For of all sad words of tongue or pen, the saddest are these: ”It might have been!”

John Greenleaf Whittier

Updated April 2020

Stock Market Bull And Bear: This is A Baby Bull

For a long time, our theme was to view all sharp pullbacks through a bullish lens as the trend based on our trend indicator was trading firmly in bullish territory. Secondly, one critical psychological component was in our favour too- the masses were either bearish or they cursed this market from the sidelines (neutral camp); hence the slogan the most hated bull market in history.

We must deter for a second by stating that a mild or brutal correction comes down to what level you embraced this market. If you embraced this Stock Market Bull in the early stages from 2009 -2011, then a mild correction would seem brutal or back-breaking in comparison to someone who just jumped into the market. A 15-20% correction would knock the socks out of them, but for you, it would appear to be nothing but a blip; this is why we have consistently stated that the best time to open long positions when the masses are in a state of despair.

Will This Bull Market Trend Continue

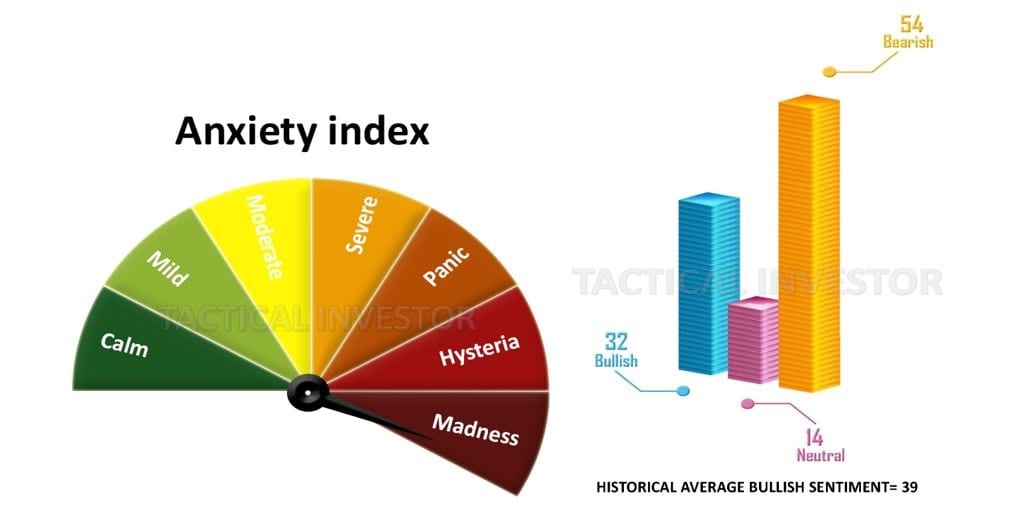

Towards the end of last year around Dec, we stated that we were getting a tad bit nervous as the crowd had started to embrace this bull market. Up until the Trump win, which we saw as a bullish event for the markets, while most experts viewed it as a death omen, the masses were either bearish or sitting on the sidelines. Bullish sentiment was generally below 40%, and the combined score of the individuals in the bearish and neutral camp was almost always above 55% and in most cases above 65%.

After Trump had won the markets experienced an initial shock but recouped twice as fast as they did with Brexit and never looked back since. During this monstrous rally, the sentiment gradually started to improve, and for the past 11 weeks, the percentage of individuals in the bullish camp has always been above the 40% mark. On three occasions in the past 11 weeks, the bullish sentiment soared above the 50% mark something we had not experienced even once over the past 30 months. As we pay close attention to the masses, this had to be treated as a significant development.

The Masses Are Not So Anxious Right Now

.

The anxiety index for the past 24 months has oscillated between the severe and hysteria zones. At the moment the gauge is sitting in the mild zone. When we combine this with the fact that more individuals are embracing this market, it suggests that being cautious might for the 1st time in many months be the most prudent form of action. Additionally, the markets are extremely overbought and are begging for any excuse to let out some steam.

