the groundwork for the next shock event.

The masses’ mindset must be utterly destroyed to establish a lasting bull market, as exemplified by the 2008-2009 crisis. The prominent players in the market are seeking a prolonged bull market of 7 to 10 years, and to achieve this, they will need to stir up the hornet’s nest. Be ready to seize the upcoming buying opportunity. The subsequent sell-off is on the horizon, but don’t be dismayed – it will pave the way for a multi-month rally.”

NDX and SPX 6 Month outlook: June 21, 2023 update

The Russell 2000 reaching the 1900-1920 range indicates an upcoming surge in volatility, with potential false downward moves before a corrective phase begins. Bullish sentiment readings have consistently increased, notably from 47 to 49.00 in the previous week.

This suggests a possible head fake scenario, where the index appears to correct but reverses and trends higher, similar to the NDX. The secondary resistance zone for the Russell is between 1980 and 2020, and ending the week above 1920 would increase the chances of testing this zone.

The ideal setup involves the Russell trading within the 1980-2020 ranges, accompanied by bullish sentiment trading above 50, ideally reaching 55 or higher. Long-term investors are advised to take profits on tech stocks that surged due to an AI Mania-driven rally and wait for a market pullback before investing fresh funds.

Insights into Market Dynamics: Navigating Inflation and Corporate Earnings

Despite some positive economic signs, many analysts remain cautious about the stock market’s prospects for the remainder of the year. Inflation remains stubbornly high, and the Federal Reserve is expected to continue raising interest rates aggressively to combat it. This could pressure corporate earnings and valuations, potentially leading to a market pullback.

One strategist predicts that the S&P 500 could fall over 15% from current levels by the end of the year as earnings disappoint and the Fed continues tightening. He expects corporate profits to decline sharply due to high inflation, supply chain issues, and slowing demand.

However, not all analysts are as bearish. If inflation modifies and the Fed slows or pauses rate hikes, the market could stabilize or resume its upward trend. Much will depend on the inflation trajectory, interest rates, and corporate earnings over the coming quarters.

Timeless Tales: From Classics to Now

Stock Market Psychology Chart: Mastering Market Emotions

The Yen ETF: A Screaming Buy for Long-Term Investors

Mob Mentality Psychology: Understanding and Profiting

IBM Stock Price Prediction: Time to Buy or Fly?

Examples of Herd Mentality: Lessons for Learning and Earning

When is the Next Stock Market Crash Prediction: Does it Matter?

Inductive vs Deductive Analysis: The Clash of Perspectives

Investor Sentiment Index Data: Your Path to Market Success

Unraveling Market Psychology: Impact on Trading Decisions

Is Value Investing Dead? Shifting Perspectives for Profit

What Will Happen When the Stock Market Crashes: Time to Buy

Dogs of the Dow 2024: Barking or Ready to Bite?

The Trap: Why Is Investing in Single Stocks a Bad Idea?

How Can Stress Kill You? Unraveling the Fatal Impact

Financial Mastery: Time in the Market Trumps Timing

Palladium Metal Price Unveiled: Impact on the Hydrogen Economy