Stock Market Bull And Bear: Dow Still Not Ready To Buckle

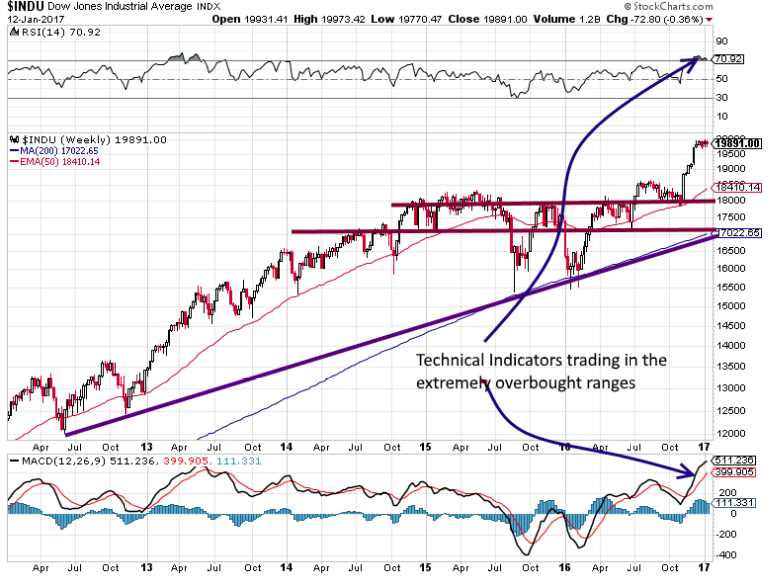

The Dow has experienced a new vertical takeoff after the results of the election results were announced; -fast, furious breaks outs are usually followed with substantial pullbacks. As can be seen in the above charts the technical indicators are trading in the extremely overbought ranges and given the massive change in sentiment over the past two months caution is warranted.

The risk to reward ratio is not in favour of the average investor anymore. The market needs to let out some steam; a 10% pullback would be quite nice and would pull it back to the point of the current break out-former resistance turned into support.

10% Drop would scare the Masses and Inject Fresh Blood into this Bull market

This would be enough to scare the living daylights out of the masses. In this case, we would favour an even stronger correction, perhaps a test of the 200-day moving average which would put the fear of God in almost 90% of investors and thus creating a splendid buying opportunity for the astute investor.

Our goal is not to focus on ideal targets but the mass sentiment, and that is why we have developed a host of tools to monitor the masses one of which we have posted above. If the Dow drops down to 18,000 ranges, but the masses are not fearful, then we would not view the situation as a buying opportunity.

A weekly close below 19,600 will signal that of the 18,200-18,600 ranges is likely. If the markets close below 18,200 on a weekly basis, it is possible they could trend much lower, but we do not want to look that far into the future and will address that hurdle when and if the Dow touches that zone.

Buy the rumour and sell the news factor

In terms of this Bull Market the trend is still very strong, so treat popular media as you would a piece of toilet paper. It’s good for one swipe but useless of after that. one could go as far as to state the mass media does not even serve the same function as a humble piece of toilet paper.

The masses panicked when they found out that Trump had won. The fake news media sites started huffing and puffing about the dire consequences the markets would face if Trump won. Several weeks earlier we went on a limb and in an article titled “Mass Psychology states Trump win Equals stock market buying opportunity” we made the following comments.

A Trump win will create uncertainty, and the lemmings will flee for the exits; markets will pull back sharply and viola the same old cycle will come into play. The cycle of selling based on fear which equates to opportunity for those who refuse to allow their emotions to do the talking. Full Story

Negativity is associated with Opportunity

We repeatedly advised our subscribers to view a Trump win through a positive lens in 2015. However, now we feel that the markets have priced in all the positive factors associated with a Trump win (at least in the short term time frames) and some bloodletting is in order. In other words, it might be time to put the principle of “buy the rumour and sell the news” into use.

This Bull Market Still has Plenty of Spunk

When you think about it, everything comes down to perception. Alter the angle of the observation slightly, and you modify the perception. What appears bullish to one could be viewed as an extremely bearish development by another. When it comes to investing the goal should be to determine what view the masses hold whether it is valid or not is irrelevant for the difference between truth and deception comes down to perception also. If the masses are leaning strongly towards a particular outlook, history indicates that taking a contrary position usually pays off.

The masses have for the first time embraced this bull market. From a mass psychology perspective, this is alone is not a huge negative. Mass Psychology dictates that the masses need to turn euphoric before one abandons the ship. It is not the time to abandon ship, but it is time to take a breather and let the storm clouds pass.

The Dow industrials exploded upwards and have experienced a near vertical move over the past two months. Under such conditions, one should not be shocked if the markets let out a stronger dose of steam than they have over the past 24 months.

Just remember it takes no effort to panic and that is why there is no reward, but it takes effort to remain calm in the face of panic and that is why the rewards are usually very high. Market Update June 2019

This bull still has legs so expect a test of the 29K ranges before it lets out some steam.

Stock Market Bull And Bear Update April 2020

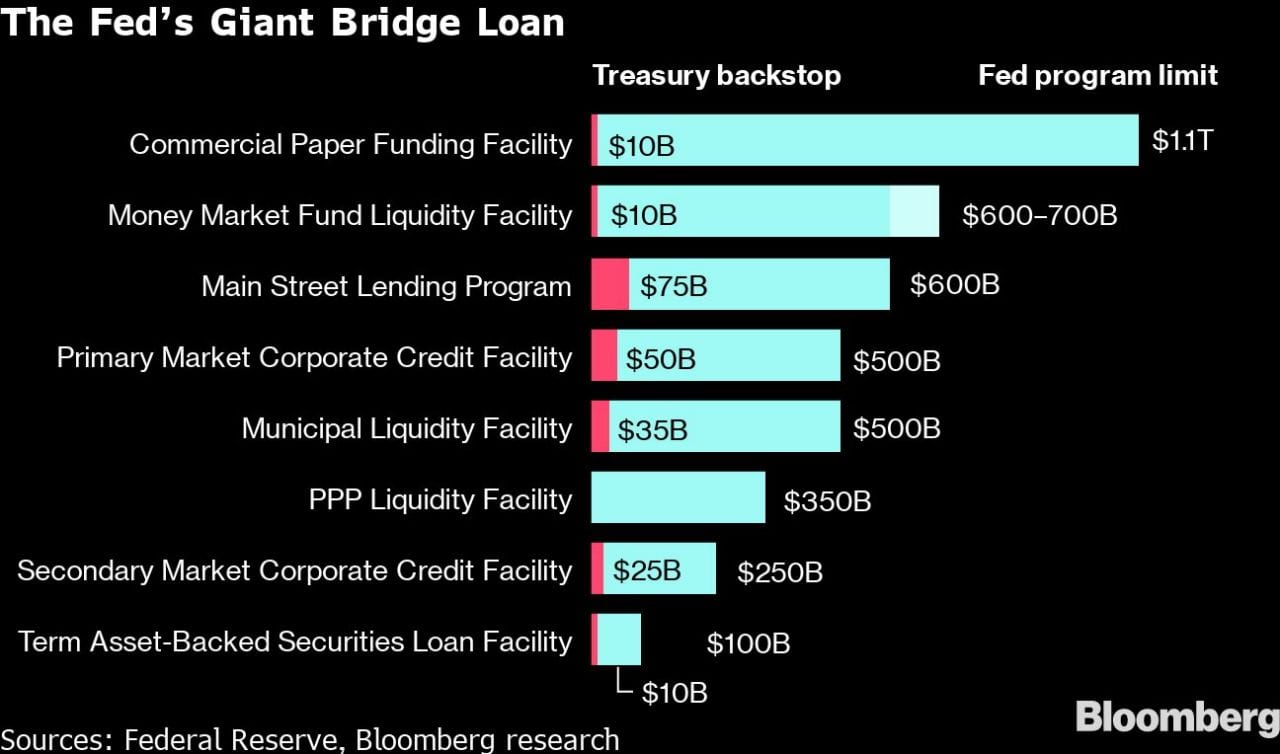

Now the world is gripped by the coronavirus pandemic and the masses are dumping everything and planning for the end of world events. Don’t fall this rubbish, back up the truck and load up on all the top stock you can get your hands. Look at how much money the fed is pumping into this market.

As the saying goes, don’t fight the Fed, to which we added you will end up dead as in dead broke. Forget the fear factor and focus on the trend. The trend is your friend everything else is just noise.

Mass sentiment speaks for itself. Everyone is panicking so its time to buy.

One man’s remorse is another man’s reminiscence.

Ogden Nash

Other Articles of Interest

BIIB stock Price: Is it time to buy

Stock market crashes timelines

Dow theory no longer relevant-Better Alternative exists

In 1929 the stock market crashed because of

Apple Stock Predictions For 2020 and Beyond

Anti Gmo: The Anti Gmo Trend Is In Full Swing?

From GMO Foods To GMO Humans: What’s Next